Ethereum hits $5.2K realized price band: New rally for ETH?

12/15/2024 22:00

Ethereum’s market activity is surging, but rising exchange inflows suggest that investors may be preparing for a sell-off.

Posted:

- Ethereum’s realized price upper band at $5.2K mirrors levels seen during the 2021 bull market peak, raising breakout expectations

- Rising exchange inflows and increased activity suggest the possibility of profit-taking.

Ethereum [ETH] is teetering on the edge of a major breakout, with its realized price upper band hitting $5.2K — mirroring levels last seen during the 2021 bull market peak.

On-chain metrics pointed to strong demand, fueling hopes of a rally beyond $5,000.

But as market dynamics evolve, investors are left wondering: is Ethereum poised to reclaim its former glory, or are the conditions fundamentally reshaping its trajectory?

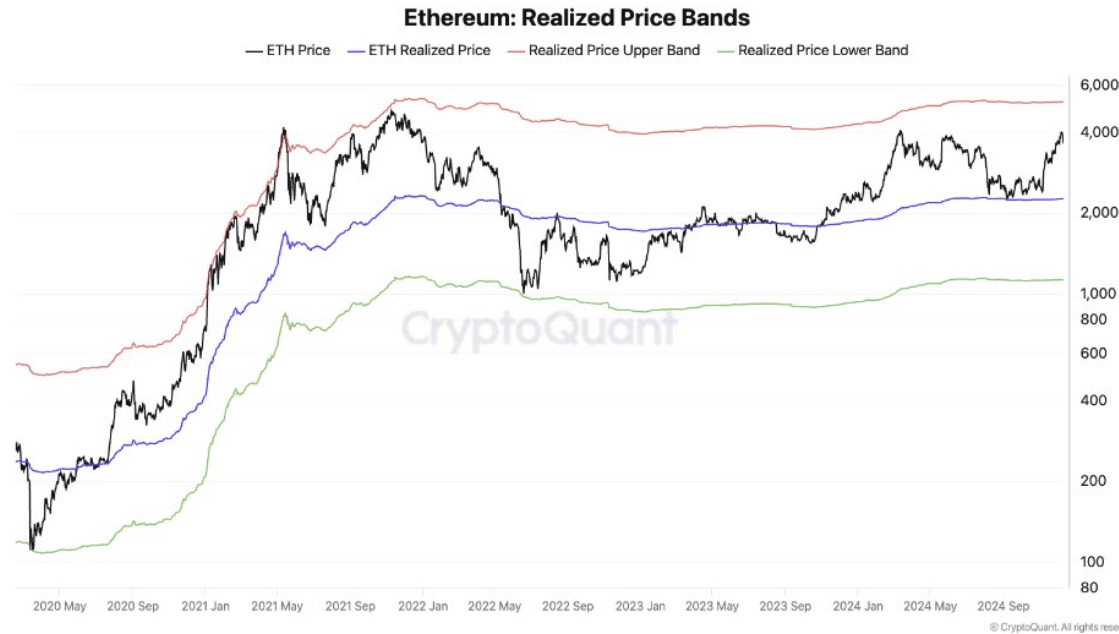

How realized price will affect this current cycle

Ethereum’s realized price upper band, at $5.2K at press time, is a key marker in understanding potential market movements.

This metric, which tracks the average price at which each unit of ETH last moved, plays a pivotal role in identifying market trends.

Per AMBCrypto’s look at CryptoQuant data, the current price alignment mirrors the 2021 bull run’s peak, when the realized price upper band coincided with a meteoric rise.

Historically, these upper band levels have signaled overheated conditions or strong bullish momentum, often preceding significant price movements.

Profit-taking ahead?

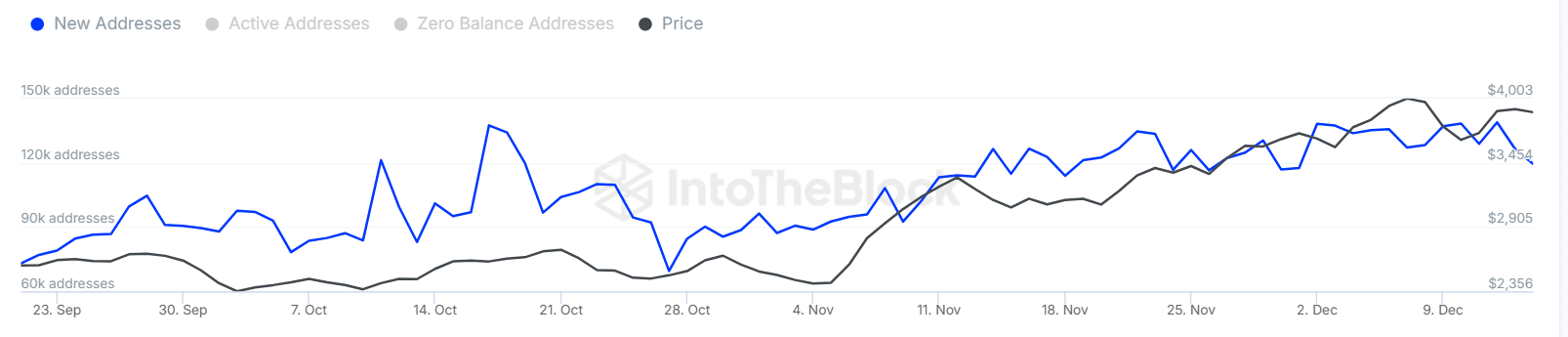

The market is showing mixed signals. The active addresses chart reveals a 10-15% increase in user engagement over the past week, indicating heightened network activity and investor participation.

Simultaneously, trading volumes have surged by nearly 20%, reflecting increased liquidity and trading momentum.

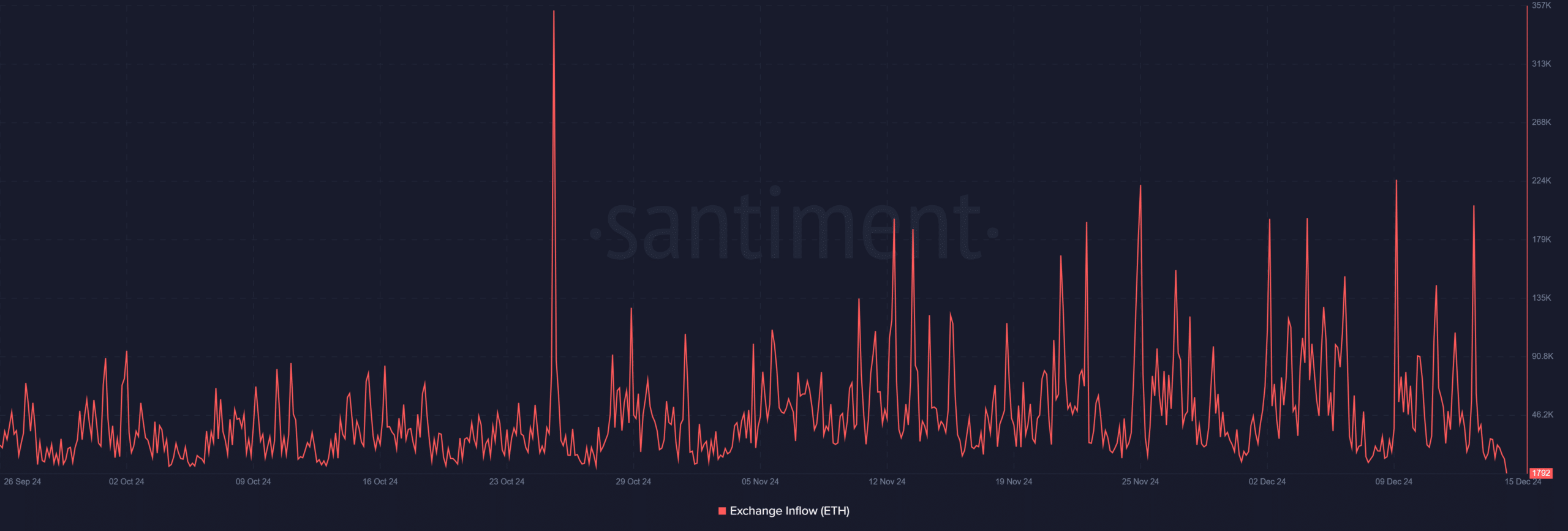

However, the spike in exchange inflows, up by 25%, raises concerns about potential profit-taking behavior.

Historically, such inflow spikes signal that investors may be positioning assets for sell-offs, particularly when paired with rising activity.

This pattern aligns with previous market tops, where increased engagement coincided with short-term corrections.

The data highlights a delicate balance — while strong participation and trading volumes signal optimism, inflows suggest caution. If inflows sustain, watch for potential downward pressure.

Whether the market consolidates or faces a correction will depend on the coming sessions’ price resilience and broader sentiment shifts.

Market sentiment and the path forward

Recent data reveals a shift in sentiment as Ethereum approaches pivotal levels. The surge in new addresses is counterbalanced by rising exchange inflows, signaling that investors may be capitalizing on gains.

Read Ethereum’s [ETH] Price Prediction 2024-25

With price volatility increasing, a deeper correction could follow if market participants begin to exit positions at these elevated levels.

As Ethereum faces key technical resistance, understanding whether this surge is a sustainable rally or a final push before a larger retreat will be critical for gauging market stability.