Ethereum nears $4K breakout amidst heavy accumulation by whales

12/16/2024 18:00

Ethereum whales accumulate 6102 ETH tokens worth $23.84 million. ETH rises by 2.07% over the past 24 hours

Posted:

- Ethereum whales accumulate 6102 ETH tokens worth $23.84 million.

- ETH rises by 2.07% over the past 24 hours.

Over the past month, Ethereum [ETH] has experienced a strong upward movement. As such, since hitting a low of $2355, the altcoin has managed to hit $4k two times. However, the altcoin has failed to experience a sustained move above $4k.

With ETH struggling to surpass this level, Whales have entered the market. Stakeholders are looking at whale activity as a needed recipe foe Ethereum’s sustained growth.

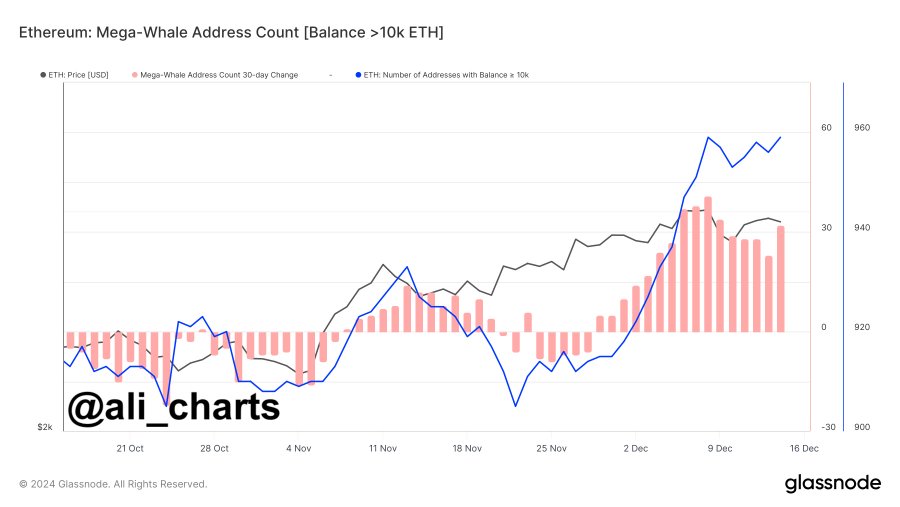

Popular crypto analyst Ali Martinez observed that Ethereum whales have been accumulating more since ETH broke $3,330.

Whales are accumulating ETH

According to Lookonchain, institutions are continually accumulating Ethereum. Thus, Two wallets from the same creator withdrew 4502 ETH tokens worth $17.54 million from Binance. After withdrawing these tokens from exchanges, the addresses staked them with KelpDAO.

Secondly, another whale bought 1600 ETH tokens worth $6.3 million from exchanges over the past 48 hours according to Lookonchain.

With whales’ increased accumulation of the altcoin, it shows their confidence in the market’s future value. As such, institutions are scrambling to Accumulate ETH before it rises higher on its price charts.

We can see this increased demand and accumulation of Ethereum as Large Holders Netflow to Exchange Netflow Ratio has declined to 0.58%.

Such a sharp decline indicates a drop in selling pressure from whales. Retail traders are left on exchange activity which often coincides with accumulation among whales as observed above.

Often, a surge in accumulation could precede a price increase as large holders buying creates a higher buying pressure resulting in a supply squeeze. These conditions could set the altcoin for more gains.

Can Ethereum see a sustained rally above $4k?

Usually, increased whale accumulation leads to a positive impact on an asset’s price. This impact has stood out for Ethereum over the past month.

In fact, at press time, Ethereum was trading at $3968. This marked a 2.07% over the past day. Equally, the altcoin has gained on weekly and monthly charts hiking by 1.48% and 27.33% respectively.

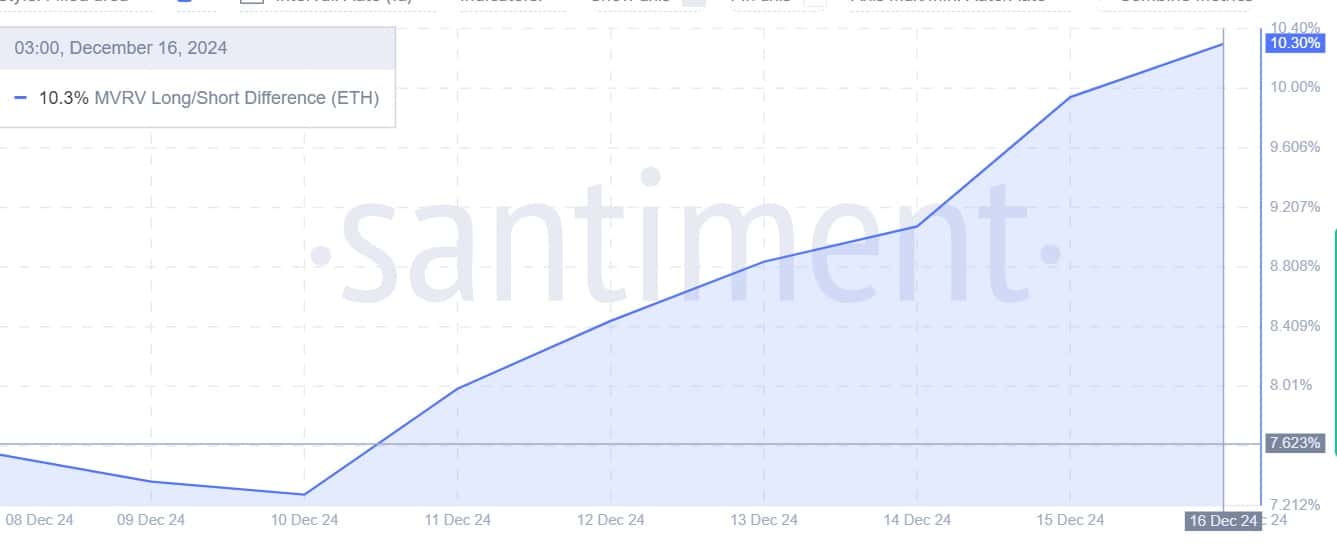

This uptrend has left most long-term holders in profit. As such, long-term holder’s profit margins have spiked over the past day with ETH reclaiming $4k resistance.

With their rising profitability, they continue to hold onto ETH anticipating more gains signaling increased market confidence. This shows that whales and long-term holders are bullish.

Read Ethereum’s [ETH] Price Prediction 2024-25

Therefore, such positive sentiments if they prevail could see ETH rise further. If so, Ethereum will reclaim $400 where it has faced multiple rejections. A breakout from here will propel ETH to $4165.

Consequently, a correction will see ETH drop to $3852.