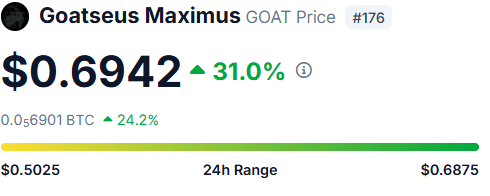

Will GOAT’s latest 31% hike finally push it above $1 on the charts?

12/12/2024 13:30

Goatseus Maximus (GOAT) seemed to be on its way back above $1 as it surged by more than 31% in the last 24 hours...

Posted:

- GOAT recorded a strong bullish bounceback after retesting the major support zone on the charts

- Almost $1 million in leveraged GOAT orders risk liquidation at $0.866

Goatseus Maximus (GOAT) seemed to be on its way back above $1 as it surged by more than 31% in the last 24 hours, at the time of writing. Its daily trading volume hit $390M too following a 7% hike – A negligible percentage when compared to the aforementioned price change.

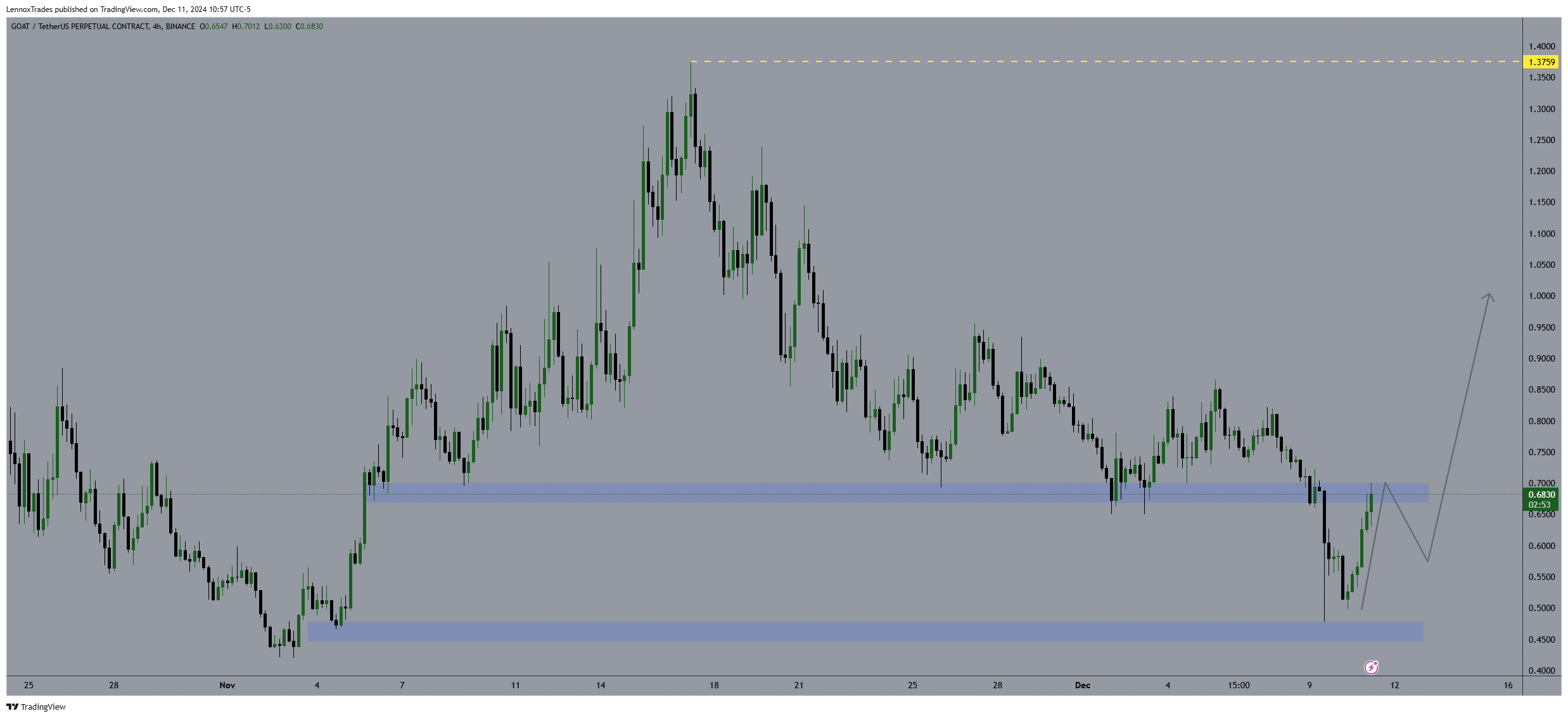

On the charts, GOAT/USDT saw a downtrend but found a support zone around the $0.46 zone. This demand zone sparked a rebound that led to the aforementioned gains, indicating a bullish response.

At press time, GOAT seemed to be approaching the $0.70-mark – A key resistance level. If this resistance could be successfully converted into support, it could indicate the potential for further uptrend.

The potential for GOAT to continue with bullish momentum hinges on the its ability to maintain above this critical resistance-turned-support level.

This would suggest a strong bullish recovery towards the $1.4 high, while potentially making a new ATH.

However, the market could “spend a bit more time below, might not,” indicating the uncertainty of its prevailing price levels in determining the next phase of price action.

GOAT’s key liquidation levels and social sentiment

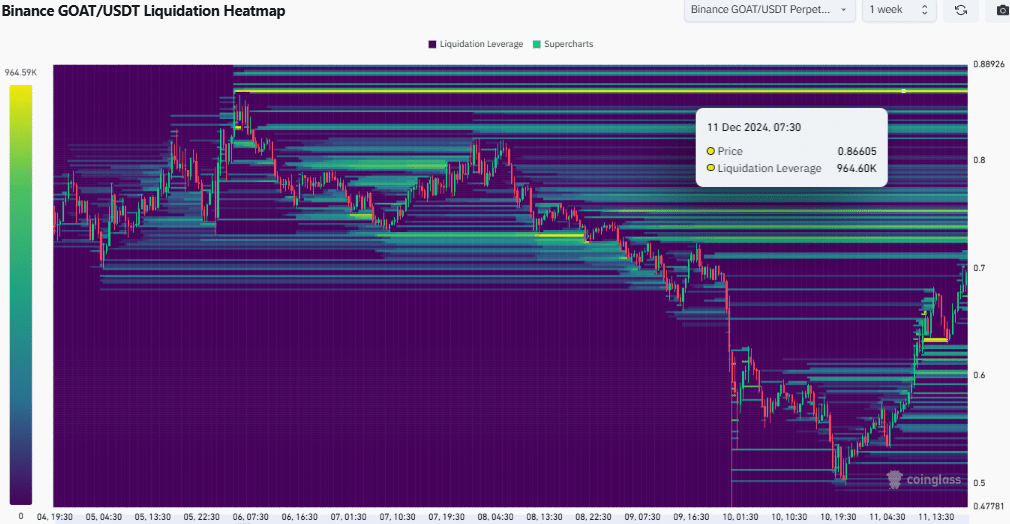

Further analysis of GOAT on the weekly timeframe revealed the most critical liquidity zone where massive leveraged positions risked liquidations. A high volume of almost $1 million in leveraged orders sitting at $0.866 could be liquidated if the price of Goatseus Maximus reaches this point.

This significant concentration of positions suggested that price movement towards this level could lead to a surge in buying activity as traders target the accumulated liquidity.

Source: Coinglass

If GOAT’s price action breaches the $0.866 resistance, this could potentially escalate into a further uptrend, causing a cascading effect of short squeezes and rapid price hikes. The importance of this level stems from its potential to act as a magnet for price action, especially if bullish momentum continues.

GOAT not only surged in price, but also its social attraction propelled it to number 14 on CoinMarketCap‘s trending list in the last 24 hours, at time of writing.

This spotlight boosted investor interest and market visibility. Historically, such visibility has led to increased trading volumes and further price appreciation as more traders jump on the trend. This surge and trending status could potentially set the stage for a sustained uptrend in GOAT’s price, as greater exposure often attracts more speculative buying in the short term.