$2.27 Billion in Bitcoin and Ethereum Options Set to Expire: Price Impact

01/10/2025 13:29

Bitcoin and Ethereum options worth $2.27 billion expire today, driving volatility. Learn impact of max pain levels and falling demand.

The crypto market is set to see $2.27 billion in Bitcoin and Ethereum options expire today, a development that could trigger short-term price volatility and impact traders’ profitability.

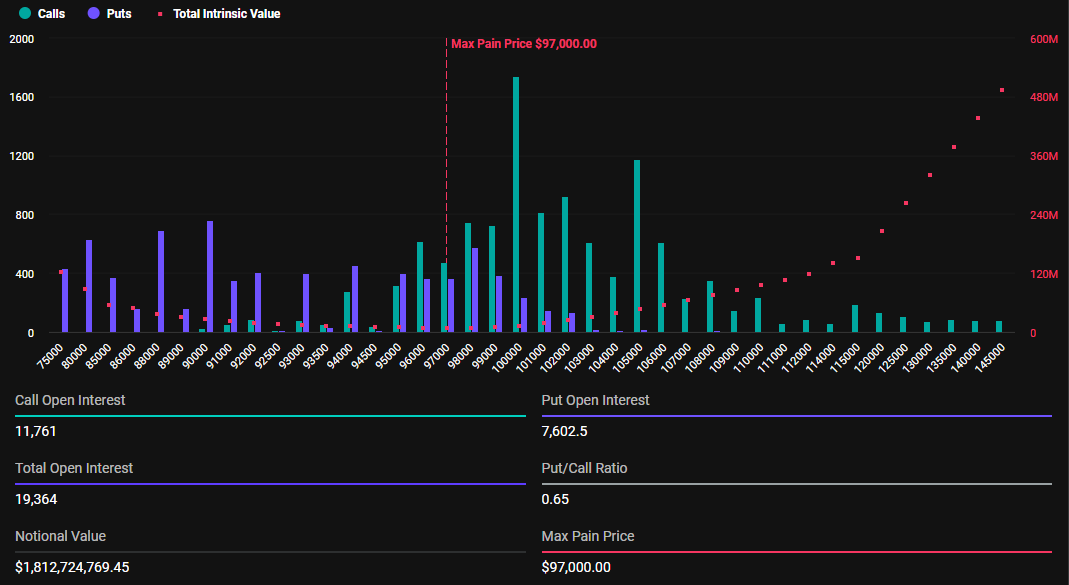

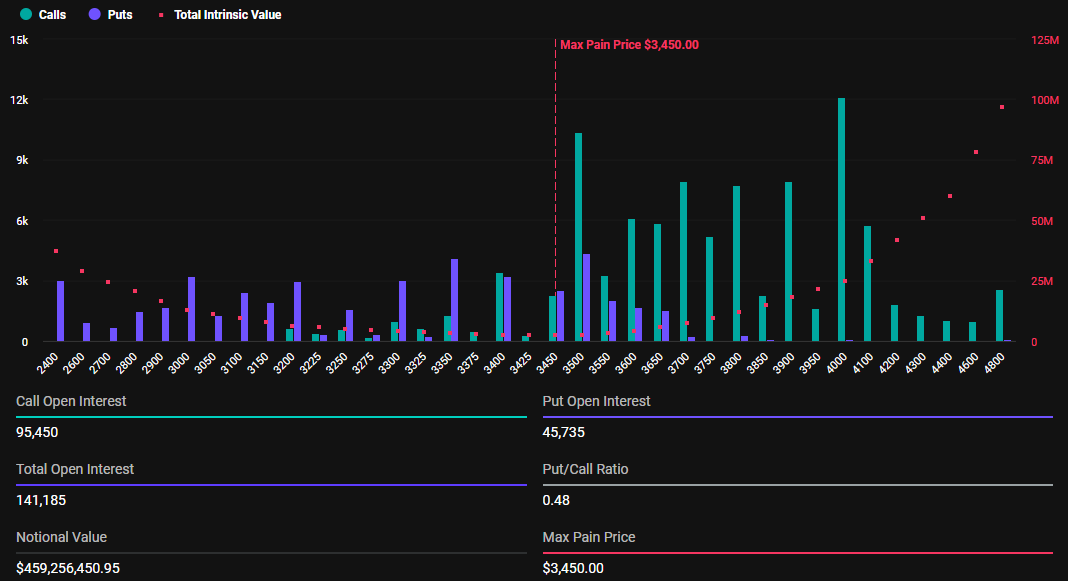

Of this total, Bitcoin (BTC) options account for $1.81 billion, while Ethereum (ETH) options represent $459 million.

Bitcoin and Ethereum Holders Brace For Volatility

According to data on Deribit, 19,364 Bitcoin options will expire today, slightly lower than the year’s opener, where 19,885 BTC contracts went bust last week. The options contracts due for expiry today have a put-to-call ratio of 0.65 and a maximum pain point of $97,000.

The put-to-call ratio indicates a generally bullish sentiment despite the pioneer crypto’s ongoing descent away from the $100,000 mark.

141,185 Ethereum options will also expire today, down from 205,724 in the first week of 2025. With a put-to-call ratio of 0.48 and a max pain point of $3,450, the expirations could influence ETH’s short-term price movement.

As the options contracts near expiration at 8:00 UTC today, Bitcoin and Ethereum prices are expected to approach their respective maximum pain points. According to BeInCrypto data, BTC was trading for $93,792 as of this writing, whereas ETH was exchanging hands for $3,258.

This suggests that prices might rise as smart money aims to move them toward the “max pain” level. According to the Max Pain theory, options prices tend to gravitate toward strike prices where the highest number of contracts, both calls and puts, expire worthless.

Price pressure on BTC and ETH is likely to ease after 08:00 UTC on Friday when Deribit settles the contracts. However, the sheer scale of these expirations could still fuel heightened volatility in the crypto markets.

“Is it a breakout or another consolidation,” Deribit posed in a post on X (Twitter).

Meanwhile, analysts remain divided about the next directional bias for Bitcoin’s price. While some hope for further upside, others bet on downside if the support around $92,000 breaks. Elsewhere, Glassnode indicates a weakening of short-term demand momentum in the market.

“Bitcoin short-term demand momentum has continued to weaken. One key indicator: Hot Capital (capital revived over the last 7 days) has plunged 66.7% from its December 12 peak of $96.2 billion to $32.0 billion,” Glassnode wrote.

The hot capital metric often gauges short-term trading activity and liquidity. The decline implies a steep drop in speculative activity. Traders who were previously active in moving Bitcoin have pulled back, indicating waning confidence or interest in short-term trading opportunities. With less capital circulating actively, Bitcoin’s overall liquidity may be diminishing.

This makes it more challenging for large trades to occur without impacting prices, potentially leading to increased volatility. A plunge of this magnitude, from $96.2 billion to $32 billion, could reflect broader bearish sentiment. Factors like macroeconomic uncertainty, tightening monetary policies, or even regulatory developments could be causing short-term traders to retreat.

The drop in hot capital could indicate traders moving to the sidelines, waiting for clearer market direction. This lower demand momentum may weigh on Bitcoin’s ability to sustain or rally from current price levels. Without fresh capital or increased activity, downward price pressure could intensify.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.