Identifying the odds of BNB rallying to $793 and beyond on the charts

12/14/2024 16:00

BNB made a strong move by breaking out of a long-standing parallel channel, signaling bullish momentum as it gained traction...

Posted:

- BNB’s breakout above $650 signaled bullish momentum with targets at $750 and $800

- Derivatives data revealed growing trader interest, with Options volume up by 47%

Binance Coin [BNB] made a strong move by breaking out of a long-standing parallel channel, signaling bullish momentum as it gained traction in the market. Trading at $718.35 at press time, the altcoin noted gains of 0.40% in the last 24 hours sat just 9.44% below its all-time high of $793.35.

Therefore, the question remains – Can BNB maintain its upward trajectory and surpass its peak?

Parallel channel breakout and price trajectory

BNB’s breakout above its parallel channel marked the end of a consolidation phase that limited price action for months. By surpassing its key resistance at $650, BNB has opened the door for potential growth.

Additionally, the press time price action indicated strong buyer support. The next critical resistance to monitor is $750, followed by the psychological level of $800. If BNB sustains this momentum, it could pave the way for a new all-time high, with $850 as the next significant target.

BNB technical indicators show growing momentum

A technical analysis flashed mixed, but promising signals. The weekly RSI stood at 64.82, signaling increasing buying pressure while staying below the overbought threshold of 70.

Furthermore, the Bollinger Bands indicated expanded volatility, as the price continued to test the upper band. However, such testing often leads to short-term pullbacks.

Therefore, traders should remain vigilant about corrections while monitoring for consolidation above $700, which would signal a stronger bullish continuation.

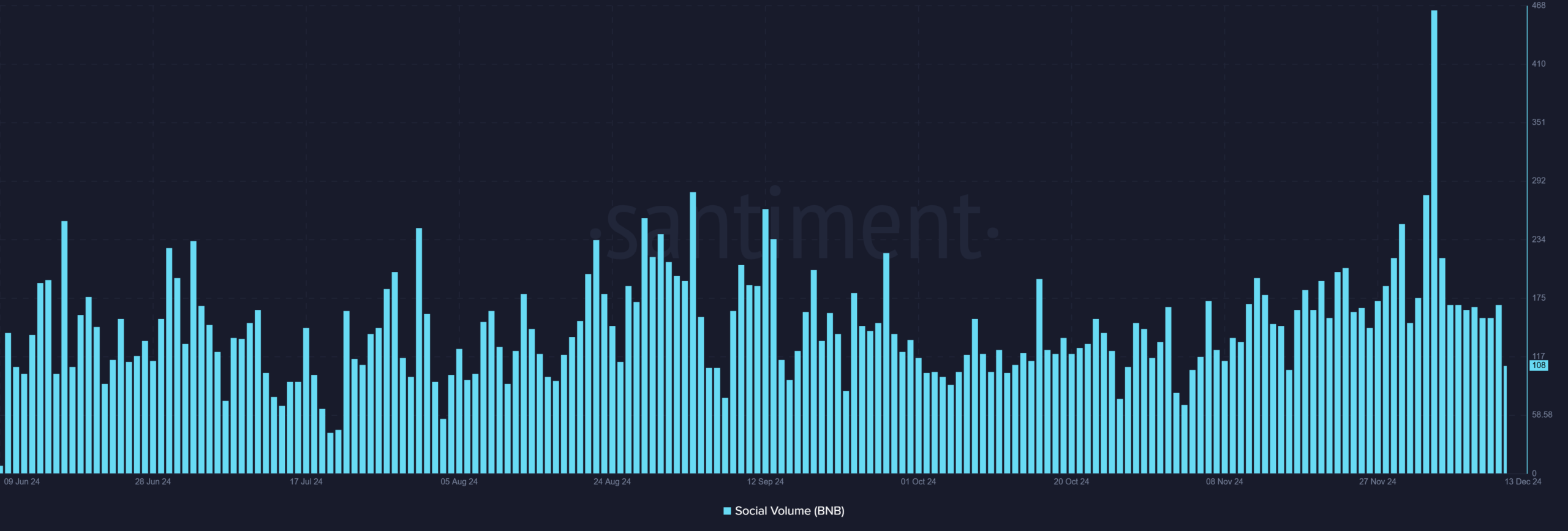

Social volume and market sentiment

While social volume did decline from a recent spike of 169 to its press time level of 108, this could indicate a shift in focus from hype-driven trading to sustained institutional activity.

Reduced social chatter often aligns with price stability, providing a healthier foundation for long-term gains. Nevertheless, market participants should keep an eye on any resurgence in discussions, as spikes in social activity often precede major price moves.

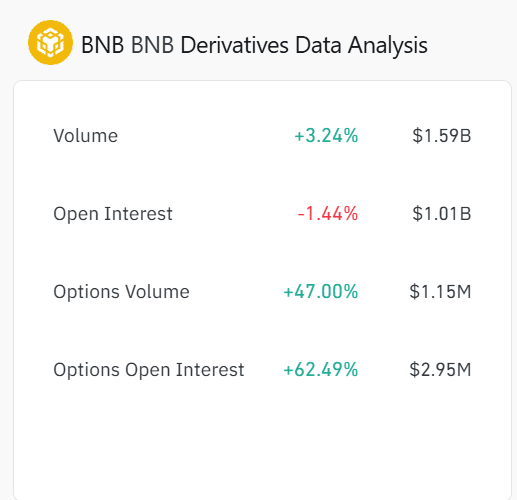

Derivatives market signals growing interest

The derivatives market highlighted increasing trader interest in BNB. Trading volume rose by 3.24% to $1.59 billion, while Options Open Interest saw an impressive 62.49% jump, reflecting bullish sentiment.

Additionally, a 47% surge in Options volume indicated a willingness among traders to bet on future price hikes. While Futures Open Interest dipped slightly by 1.44%, the broader derivatives data supported a positive outlook for BNB’s price.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

BNB poised for a breakout above $793?

At press time, BNB appeared well-positioned to reclaim its all-time high of $793.35, given its technical breakout, rising derivatives interest, and stable sentiment. Therefore, with sustained momentum and strong buyer support, BNB may be likely to surpass its peak and could lead the market into its next bullish phase.