JASMY rally stalls after whale profit-taking – What next?

12/11/2024 08:00

JASMY saw vastly increased whale activity in the past week, coinciding with the price forming local highs and retesting demand zones.

Posted:

- Jasmycoin saw a vast surge in whale activity as prices formed a local high at $0.059.

- While profit-taking was seen, the long-term uptrend might not be ending right away.

Jasmycoin [JASMY] was one of the coins that saw a notable spike in whale transactions over the past week.

In a Santiment Insights post, user Brianq noted that JASMY was among the projects with more than $500 million market cap.

Surging whale activity and the implications

Jasmycoin had a 616% increase in whale transactions, classified as $1 million or more. Such a dramatic spike in whale activity could either be profit-taking or massive accumulation, depending on the price movement.

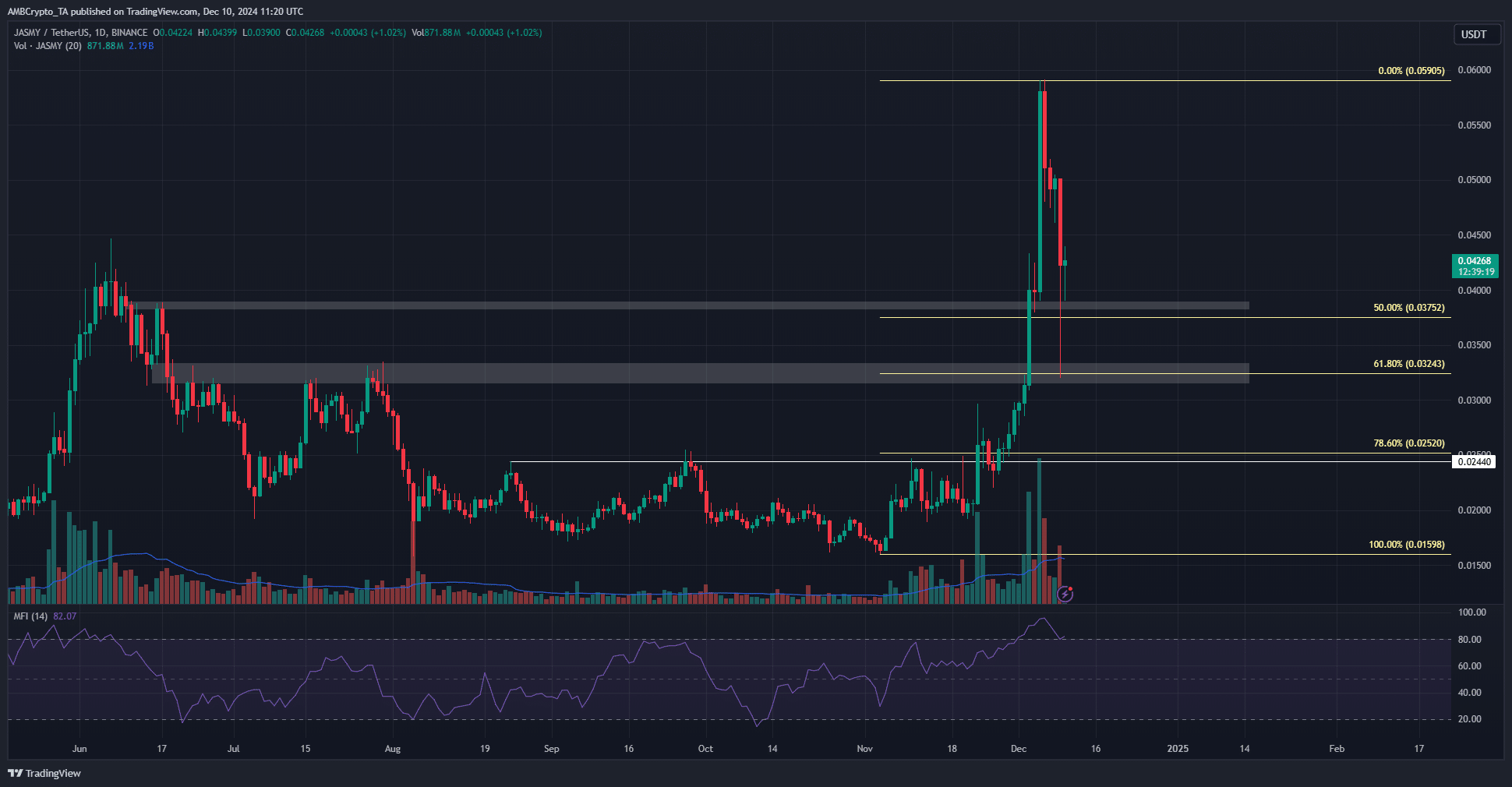

In the past five days, Jasmycoin has tested the $0.059 local highs and retreated as deep as the $0.032 demand zone.

Two potential demand zones at $0.032 and $0.04 were identified from the price action earlier this year, and JASMY bulls have defended both during the move downward.

The timing of the whale activity showed that it was a bit of both profit-taking near the highs, as well as accumulation around the $0.04 area.

AMBCrypto’s technical analysis of the daily timeframe showed that the market structure was bullish. The MFI did not show a divergence yet.

The high trading volume in December has receded during the pullback, and needs to pick up for the rally to continue.

Profit-taking during the uptrend

The daily active addresses soared in November and December as JASMY climbed past highs set in the past six months. This was expected, as soaring prices draw greater attention from the crowds.

It also saw the mean coin age trend downward, especially in the past six weeks. This is also expected, as strong rallies are accompanied by profit-taking.

Of particular interest were the spikes in whale transactions. They were numerous over the past week, as JASMY reached local highs.

It picked up once again on the 9th of December, when JASMY was trading near the $0.032 and $0.04 demand zones.

The supply distribution supported the idea of distribution leading up to the end of November. Different cohorts of holders began to buy Jasmycoin at different periods in the past ten days.

The 10k-10M band began on the 29th of November.

Realistic or not, here’s JASMY’s market cap in BTC’s terms

Meanwhile, the 10M+ wallets were selling till the 8th of December, and began to increase their holdings on Monday.

Overall, Jasmycoin appeared to have a strongly bullish outlook despite the spike in whale activity. It is anticipated that a period of consolidation could follow before the next uptrend.