Bitcoin and Ethereum whales are looking to capitalize on the market-wide downturn as the leading assets are trading at a discount.

Bitcoin (BTC) fell 1.4% in the past 24 hours and is trading at $97,300 at the time of writing. The flagship cryptocurrency touched an all-time high of $103,700 last week.

Ethereum (ETH) dropped 3.3% and is currently changing hands at $3,750 — the leading altcoin broke the $4,000 mark on Dec. 6 for the first time in nine months.

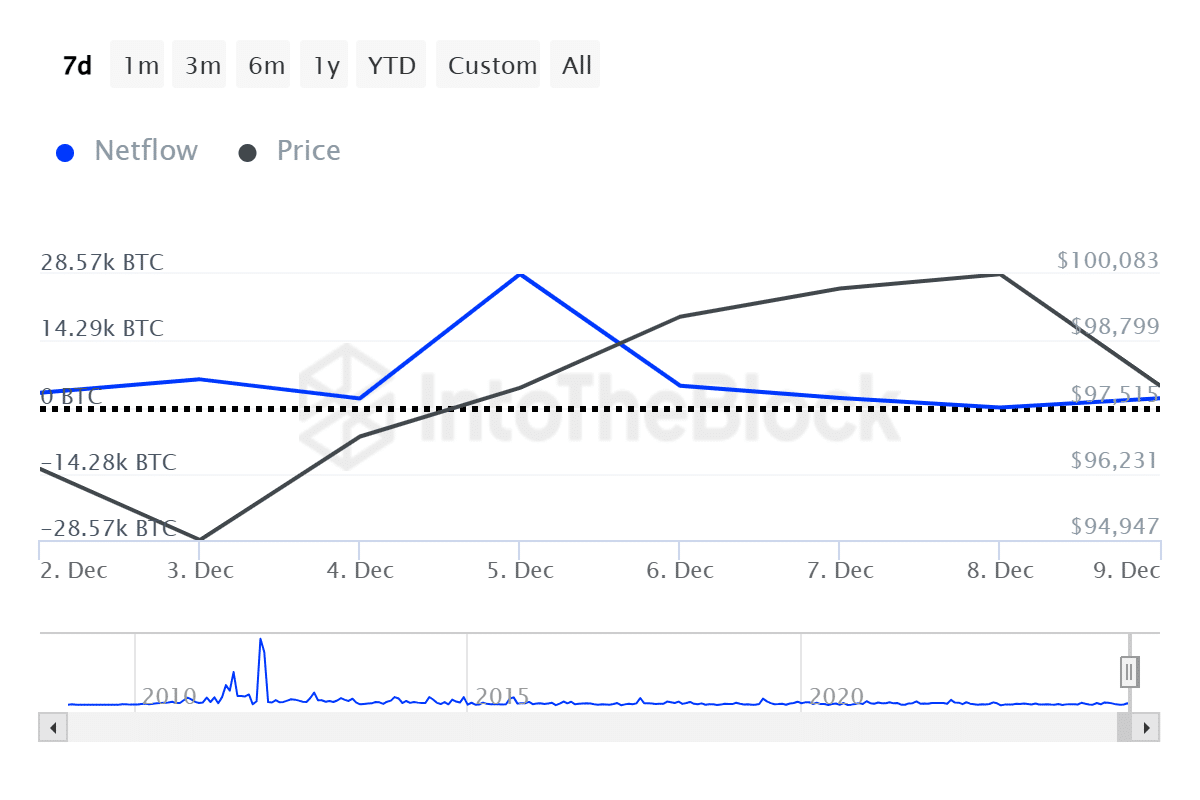

As both of the leading assets witnessed price drops, whales started to accumulate. According to data from the market analytics platform IntoTheBlock, large Bitcoin holders registered a net inflow of 1,900 BTC on Monday after seeing consistent declines since Dec. 5.

The Bitcoin whale transactions, worth at least $100,000, increased by 116% to $93 billion yesterday.

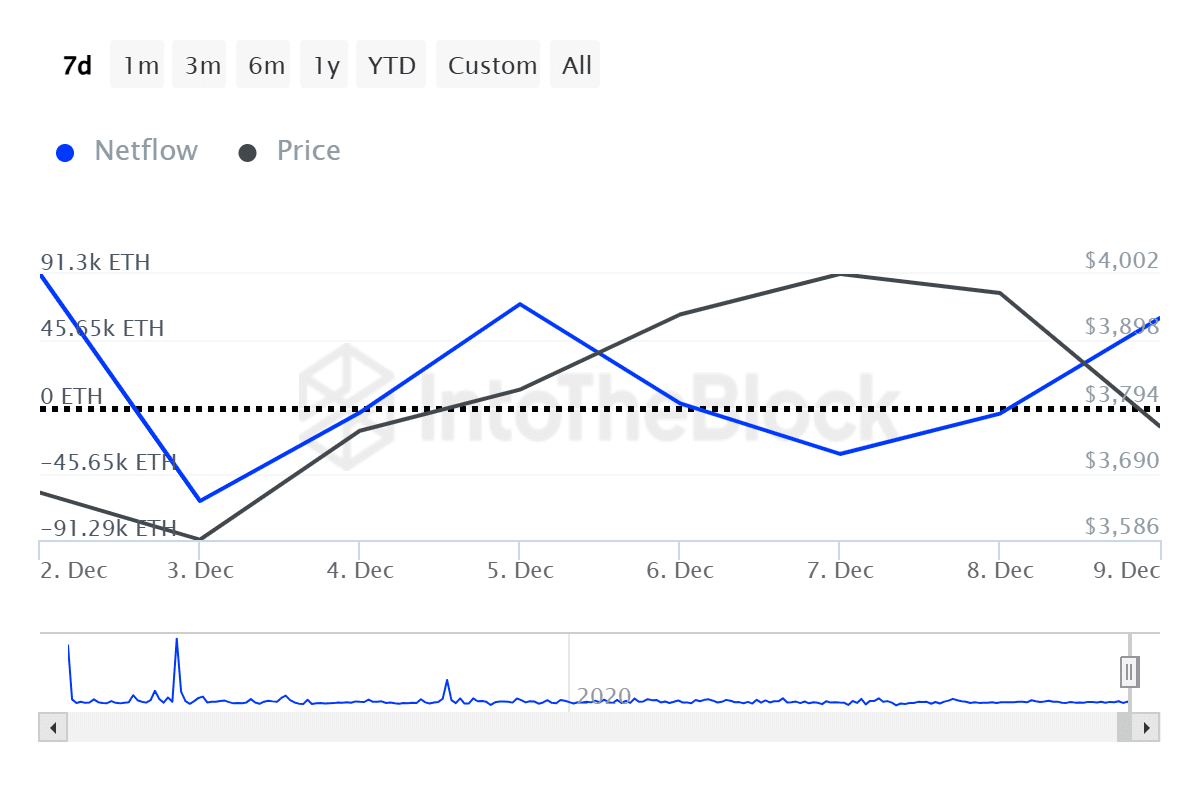

Ethereum whales recorded a similar movement with a net inflow of 61,000 ETH on Dec. 9, per ITB data. The spikes in BTC and ETH large holder net flows came as soon as the prices started to decline.

The amount of large Ethereum transactions also surged 127% to $10.9 billion on Monday.

Sudden positive shifts in whale activity could potentially trigger FOMO (fear of missing out) among retail investors to consequently push the prices again.

ITB data shows that over $200 million in USDT entered centralized exchanges on Dec. 9. Usually, the crypto market registers bullish momentum as investors buy Bitcoin and altcoins using the largest stablecoin.

Currently, the global crypto market cap is down 6% in the last 24 hours and is hovering at $3.65 trillion, according to data from CoinGecko. The daily trading volume, however, surged from $247 billion to $475 billion over the past day.

One of the main reasons behind the market-wide cooldown would be the expectations of the U.S. Consumer Price Index, scheduled for tomorrow, and the next FOMC meeting, scheduled for Dec. 17 and 18.

If these macro events show bullish signs, the crypto market will likely see another phase of upward momentum.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.