Analyzing Bitcoin’s miner reserves, HODLing trends, and market confidence

01/05/2025 06:00

Miner activity is an essential part of the Bitcoin ecosystem and as such, changes in its dynamics may offer critical market insights...

- Bitcoin’s miner activity demonstrated a surge in unrealized profits, indicating bullish optimism

- A few key bullish signals could help dictate how BTC does on the price charts

Miner activity is an essential part of the Bitcoin ecosystem and as such, changes in its dynamics may offer critical market insights. Bitcoin miner data collected over the last few months may provide a rough idea of the prevailing sentiment and level of confidence.

In fact, a recent miner analysis on CryptoQuant revealed that Bitcoin miner flows into exchanges have dipped considerably since April 2024. This observation suggested that miners have been holding on to more BTC in the hopes of selling it at higher prices.

The same analysis revealed that the net unrealized profit and loss metric was still positive at press time. This seemed to be confirmation that Bitcoin miners are still sitting on unrealized profits, hence not contributing much to the sell pressure in the market.

Are Bitcoin miners still anticipating profits?

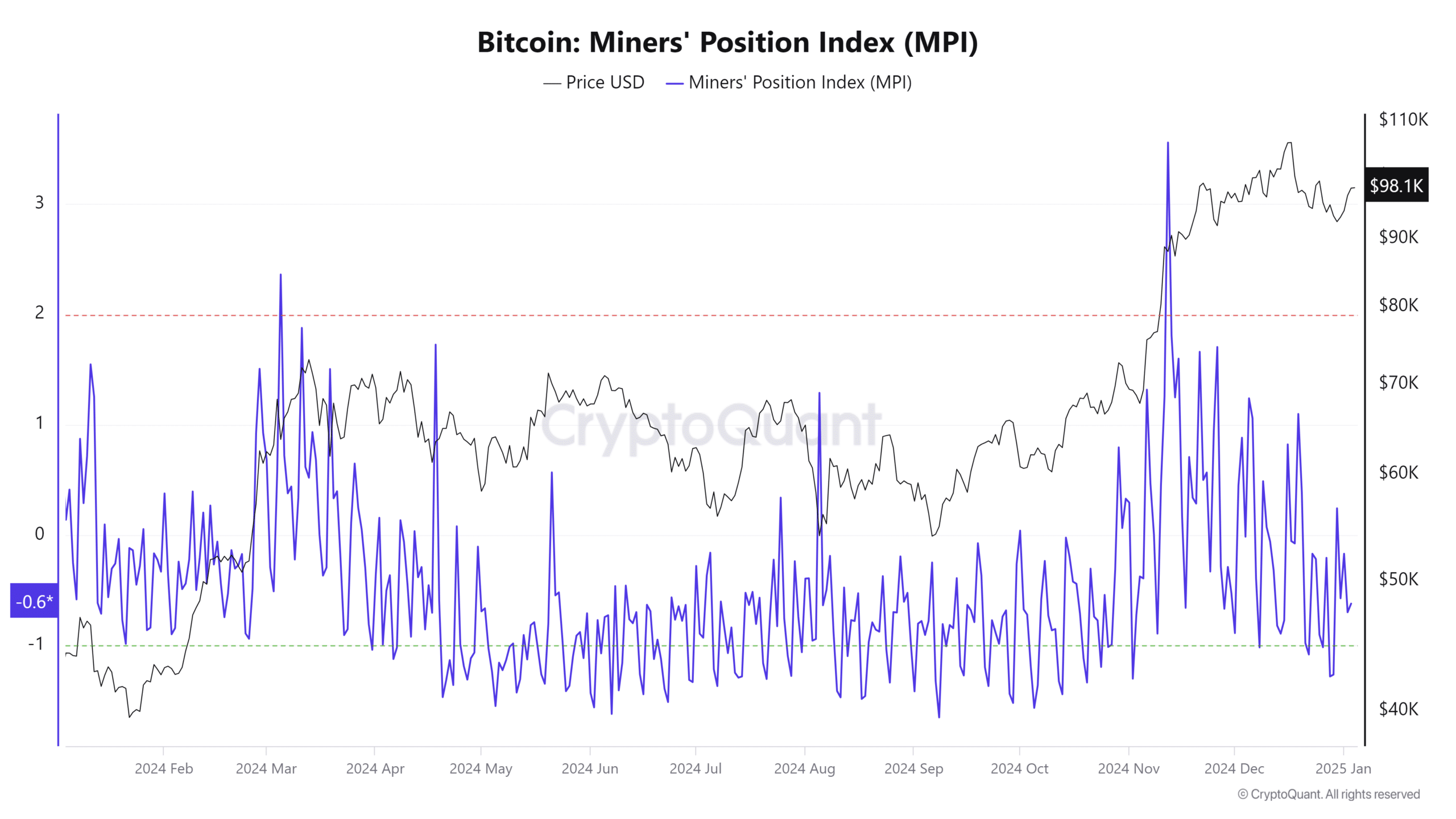

The aforementioned observation seemed to be in line with the miner position index (MPI). A high MPI indicates that miners are transferring more BTC, which often translates to more sell pressure.

This indicator’s last peak was on 12 November, just a few weeks before the price achieved its historic peak.

The MPI peak confirmed strong sell pressure from Bitcoin miners. However, it has since dipped considerably, and it closed December near its bottom range – A sign that miner outflows cooled down considerably.

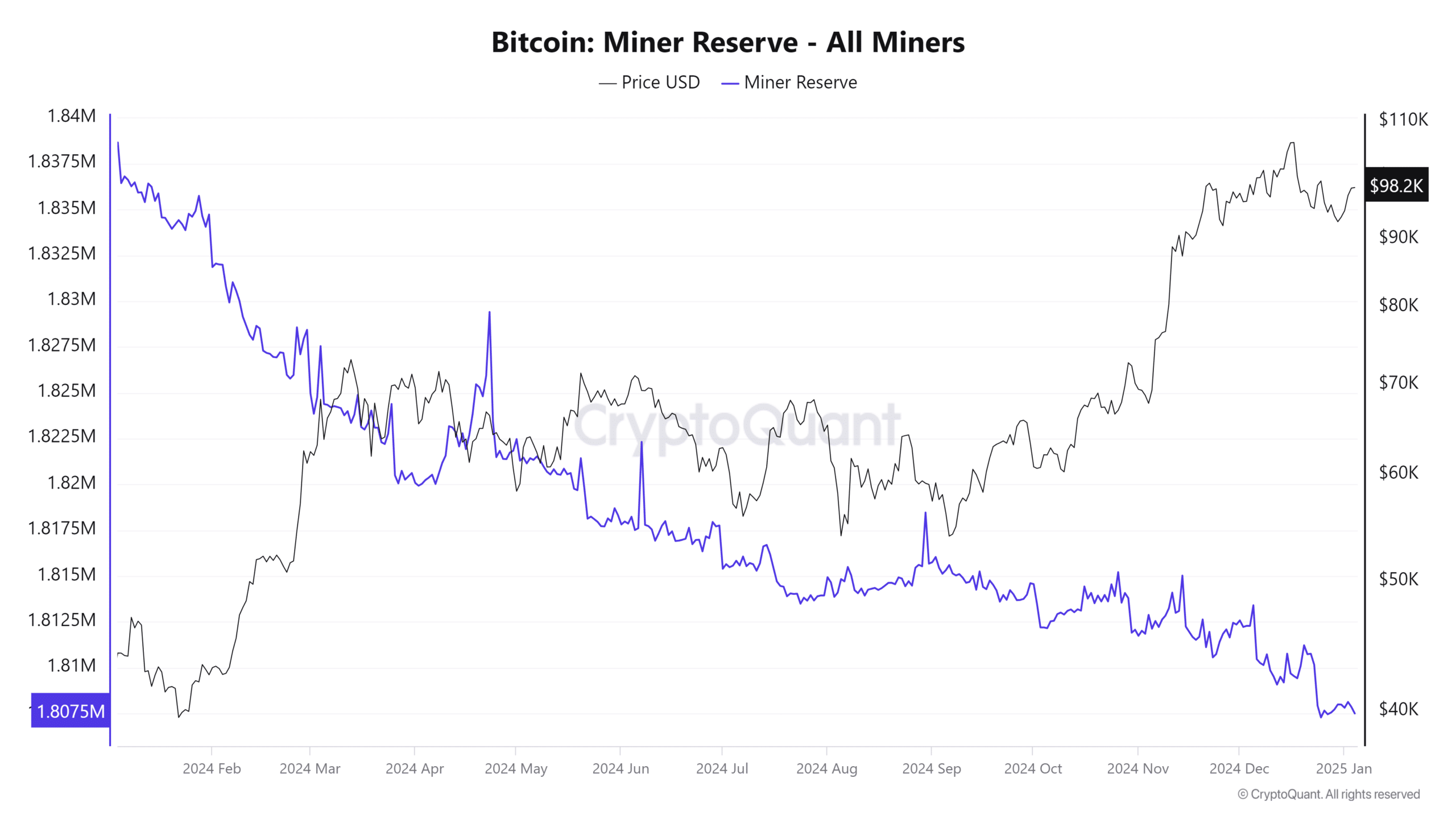

Despite this, however, Bitcoin miner reserves have been declining and hovered close to 12-month lows, at the time of observation. For context, there were slightly over 1.838 million in Bitcoin miner reserves towards the beginning of 2024. That figure has since dipped to 1.807 million BTC.

The declining miner reserves confirmed that miners are still taking some profits, especially as the price soars higher. This is an expected outcome since miners still need to cash out some of their coins to cover the cost of operations.

The MPI confirmed that the rate of sell pressure has been declining as the market pulled back. In other words, Bitcoin miners may he holding on to some of their coins in anticipation of higher prices in 2025.

Miner reserve upticks have been taking place along the way and the next major uptick could trigger another spike. Here, it’s worth noting that another key indicator to look out for is institutional demand. ETFs tend to be at the forefront of strong demand.

ETF flows were mostly negative in the second half of December and kicked off the first 2 days of 2025 in the negative. However, ETF flows on Friday turned back positive with a massive $908.1 million acquired. Sustained demand in the coming weeks could potentially pave the way for the price reclaiming the $100,000 price level.