With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

Semler Scientific's aggressive Bitcoin strategy adds 211 BTC, raising holdings to 2,084 BTC as its BTC Yield hits 92.8% in 2024.

Semler Scientific Inc. (NASDAQ: SMLR), a healthcare-focused technology firm, continues to gain attention for an aggressive Bitcoin investment strategy. Between December 5 and December 15, 2024, Semler added 211 BTC $106 303 24h volatility: 2.9% Market cap: $2.11 T Vol. 24h: $123.55 B to its portfolio at an average price of $101,890 each, totaling $21.5 million in investments during the span.

Semler Scientific has acquired 211 BTC for ~$21.5 million at ~$101,890 per #bitcoin and has generated BTC Yield of 67.0% QTD and 92.8% since adopting our BTC treasury strategy in May. As of 12/15/24, we held 2,084 $BTC acquired for ~$168.6 million at ~$80,916 per bitcoin. $SMLR

— Eric Semler (@SemlerEric) December 16, 2024

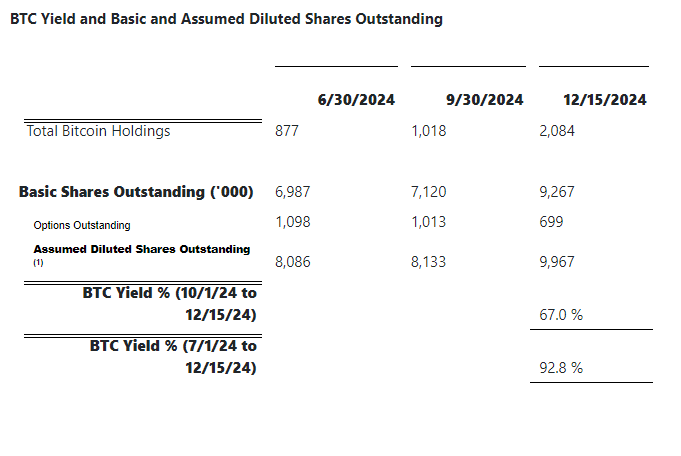

The company disclosed an increase in bitcoin holdings to 2,084 BTC, with the acquisition costing $168.6 million in total. Each Bitcoin purchase averaged $80,916, factoring in associated fees and expenses. Semler funded these acquisitions through proceeds from its ongoing at-the-market (ATM) stock offering and operational cash flows.

Semler’s ATM offering has proven to be a major fundraising tool. As of December 13, 2024, the company raised $100 million in gross proceeds by selling shares. Recently, it boosted the total offering capacity to $150 million, signaling confidence in its ability to leverage equity markets to support its bitcoin strategy.

A standout highlight of Semler’s bitcoin venture is its BTC Yield, a unique performance metric. Between July 1 and December 15, 2024, the BTC Yield surged to 92.8%. This massive BTC Yield measures the growth in bitcoin holdings relative to assumed diluted shares outstanding. For the October-December period alone, the BTC Yield reached 67%, underlining the rapid expansion of its bitcoin reserves.

Source: Semlerscientific

BTC Yield serves as a tool to assess the effectiveness of Semler’s approach in acquiring bitcoin in ways the company believes benefit stockholders. While the KPI is not a traditional measure of financial performance, Semler emphasizes that it supplements investors’ understanding of its strategy to fund bitcoin purchases using stock sales.

The company has been candid about the limitations of BTC Yield, noting that it doesn’t account for all sources of capital used for bitcoin purchases. Despite this, the metric underscores Semler’s ability to turn equity funding into substantial digital asset holdings.

Semler’s aggressive bitcoin strategy aligns with its broader financial vision. By December 2024, it had increased its share count significantly. Basic shares outstanding climbed from 6.99 million in June 2024 to 9.27 million by mid-December. Including stock options, the assumed diluted shares reached 9.97 million.

Despite the focus on bitcoin, Semler doesn’t view its cryptocurrency holdings as directly influencing its stock value. The company reiterated that its stock price depends on various factors, not just the market value of its bitcoin holdings.

While the BTC Yield metric is impressive, Semler has clarified its nuanced purpose. It’s not an indicator of stockholder returns or operational performance. Instead, it reflects management’s focus on using equity capital in ways they believe will drive long-term stockholder value.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Bitcoin News, Cryptocurrency News, News

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.