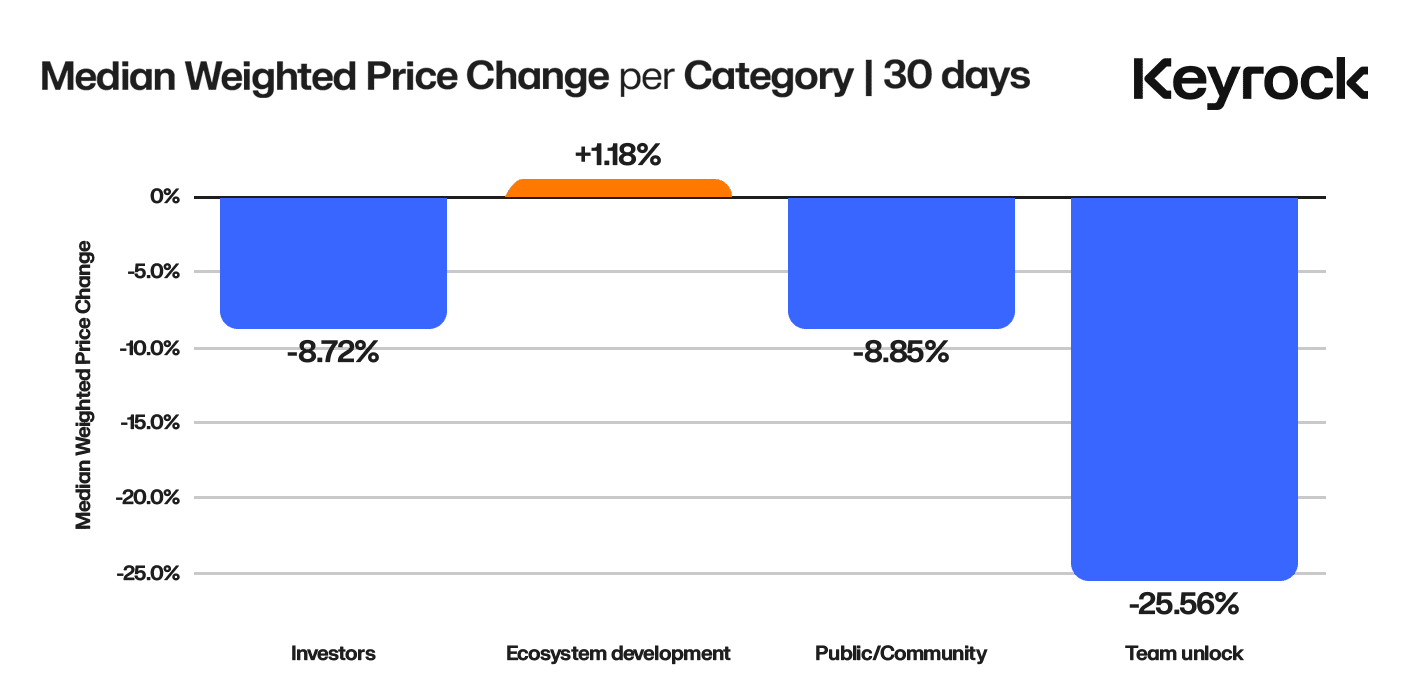

Weekly token unlocks see 90% resulting in price drops, Keyrock’s study reveals, showing that larger events cause more severe declines and team unlocks triggering crashes up to 25%.

When token unlocks happen, most of the time, prices take a big hit. In fact, about 90% of unlock events result in price declines, data compiled by market maker Keyrock reveals. The analysis, which examined over 16,000 token unlocks, reveals that weekly unlocks result in $600 million worth of new tokens entering the market, a significant factor in price fluctuations.

“Across the 16,000 unlock events we analyzed, a striking pattern emerged: unlocks of all types, sizes, and recipients are almost always negative for price. This highlights the importance of keeping track of unlock schedules and understanding their implications, especially for traders aiming to time the market effectively.”

Keyrock

The study suggests that despite overall market conditions, it is the surge in token supply that most often triggers these price drops. For instance, during a team unlock, which releases tokens held by the project’s team or early investors, the market faces heavy selling pressure as these stakeholders liquidate their holdings.

Apecoin’s (APE) case from Yuga Labs shows this trend. A team unlock started releasing 0.7% of the total supply each month, worth $11 million. Over seven months, the price of the APE token dropped 77%, far more than the 9% decline in Ethereum (ETH), the analysts note.

“We know this as onchain data shows the team depositing into Market Maker OTC accounts. Knowing this was an upcoming vesting unlock that was going to persist for a while could have helped better inform a trade to potentially hold off on Buying Ape at that time.”

Keyrock

Investor unlocks, in contrast, tend to have a more controlled impact, Keyrock notes. These stakeholders often employ hedging strategies like over-the-counter sales or options, minimizing market disruption. “VC and investor unlocks are not the primary drivers of price declines,” the report notes, emphasizing that these participants align with long-term protocol goals.

Keyrock analysts noted that tying ecosystem unlocks to growth initiatives can boost liquidity and drive adoption, presenting potential opportunities. However, they emphasized that team unlocks need careful handling to prevent major price declines.