Sell signals flash for Chainlink: Time to let go of LINK?

12/11/2024 00:00

Chainlink [LINK] of late has showcased remarkable growth in its network activity, reflecting a rise in adoption and usage.

Posted:

- LINK’s TD sequential flagged a sell signal on the token’s chart.

- Selling pressure increased, and whales were also dumping their holdings.

Chainlink [LINK] has showcased remarkable growth of late in its network activity, reflecting a rise in adoption and usage. This massive hike in usage, however, couldn’t propel LINK’s growth as it fell victim to a double-digit price decline in the last 24 hours.

Chainlink is in trouble

IntoTheBlock recently posted a tweet highlighting Chainlink’s rising network activity. The tweet mentioned that Chainlink was averaging 8.22k daily active addresses, a remarkable 142% growth compared to one month ago.

Not only did daily active addresses increase, but the blockchain’s number of transactions also went up and averaged at 11.26k transactions in the last seven days.

While LINK’s network activity gained momentum, the token’s price declined sharply. To be precise, LINK’s value dipped by over 12% in the last 24 hours, pushing its trading price down to $22.89.

The latest price correction pushed 156k LINK addresses “out of the money,” which accounted for over 22% of the total number of LINK addresses, as per IntoTheBlock’s data.

A possible reason behind this was revealed by Ali Martinez, a popular crypto analyst. Martinez posted a tweet pointing out a sell signal flagged by LINK’s TD sequential.

What to expect from LINK

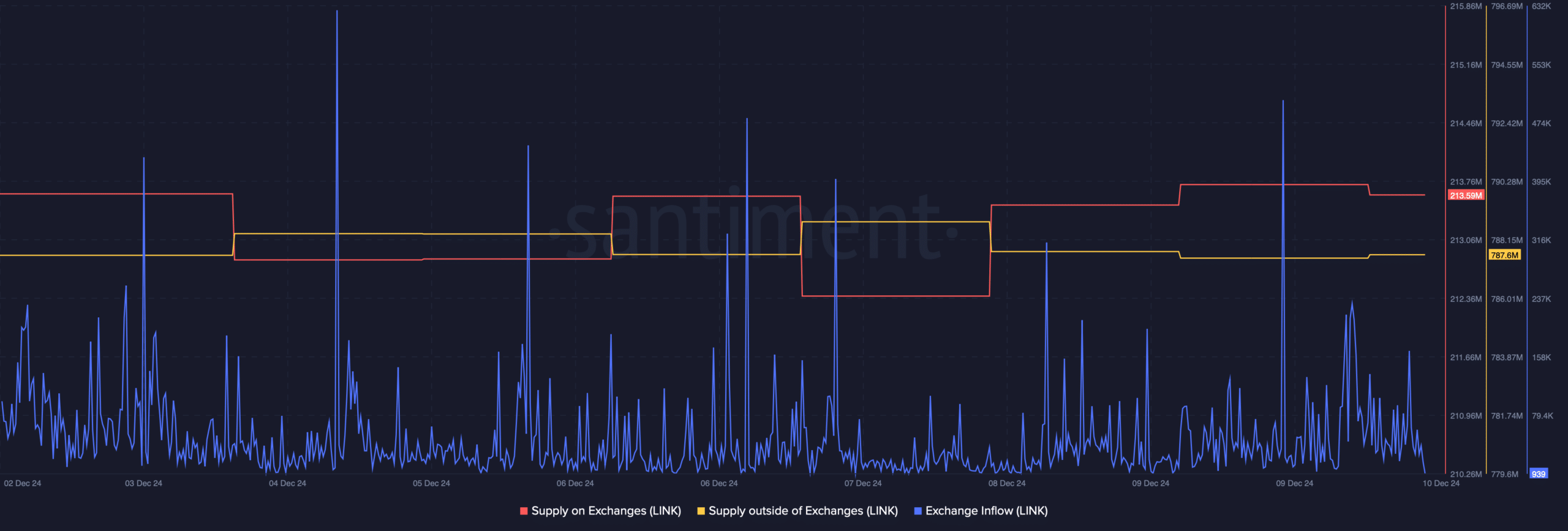

AMBCrypto’s analysis of Santiment’s data revealed that investors actually sold their holdings when the sell signal flashed. This was evident from the rise in LINK’s supply on exchanges and a decline in its supply outside of exchanges.

The fact that selling pressure was high was further proven by the increase in Chainlink’s exchange inflow.

Meanwhile, the big pocketed players in the market also chose to sell. Santiment’s latest tweet pointed out that whales deposited LINK worth more than $25 million in the past few days to centralized exchanges.

This was a clear sign of declining confidence in the token, which had the potential to push LINK’s price further down in the coming days. If that turns out to be true, then it won’t be surprising to see LINK once again dropping to the $20.66 support level.

However, the fear and greed index had a value of 38% at press time, meaning that the market was in a “fear” phase.

Is your portfolio green? Check out the LINK Profit Calculator

Whenever the metric reaches this level, it indicates that there are chances of a trend reversal.

If the bulls buckle up and initiate a recover, then it will be crucial for LINK to first cross $24.3 as liquidation will rise substantially. An increase in liquidation often results in short-term pullbacks.