Will Stellar [XLM] rally again? THIS level holds the answer

12/11/2024 19:30![Will Stellar [XLM] rally again? THIS level holds the answer](https://ambcrypto.com/wp-content/uploads/2024/12/canva-xlm-1000x600.png)

Stellar eyes upside if 50% Fibonacci retracement holds at $0.3685. Bulls target the 1.0 extension at $1.1687.

- XLM traded at $0.4115 at press time, up 0.77% in 24 hours.

- The altcoin tested the 50% Fibonacci retracement at $0.3685.

Stellar [XLM] was trading at $0.4115 at the time of writing, up 0.77% in the past 24 hours, with a 24-hour low of $0.364 and a high of $0.4384.

Despite its impressive 279% rally over the past 30 days, XLM has lost momentum in recent weeks. The volume remained strong at $1.37 billion, though the price is still 55.79% below its $0.9381 ATH in January 2018.

Bitcoin’s [BTC] slight decline continues to pressure altcoins like Stellar, leading to deeper corrections.

50% Fibonacci level is key

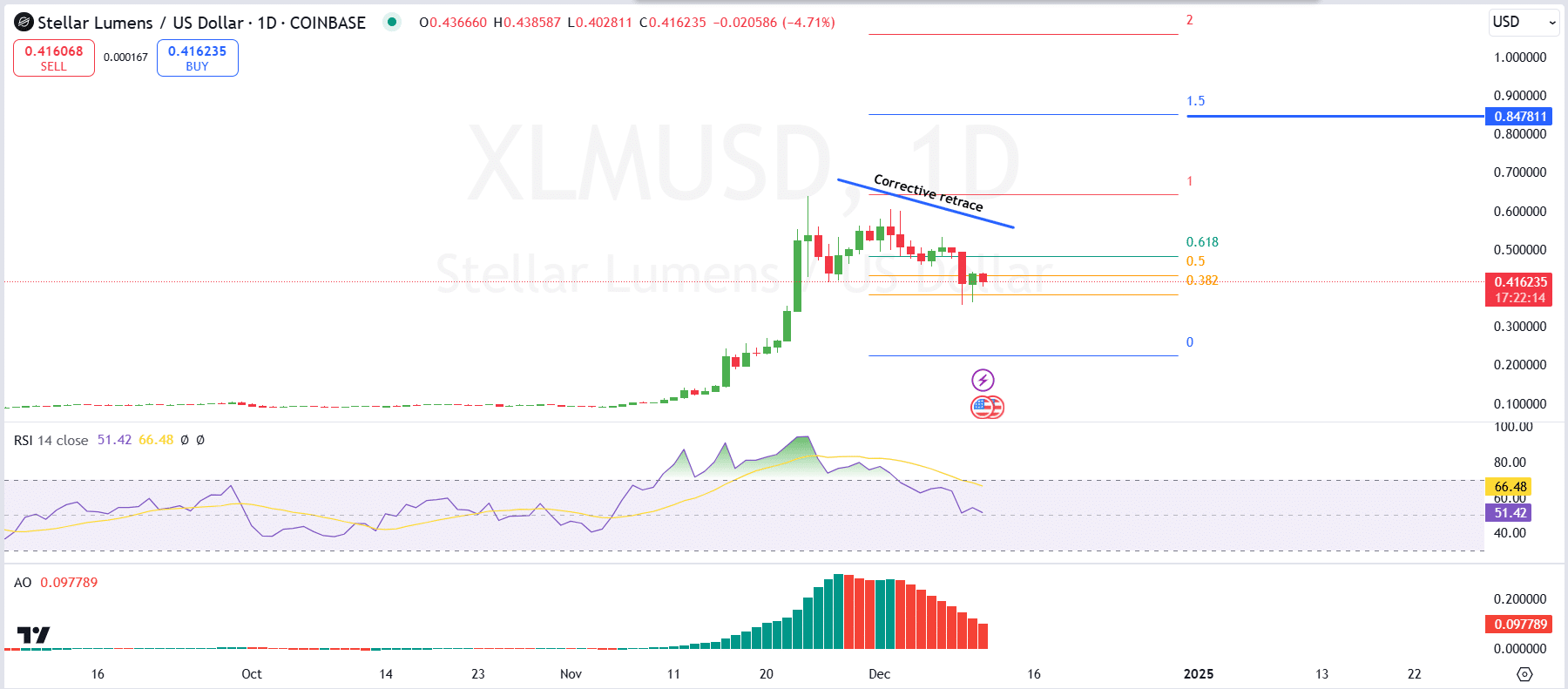

The XLM/USD daily chart indicated a corrective retracement after a strong rally at the time of writing, with the price at $0.4116.

The retracement aligned closely with the 50% Fibonacci level at $0.3685, which was now an important support level.

If the price successfully holds above this level, it could signal a reversal and pave the way for further bullish momentum. Below this, the 61.8% Fibonacci level at $0.3030 provides a critical support zone for the ongoing retracement.

The upward targets, should the price bounce from current levels, include the swing high at $0.8478 and the 1.0 Fibonacci extension at $1.1687.

A breach of the $0.5 resistance level would reinforce bullish sentiment, increasing the probability of these targets being tested.

Conversely, a break below the 61.8% level at $0.3851 could result in further declines and shift the market bias to bearish.

Momentum indicators reflected a neutral market sentiment. The RSI was positioned at 51.42, signaling neutral momentum without strong overbought or oversold conditions.

The Awesome Oscillator (AO) showed declining bullish momentum, with smaller green bars indicating weakening upward pressure.

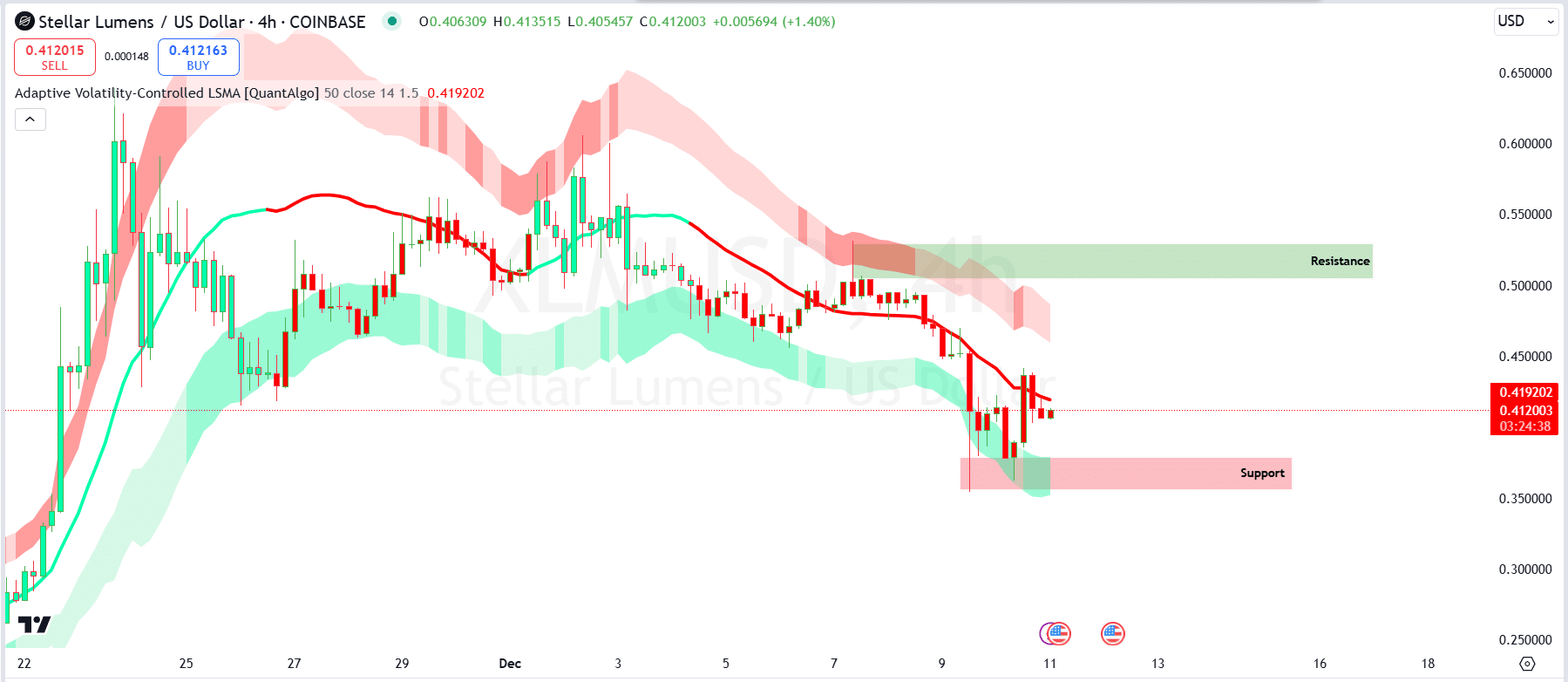

On the 4-hour chart, there was resistance near $0.4191 on the Adaptive Volatility-Controlled LSMA.

While the price appears to have formed a double bottom around $0.3500, a bullish reversal pattern indicated potential upward momentum if buyers regain control.

The lower band of the volatility channel provides additional support, suggesting a possible stabilization in this range.

If bullish momentum builds, the price could climb toward $0.5000, a key resistance level.

However, sustained rejection at $0.4191 or a drop below $0.4000 may trigger a retest of the $0.3500 support zone.

Bulls and bears are balanced

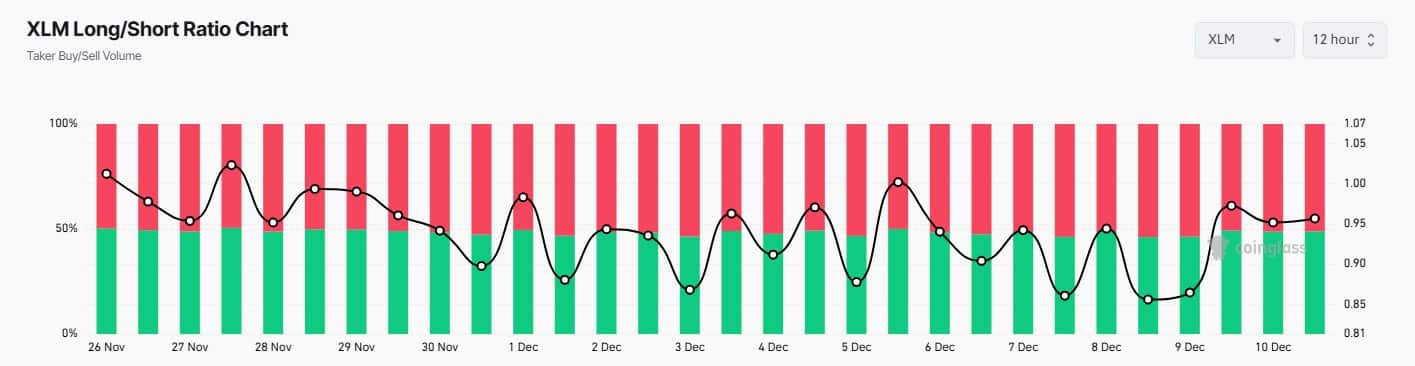

AMBCrypto analyzed XLM’s Long/Short Ratio, measured every 12 hours, to assess market sentiment. A ratio above 1 reflects bullish sentiment, indicating more traders opening long positions, expecting price increases.

Conversely, a ratio below 1 signals bearish sentiment, where short positions dominate, indicating expectations of a price decline.

The data revealed a fluctuating trend, with sentiment shifting between bullish and bearish positions.

On the 9th and 10th of December, the ratio briefly climbed above 1, showing optimism among traders.

However, the latest reading places the ratio slightly below 1, indicating a near-balance in sentiment but leaning toward a bearish outlook.

This shift highlights the cautious approach of traders toward XLM’s short-term price movements.

XLM TVL surges in 2024

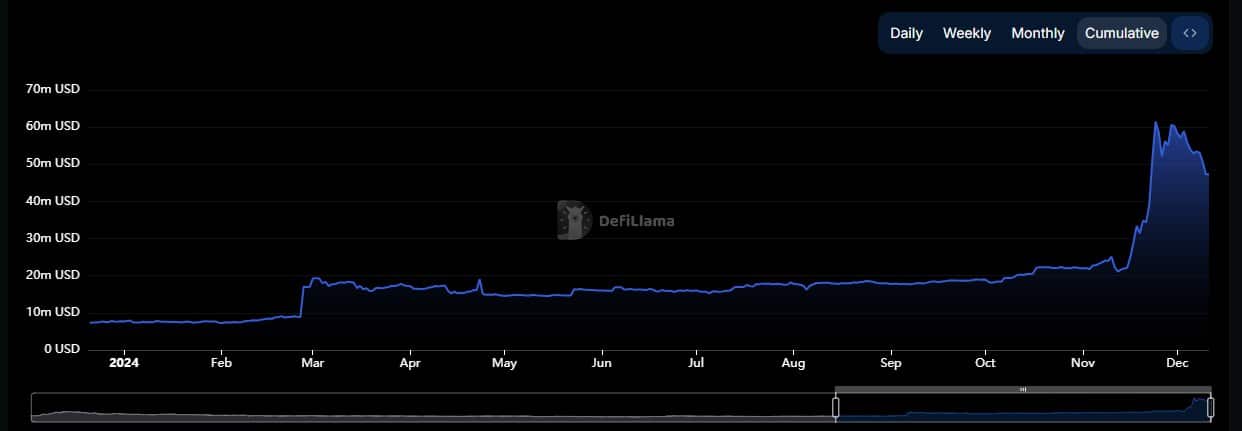

The XLM’s Total Value Locked in USD exhibited steady growth in early 2024 before skyrocketing in late October.

TVL remained stable around $10-20 million for most of the year, but in November, it surged dramatically to nearly $70 million, reflecting increased network activity and a sharp influx of liquidity.

Following the 25th of November, the TVL saw a noticeable drop, retracing to approximately $55 million by December.

Read Stellar’s [XLM] Price Prediction 2024–2025

This decline likely stemmed from profit-taking and broader market corrections.

Despite the pullback, TVL levels remained significantly higher than earlier in the year, showcasing sustained investor interest and confidence in XLM’s network.