Can AAVE avoid dropping to $203? – Analyst predicts…

01/11/2025 20:00

AAVE has declined over the past month by 20.52%. An analyst is predicting a potential decline to $203 amidst increased selling

- AAVE has declined over the past month by 20.52%.

- An analyst predicted a potential decline to $203 amidst increased selling.

Since hitting $361 a week ago, Aave [AAVE] has struggled to maintain an upward momentum. Over this period, the altcoin has dropped to hit a low of $272.

At the time of writing, AAVE was trading at $282, marking a 2.61% decline on daily charts. The altcoin has also declined on weekly and monthly charts, dropping by 17.17% and 20.52% respectively.

The recent market conditions have left analysts pessimistic, predicting a further dip. Popular crypto market analyst Ali Martinez has suggested a potential dip to $203, citing a sell signal.

Market sentiment

In his analysis, Martinez observed that the TD Sequential Indicator has signaled a sell on the AAVE on weekly charts.

According to him, this signal is pointing to a potential dip to $264 and even $203 to the lower downside. When the TD sequential indicates sell, it suggests that the upward trend is exhausted and a downward decline is a possibility.

Therefore, if sellers enter the market, we could see a downward pressure strengthen resulting in further decline.

What AAVE’s charts suggest

While the analysis above offers a cautionary tale to holders, it’s essential to check other market indicators.

AAVE’s Relative Strength Index (RSI) has dropped to 41, with a sustained decline since the bearish crossover. This confirms strong selling pressure, with sellers dominating the market.

Equally, the Advance Decline Ratio (ADR) has declined to hit a monthly low of 0.31. When ADR drops below 1, it suggests that AAVE is making more losses than gains.

With the altcoin closing with lower lows, this reflects strong downward pressure.

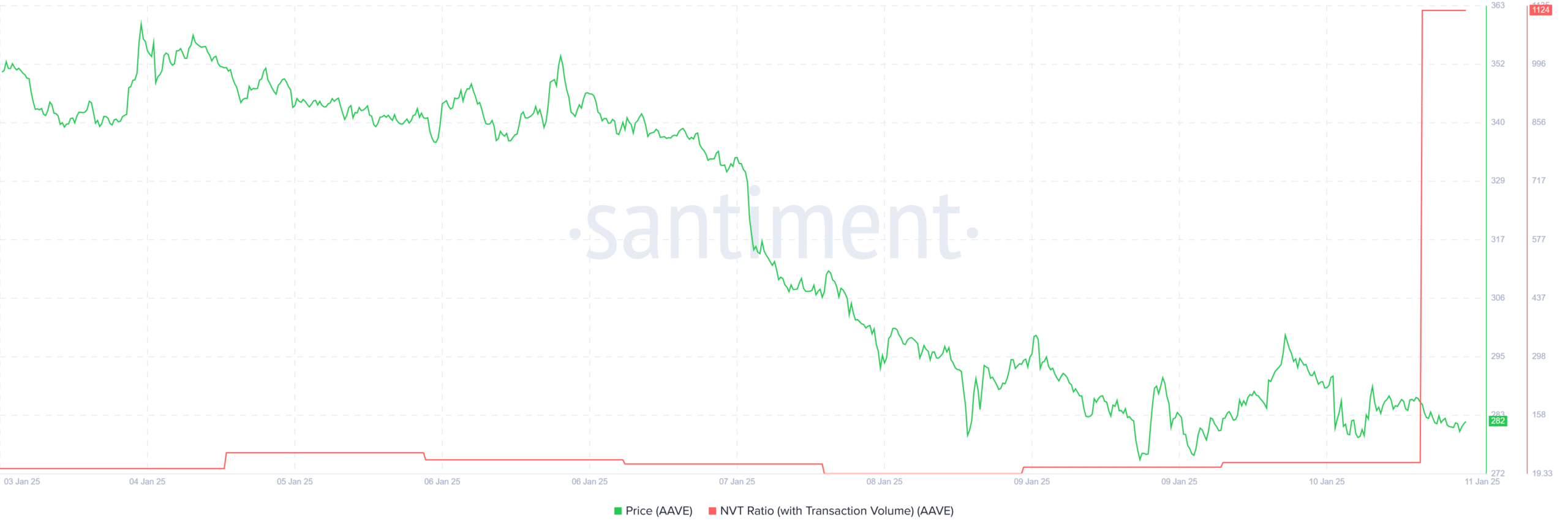

Looking further, AAVE has experienced a strong decline in network activity, as reflected by a surging NVT Ratio. This has spiked to 1124 indicating that the altcoin’s market cap is high relative to transaction activity.

This indicates that the altcoin is overvalued relative to its usage.

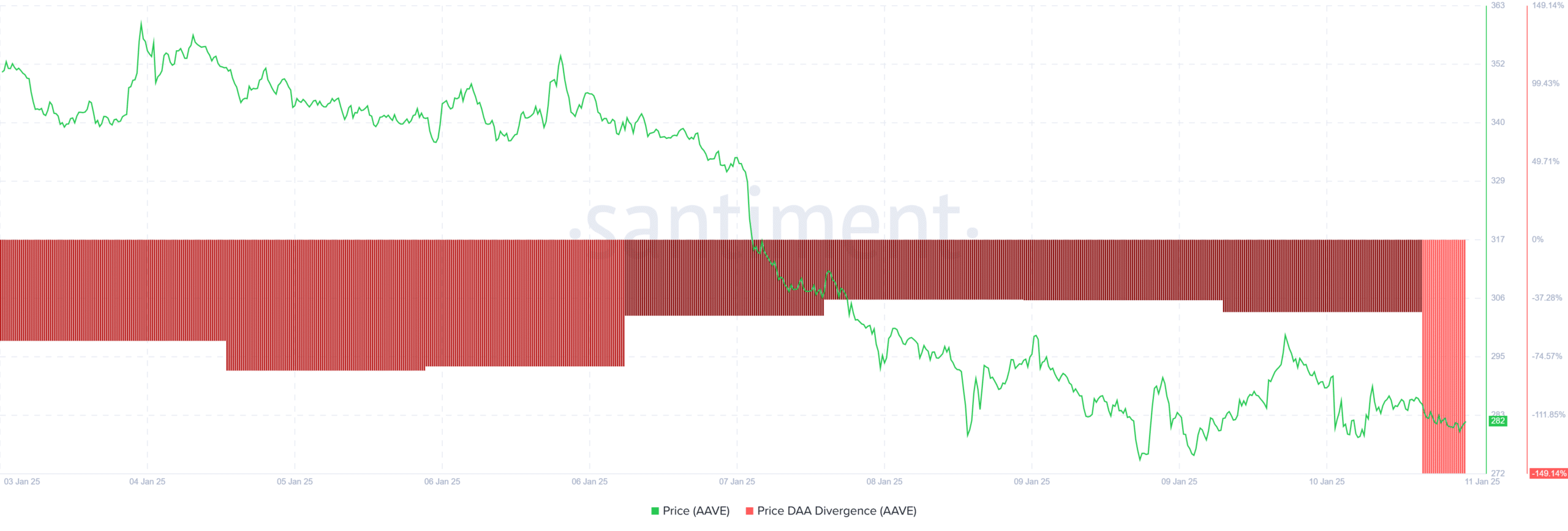

This phenomenon is further confirmed by a negative price DAA Divergence. When this remains negative for a long time, it reflects declining network usage and signals a potential correction to meet the actual demand.

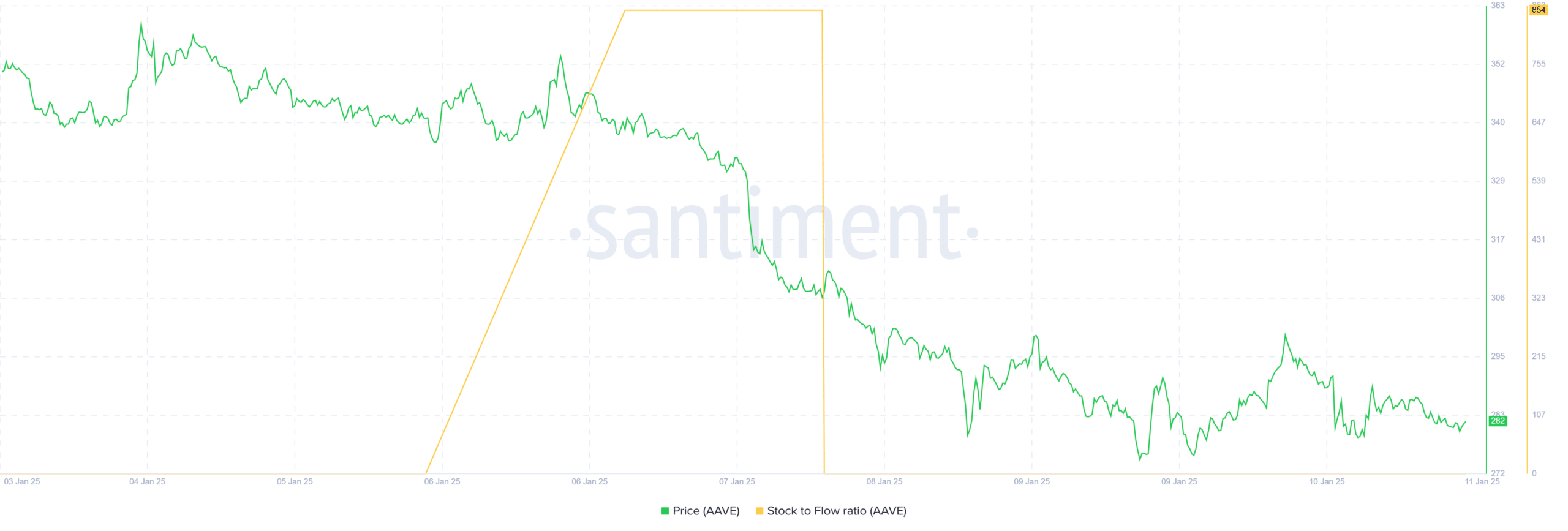

Finally, AAVE has become oversupplied, suggesting increased inflow into exchanges. As such, stock to flow ratio has dipped to zero and has remained so for the last three days.

With the altcoin showing oversupply, it could decline as a result of excessive selling pressure.

Read Aave’s [AAVE] Price Prediction 2025–2026

Simply put, AAVE is experiencing strong downward momentum as sellers dominate the market.

These conditions position the altcoin for further decline. If sellers continue to dominate, AAVE could drop to $272, with a further dip to $246. However, a trend reversal could see the altcoin reclaim $300 levels.