Bitcoin: How THIS can push prices back down to $85K

12/29/2024 16:00

Bitcoin [BTC] has been in a tough spot over the last few weeks as the coin has failed to register promising gains.

Posted:

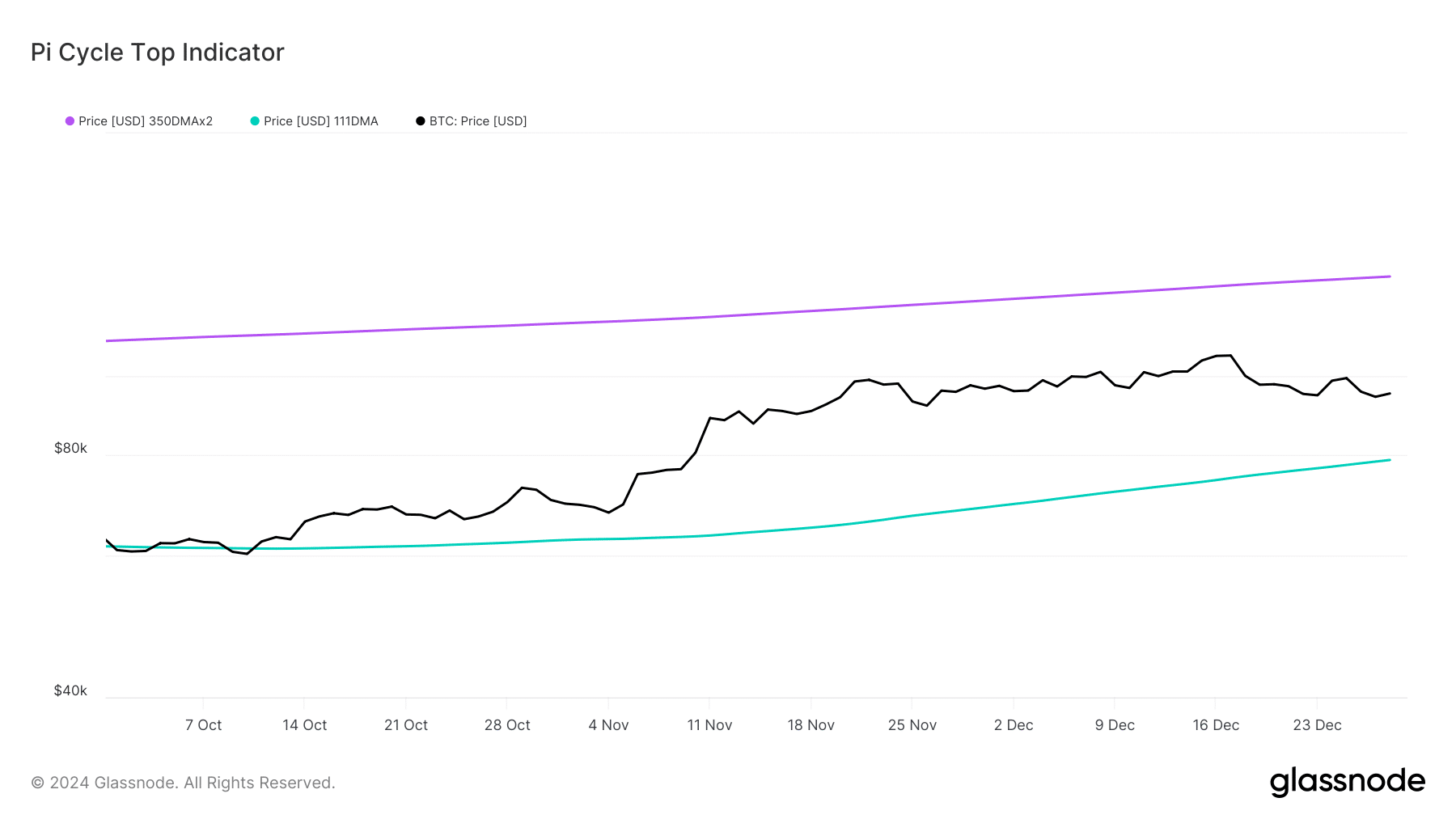

- The Pi Cycle Top indicator hinted at a possible market bottom near $78k.

- Selling pressure on BTC was rising, which could push its price further down.

Bitcoin [BTC] has been in a tough spot over the last few weeks as the coin has failed to register promising gains.

In fact, the latest analysis suggested that things can get worse, as there is a chance of the coin dropping to $85k again in the near-term.

Bitcoin is in trouble!

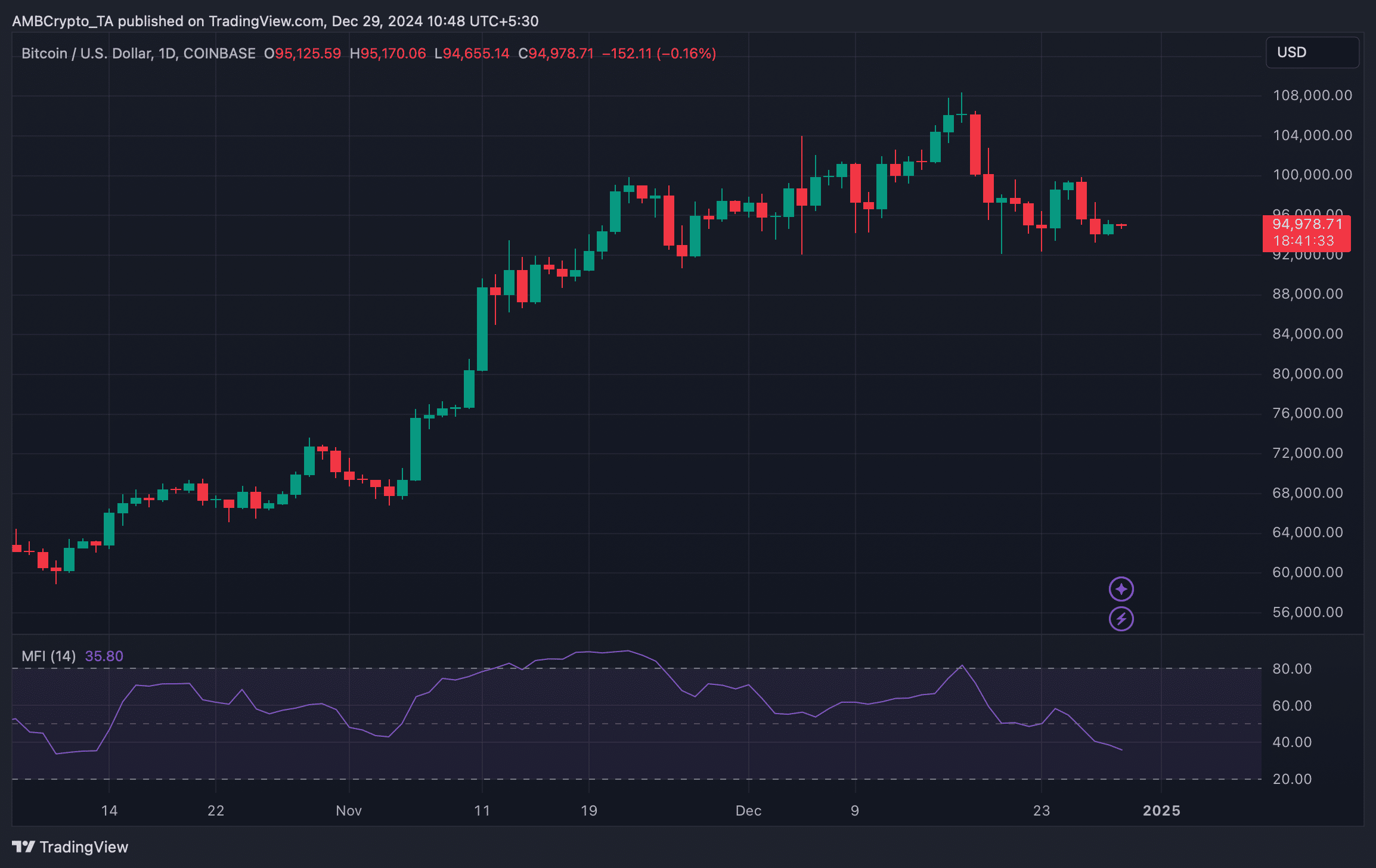

Bitcoin’s price has been somewhat consolidating in the past few days.

In the past 24 hours, the king coin’s price registered a modest 0.5% uptick, making it trade at $94,937.45 with a market capitalization of over $1.88 trillion.

While BTC’s price volatility dropped, Alphractal, a popular data analytics platform, posted a tweet, mentioning a possible obstacle for BTC going forward.

The tweet used BTC’s Short-Term Holder Realized Price metric, representing the average acquisition price of Bitcoin for investors considered short-term holders, typically defined by the movement of coins held for less than 155 days.

The tweet mentioned,

“Losing the 85k region could be disastrous for the price, and a bear market may follow. Therefore, between 85k and 86k, the bulls will do everything they can to maintain the price!”

Will BTC drop to $85k again?

As per the Pi Cycle Top indicator, BTC had a possible market bottom at near the $78k mark. Therefore, the possibility of BTC falling to $85k can’t be ruled out.

Apart from this, selling pressure on the king coin was also rising.

AMBCrypto reported earlier that BTC’s spot exchange reserves, after declining consistently over the past month in light of investors getting their assets off exchanges, recently recorded a significant uptick with 20k BTC inflows.

A rise in the metric means that investors are selling their holdings, which often has a negative impact on prices. Things in the derivatives market also looked concerning.

As per CryptoQuant’s data, Bitcoin’s taker buy/sell ratio turned red. This clearly meant that selling sentiment was dominant in the futures market.

Is your portfolio green? Check out the BTC Profit Calculator

The fact that investors were selling their assets was further proven by the technical indicator Money Flow Index (MFI) as it registered a downtick.

If selling pressure continues to rise, then Bitcoin might as well fall to the $85k range again in the near-term.