Avalanche’s path to $150: Why analysts are bullish on AVAX’s next move

01/07/2025 07:30

AVAX records $196M in large transactions, reflecting whale interest and bullish momentum as the token eyes a $150 breakout.

- Analyst predicts AVAX could rally to $150 if bullish breakout patterns hold strong.

- Key resistance near $44 must be cleared for AVAX to reach the short term $50 target.

Avalanche [AVAX] is capturing market attention, with its price climbing 1.82% to $43.30 in the past 24 hours. The token traded between $41.29 and $43.91, showing strong price resilience during this period.

With a market cap of $17.76 billion and a 24-hour trading volume of $486.1 million, AVAX remains a key focus for investors.

Institutional interest is fueling bullish momentum for AVAX, making it a standout performer in the market. BlackRock’s BUIDL fund has contributed significantly to the positive sentiment around the token.

This increasing attention shows a solid foundation for upward movement in the near term.

AVAX on the brink of a massive breakout

Avalanche is gearing up for a significant breakout, with technical indicators pointing toward a potential rally to $150.

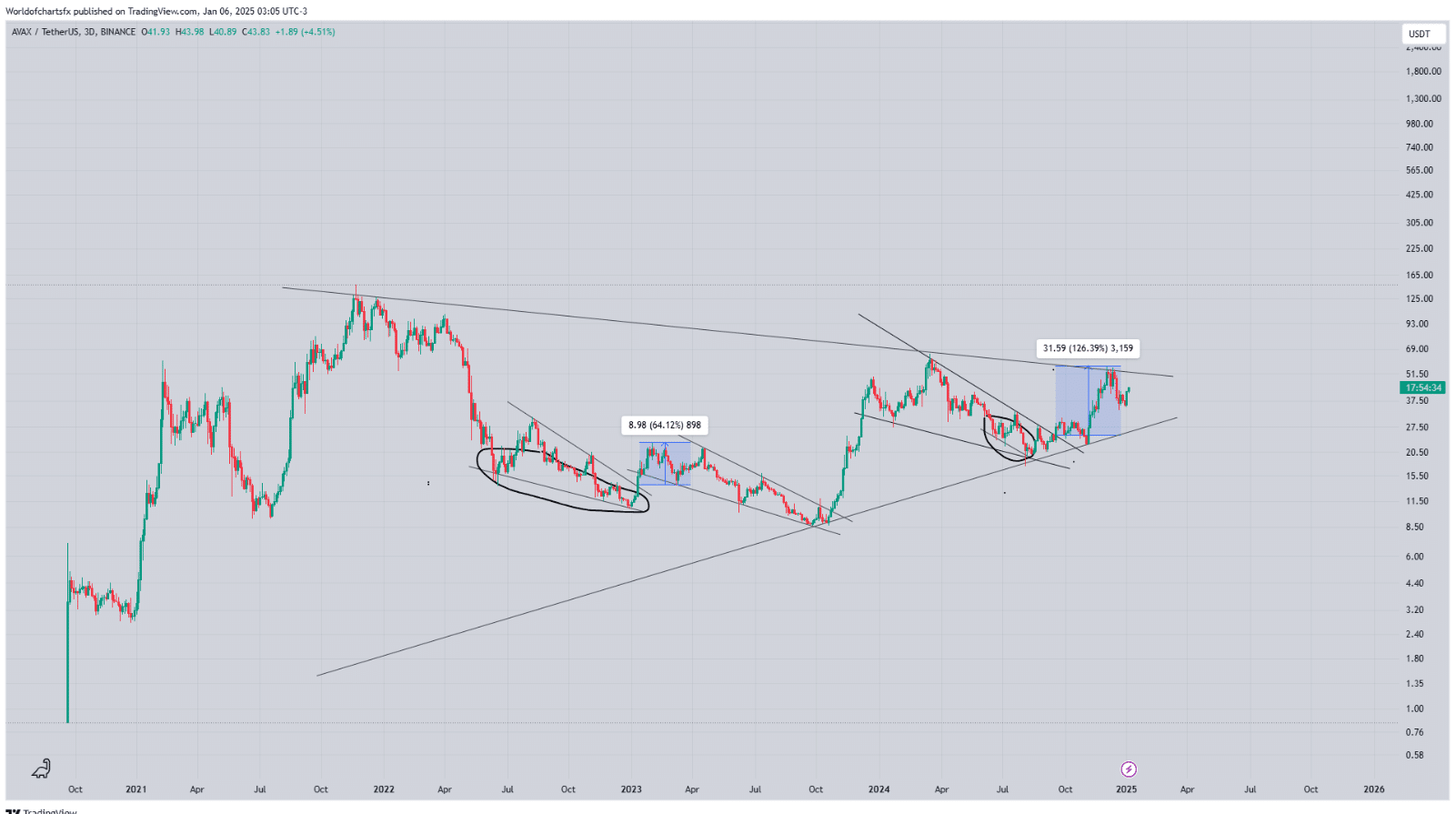

Recent data from World of Charts revealed ascending consolidations since 2021, reflecting the token’s ability to sustain higher lows.

These setups align with the current price trend, where AVAX is testing resistance within a narrowing range.

The Avax price highlighted strong bullish sentiment, indicating that a breakout above this resistance could trigger significant price movement.

Adding to this bullish outlook, AVAX recorded a trading volume of $196.81 million in the last 24 hours, demonstrating robust liquidity and active trader participation.

$44 resistance critical for next move

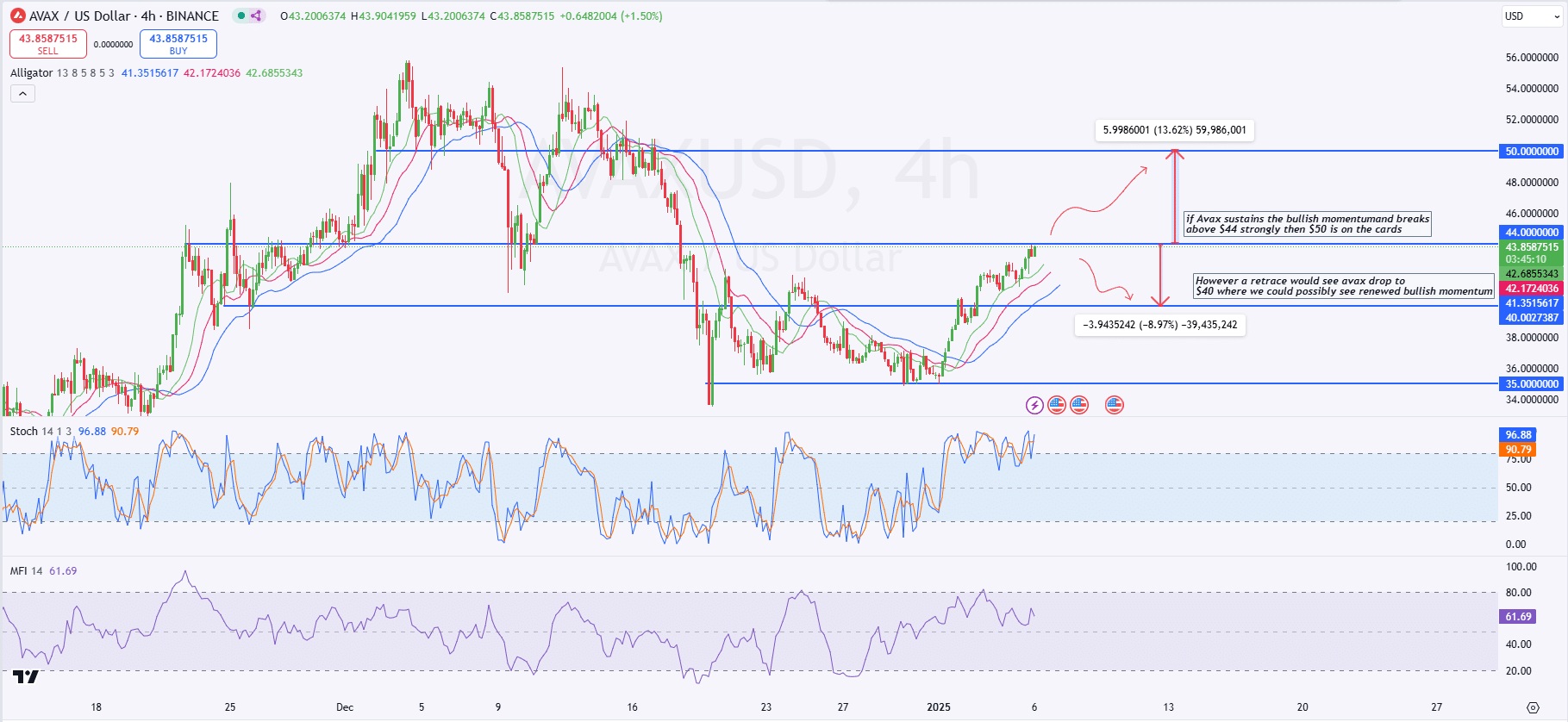

Avalanche was trading near the $44 level, a key resistance zone that could dictate its next price movement.

If the bullish momentum persists and AVAX breaks decisively above $44, the price may target the psychological resistance at $50, representing a potential 13.62% upside.

However, failure to maintain this level could trigger a retrace toward $40, a critical support level where bullish activity may renew.

The Alligator indicator showed a wide divergence among the moving averages, signaling strong upward momentum.

The Stochastic RSI is overbought at 96.88, suggesting that a short-term cooldown might occur.

Meanwhile, the Money Flow Index (MFI) stood at 61.69, indicating moderate buying pressure but leaving room for further accumulation if bullish sentiment strengthens.

AVAX holder sentiment

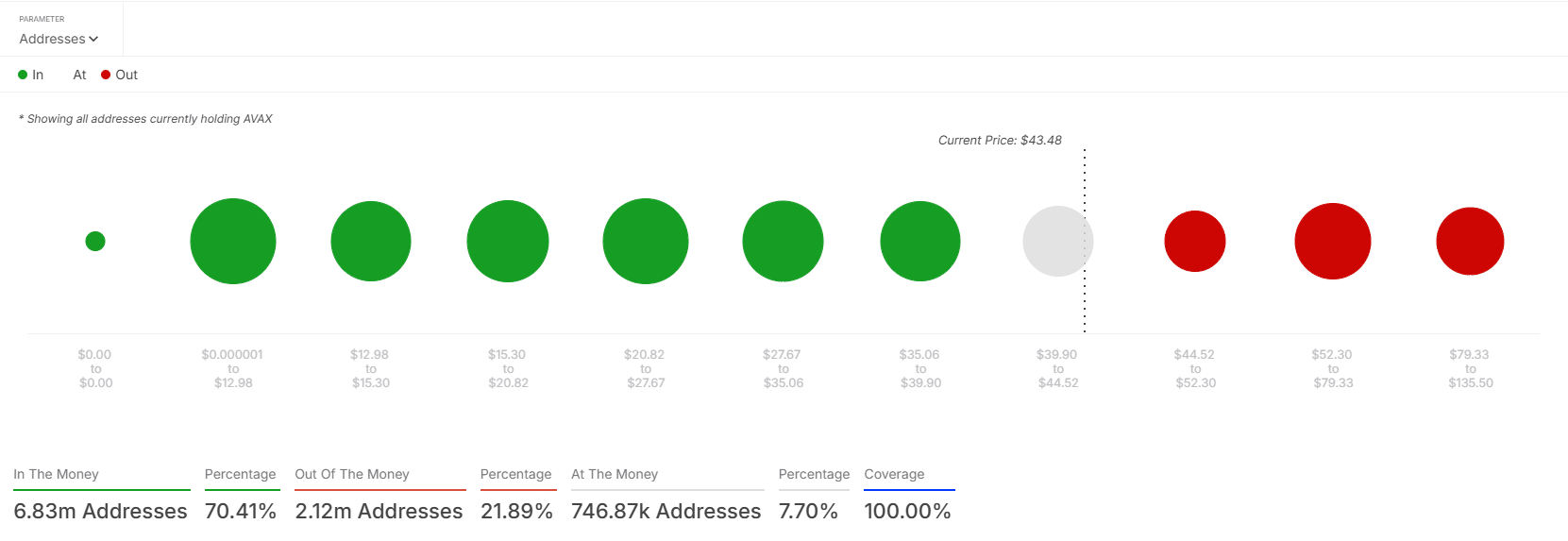

Avalanche’s holder data from IntotheBolck showed that 70.41% of addresses holding AVAX were profitable at press time, with the acquisition cost below $43.48.

Approximately 21.89% of addresses were out of the money, holding tokens at prices above the current level. Meanwhile, 7.70% of addresses were at the money, indicating a balanced position at the current price.

Read Avalanche’s [AVAX] Price Prediction 2025–2026

Clusters of profitable holders accumulated AVAX between $12.98 and $27.67, marking this as a significant historical buying zone.

As AVAX closes in on $44 resistance, potential selling pressure may emerge from holders seeking to exit at break-even levels.