Add Haliey Welch, the viral “Hawk Tuah” star, to the growing list of influencer misadventures in the crypto space.

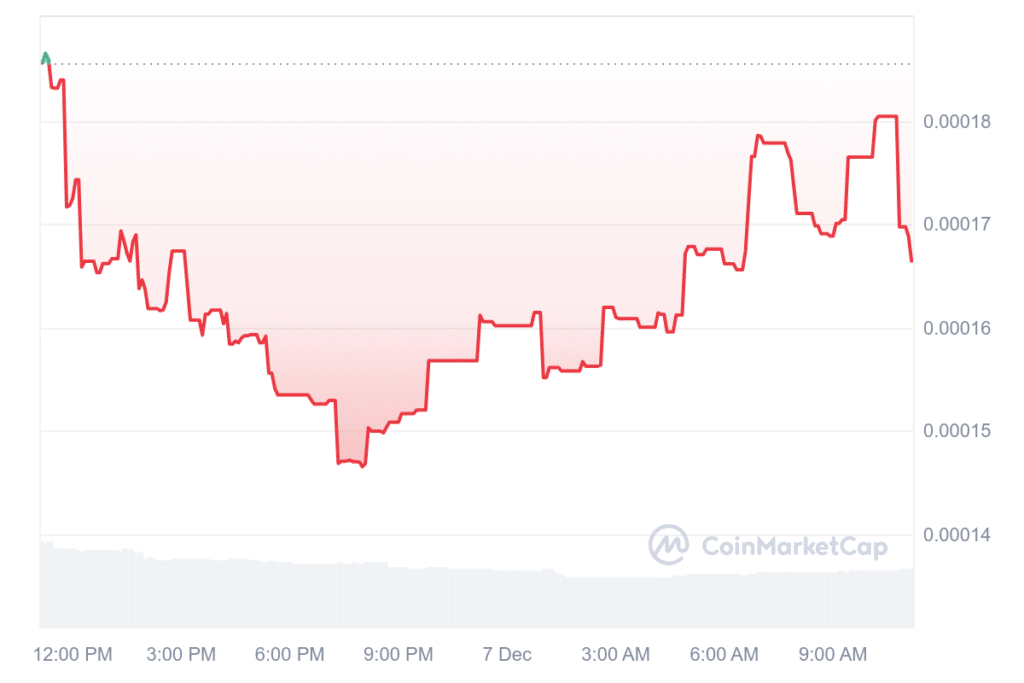

The meme personality is facing serious backlash after her newly launched cryptocurrency, Hawk, took a nosedive from a $490 million market cap to just $60 million in mere hours.

The crypto community, including YouTuber “Coffeezilla” (whose real name is Stephen Findeisen), is accusing Welch of running a “pump and dump” scheme, where hype drives the price up, only for insiders to cash out and leave investors hanging.

Welch denied any wrongdoing. In a social media post, she claimed that her team “tried to stop snipers,” bad actors who artificially inflate prices by buying large amounts early, creating an illusion of demand.

— Haliey Welch (@HalieyWelchX) December 4, 2024Copy and pasting:

Hawkanomics:

Team hasn’t sold one token and not 1 KOL was given 1 free token

We tried to stop snipers as best we could through high fee’s in the start of launch on @MeteoraAG

Fee’s have now been dropped pic.twitter.com/E7xN9VmCrx

A community note on Welch’s X post indicated that Welch’s team had been “selling their token since launch.”

At last check Saturday, the Hawk Tuah coin was down over 7%. Just minutes earlier, it was up by 0.45%.

What’s at stake and did Hawk Tuah Girl profit?

Sniping entices ordinary investors to buy in on a token at a high price, thinking they’re catching a rising trend.

After snipers sell their holdings, the token’s price falls off a cliff, leaving late investors holding nearly worthless assets.

Hawk launched on the Solana blockchain, and while meme coins are usually seen as low-risk fun, this one has sparked accusations of rug pulling, a cryptocurrency scam in which developers withdraw liquidity or suddenly abandon a project, resulting in the token’s price plummeting.

In a YouTube video posted Dec. 5, Coffeezilla — who has made a name for scrutinizing the legitimacy of coins backed by influencers (i.e., Andrew Tate) — noted that

Welch, who made a name by pretending to spit in a viral video, claimed the coin was meant to unite fans and tackle impersonators.

Unfortunately, it seems the only thing united was the confusion. A recorded back-and-forth between Coffeezilla and Welch’s legal representative, which currently has over 2.7 million views on YouTube, reveals what appears to be a convoluted payment structure for Welch and the Hawk Tuah-inspired coin.

Welch, according to Coffeezilla citing comments from her reps, was paid roughly $125,000 in advance from an unnamed company to market the Hawk Tuah token. She was subsequently meant to receive 50% of net proceeds after “payments of costs to third parties,” Coffeezilla adds.

Details regarding the third parties remains unclear. Crypto.news has asked Welch to comment, but has not heard back.

“I think this whole situation is terrible and she should feel bad,” Coffeezilla concludes. “[Welch] got in bed with these people who clearly saw dollar signs. She saw dollar signs and they did this and people have been hurt.”

See Coffeezilla’s exposé before.