Algorand TVL surges 300% in a month – Will ALGO’s price mirror the uptrend?

12/09/2024 09:00

Algorand’s TVL surged 300%, hitting $244 million. Explore ALGO’s bullish momentum and rising network activity.

- Algorand’s TVL jumped 300% in a month, with Folks Finance driving DeFi growth.

- ALGO’s price maintains bullish momentum, supported by rising network activity.

Algorand [ALGO] has seen a remarkable increase in Total Value Locked (TVL) over the past month. Fueled by protocols like Folks Finance, this growth reflects a renewed interest in Algorand’s ecosystem.

Meanwhile, despite minor retracements, ALGO’s bullish price performance and rising network activity highlight sustained momentum.

DeFi driving the Algorand surge

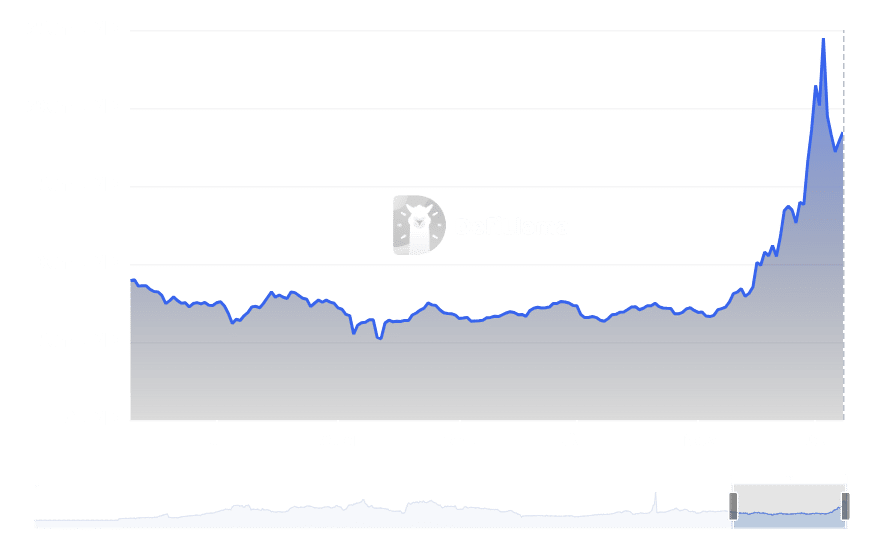

Algorand has experienced an impressive surge in Total Value Locked (TVL), recording over 300% growth in the past 30 days, according to DeFiLlama.

On the 3rd of December, the blockchain’s TVL hit $244.74 million, its second-highest level in history.

However, at the time of writing, TVL has settled around $184.5 million, reflecting a slight retracement but maintaining an upward trajectory.

The TVL growth was significantly propelled by Folks Finance, which saw a 289% increase over the past month, with more than $284 million in assets locked.

This makes it the leading protocol driving Algorand’s DeFi ecosystem expansion. Other DeFi protocols on Algorand have also seen a steady increase in activity, signaling a renewed interest in its ecosystem.

Price performance: Bullish momentum sustained

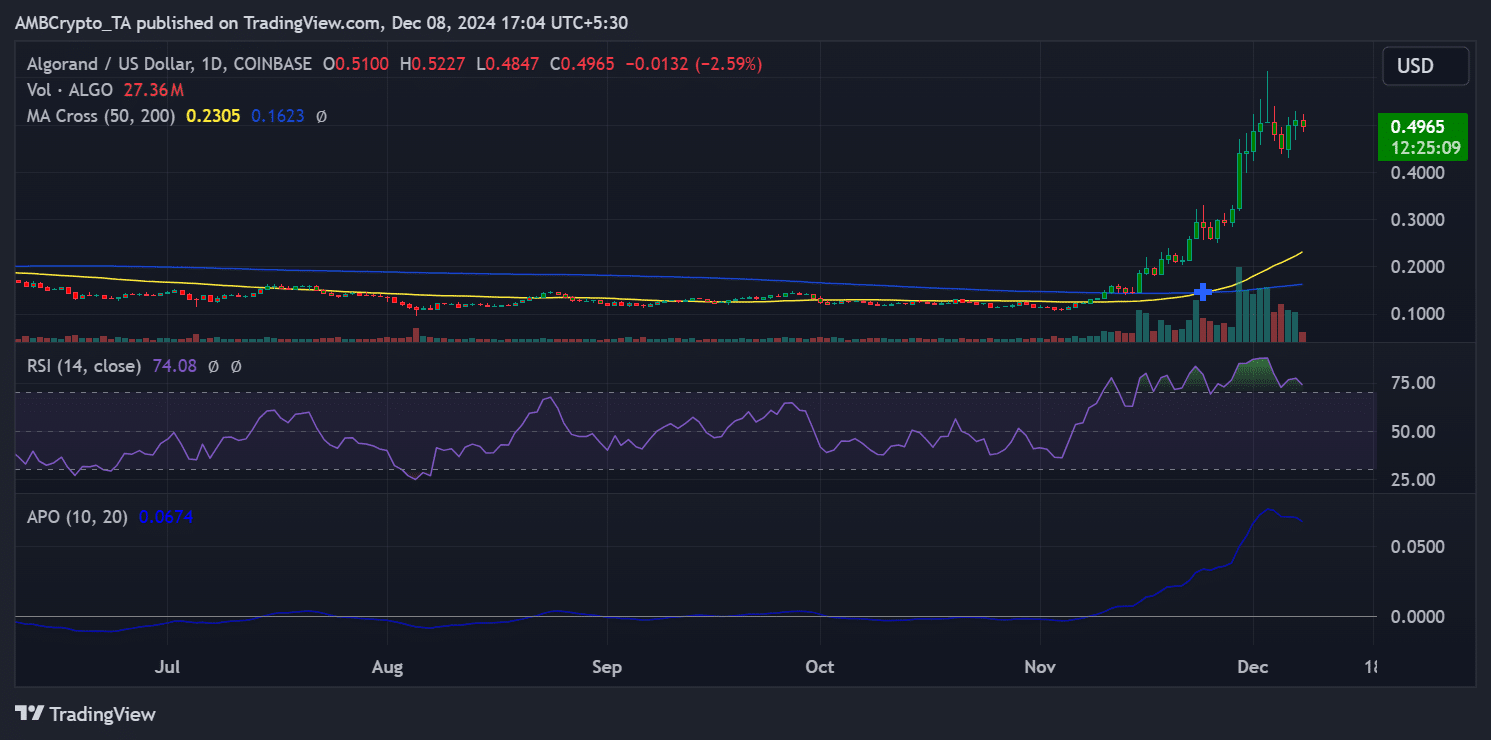

Algorand’s native token, ALGO, has mirrored the positive on-chain metrics with substantial price gains.

ALGO was trading at $0.4965, reflecting a slight dip from its recent highs but maintaining a strong overall uptrend. The token broke above its 200-day moving average, signaling a bullish outlook.

The Relative Strength Index (RSI) of 74.08 suggests that ALGO is currently in overbought territory, indicating potential consolidation or profit-taking.

However, the Average Price Oscillator (APO) continues to display upward momentum, highlighting sustained bullish sentiment.

Volume analysis: Network and market activity surge

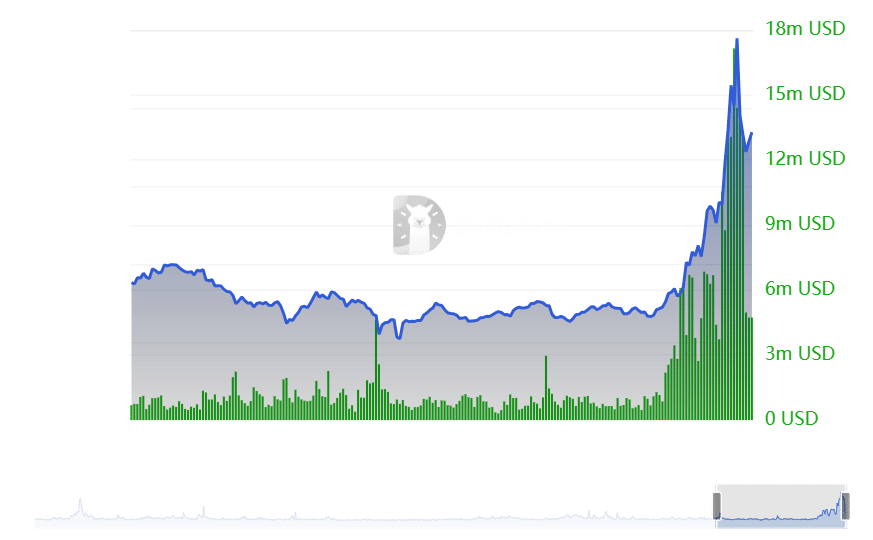

The recent performance of Algorand’s Total Value Locked (TVL) is strongly supported by its strong volume activity. The trading volume on the network saw a surge, reaching 27.36 million on the 8th of December.

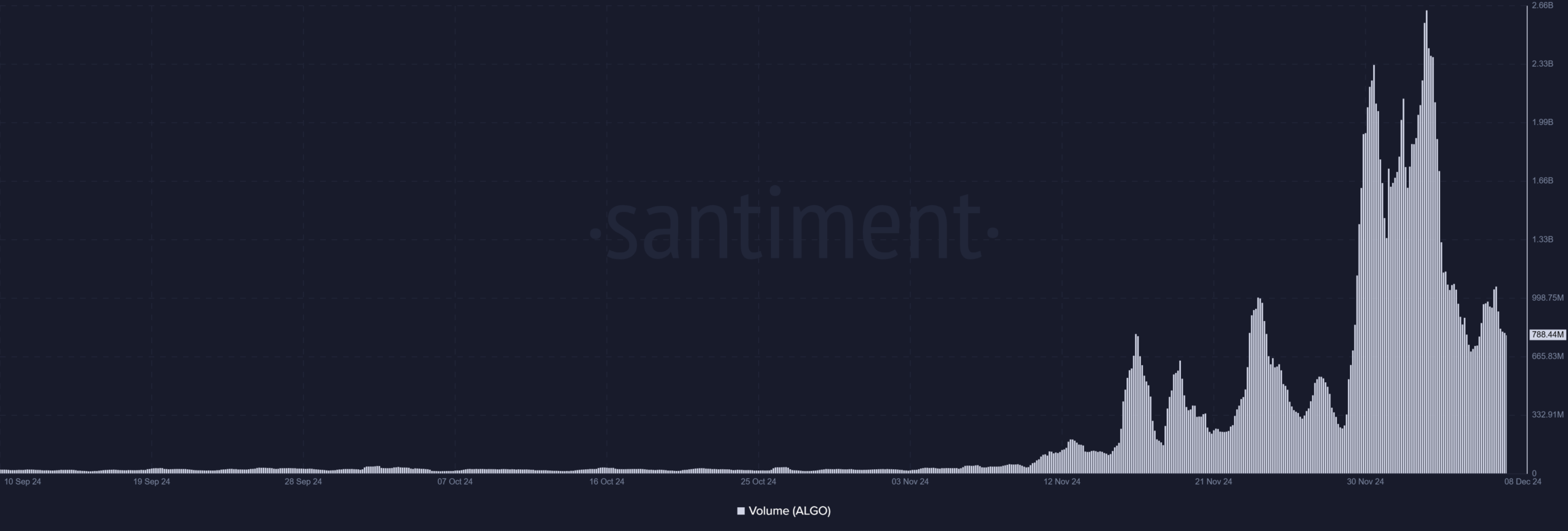

Data from DefiLlama shows a significant spike in Algorand’s network volume, peaking at 2.33 billion ALGO in late November.

Although it has since retraced to approximately 788.44 million ALGO, the elevated levels still signify heightened activity on the network.

This aligns with the explosive TVL growth recorded on platforms like Folks Finance. The growth suggests increased network engagement.

Additionally, data from Santiment shows a significant spike in ALGO’s volume, peaking at $2.33 billion ALGO during late November.

Although it has since retraced to approximately $788.44 million, the elevated levels still signify heightened activity on the network.

Is your portfolio green? Check out the ALGO Profit Calculator

The interplay between network and trading volumes paints a picture of heightened utility and interest in Algorand.

However, with both metrics pulling back from their recent highs, it remains to be seen if the network can sustain its recent momentum or if a correction is imminent.