‘Profitable’ Render holders, here’s how you can dictate RNDR’s price action!

12/19/2024 13:00

Render recorded a sharp 15% price decline on the daily chart, reflecting broader market uncertainty. Interestingly though, 70% of RNDR...

Posted:

- Render’s price has dipped by 15% over three days, yet 70% of its holders remained in profit at press time

- Altcoin’s large transactions have been shrinking, raising concerns about market momentum

Render recorded a sharp 15% price decline on the daily chart, reflecting broader market uncertainty. Interestingly though, 70% of RNDR holders were in profit at press time. This suggested that a significant portion of holders are still in their long positions.

However, it raises questions about how long this profitability can persist. Especially as the altcoin approaches a critical support level technically and fundamentally.

The profitability metric is a double-edged sword. On one hand, it highlighted a resilient investor base. On the other hand, it may trigger sell pressure as profitable holders seek to lock in gains.

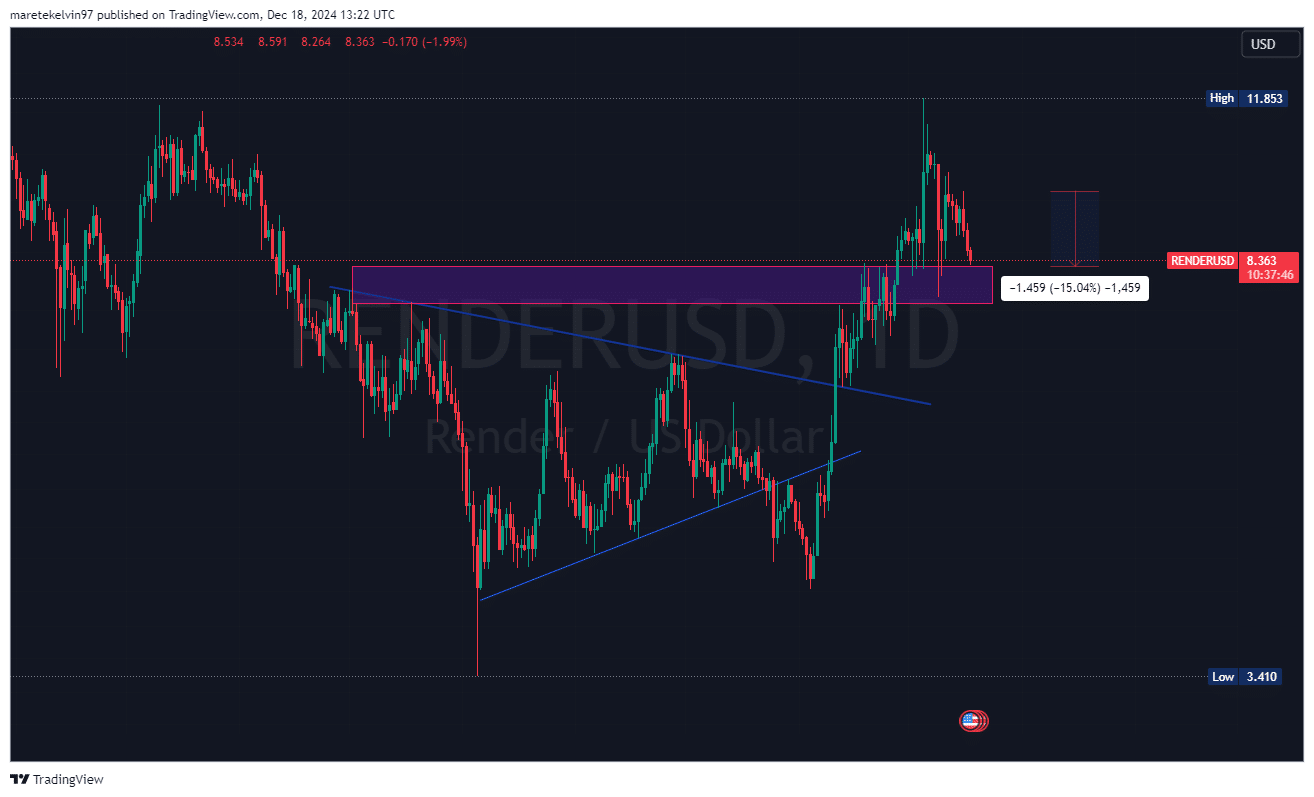

Both dynamics make the upcoming $8.26 support level pivotal for RNDR’s short-term outlook.

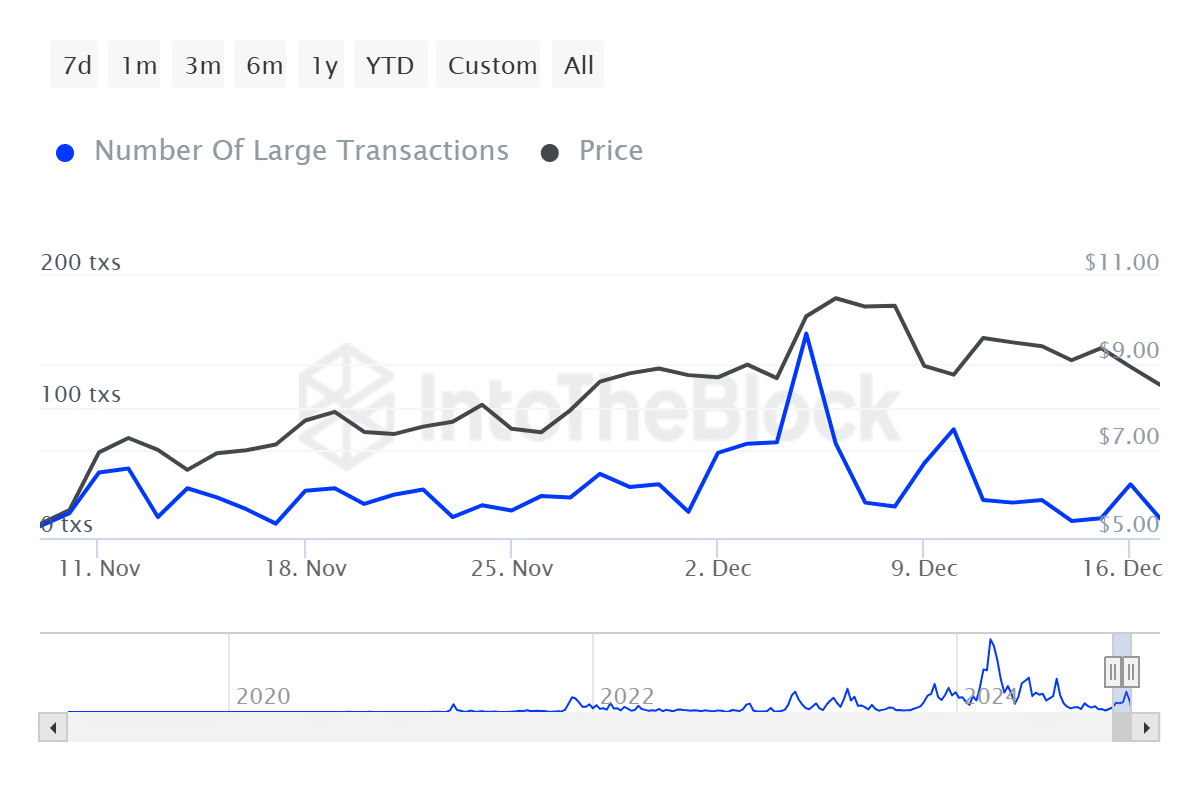

RNDR whales and trading activity shrink

While profitability still remains high, Render’s whale activity has been starting to show some signs of exhaustion. For instance, according to IntoTheBlock data, large transactions fell significantly by 79% over the last 24 hours.

Such a sharp decline in whale participation may signal low confidence among the major players, something that often precedes extended bearish trends.

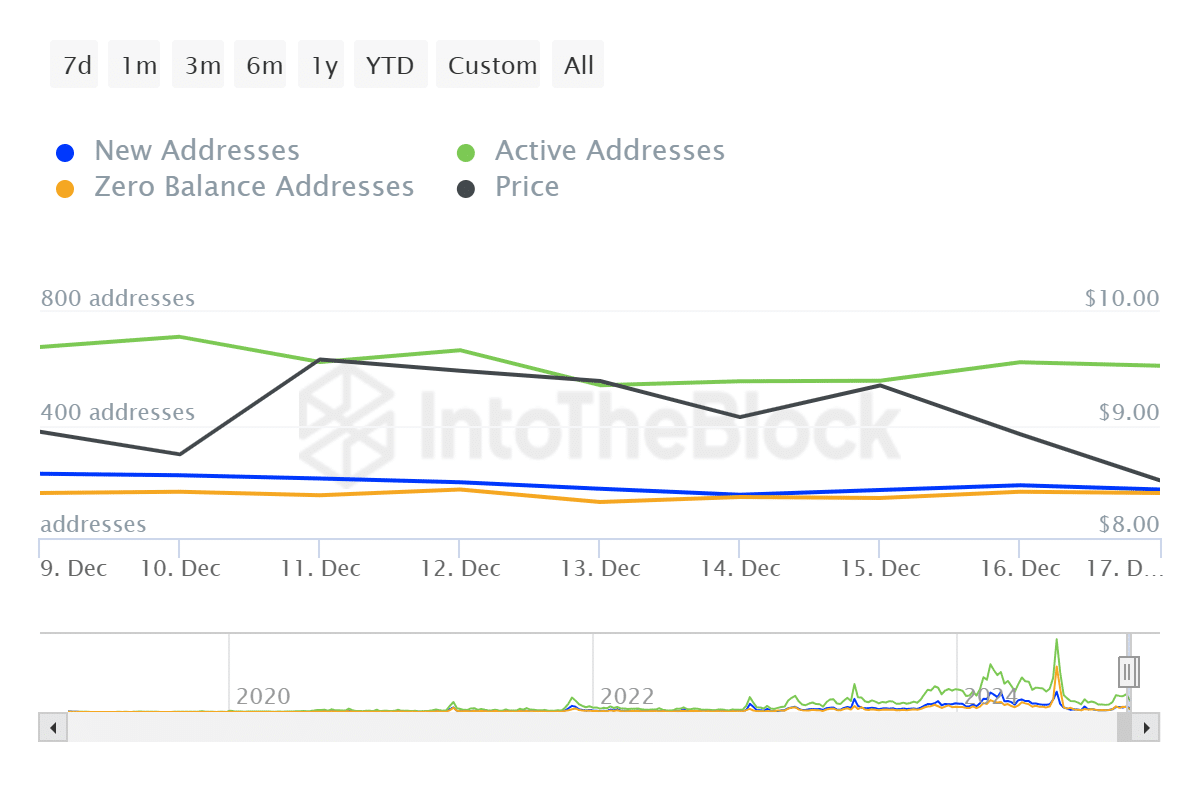

At press time, retail activity also appeared to be cooling. For example – active addresses fell by about 2% over the same period. While this fall is modest, it revealed that enthusiasm among smaller holders has been waning.

Taken together cumulatively, these metrics painted a picture of a market that has been gradually losing momentum.

RNDR’s price now approaching key support levels

As Render’s price continues its descent, all eyes seem to be on the $8.26 key support level. Historically, this level has acted as a psychological barrier where buyers might step in to prevent further losses.

However, if this level fails, it could open the floodgates for additional declines. The 70% of Render’s holders still in profit will play a critical role here. If they decide to hold through the price correction phase, it could bolster the critical support level.

Alternatively, a wave of profit-taking could push the price further down.

In addition to the aforementioned technical and on-chain metrics, the 162.34k pool of positions liquidated at $8.269 flashed a green signal of a potential price reversal to a potential rally.