Why Ethereum Classic could be setting up for a 20% price jump

12/22/2024 16:30

Ethereum Classic (ETC) is poised for a 22% rally, as it has formed a bullish pattern and gained notable attention from investors.

Posted:

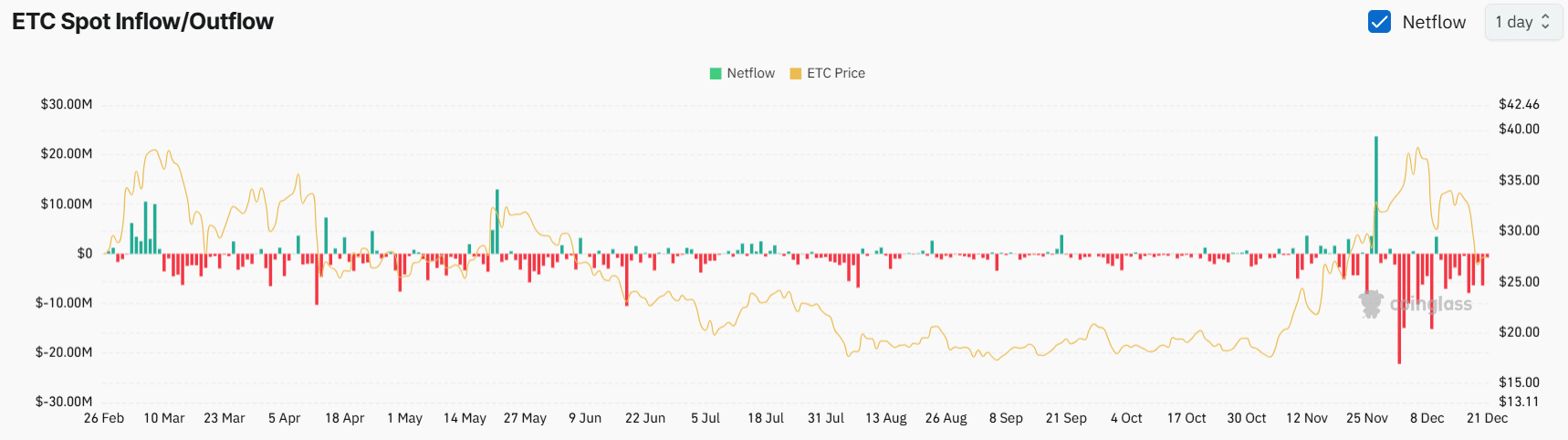

- On-chain metrics revealed that exchanges have experienced a substantial $22.85 million worth of ETC outflow.

- ETC long/short ratio indicating strong bullish sentiment among traders.

ETC, the native token of Ethereum Classic, has been making waves with its impressive rally following a notable price decline in recent days. The overall market sentiment seems to be shifting towards price recovery after a significant decline, including major assets like Bitcoin [BTC] and Ethereum [ETH].

Ethereum Classic’s bullish on-chain metrics

Amid this ongoing price recovery, ETC has soared more than 22%, attracting long-term holders as the price recovery brings the altcoin into a zone where it could easily gain upside momentum in the coming days.

According to Coinglass’s ETC spot inflow/outflow metrics, exchanges across the cryptocurrency landscape have experienced a substantial $22.85 million worth of ETC outflow.

This substantial outflow indicates a potential upside rally and an ideal buying opportunity for ETC holders, as it suggests that the assets have transferred from exchanges to long-term holders’ wallets, indicating potential accumulation.

In addition to long-term holders’ interest, traders have also begun showing interest in the token, as reported by the on-chain analytics firm Coinglass. At present, the ETC long/short ratio stands at 1.019, indicating strong bullish sentiment among traders.

Ethereum Classic (ETC) price action and upcoming level

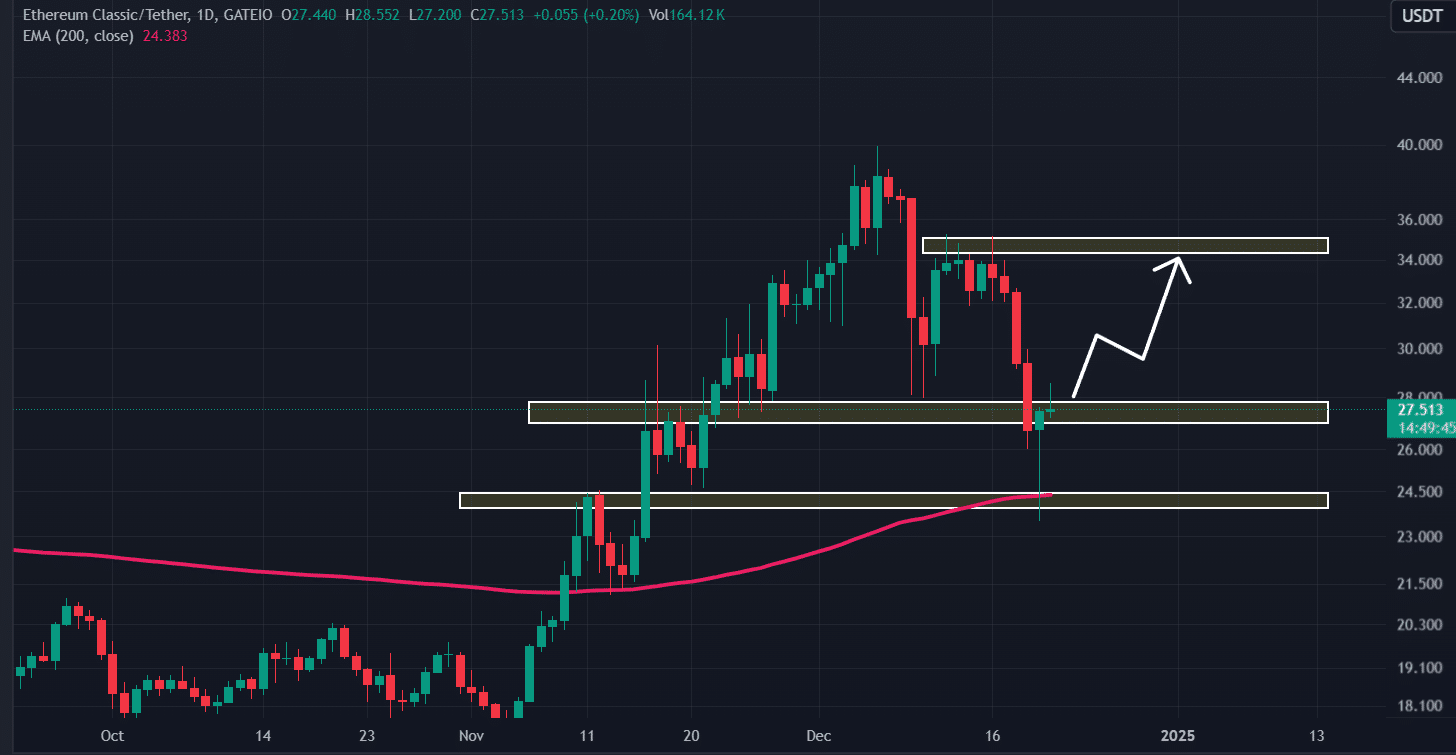

This rising interest from whales and traders appears as ETC has successfully retested its breakout level and the 200 Exponential Moving Average (EMA) on the daily time frame, which itself hints at a bullish sign.

According to expert technical analysis, ETC has formed a bullish hammer candlestick at the crucial support level of $26.70 and has also found support at the 200 EMA.

Based on the recent price action, if ETC closes a daily candle above the $28.50 level, there is a strong possibility it could soar by 20% to reach the next resistance level of $34.25 in the future.

On the positive side, ETC’s Relative Strength Index (RSI) currently stands near the oversold area, suggesting upside momentum.

Read Ethereum Classic’s [ETC] Price Prediction 2024–2025

When combining these on-chain metrics with the technical analysis, it appears that bulls are currently dominating the asset and could soon propel the asset price to the $34 mark.

Currently, ETC is trading near $27.54 and has experienced a price surge of over 13.5% in the past 24 hours. During the same period, its trading volume dropped by 30%, indicating lower participation from traders and investors.