Arbitrum: Decoding what ARB needs to trigger a bull run

12/20/2024 12:00

Over the past week, whales have accumulated over 40 million ARB tokens, signaling growing interest from key market players.

Posted:

- Whale accumulation and rising address activity suggest growing interest in ARB’s potential rally.

- Liquidations and cautious funding rates emphasize the importance of breaking key resistance levels.

Over the past week, whales have accumulated over 40 million Arbitrum [ARB] tokens, signaling growing interest from key market players. At press time, ARB was trading at $0.8442, reflecting a 9.73% daily decline.

This significant accumulation raises the question: can ARB capitalize on this interest and break through critical resistance levels to trigger a rally?

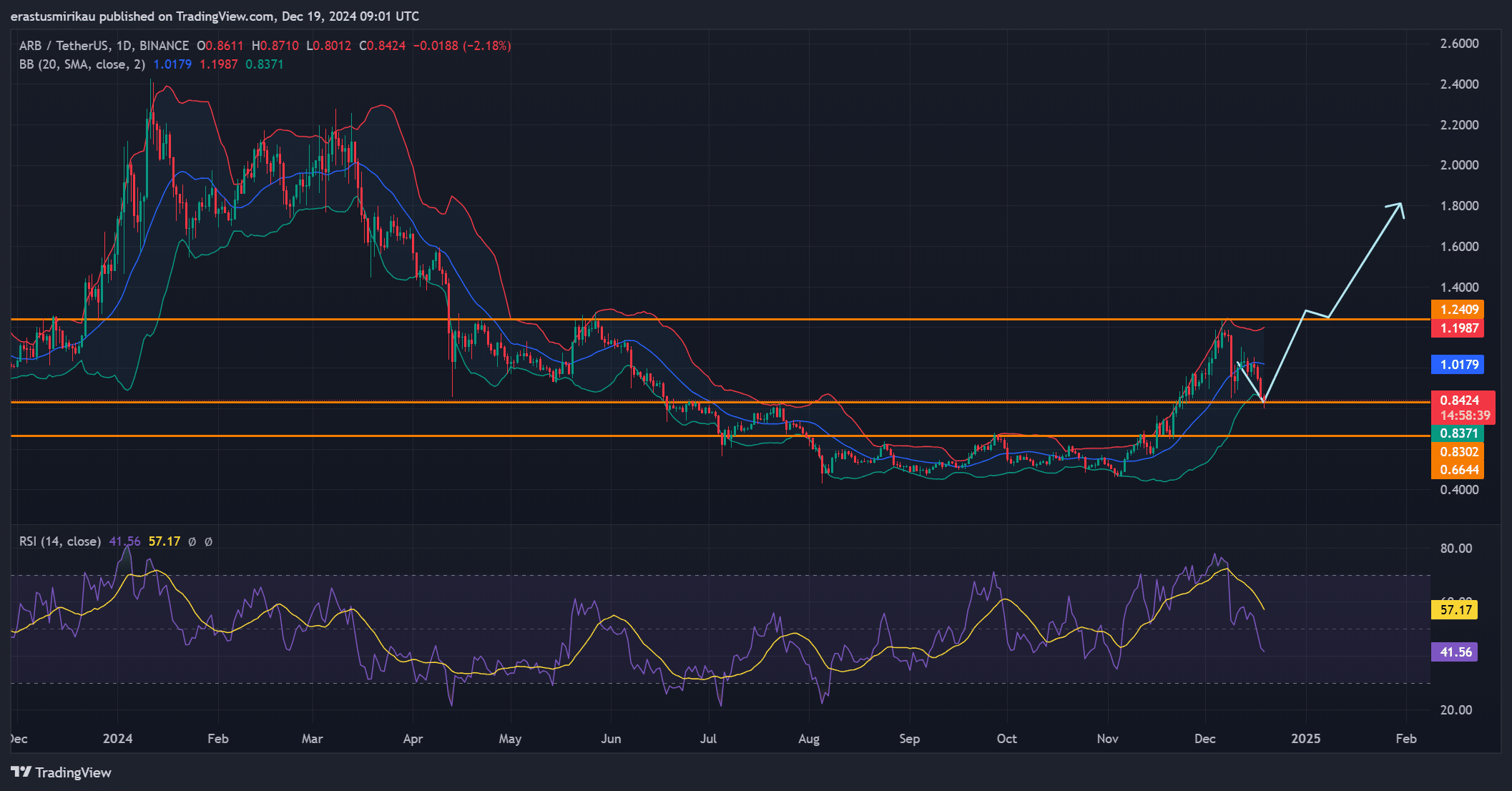

ARB technical analysis reveals key levels to watch

The price movement of ARB shows a crucial support zone around $0.8302, while resistance lies near $1.2409. Furthermore, Bollinger Bands (BB) indicate increasing volatility, with the price testing the lower band.

Meanwhile, the Relative Strength Index (RSI) sits at 41.56, signaling mild bearish momentum. However, if ARB holds the $0.8302 support and reclaims the $1.0179 level, a reversal could be on the horizon. Therefore, these levels remain essential for traders to watch closely.

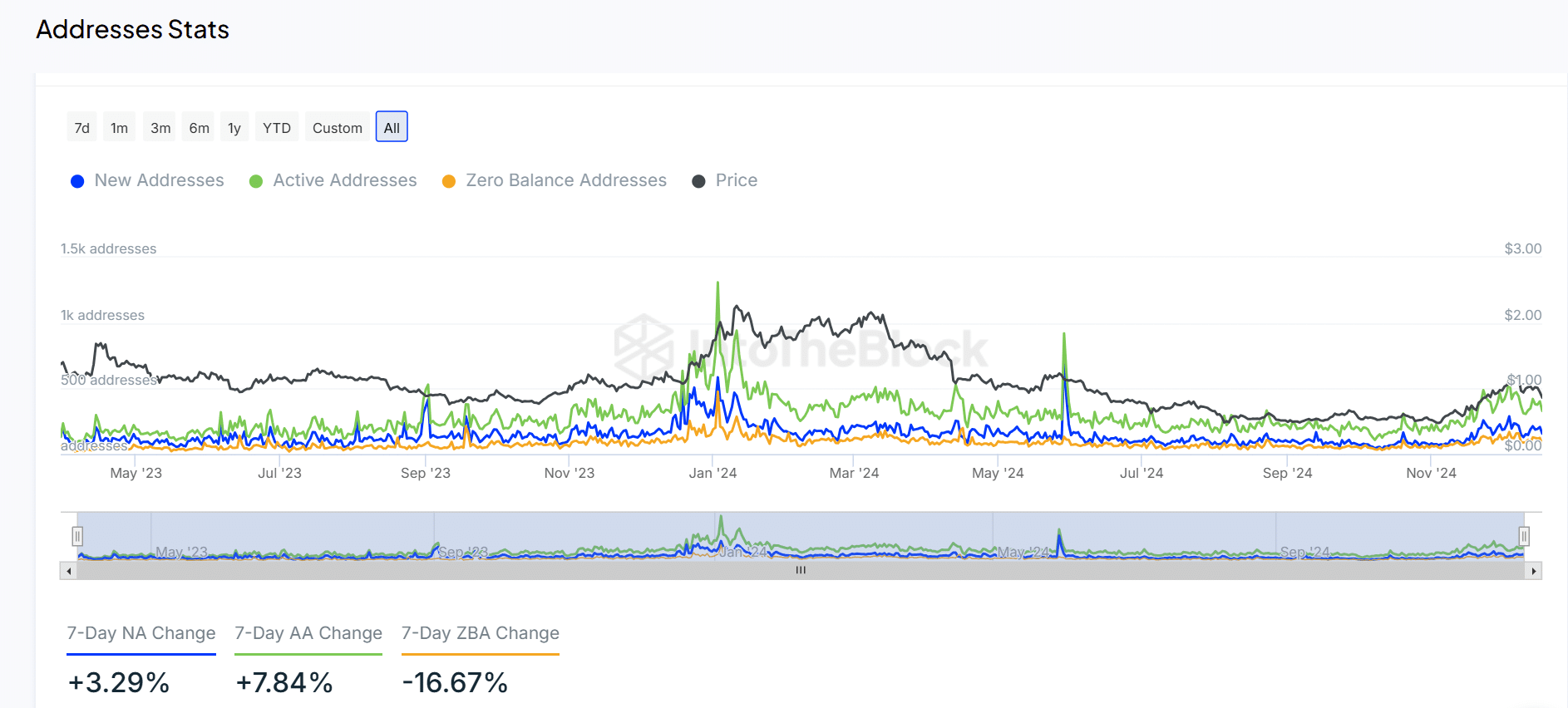

ARB address stats highlight growing interest

Additionally, address activity points to increased user engagement. New addresses rose by 3.29% in the past seven days, while active addresses surged by 7.84%.

These increases align with whale activity, suggesting heightened interest from both institutional and retail investors.

However, the 16.67% drop in zero-balance addresses indicates existing holders are retaining tokens, supporting the case for accumulation. Therefore, this trend could signal growing confidence in ARB’s long-term potential.

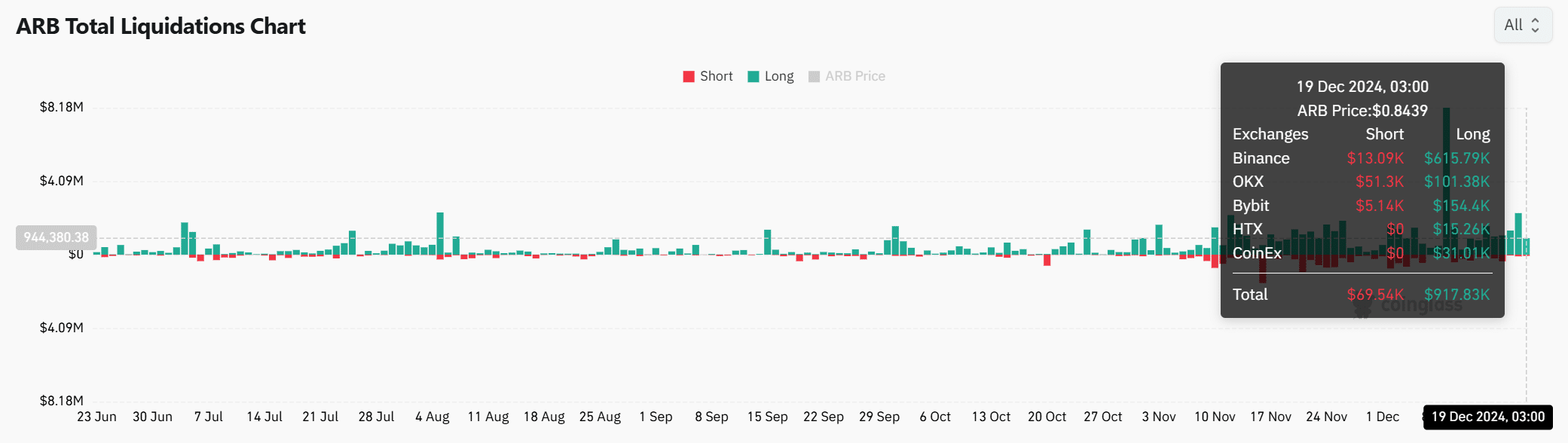

Liquidation data signals market imbalance

Liquidation data shows $917.83k in long positions were liquidated, significantly outpacing the $69.54k in shorts. This highlights over-leveraged bullish sentiment.

Therefore, for ARB to avoid further downward pressure, it must surpass key resistance levels and sustain momentum. This imbalance underscores the need for traders to exercise caution in the short term.

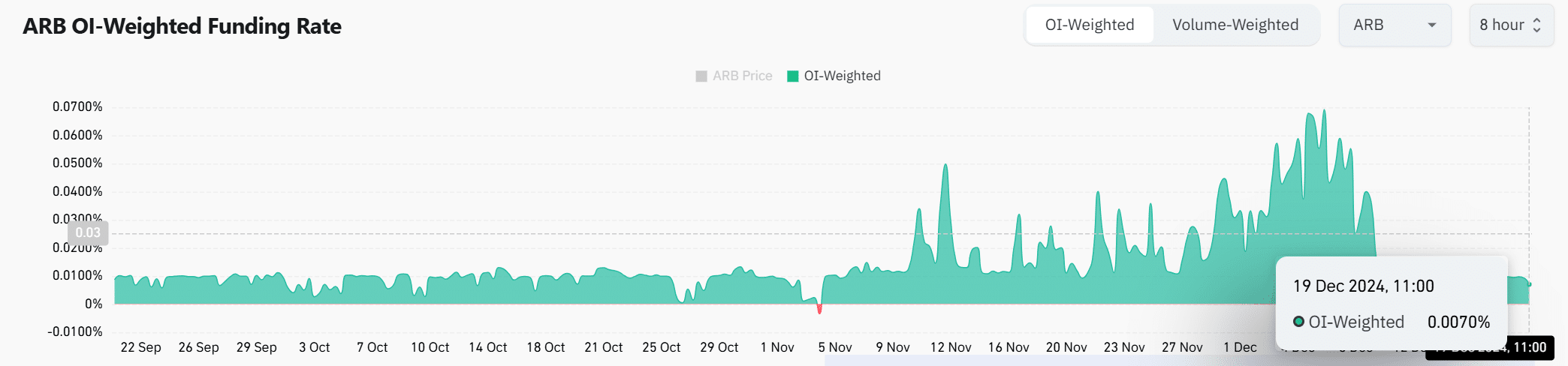

Funding rates indicate cautious optimism

Finally, the OI-weighted funding rate sits at a modest 0.007%. While this reflects cautious optimism among traders, higher funding rates are necessary to signal broader confidence in a bullish breakout.

Therefore, a shift in sentiment could depend on sustained price action above critical levels.

Read Arbitrum’s [ARB] Price Prediction 2024–2025

ARB needs to break resistance to rally

In conclusion, while whale activity and growing address engagement are promising, ARB must overcome critical resistance near $1.2409 to trigger a sustained rally.

Without this breakout, the current accumulation phase may remain neutral. Therefore, traders should closely monitor upcoming price movements to confirm a bullish trend.