BonkDAO’s 1.69 trillion token burn: Will it affect BONK’s price?

12/27/2024 02:00

BonkDAO's decision to burn 1.69 trillion Bonk [BONK] tokens as part of the "BURNmas" event has grabbed attention in the crypto community.

Posted:

- BonkDAO’s token burn reduced supply by 1.8%, yet BONK faced resistance at $0.00003517.

- Market sentiment remained bearish, with high short interest and weak technical indicators for BONK.

BonkDAO’s decision to burn 1.69 trillion Bonk [BONK] tokens as part of the “BURNmas” event has grabbed attention in the crypto community.

With $54.52 million worth of tokens being removed from circulation, the total supply of BONK is reduced by 1.8%.

This could have significant implications for the market. At press time, BONK is trading at $0.00003144, reflecting a 6.50% decline in the past 24 hours.

Given this deflationary action, the question arises: Will it influence BONK’s price and market sentiment moving forward?

What is the outlook for BONK’s price action?

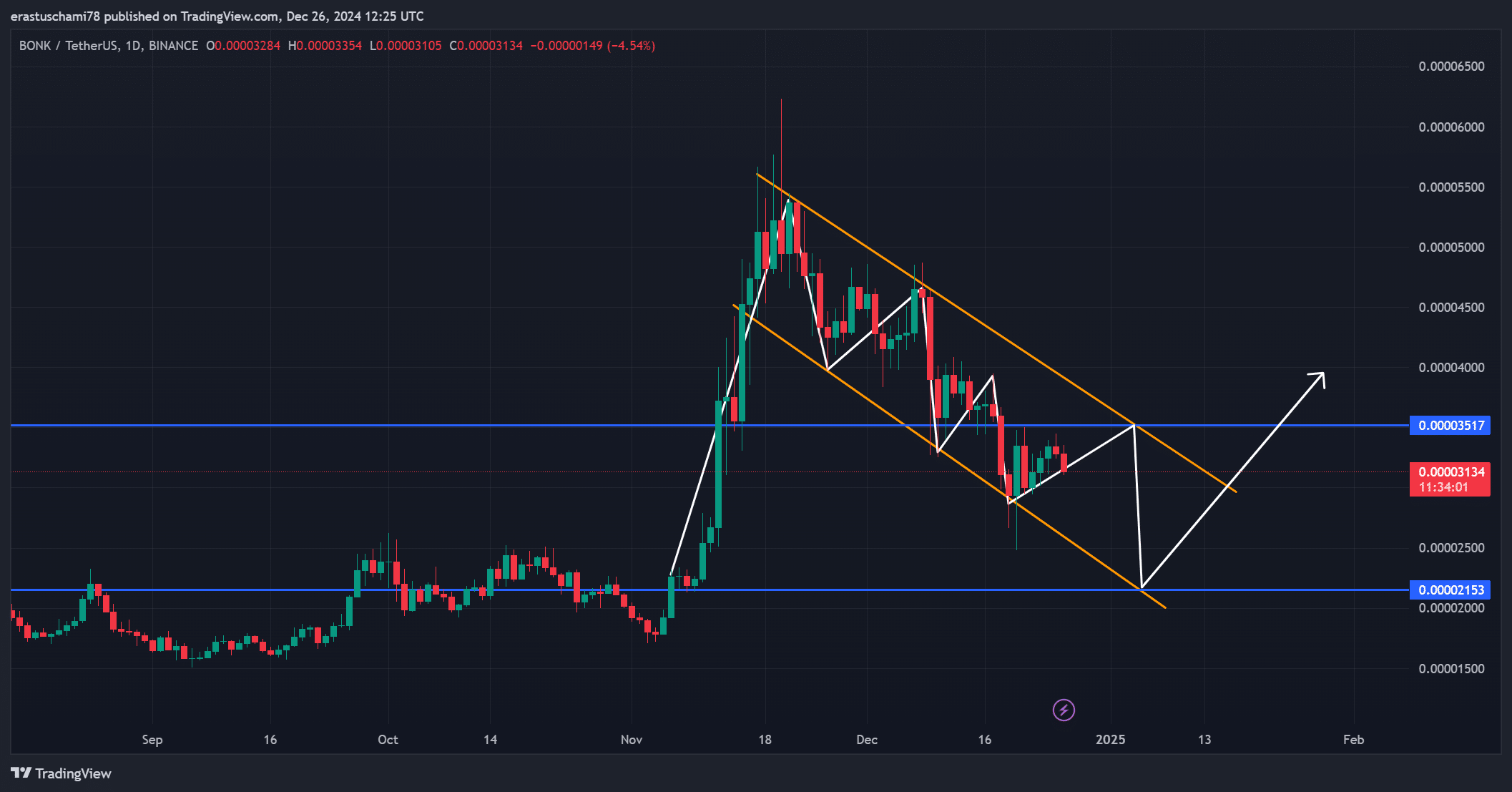

BONK’s price action reveals a pattern of resistance, particularly at the $0.00003517 level. This resistance point could act as a barrier to further upward movement unless substantial buying volume comes into play.

However, with BONK trading at $0.00003144 at press time, it faces challenges in breaking through this resistance without increased market support.

The 6.50% drop in the last 24 hours indicated that the ongoing trend was still in a consolidation phase.

Of Social Volume

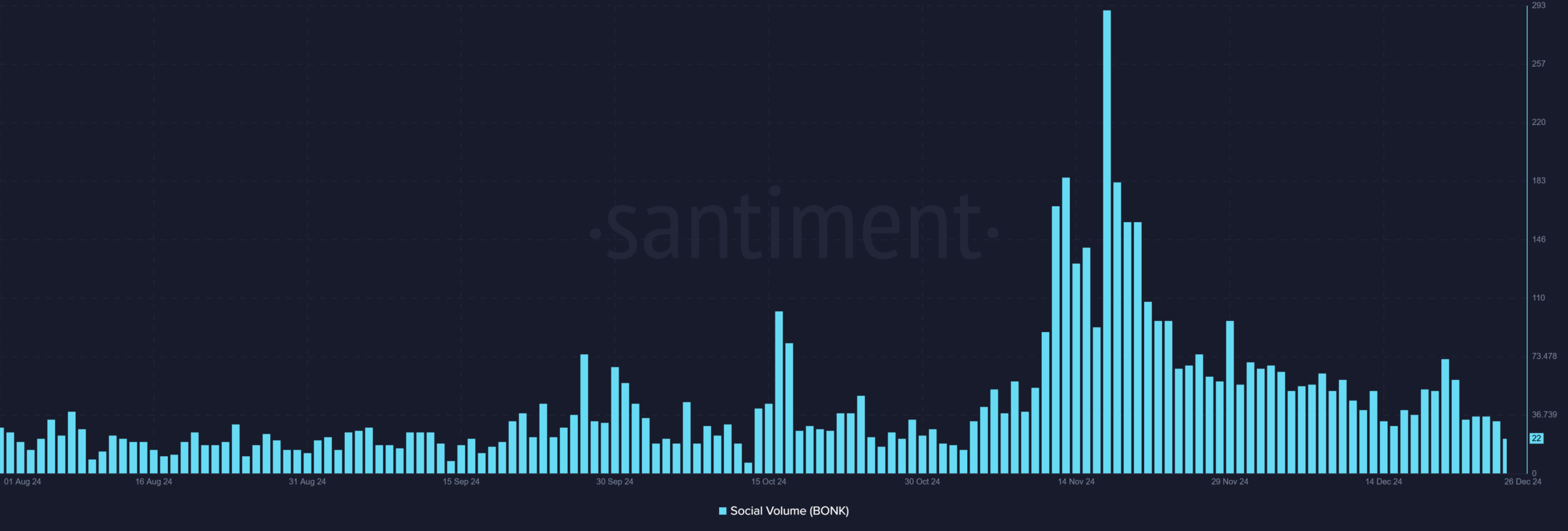

Social Volume data painted a picture of decreasing interest in BONK. In mid-November, social mentions peaked at over 290, but by the 26th of December, they had dropped to just 22.

This significant reduction in social engagement suggested that the excitement surrounding the token burn was fading.

While high Social Volume often signals strong price action, this drop could be an indicator that the market is moving away from BONK, awaiting a fresh spark to reignite its momentum.

Are traders betting on a further decline?

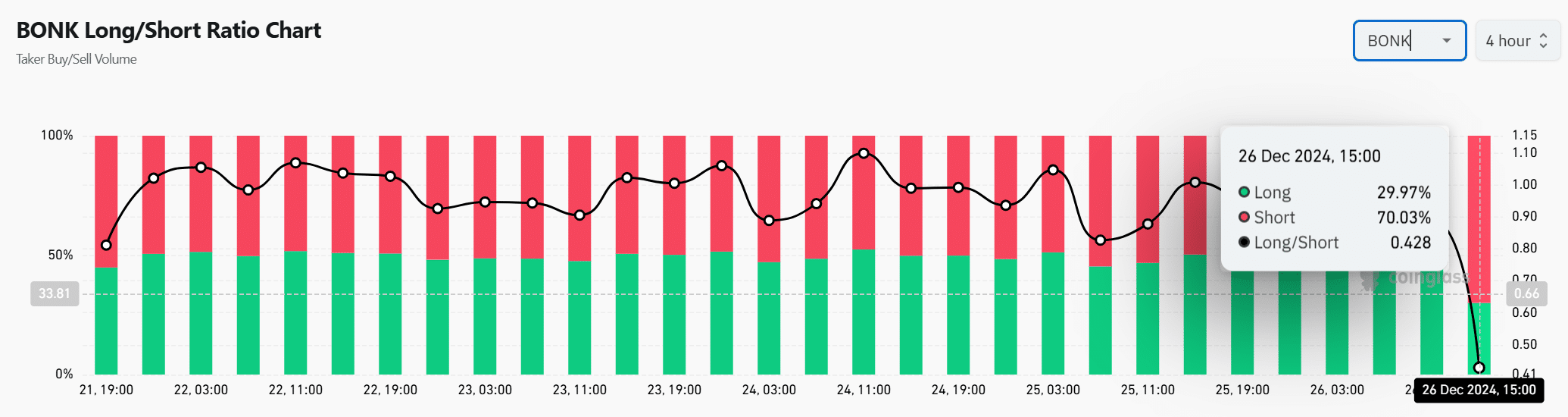

Market sentiment leans heavily towards short positions. As of the 26th of December, only 29.97% of positions are long, while 70.03% are short.

This shows that traders are expecting a further decline in BONK’s price.

The large short interest suggests a bearish outlook, though this could lead to a short squeeze if the market moves in an unexpected direction.

What do technical indicators suggest for the price trend?

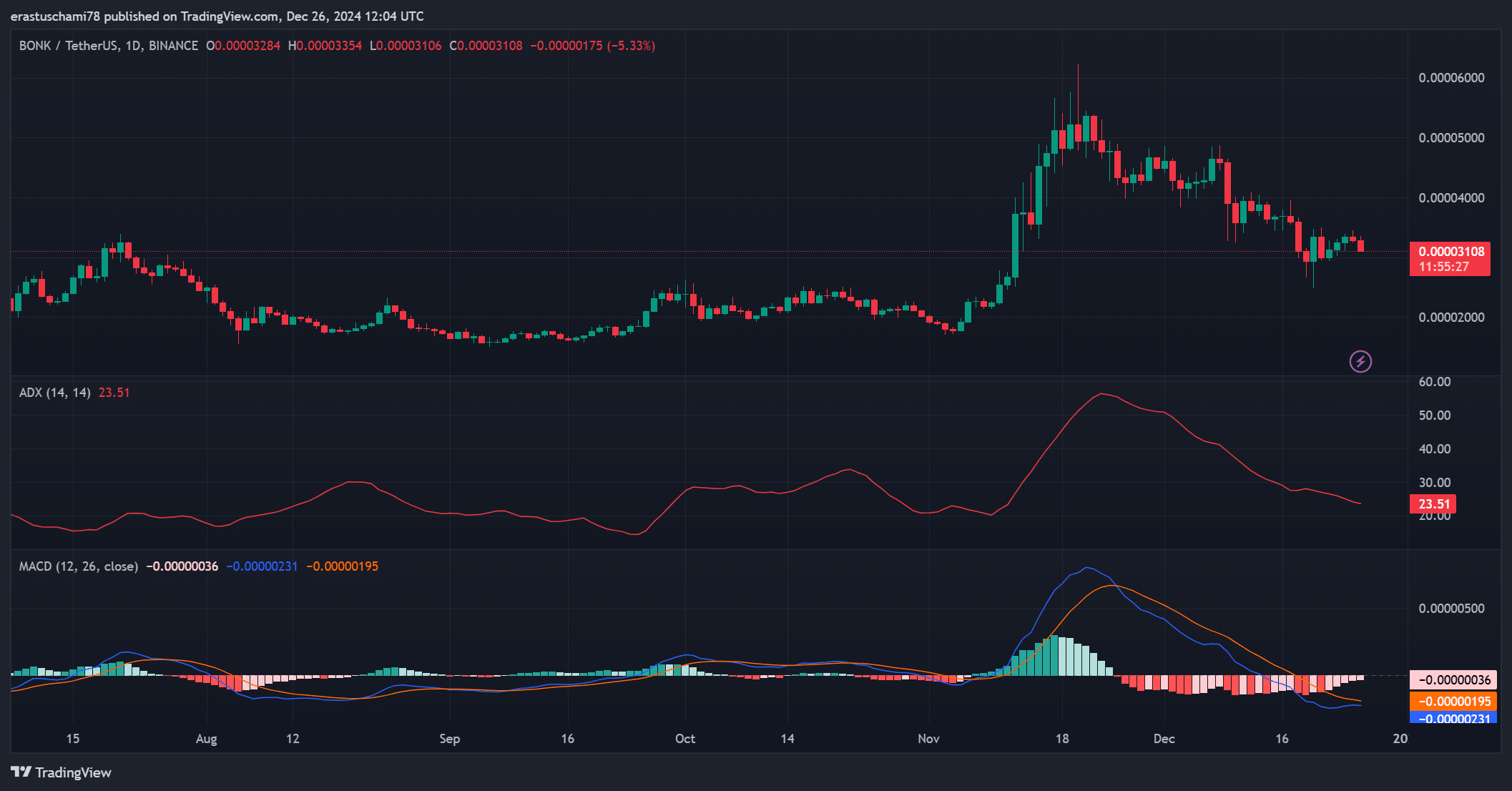

The technical indicators show mixed signals. The Average Directional Index (ADX) is at 23.51, indicating a weak trend, while the Moving Average Convergence Divergence (MACD) shows a negative reading of -0.00000036.

These indicators suggest that although a small rally is possible, the market lacks strong momentum to sustain a significant price rise in the near term.

Market sentiment

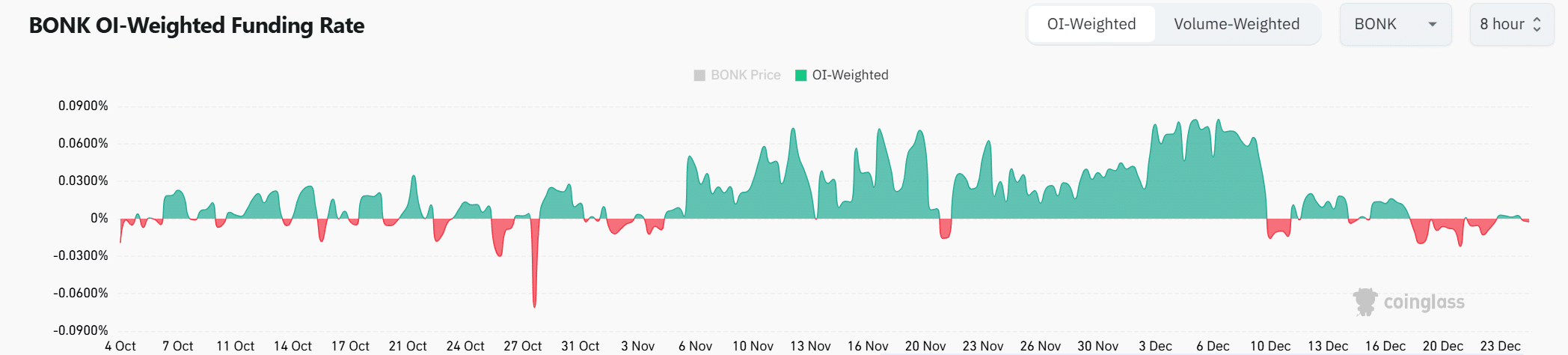

The OI-Weighted Funding Rate has fluctuated between -0.09% and 0.09% in recent months, and was 0% at press time.

This indicated that traders were unsure about the market’s direction and were hesitant to take large positions, resulting in a neutral market stance.

Read Bonk’s [BONK] Price Prediction 2024–2025

While the token burn event by BonkDAO reduces the supply of BONK, the current bearish sentiment, reflected in Social Volume, Long/Short Ratios, and weak technical indicators, suggested that this deflationary action would not trigger a significant price rally in the short term.

Therefore, without new catalysts, BONK is unlikely to experience a substantial price increase.