NewsBriefs - Trump aims for Bitcoin to reach $150,000 during his presidency, Axios reports

12/11/2024 00:37

Following his election victory, President Donald Trump expressed a desire for Bitcoin to surpass $150,000, reflecting his focus on the token...

Editor-curated news, summarized by AI

Trump aims for Bitcoin to reach $150,000 during his presidency, Axios reports

Following his election victory, President Donald Trump expressed a desire for Bitcoin to surpass $150,000, reflecting his focus on the token's price as a measure of economic success. Bitcoin's price has notably increased since Trump's election, reaching new highs. Additionally, Trump plans to implement crypto-friendly regulations and has nominated Paul Atkins for SEC chair, indicating a proactive stance on crypto during his presidency.

Latest

-

Trump aims for Bitcoin to reach $150,000 during his presidency, Axios reports

Following his election victory, President Donald Trump expressed a desire for Bitcoin to surpass $150,000, reflecting his focus on the token's price as a measure of economic success. Bitcoin's price has notably increased since Trump's election, reaching new highs. Additionally, Trump plans to implement crypto-friendly regulations and has nominated Paul Atkins for SEC chair, indicating a proactive stance on crypto during his presidency.

Expand

-

Tether's USDT gains acceptance as a virtual asset in Abu Dhabi Global Market

The Financial Services Regulatory Authority (FSRA) of the Abu Dhabi Global Market (ADGM) has officially recognized Tether's USD₮ as an Accepted Virtual Asset (AVA), enabling authorized personnel to offer services associated with USD₮ in ADGM. This development aligns with the United Arab Emirates' strategy to integrate digital and traditional finance, reinforcing Abu Dhabi and Dubai's positions as global leaders in crypto innovation. The recognition marks a significant advancement in Tether's effort to support financial inclusion and bridge the gap between conventional and digital economies.

Expand

-

Bernstein predicts quantum threat to Bitcoin is decades away

Bernstein analysts have determined that Google's new Willow quantum chip does not pose an immediate risk to Bitcoin's security, stating the threat from quantum computing seems decades away despite recent advancements. Currently, Bitcoin uses cryptographic algorithms like ECDSA and SHA-256, which remain secure against quantum attacks with the current level of quantum technology. Discussions continue within the crypto community about moving to quantum-resistant encryption to preempt future threats.

Expand

-

Eric Trump forecasts Bitcoin reaching $1 million

Eric Trump, at the Bitcoin MENA event in Abu Dhabi, predicted Bitcoin will eventually hit $1 million, citing its scarcity and transformative potential. Trump portrayed Bitcoin as more than an investment, emphasizing its role as a global asset, store of value, and hedge against various instabilities. He also noted increasing government adoption and the decentralized, middleman-free nature of Bitcoin as significant to its ascent.

Expand

-

Crypto.com secures corporate banking services from Deutsche Bank in Singapore, Australia, and Hong Kong

Crypto.com has partnered with Deutsche Bank to receive corporate banking services in Singapore, Australia, and Hong Kong. This partnership aims to enhance Crypto.com's corporate banking capabilities, increase operational efficiency, and strengthen its banking foundation in these regions. Deutsche Bank's support is part of a broader relationship that might expand to more countries, emphasizing Crypto.com's commitment to security and compliance, and supporting its global growth ambitions.

Expand

-

Crypto market experiences broad selloff with significant declines in altcoins

A significant downturn hit the crypto market, with Bitcoin and other major tokens witnessing sharp declines. Bitcoin dropped to just above $95,000, a 5% decrease, while Ether fell by 10%. The broader CoinDesk 20 Index reported an over 8% decline, notably impacted by approximately 20% drops in Cardano, Avalanche, and XRP. The market's tumult resulted in over $750 million in leveraged derivatives positions being liquidated, indicating a high volume of bullish bets were wiped out. This market behavior signals a potentially brief consolidation phase before a possible rebound, necessitating strategic trading adjustments.

Expand

-

Ripple CEO criticizes 60 Minutes for omitting key XRP ruling

Brad Garlinghouse, CEO of Ripple Labs, criticized 60 Minutes for excluding critical details about a federal judge's decision that XRP is not a security, in their segment on Ripple's involvement in the 2024 US elections. The segment, which aired on December 8, focused on Ripple's funding of Fairshake, a political action committee supporting pro-crypto candidates, and the ongoing SEC lawsuit regarding XRP as an unregistered security. Garlinghouse highlighted the omission as misleading because it ignored the judge's favorable July ruling for Ripple.

Expand

-

CoinShares reports record $3.85 billion inflow into crypto investment products

Crypto investment products experienced a record-breaking week with inflows of over $3.85 billion, mainly led by the US, as reported by CoinShares. The funds currently boast a total of $41 billion in net inflows year-to-date, with assets under management reaching a new high of over $165 billion. Bitcoin commanded the largest share of these inflows, contributing $2.5 billion, while Ethereum also saw record inflows of $1.2 billion. Notably, Solana experienced its second week of outflows.

Expand

-

Total stablecoin market cap exceeds $200 billion as DeFi lending yields surge

The total market capitalization of stablecoins has surpassed $200 billion, indicating a 13% increase in the past month, driven by investors seeking high yields on decentralized finance (DeFi) platforms. This surge is attributed to elevated lending rates offered by DeFi protocols such as Aave and Compound, with stablecoin borrowing and lending rates reaching 10-20% annualized. Additionally, the total value locked in lending protocols has peaked at $54 billion, highlighting the growing investor interest in accessing higher yields through onchain activities.

Expand

-

Radiant Capital confirms North Korea orchestrated $50M DeFi platform hack

Radiant Capital's DeFi platform was hacked in October, leading to a $50 million loss through malware delivered via a Telegram message from a North Korea-aligned hacker impersonating an ex-contractor. Cybersecurity firm Mandiant attributes the attack to a DPRK-nexus threat actor. The malware, concealed within a ZIP file purportedly from a trusted source, compromised multiple developer devices and manipulated transactions undetected.

Expand

-

UK top financial regulator warns against unauthorized Solana-based memecoin launchpad Pump.fun

The UK Financial Conduct Authority (FCA) has issued a warning about Solana-based memecoin launchpad Pump.fun, stating that it is not authorized to operate in the UK and may be targeting local consumers. The FCA advised the public to avoid dealing with Pump.fun, highlighting potential risks and scams. This situation could affect UK customers as they may lack certain financial protections and might not recover funds if issues occur.

Expand

-

Altcoins show resilience and potential decoupling from Bitcoin amid market volatility

Major altcoins like Ethereum and Solana have demonstrated stability and minor retracements despite Bitcoin's significant volatility, which included a drop from over $103,000 to below $92,000. According to Bitwise's André Dragosch, there is evidence of a growing decoupling between Bitcoin and altcoins, marked by reduced performance correlations and a variety of investment narratives, particularly since the US election. Additionally, record inflows into crypto exchange-traded products underscore increasing investor interest in altcoins.

Expand

-

Bitcoin miner BitFuFu reports holding 1,643 BTC and an 84 BTC self-mining output for November 2024

In November 2024, BitFuFu Inc. reported holding 1,643 BTC and producing 84 BTC through self-mining operations. The company also announced a net cash position of $98 million as of November 30, 2024, and plans to add 1 GW of mining capacity by the end of 2026. BitFuFu secured a $100 million credit line from Antpool Technologies and has expanded its mining fleet by 13,300 miners, increasing its total mining capability by roughly 2.4 EH/s.

Expand

-

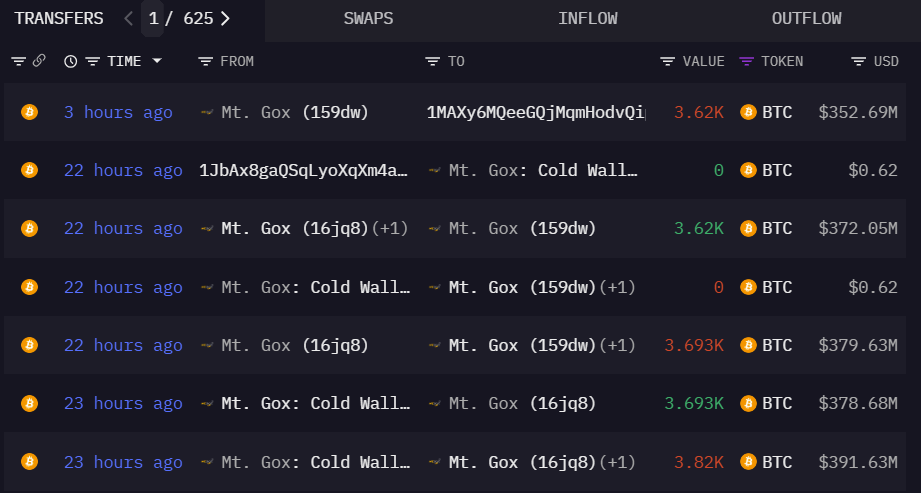

Mt. Gox transfers over $350 million in Bitcoin amid price fluctuations

Mt. Gox has executed two significant Bitcoin transactions totaling over $350 million. The first transaction moved 3,493 BTC to a new wallet, and the second transferred 126,577 BTC to another address. This activity follows a recent $2.8 billion Bitcoin transfer by Mt. Gox and comes after Bitcoin's price exceeded $100,000. The transactions are part of Mt. Gox's ongoing handling of funds, which is often speculated to involve paying off creditors, although only a portion of the transferred Bitcoin is expected to enter the market.

Expand

-

Financial Times apologizes for years of negative Bitcoin coverage after price hits $100K

FT Alphaville has issued an apology acknowledging its long-standing skepticism towards bitcoin, despite consistent critical coverage. This comes after bitcoin's price recently exceeded $100,000, leading to significant reader backlash. The editorial team reiterated that their past articles, which depicted bitcoin as inefficient and questioned its intrinsic worth, remain defended. However, they expressed regret for any influence their skeptical views may have had on readers' financial decisions.

Expand