Bitcoin: Exchanges see $40M daily USDT surge – Is BTC’s rally just starting?

12/20/2024 15:00

Tether inflows to exchanges surge, fueling Bitcoin's rally to $108,000. Stablecoins drive market momentum.

Posted:

- USDT inflows signal strong demand for Bitcoin, driving price up.

- Stablecoins are integral to Bitcoin’s continued bullish momentum.

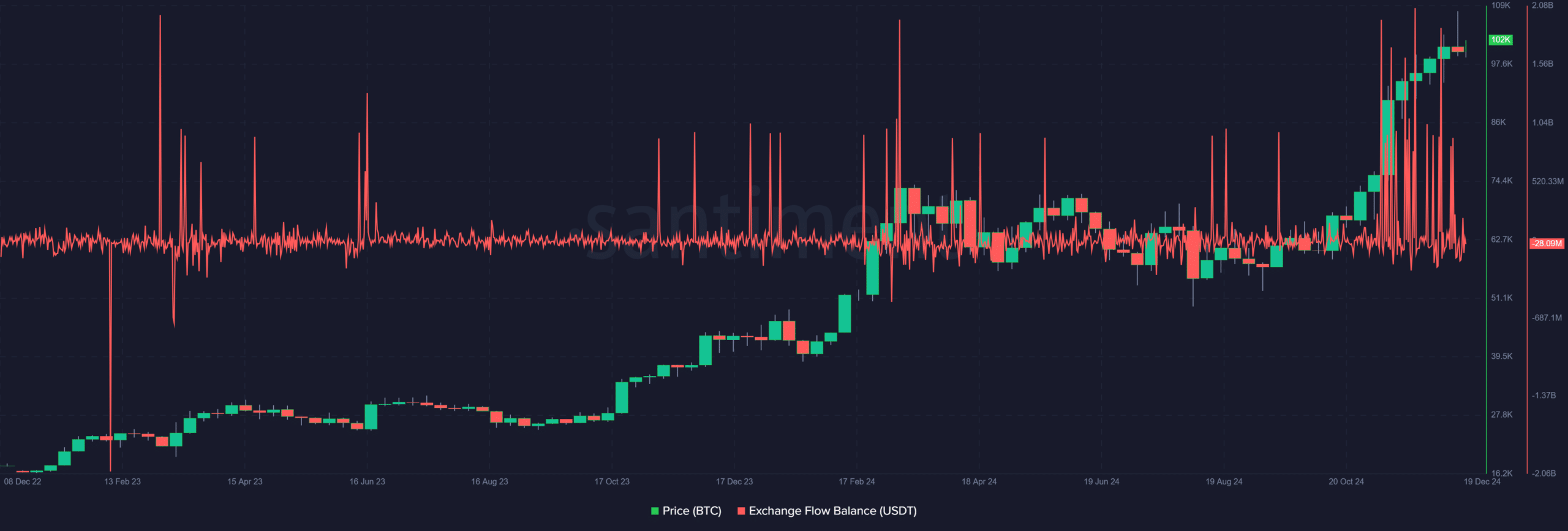

Recent on-chain data highlights a surge in Tether [USDT] inflows to centralized exchanges, averaging $40 million per day. This trend suggests that stablecoins may be the driving force behind Bitcoin’s ongoing rally, which recently saw the cryptocurrency hit a record-breaking $108,000.

The significant USDT deposits indicate large investors are positioning themselves for further gains. As stablecoins serve as a gateway to other assets, this inflow could signal confidence in Bitcoin’s potential for continued growth.

Significance of USDT inflows and their impact

The steady inflow of USDT into centralized exchanges has become a key indicator of investor sentiment.

Unlike other assets, stablecoin deposits typically signal preparation for trading activity rather than imminent sell-offs. Investors use USDT as a liquidity bridge to purchase volatile assets like Bitcoin when market conditions are favorable.

With exchanges receiving an average of $40 million USDT daily, these inflows reflect increased demand for crypto exposure. This surge highlights institutional and retail interest in Bitcoin’s rally, suggesting that stablecoins are playing a pivotal role in sustaining market momentum.

The trend is particularly noteworthy during times of heightened price activity, as it underscores the capital readiness to fuel further bullish runs.

Effect of stablecoin flows on Bitcoin’s price

Stablecoin flows, particularly those involving Tether, directly influence Bitcoin’s price dynamics by increasing buying pressure. When large volumes of USDT are deposited into exchanges, they often precede heightened trading activity, driving up Bitcoin’s price.

This pattern aligns with Bitcoin’s recent surge to a new all-time high of $108,000, fueled by significant USDT inflows.

Unlike traditional assets, stablecoins enable rapid market entry, amplifying the impact of large-scale movements. The consistent $40 million daily deposits suggest a strong demand pipeline for Bitcoin, helping sustain its bullish momentum.

As stablecoin inflows continue, analysts predict further price increases, reinforcing the vital role of USDT in shaping market trends.

Looking ahead

The stablecoin market is set for significant growth and maturation in 2025. Analysts predict that the combined market capitalization of leading stablecoins like USDT and USDC could double or even triple, reflecting their shift from niche financial tools to mainstream assets.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This expansion will likely stem from clearer regulations, increased adoption, and the rise of stablecoins pegged to local currencies, which may challenge the dominance of dollar-backed options.

Additionally, the integration of stablecoins into traditional banking systems should enhance financial services, providing faster and more inclusive solutions globally.