Solana price prediction: Can SOL hit $240 and break its downtrend?

12/13/2024 01:00

Solana's recovery faced a roadblock at $235 but clearing it could push it to $245 and break its short-term downtrend.

Posted:

- SOL was up 14%, but the recovery faced a roadblock at $235.

- Will the liquidity level at $245 trigger a breakout from the downtrend channel?

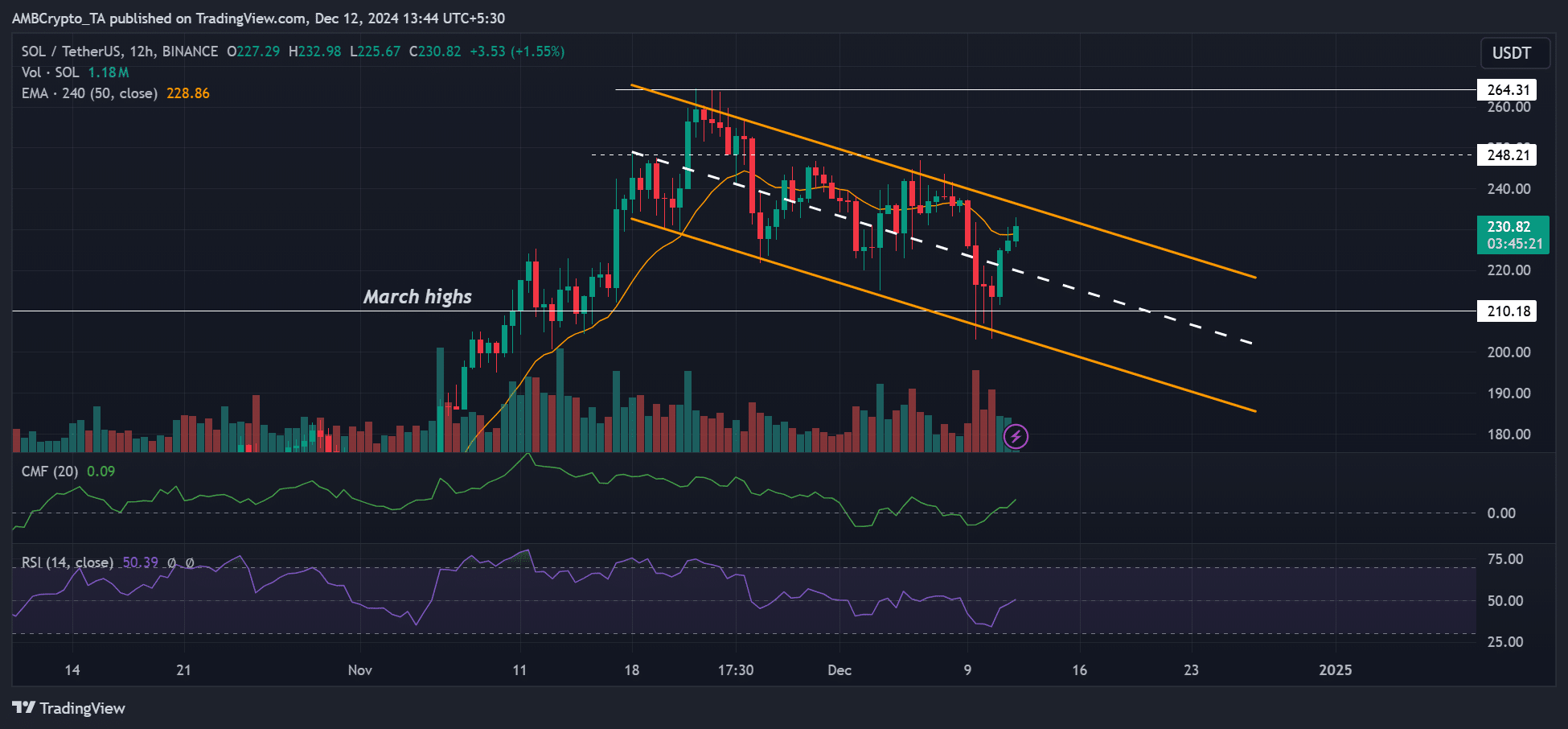

After peaking at a new all-time high of $264, Solana [SOL] cooled off and shed over 20% of its value in three weeks.

In December, SOL attempted to reverse recent losses. At press time, it was up 14% after retesting March highs as support. But can it breach its downtrend and extend the recovery?

In November, SOL price consolidated at March highs of $210 before climbing to an ATH of $264. Retesting the level as support meant it was a key level going forward.

However, recent recovery attempts were rejected at the range-highs of the downtrend channel. At press time, the upper levels coincided with $235.

A decisive move above $235 could break the short-term downtrend and reinforce a bullish target of $248 or $264.

That said, the RSI hasn’t decisively soared above the neutral level throughout December. This muted demand could delay a strong breakout prospect for SOL.

So, another price rejection at the range high could drag SOL back to the middle level or March highs.

$245 breakout target

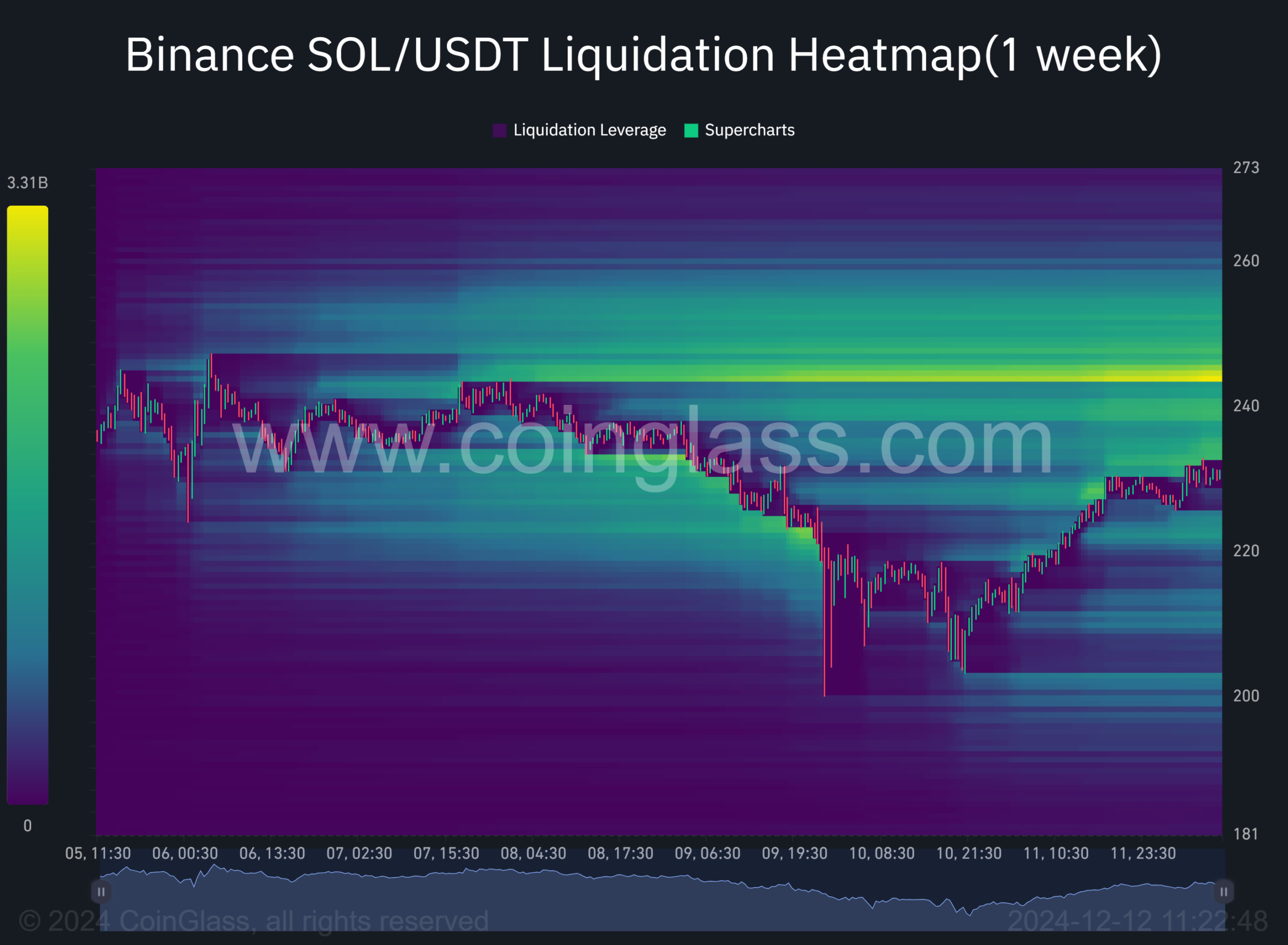

According to Conglass’s liquidation heatmap, the key upside liquidity level was at $244-$245 area (bright yellow level). This meant that a breakout from the downtrend could push SOL to $245.

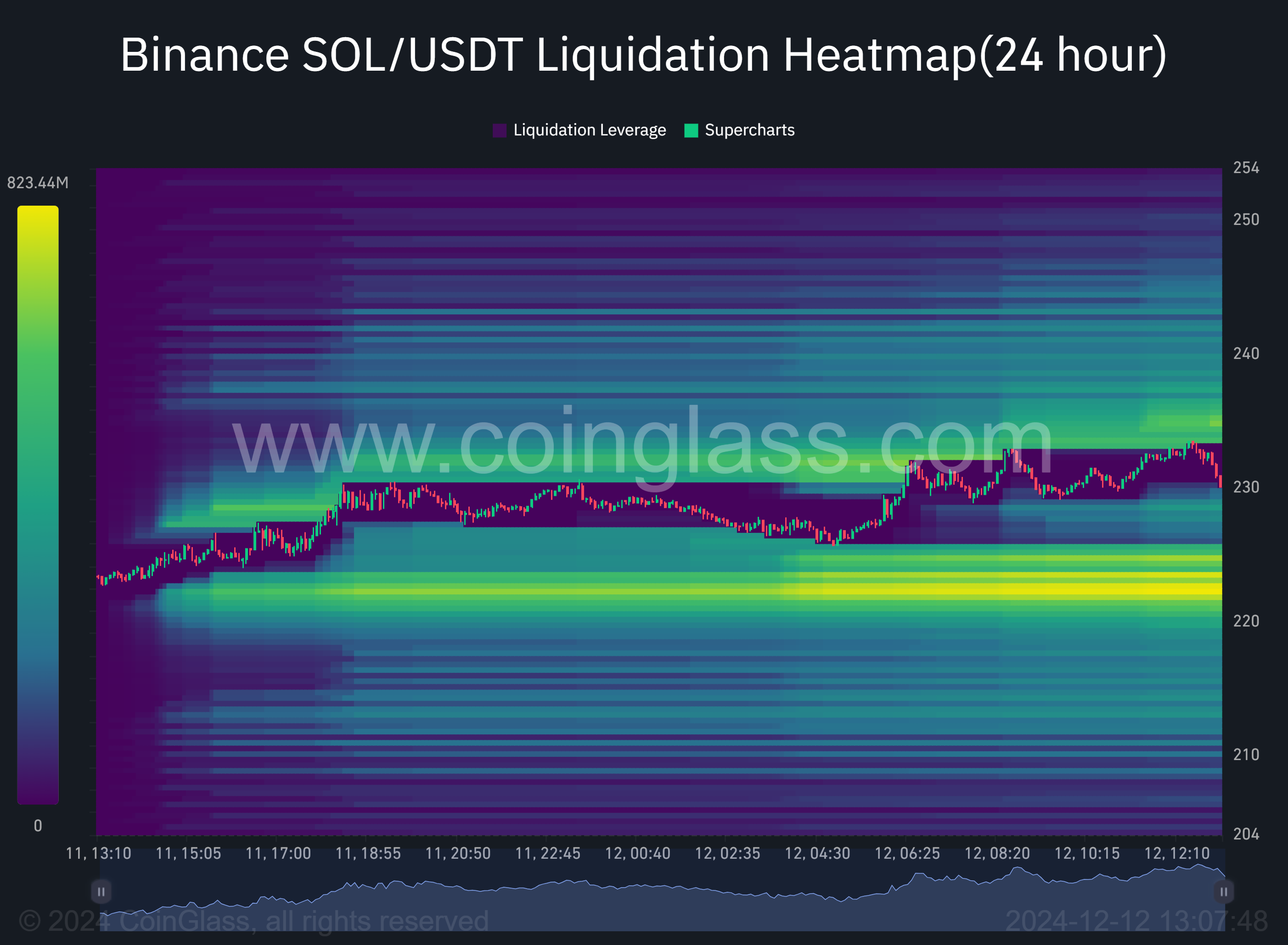

However, daily charts had another pocket of liquidity above $220, which was around the channel’s mid-range.

Read Solana [SOL] Price Prediction 2024-2025

Taken together, the liquidation heatmap data suggested that SOL could slide towards $220 if it stalls at the range-high before attempting another break out from the channel.

Despite the likely choppy price action for SOL in the short term, the asset manager Bitwise has maintained a bullish outlook in the long term. The firm predicted a $750 price target in 2025.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion