Is AAVE’s surge to $400 sustainable? Here’s why key metrics suggest caution

12/25/2024 10:00

AAVE has displayed a tremendous performance in the last 24 hours with its double-digit price gains, suggesting a move towards $400

Posted:

- AAVE’s price shot up by 18% in the last 24 hours.

- Selling pressure on the token increased, hinting at a slight price correction.

AAVE has displayed a tremendous performance in the last 24 hours with its double-digit price gains. This recent uptrend might push the token further up above $400, as predicted by a popular analyst.

Therefore, AMBCrypto assessed its metrics to find out whether the road ahead is clear.

AAVE bulls are on the move

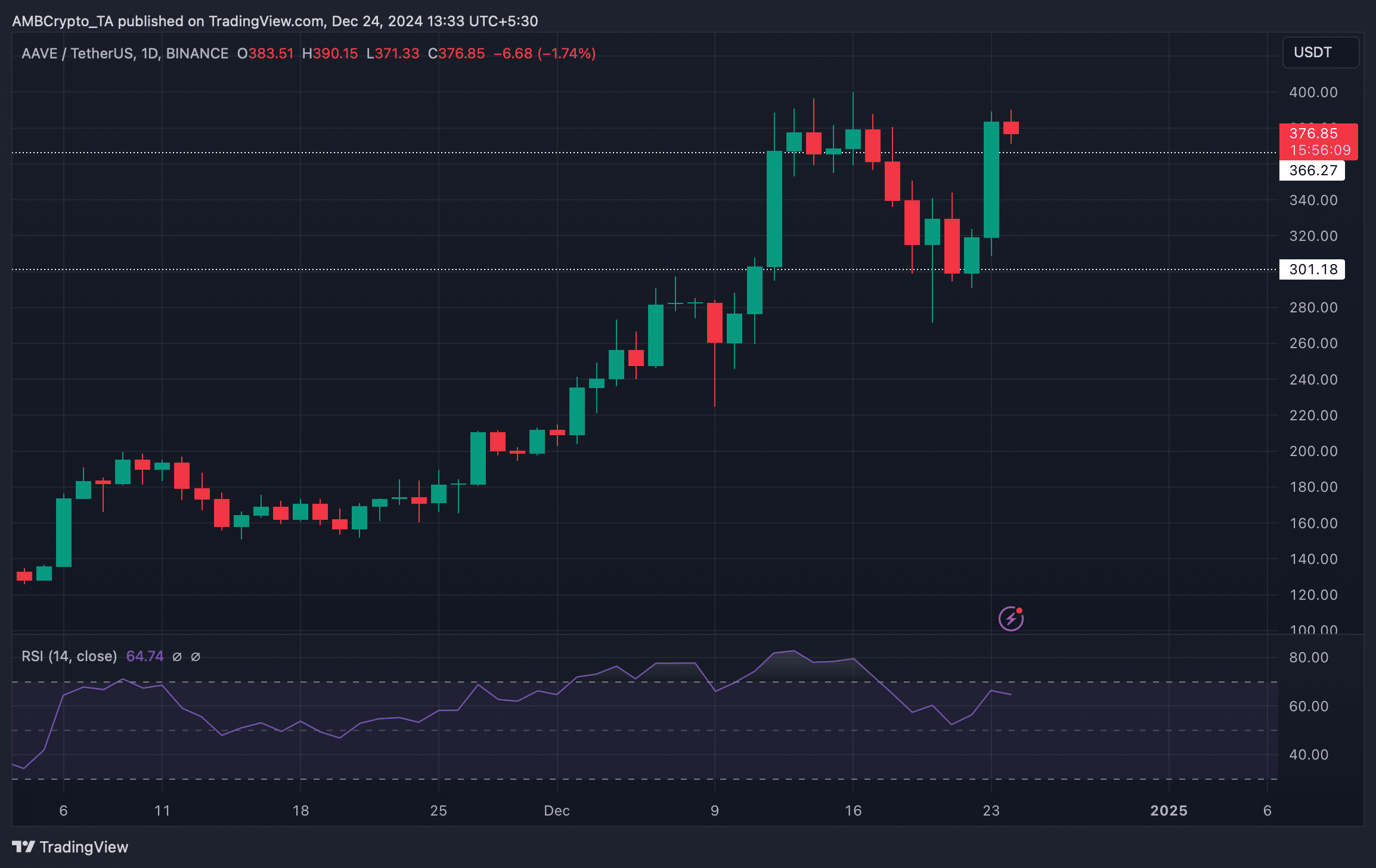

AAVE decoupled from the top cryptos as it registered an 18% price hike in just the last 24 hours. At press time, it was trading at $378 with a market capitalization of over $5.6 billion.

Ali Martinez, a popular crypto analyst, posted a tweet that hinted at a similar growth if one condition was met. As per the tweet, an Adam and Eve pattern was forming on the token’s chart. In case of a successful breakout above the $342 resistance zone, the token might cross $400 soon.

To be precise, Martinez mentioned that a breakout could result in a 19% price hike. Thankfully, the token managed a successful breakout, and at press time, it was marching towards the $400 mark.

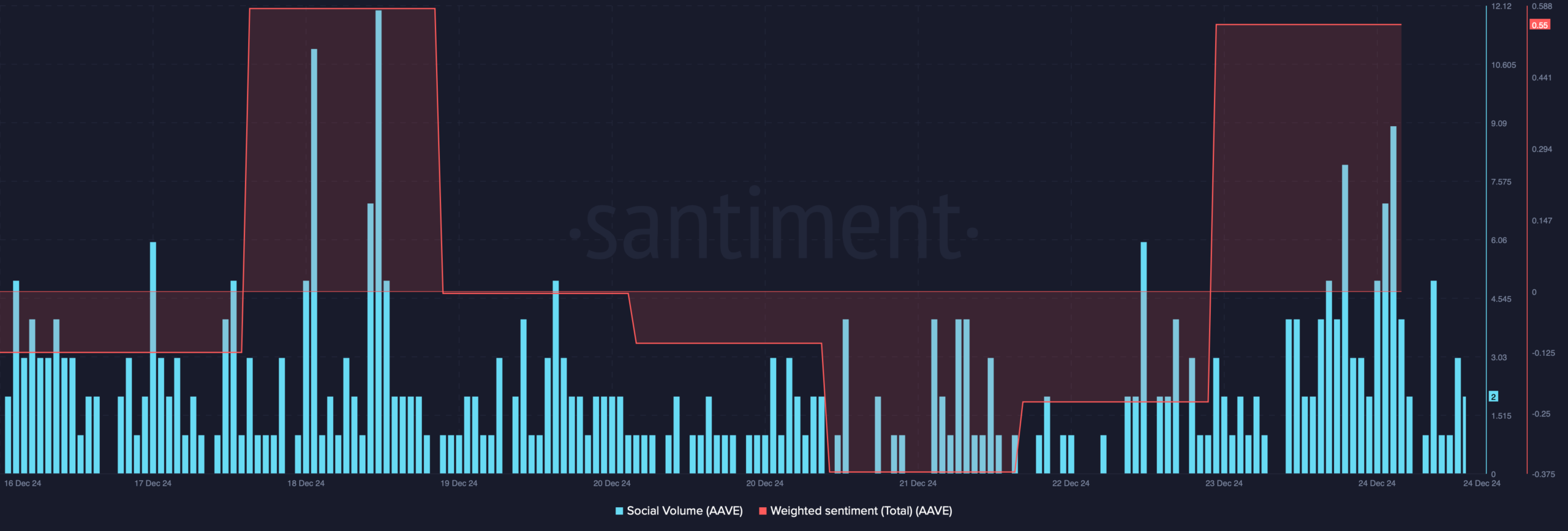

This recent price increase also had a positive impact on the token’s social metrics. For example, its weighted sentiment went into the positive zone, meaning that bullish sentiment around AAVE was rising.

Its social volume also increased—a clear sign of the coin’s popularity in the crypto market.

Odds of AAVE sustaining the pump

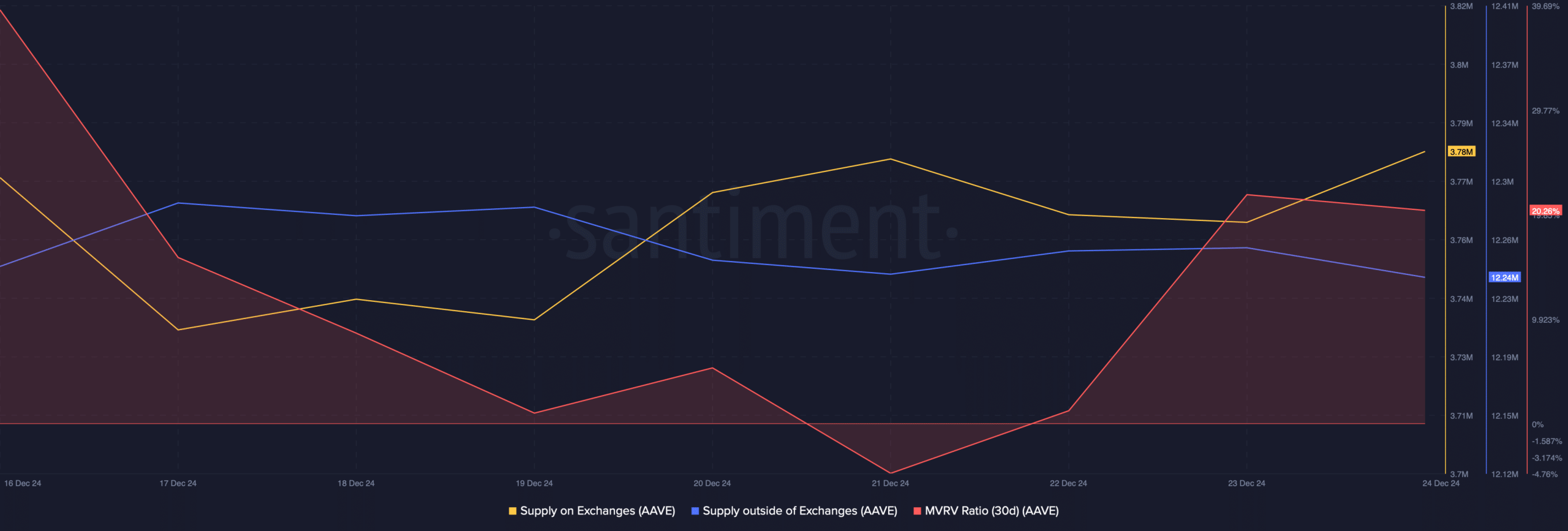

AMBrypto then took a look at the token’s on-chain data to find out whether this bull run will continue. As per the analysis, selling pressure seemed to have increased in the recent past.

AAVE’s supply on exchanges increased, while its supply outside of exchanges dropped. Whenever that happens amidst a bull rally, it indicates that investors are cashing out to gain profit, which often results in price corrections.

Another bearish metric was the MVRV ratio, as it dropped slightly after registering a promising uptick on the 23rd of December.

Similar to the aforementioned metrics, Coinglass’ data revealed that there were more short positions in the market than long positions, as the token’s long/short ratio (4-hour) declined in the last 24 hours.

Read Aave’s [AAVE] Price Prediction 2024-25

If a price correction happens, then it will be crucial for AAVE to test its support at $366 in order to restart a rally towards $400 in the coming days.

But if the token slips under the support, its price might once again drop to $301.