SuperVerse crypto hits $1B market cap in 30 days: Can SUPER keep its gains?

12/10/2024 06:00

SUPER remains in bullish territory, buoyed by strong market sentiment. After a market cap of $1 Billion, what's next for SuperVerse crypto?

Posted:

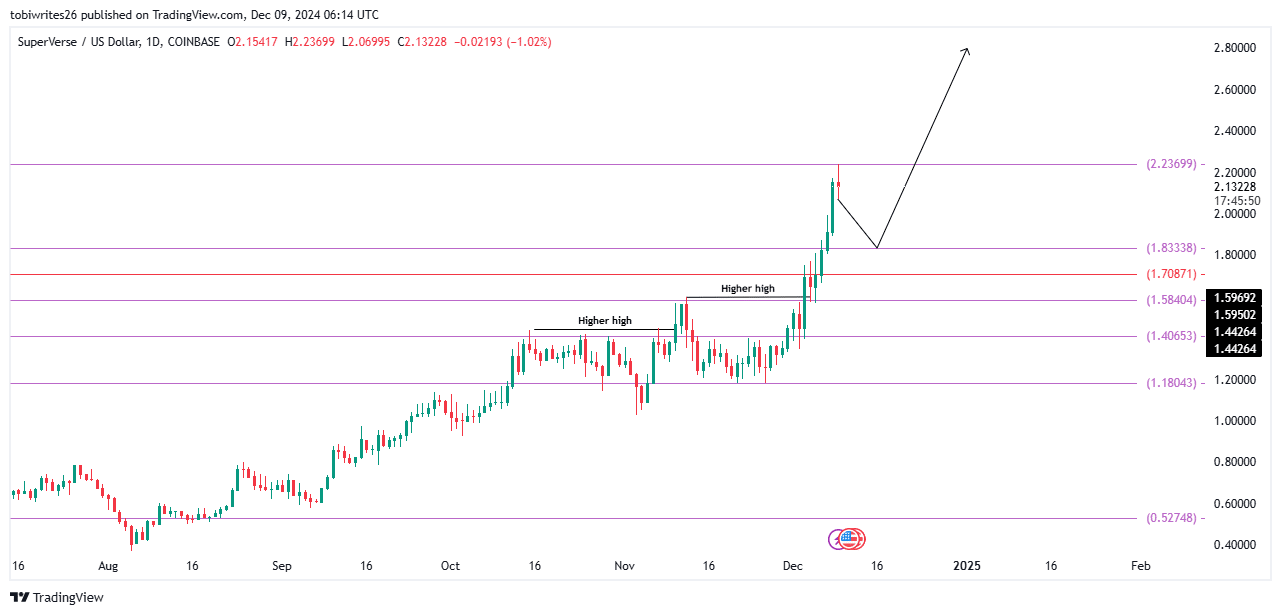

- A Fibonacci retracement showed where the price of SuperVerse crypto might temporarily dip.

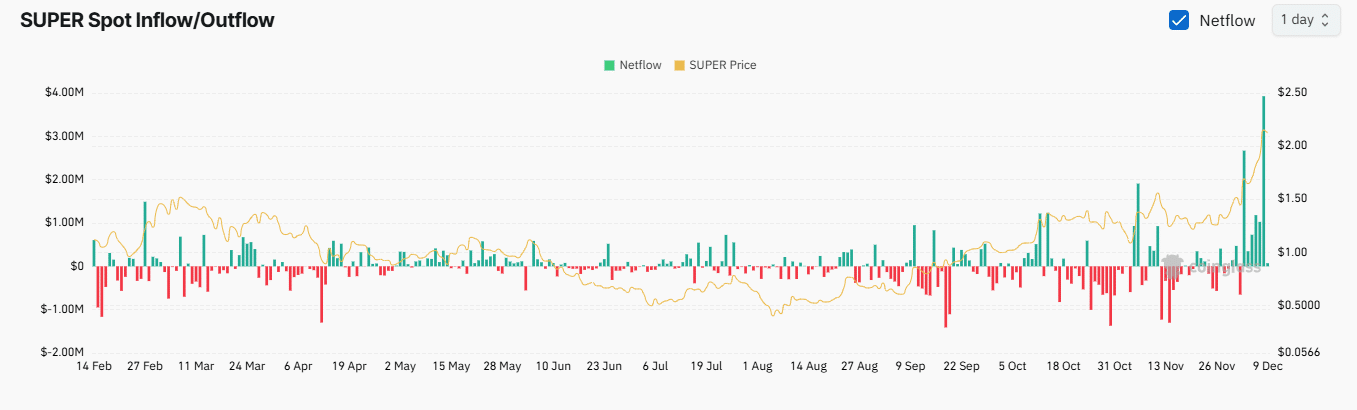

- Caution persists as positive Exchange Netflow highlights the potential for increased sell pressure.

Over the past month, SuperVerse [SUPER] has skyrocketed 60%, aligning with broader market gains. This rally propelled its market capitalization to an impressive $1 billion in just 30 days.

Recent movements suggest buyers remain in control, aiming to push the asset to uncharted highs. However, whether this momentum can sustain itself amid potential market headwinds isn’t determined.

Decline-rally pattern: What’s next for SUPER?

According to the chart, there’s a strong likelihood that SUPER’s upward momentum may pause temporarily as it seeks a key support level where sufficient buy orders could reignite the rally.

The Fibonacci retracement tool highlighted the 0.382 level, situated at $1.83, as the nearest support zone. This represented a potential 18.14% drop from the recent peak before a recovery resumes.

However, there’s a possibility that the decline could extend further to the 0.5 retracement level, marked by the $1.70 price zone, before an upward continuation.

Analysis from AMBCrypto identified a major factor that may contribute to this potential short-term pullback in SUPER’s price.

SuperVerse crypto faces downward pressure

Data from Coinglass revealed that on the 8th of December, SUPER recorded its highest daily Exchange Netflow since inception, with $3.93 million worth of the asset added to cryptocurrency exchanges.

Exchange Netflow measures the difference between the inflow and outflow of an asset on exchanges. A positive Netflow indicates increased selling activity as assets are moved to exchanges for liquidation.

Conversely, a negative Netflow suggests holders are moving assets off exchanges, signaling long-term holding commitments.

For SUPER, the Netflow is both high and positive, which is a sign of a significant selling activity. This increased sell pressure has contributed to a decline in demand, driving prices lower.

According to the chart, support levels may be found at the 0.382 Fibonacci retracement ($1.83) or potentially the 0.5 retracement level ($1.70).

Market remains firmly bullish

Current market sentiment indicates a strong bullish outlook for SUPER, supported by key metrics within this range.

As of now, Open Interest—a metric tracking the total number of unsettled futures contracts—has risen by 9.81%, reaching $41.46 million.

This increase signals more buyers entering the market with long positions, which could drive the asset to trend higher from its current levels.

Read SuperVerse’s [SUPER] Price Prediction 2024–2025

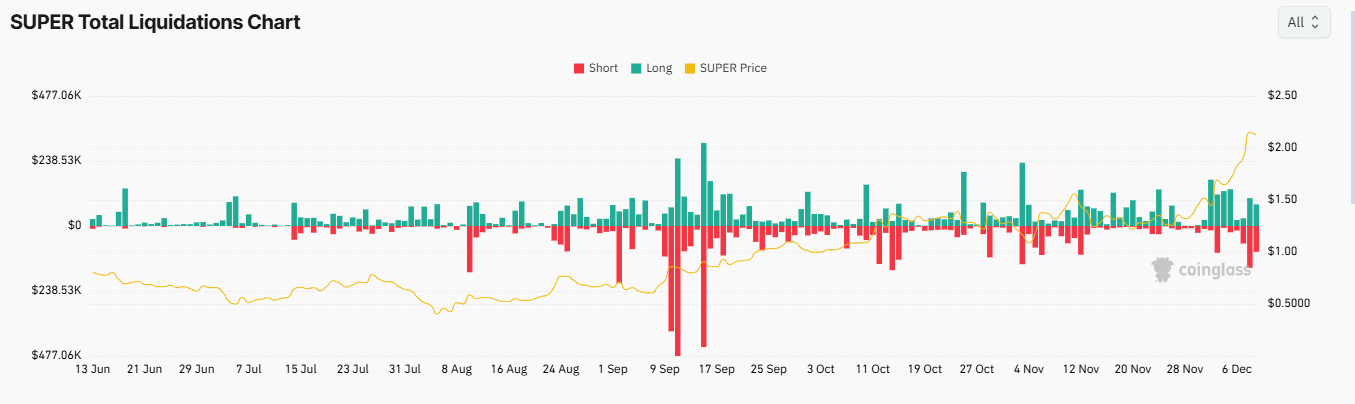

Additionally, short liquidations have outpaced long liquidations, with $296.48K shorts closed in the past 24 hours. This dynamic adds some downward pressure to the market, but ultimately favors buyers.

These conditions suggest a market bias toward long positions. If this trend holds, SUPER could surpass its recent highs.