With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

Trump prepares to nominate new SEC chair, with Paul Atkins likely to bring a pro-innovation approach and clearer crypto regulations.

Donald Trump is gearing up to announce his pick for the next chair of the US Securities and Exchange Commission (SEC), with sources close to the matter hinting the decision could be unveiled “as soon as tomorrow”, according to journalist Eleanor Terrett of FOX Business. Wall Street and the crypto industry are buzzing with anticipation, expecting a potential shift in the regulatory approach from the nation’s top financial watchdog.

🚨NEW: @realDonaldTrump’s pick to replace @GaryGensler as @SECGov Chair could be announced as soon as tomorrow, sources tell @FoxBusiness. Stay tuned 📺.

— Eleanor Terrett (@EleanorTerrett) December 3, 2024

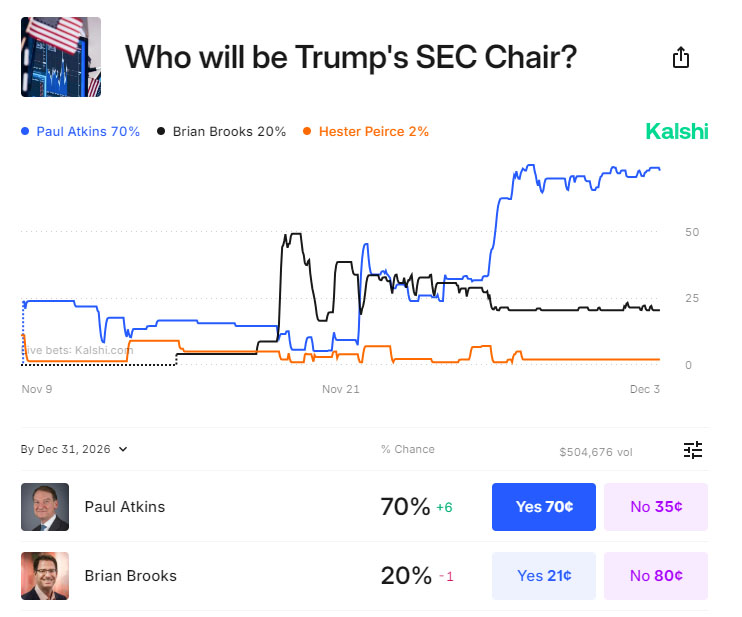

Currently, speculation favors Paul Atkins, a former SEC commissioner. Atkins, known for his pro-innovation views, is leading the predictions market Kalshi with a 70% probability of being appointed. This puts him well ahead of his closest contender, Brian Brooks, who has dropped to a 20% chance. If chosen, Atkins is expected to champion clearer crypto regulations, steering the agency away from the enforcement-heavy approach under outgoing Chair Gary Gensler.

Source: Kalshi

The transition team’s deliberations also consider other candidates like Mark Uyeda, Dan Gallagher of Robinhood, and ex-CFTC Chair Heath Tarbert. However, Atkins’ prior interviews with Trump’s team and his strong backing by crypto proponents have made him the frontrunner.

Gary Gensler’s tenure as SEC Chair, concluding on January 20, 2025, was marked by aggressive scrutiny of the cryptocurrency sector. His leadership saw multiple enforcement actions targeting crypto intermediaries, cracking down on fraud and registration violations. Under Gensler, the SEC also made waves by approving both spot and futures Bitcoin and Ethereum ETFs, though these moves often divided industry opinion.

Atkins, in contrast, offers a vision focused on regulatory clarity. Speaking at a Federalist Society event earlier this year, he identified the absence of clear crypto regulations as a “fundamental underlying issue”. His emphasis on fostering innovation while maintaining investor protection resonates with a tech-forward financial ecosystem eager to move past the legal ambiguities that have plagued the space.

Ripple’s Chief Legal Officer Stuart Alderoty recently outlined his roadmap for future crypto regulation, echoing calls for clarity. He proposed swift resolutions for non-fraud crypto cases, better collaboration with Congress, and reforms aimed at increasing transparency. These ideas have found traction among many in the crypto world, who are hopeful that the next SEC chair will bring constructive change.

A lot of unsolicited advice on here about who should (or shouldn’t) be the next SEC Chair. I trust the transition team to make the right call with these table stakes for crypto in mind:

— Stuart Alderoty (@s_alderoty) November 21, 2024

1.End all non-fraud crypto litigation on Day 1.

2.Get commitments from Commissioners Uyeda and…

The financial world is watching closely. Trump’s pick will arrive at a crucial time when the SEC faces pressure to regulate a $3 trillion cryptocurrency market. The SEC maintains much of crypto falls under its jurisdiction, but industry leaders insist that Congress needs to establish clearer rules to guide digital asset trading.

As the transition unfolds, the SEC faces an unusual situation. When Trump takes office on January 20, the commission will likely have only three members — short of its five-person capacity — due to the planned departures of Gensler and Commissioner Jaime Lizárraga, who step down on January 20 and January 17, respectively. This reduced lineup could slow the agency’s ability to push forward controversial agendas.

Wall Street anticipates a lighter regulatory touch from Trump’s administration, a stark contrast to Gensler’s sweeping oversight. The crypto lobby and financial firms alike see this as an opportunity to recalibrate the SEC’s approach, potentially fostering a friendlier environment for innovation and growth.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

SEC Crypto News, Cryptocurrency News, News

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.