Dogecoin prepares for lift-off: Historical patterns hint at a 12,000% rally

12/24/2024 03:00

Dogecoin's historical patterns suggest a 12,000% rally could be incoming as address activity and whale transactions soar.

Posted:

- Dogecoin address activity surges 111%, signaling strong interest ahead of a potential massive rally.

- Historical patterns suggest Dogecoin could see a 12,000% rally as whales ramp up transactions.

Dogecoin [DOGE] has shown a recurring trend of sharp price increases followed by corrections. In 2017, DOGE climbed 212%, retraced 40%, and then gained 5,000%. Similarly, in 2021, it rose 476%, corrected by 56%, and later surged 12,000%.

In 2024, Dogecoin has followed a comparable trajectory, increasing by 440% from $0.065 to $0.39547 before retracing 46%.

According to crypto analyst Ali, this pattern suggests the potential for another significant rally if the trend continues as it has in previous cycles.

Current price action and critical levels

Dogecoin was trading at $0.3167 at press time, reflecting a 1.43% decline over the last 24 hours and a 21.23% drop in the past week. The cryptocurrency has a market capitalization of $46.66 billion and a 24-hour trading volume of $4.37 billion.

Price data shows DOGE holding within its long-term logarithmic price channel. Support levels have been identified at $0.065 and $0.19-$0.20, while resistance is seen at $0.39547 and $0.73665, the record high set in 2021.

Analysts have projected a potential upper boundary of $17.94 if Dogecoin maintains its historical upward trend within this channel.

On-chain activity shows increased interest

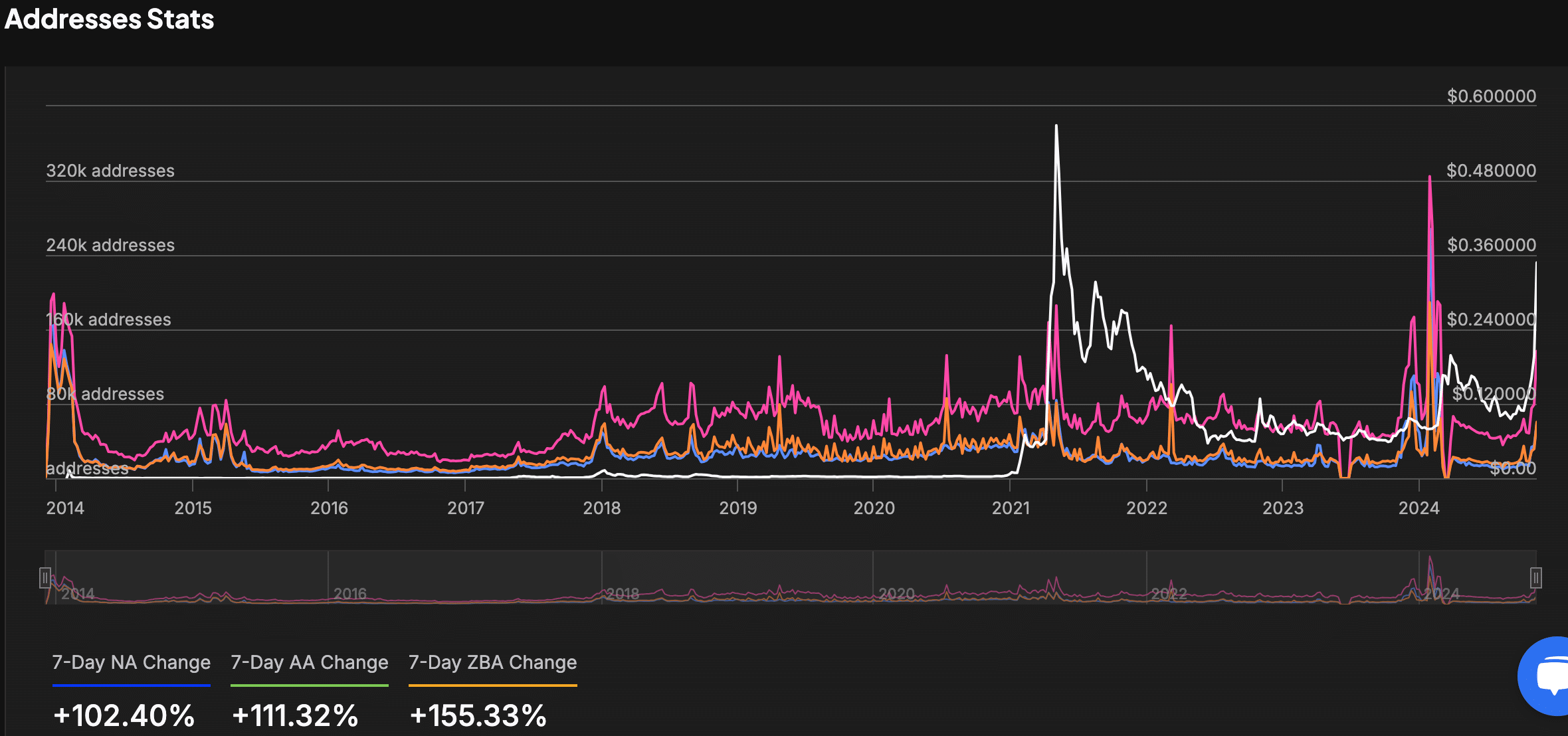

Data from IntoTheBlock indicates a rise in network activity. As of 11th November, active addresses totaled 136,850, with 58,990 new addresses created.

Over the past week, new addresses rose by 102.40%, active addresses by 111.32%, and zero-balance addresses increased by 155.33%.

Source: IntoTheBlock

This growth in address activity coincided with Dogecoin’s recent price move to $0.40. The increased participation suggests a resurgence in interest, possibly from both retail and institutional investors.

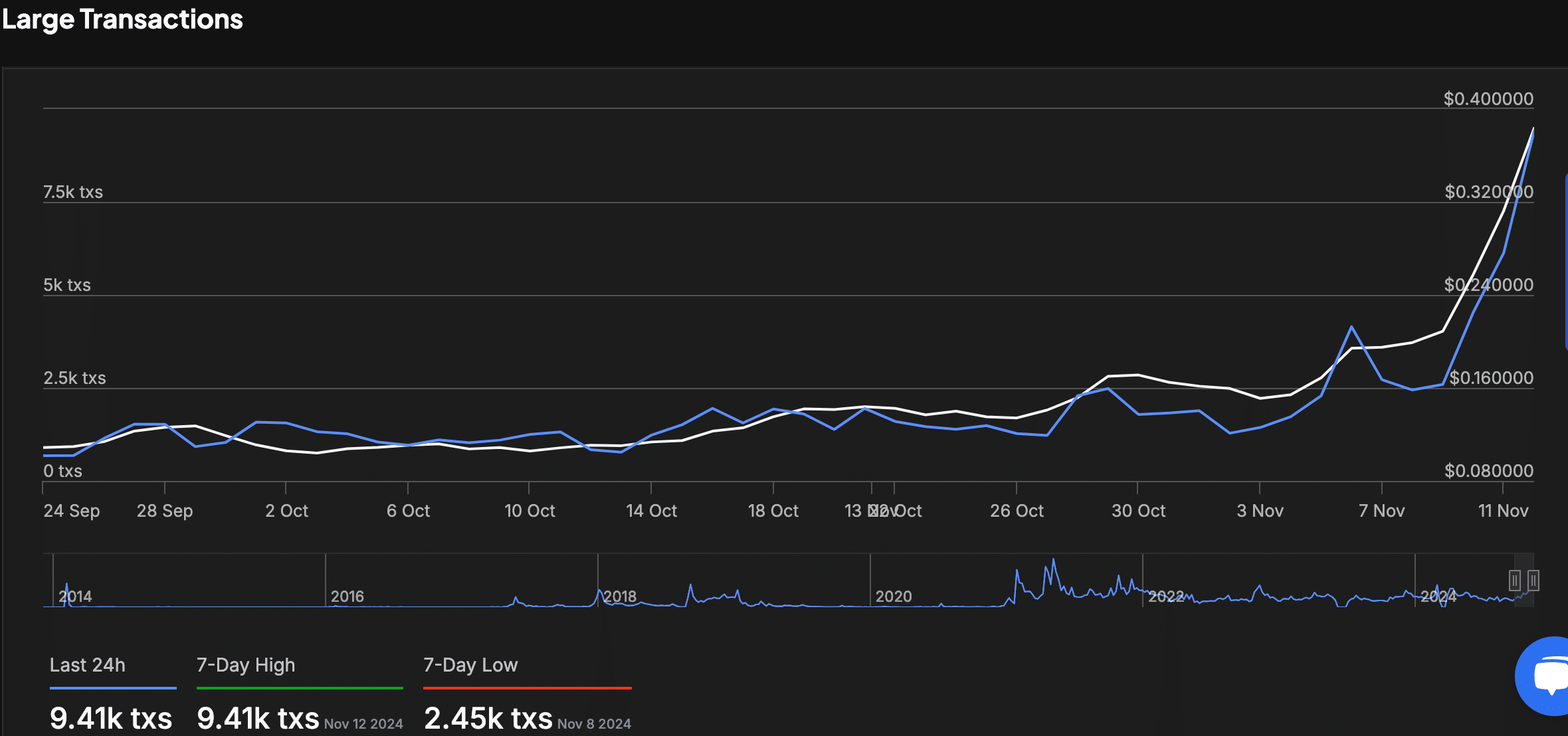

Large transactions involving Dogecoin have also seen an uptick. Over the past week, whale transactions reached a peak of 9,410, aligning with the recent price surge.

This marks a sharp increase from the weekly low of 2,450 transactions observed on 8th November.

Source: IntoTheBlock

Market data from Coinglass shows trading volume down by 24.83% to $7.42 billion, while open interest in futures contracts declined 4.71% to $1.95 billion.

Options trading volumes dropped 58.52% to $427.08 million, with open interest in options contracts at $1.18 million.

With historical trends, increasing address activity, and large transactions aligning, the data suggests that Dogecoin may be positioning itself for another significant price movement.