XRP eyes $2 as correction intensifies: Can it avoid further decline?

12/10/2024 20:00

XRP faces resistance at $2.40, testing $2.00 support. Will the coin reverse or will it continue on downward?

Posted:

- XRP faces mounting resistance near $2.40, triggering a 10% correction to $2.00

- Liquidations and profit-taking add pressure, making the $2.00 level crucial for XRP

XRP’s rally hit a wall at $2.40, plunging over 10% to test the critical $2.00 support. While the broader market weakness plays a role, mounting liquidations and profit-taking appear to be accelerating the drop.

As traders eye the $2.00 level, the question looms: can XRP hold the line or is more downside ahead?

XRP rally stalls at $2.40 amid mounting resistance

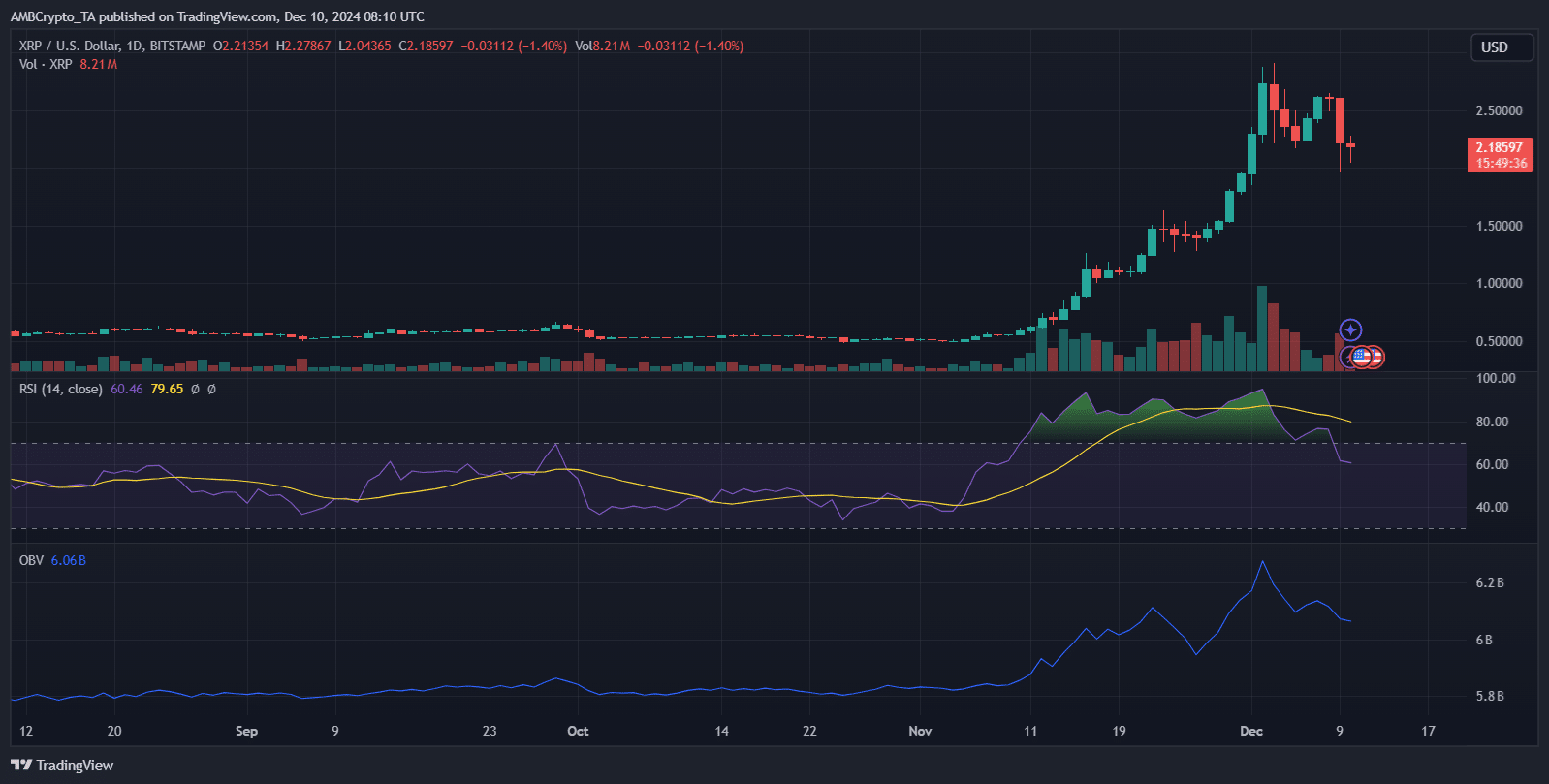

XRP’s rally to $2.50 was abruptly halted at the $2.40 resistance, leading to a sharp correction below $2.30. The daily RSI has retreated from overbought levels, as it hit 60.65 at press time, indicating waning bullish momentum.

Meanwhile, the OBV showed a decline from its peak, reflecting reduced buying pressure and fading market enthusiasm.

Despite a minor recovery above $2.20, XRP’s failure to regain the $2.30 mark, combined with bearish momentum indicators, suggests persistent selling pressure.

Without a decisive push above $2.30, XRP could remain vulnerable to further losses, with $2.00 emerging as a critical support level to watch.

The $2 support: XRP’s critical line in the sand

The $2.00 level stands as a pivotal support for XRP, both psychologically and technically. Historically, key round numbers like $2.00 act as a magnet for traders, often serving as a strong floor or trigger point for further declines.

Technically, losing this level could signal a shift in XRP’s medium-term trend, with potential for a deeper correction toward the $1.88 or even $1.75 support zones.

A decisive break below $2.00 could also trigger a cascade of liquidations as leveraged positions unwind, amplifying selling pressure. With the RSI already in bearish territory and the price struggling below major moving averages, holding $2.00 is critical.

If this support fails, it could spark heightened volatility and potentially derail bullish recovery efforts in the near term.

The role of liquidations and investor sentiment

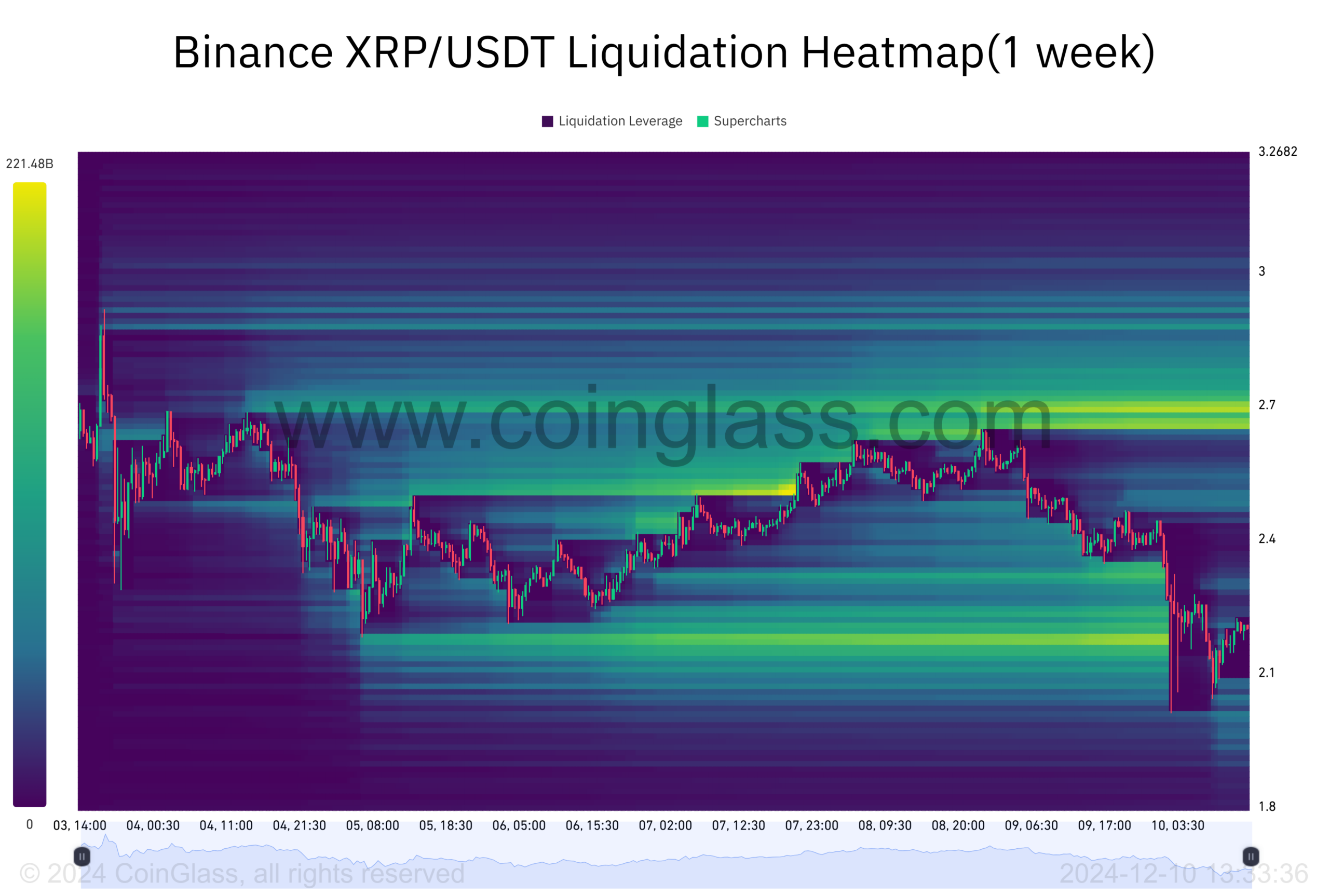

Liquidation data reveals significant turbulence during XRP’s drop from $2.50 to $1.98. The heatmap highlights clustered liquidations between $2.40 and $2.25, with intensified activity near $2.10 as long positions were forcibly closed.

This suggests overleveraged traders contributed to the price cascade, compounding bearish momentum.

On-chain behavior indicates a surge in retail exits alongside potential whale sell-offs as XRP approached critical support. If the $2.00 level is breached, additional liquidation cascades could amplify downside volatility, mirroring recent patterns.

These dynamics show the precarious balance between technical levels and market sentiment.

Is XRP poised for a reversal or more losses?

XRP’s ability to reverse its downtrend hinges on whether it can reclaim the $2.30 resistance and stabilize – the path to recovery seems uncertain, especially as liquidation pressures persist.

Read XRP’s Price Prediction 2024–2025

A bounce from the $2.00 support could spark a short-term recovery, but if selling momentum accelerates, XRP risks deeper declines, potentially targeting sub-$2.00 levels.

The upcoming price action will depend heavily on broader market sentiment and the behavior of leveraged traders, making a decisive move crucial for XRP’s next direction.