How MOVE’s recovery prospects may be at risk thanks to selling pressure

01/13/2025 08:00

Movement token was trading near the range lows at $0.8, and the 30-day realized cap metric could signal the next uptrend...

- Movement token has a bearish technical bias in the short-term, faces sell-pressure at $1

- On-chain metrics suggested bulls can be hopeful of a recovery

Movement [MOVE] saw a 5% hike in Open Interest in the 24 hours before press time. This was accompanied by a 3.3% price gain. During this time, Bitcoin [BTC] gained by 0.04%, with its OI dropping by 0.09% too.

Despite the bearishness of Bitcoin, however, the realized cap and supply distribution metrics revealed that MOVE might be gearing up for a recovery.

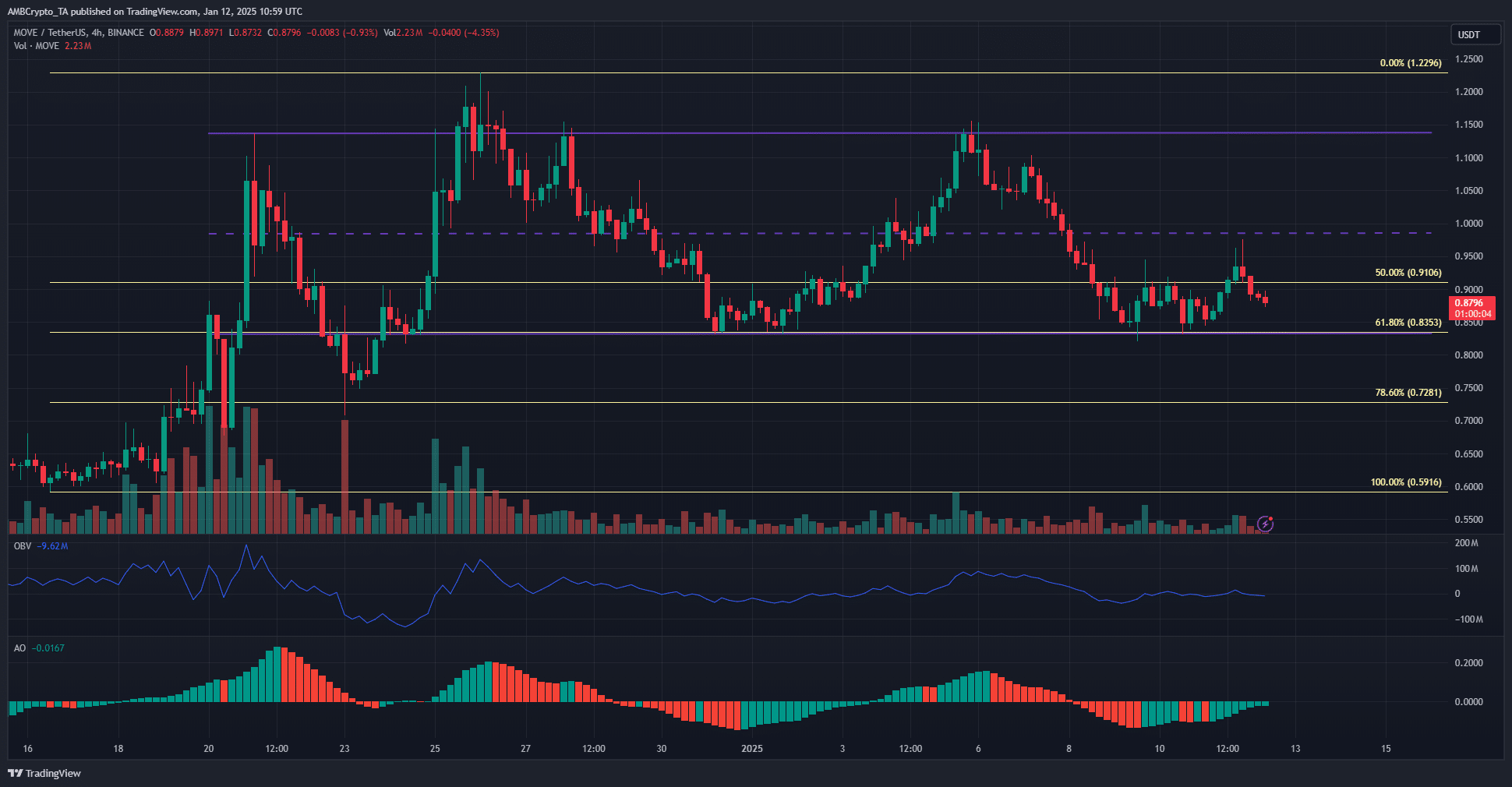

MOVE range formation outlines crucial support and resistance levels

Over the past month, Movement token has traded within a range. It climbed from $0.83 to $1.13, with the mid-range level at $0.98. Over the last five days, the mid-range level has opposed bullish efforts at recovery. It also lined up with the psychological $1-level, making it a harder challenge for the buyers to overcome.

The $0.8-$0.83 area is a support zone. The OBV has not formed new lows over the past two weeks – An encouraging sight. The selling volume was not overwhelming either. The Awesome Oscillator showed bearish momentum was the norm in recent days, but it seemed to be on the verge of forming a bullish crossover too.

Meanwhile, data from Coinalyze highlighted strong short-term bearish sentiment.

The Open Interest has been trending lower alongside the spot CVD. The 5% gains over the last 24 hours were too little to counteract the prevalent selling sentiment.

Short-term realized cap underlines distribution trends

The NVT ratio saw a sharp uptick recently. This indicated potential overvaluation of the token, relative to its transaction volume. The 30-day MVRV ratio was at -4%, highlighting that MOVE holders were at a minor loss.

The realized cap across the 30-day window saw a steep fall last week, alongside its dwindling price. Since the realized cap calculates the value of an asset based on the price at which each token was last moved, this meant participants were moving the token at lower prices.

Finally, supply distribution analysis showed that apart from the wallets holding 100k-1 million MOVE, most other market participants were buying more. This whale cohort is arguably among the most important holders. Despite the downtick over the past week, their numbers were still higher than it was before Christmas.

Read Movement’s [MOVE] Price Prediction 2025-26

Overall, the short-term bias was bearish, and the OI change was not enough for MOVE’s recovery. Thus, traders can keep an eye on the realized cap metric.

A sudden spike would be a buy signal. Meanwhile, steady accumulation from some cohorts of holders also implied conviction.