Venture Funding Surges in Crypto Sector With Over $1 Billion Raised After Trump's Election

12/15/2024 17:18

The crypto industry has witnessed a surge in funding, raising $1.3 billion since Donald Trump’s election victory.

The crypto industry has experienced a surge in investment, with startups raising over $1 billion from Venture Capital (VC) funds since Donald Trump’s election victory.

This influx of capital reflects growing optimism about a more favorable regulatory environment under the incoming administration.

Crypto Startups Attract Over $1 Billion in Funding

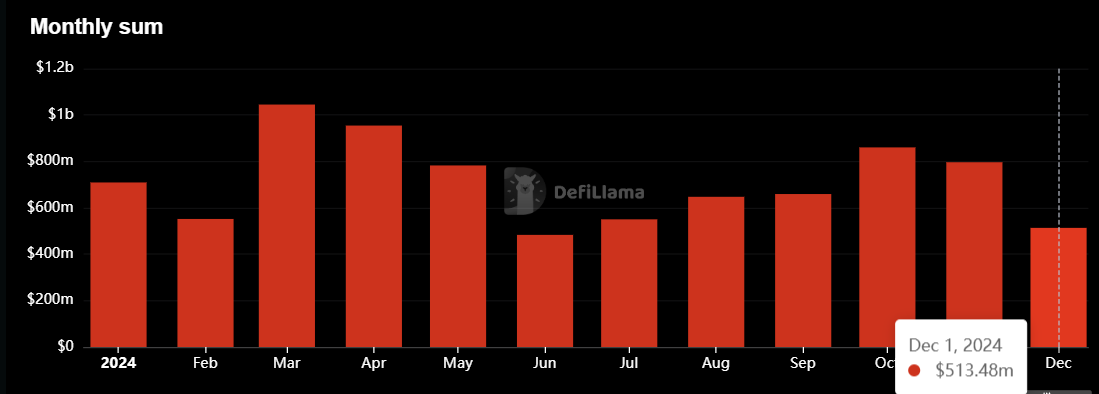

Since Trump’s election victory on November 6, crypto startups have attracted approximately $1.3 billion in funding. DefiLlama data shows that VCs contributed $796 million in November and an additional $511 million in December.

The Avalanche Foundation emerged as the largest fundraiser during this period, securing $250 million through a private token sale. This funding aligns with the network’s upcoming Avalanche9000 upgrade, scheduled for December 16, which promises to enhance blockchain scalability and reduce costs.

Venture capitalists have significantly increased their interest in crypto infrastructure projects. They directed over $500 million toward infrastructure developers, with Zero Gravity Labs raising $40 million and Bitcoin miner Canaan Creative securing $30 million in notable funding rounds.

Meanwhile, the DeFi sector also saw a boost, receiving more than $150 million in funding. Key investments included $45 million for USDX Money and $30 million for World Liberty Financial. This resurgence follows a recovery in the DeFi market, with the sector now attracting interest from both retail and institutional investors.

The funding spike is linked to anticipation of a pro-crypto stance in the upcoming administration. Trump has expressed strong support for the crypto industry, pledging to bring long-awaited regulatory clarity and establish a Strategic Bitcoin Reserve (SBR) in the United States.

Since his election win, Trump has announced several pro-crypto appointments. These include Paul Atkins as the proposed chair of the Securities and Exchange Commission (SEC) and David Sachs as the White House’s first crypto czar.

Experts believe these appointments could drive regulatory clarity, remove barriers to institutional adoption, and foster greater investment in the sector.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Oluwapelumi Adejumo is a journalist at BeInCrypto, where he reports on a broad range of topics including Bitcoin, crypto exchange-traded funds (ETFs), market trends, regulatory shifts, technological advancements in digital assets, decentralized finance (DeFi), blockchain scalability, and the tokenomics of emerging altcoins. With over three years of experience in the industry, his works have been featured in major crypto media outlets such as CryptoSlate, Coinspeaker, FXEmpire, and Bitcoin...

Oluwapelumi Adejumo is a journalist at BeInCrypto, where he reports on a broad range of topics including Bitcoin, crypto exchange-traded funds (ETFs), market trends, regulatory shifts, technological advancements in digital assets, decentralized finance (DeFi), blockchain scalability, and the tokenomics of emerging altcoins. With over three years of experience in the industry, his works have been featured in major crypto media outlets such as CryptoSlate, Coinspeaker, FXEmpire, and Bitcoin...

READ FULL BIO