RENDER’s 18% hike means 81% addresses are profitable – What next?

12/07/2024 18:00

As the market condition remained bullish last week, Render [RENDER] also performed well by pushing its price in double digits...

- Buying pressure on RENDER increased sharply last week

- However, technical indicators hinted at a price correction towards $8.8 soon

As the market condition remained bullish last week, Render [RENDER] also performed well by pushing its price by double digits. However, while this instilled bullish sentiment among investors, a few other developments also happened.

These could propel further growth on the altcoin’s price charts.

Is RENDER ready to explode?

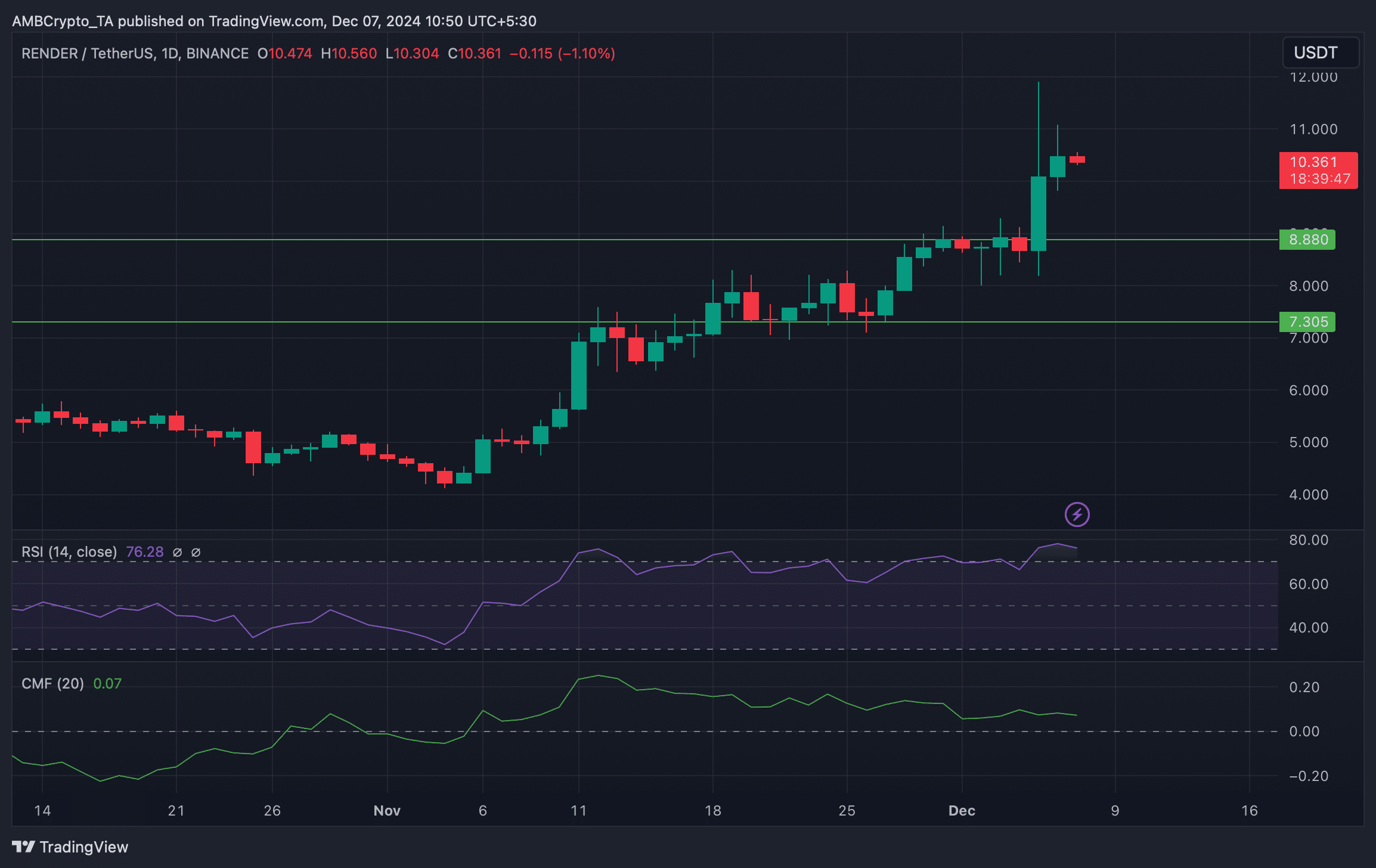

RENDER bulls dominated the market last week by pushing the token’s price up by more than 18%. This pump allowed the token to trade at $10.43 at press time, with a market capitalization of over $5.4 billion.

Thanks to the same, 64k RENDER addresses were “in money,” which accounted for 81% of the total number of the token’s addresses, as per IntoTheBlock.

Meanwhile, Rendoshi Takamoto, a popular crypto analyst, shared a tweet highlighting the possibility of a massive bull rally for the token. The tweet mentioned that RENDER has been listed on Upbit, the largest crypto exchange in South Korea. New listings often have a positive impact on the price as they increase the availability and adoption of an asset.

Apart from this, another major development was the reduction in mint inflation of 35%.

These developments, together, have the potential to reduce headwinds ahead and help the token move north.

What lies ahead…

Since the aforementioned updates looked promising, AMBCrypto checked the token’s on-chain metrics to find out whether they also hinted at a price hike in the coming days.

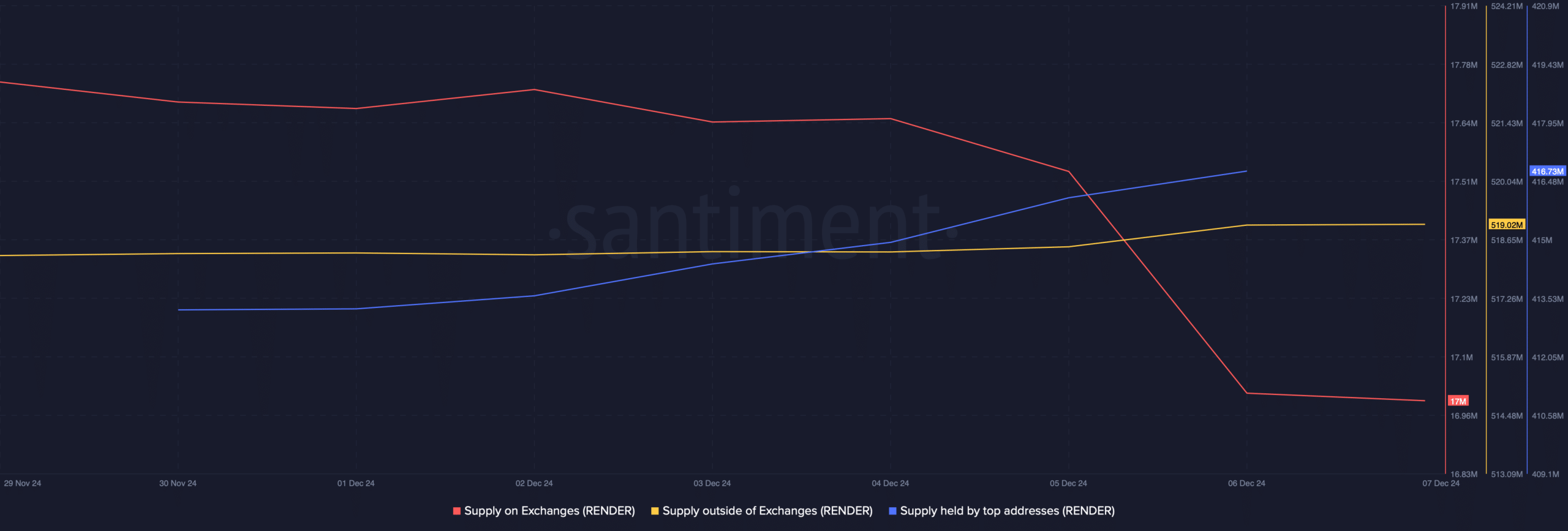

According to Santiment’s data, buying pressure on the token has been rising. This was evidenced by the substantial drop in RENDER’s supply on exchanges. The fact that investors were buying the token was further proven by the slight uptick in its supply outside of exchanges.

Notably, big-pocketed players in the market also acted similarly. The token’s supply held by top addresses increased last week—A sign of increasing whale accumulation.

Coinglass’ data also revealed that the token’s funding rate also increased, along with its price. A hike in the funding rate in crypto Futures means that the market is optimistic and traders expect the price to climb. This, because traders who believe the price will rise are willing to pay extra to keep their long positions.

On the contrary, the technical indicators told a different story. At press time, the Relative Strength Index (RSI) was resting in the overbought territory. This might motivate investors to sell, which can push the token’s price down. The Chaikin Money Flow also moved sideways.

Read Render’s [RNDR] Price Prediction 2024–2025

In case RENDER records a correction, it might drop to its support near $8.8. A slip under that level could further push the token down to $7.3 in the coming days.