Chainlink mirrors Ethereum: Will this help LINK surge past $90?

12/14/2024 02:00

This movement mirrored Ethereum's price trajectory during a similar period, suggesting that LINK could mimic ETH’s past performance.

Posted:

- Chainlink mirrored a historical pattern of Ethereum, suggesting a potential rally.

- Whales and institutions continue to accumulate LINK tokens.

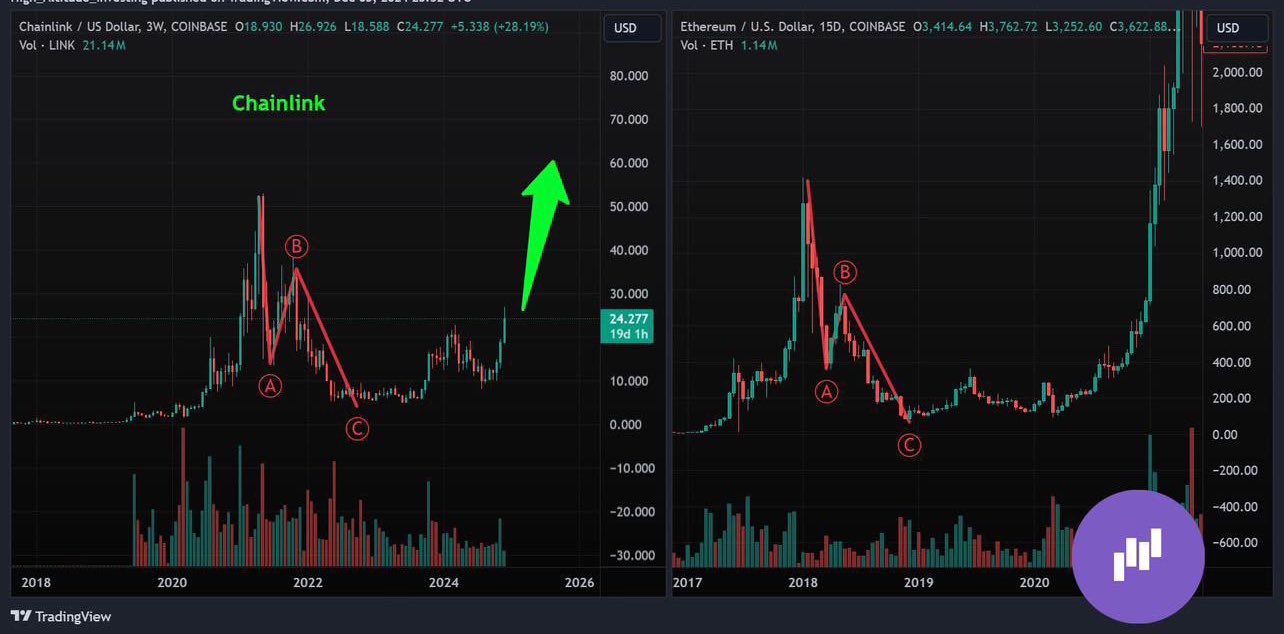

Comparing Chainlink [LINK] and Ethereum [ETH] price actions showed a potential similarity in both the coins’ patterns.

LINK’s three peaks and troughs from 2018 to 2024, surged peaking around $52, followed by a sharp decline to B and a slower, steadier recovery phase to C.

This movement mirrored Ethereum’s price trajectory during a similar period, suggesting that LINK could mimic ETH’s past performance.

Ethereum, on the other hand, showed a more pronounced movement, soaring to new heights in its later stages, particularly noticeable in the strong uptrend after 2020, achieving a new peak at $4800.

If Chainlink continues to follow ETH’s historical performance, it could ascend toward the $90 mark. These could offer a bullish outlook for LINK, assuming current market conditions are sustained.

LINK’s Open Interest

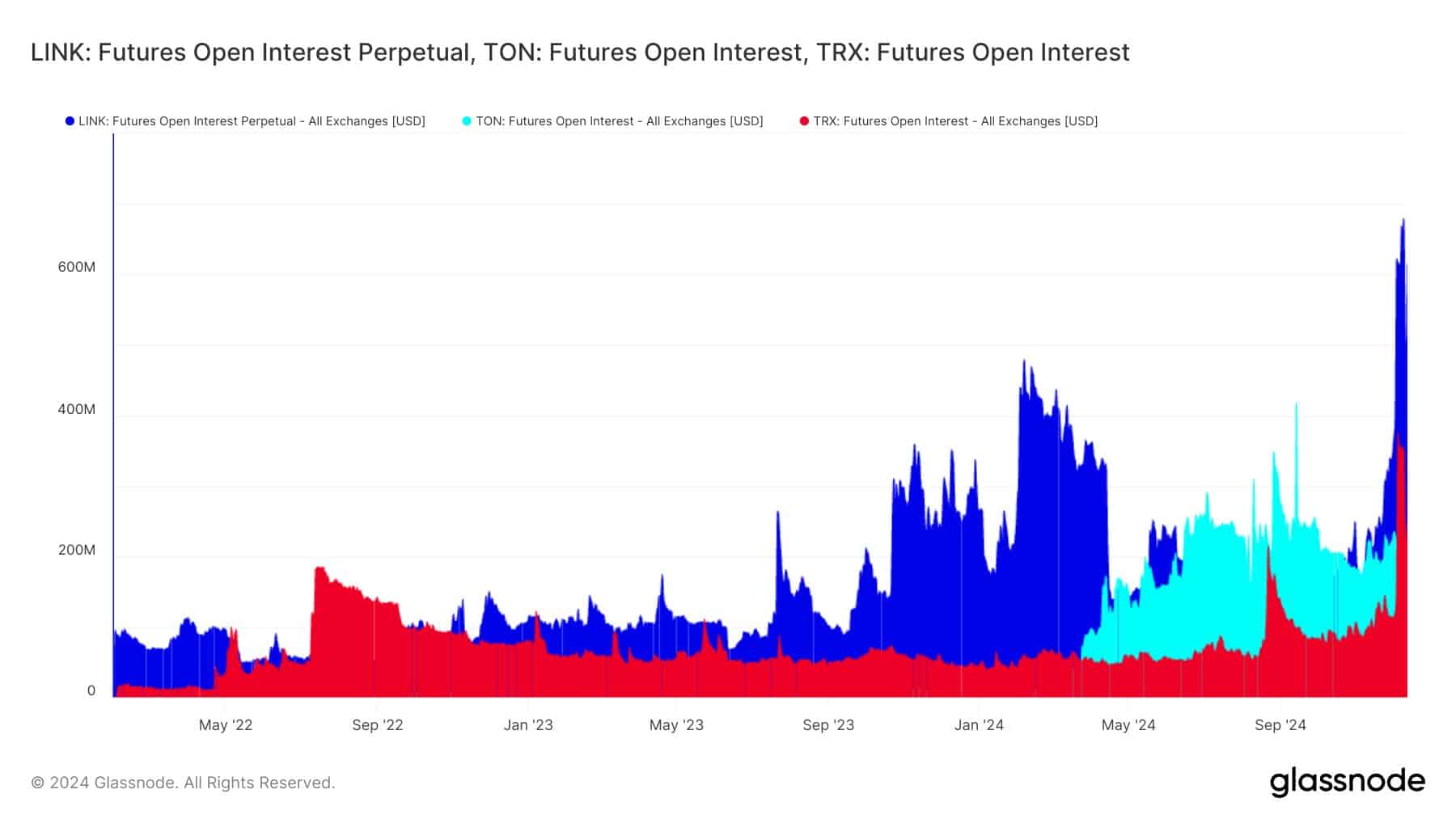

Furthermore, LINK’s Futures Open Interest(OI) soared to a record $770.27 million, surpassing both Toncoin [TON] and Tron [TRX].

This surge in LINK’s OI, nearly three times that of TON and twice that of TRX, indicated growing trader confidence or speculative interest in its future price movements.

Historically, this period saw LINK achieving its highest price in nearly two years, highlighting renewed interest and possibly speculative optimism in its market potential.

The recent steep rise in LINK’s OI indicated heightened engagement, suggesting traders could be positioning for further appreciation or hedging against other positions.

This pattern suggested that LINK’s dynamics were heavily influenced by derivatives trading, which could either stabilize or increase volatility.

Whale and institutional buying

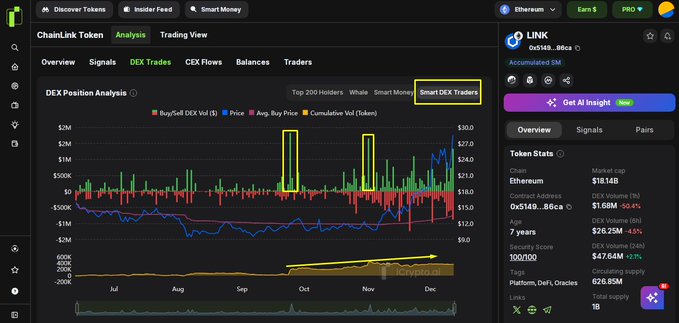

DEX position analysis revealed a rise in LINK holdings by whales and Smart DEX Traders, with buying activity surpassing selling.

This surge in buying activity correlated with LINK’s price hikes, suggesting major holders might be accumulating and expecting future price increases.

This indicated strong buying pressure, which could have contributed to the stabilization or increase in LINK’s market price. If the trend continues, it could lead to further appreciation.

Additionally, Donald Trump’s World Liberty Financial increased its holdings in LINK and AAVE. The fund purchased an additional 37,052 LINK for $1 million and 685.4 AAVE for $247,000.

Is your portfolio green? Check out the LINK Profit Calculator

This buying reached a total of $2 million on 78,387 LINK at an average cost of $25.51, which has appreciated by $232,000, reflecting an 11.6% gain.

Following this, Zach Rynes heaped praise for the U.S. President-elect on X (formerly Twitter):

“Donald Trump is the Michael Saylor of Chainlink $LINK”

This aggressive accumulation underlined the fund’s bullish outlook on LINK, projecting potential gains if the trend persists.