Can Ethereum’s HODLers save ETH from dipping to $3,169?

01/13/2025 17:00

Ethereum’ rebound is now more dependent on the overall market recovery than ever before. So, tread carefully!

![Ethereum [ETH]](https://ambcrypto.com/wp-content/uploads/2025/01/Ritika-1-6-1200x675.webp)

- Ethereum has plunged 12% this week, mirroring the broader struggle as altcoins face double-digit losses.

- Its recovery now hinges more than ever on a wider market rebound.

Ethereum[ETH] has lost over half of its post-election gains and is now caught in a high-stakes tug-of-war.

With Bitcoin’s consolidation holding back any major breakout, investors are playing it safe. So, given the current landscape, is it time to exercise caution or seize the opportunity?

The scale is tipping in favor of…

Traditionally, Bitcoin’s[BTC] stagnation signaled the start of an altcoin season – but not this time. Altcoins are struggling to gain traction, with 70% of the top 10 high-caps (excluding stablecoins) suffering double-digit losses in just a week.

Ethereum hasn’t escaped the downturn either, with a 12% weekly drop, partly due to strong U.S. economic data. The ETH/BTC pair is hitting daily lows, making ETH’s rebound look tied to a broader market recovery.

But the pressure doesn’t stop there. Whales are feeling the heat, dumping 10,070 ETH at $3,280, locking in a $1M loss. As a result, ETH was down by 1.15%, sitting at $3,227, at press time. However, the stakes are higher than ever.

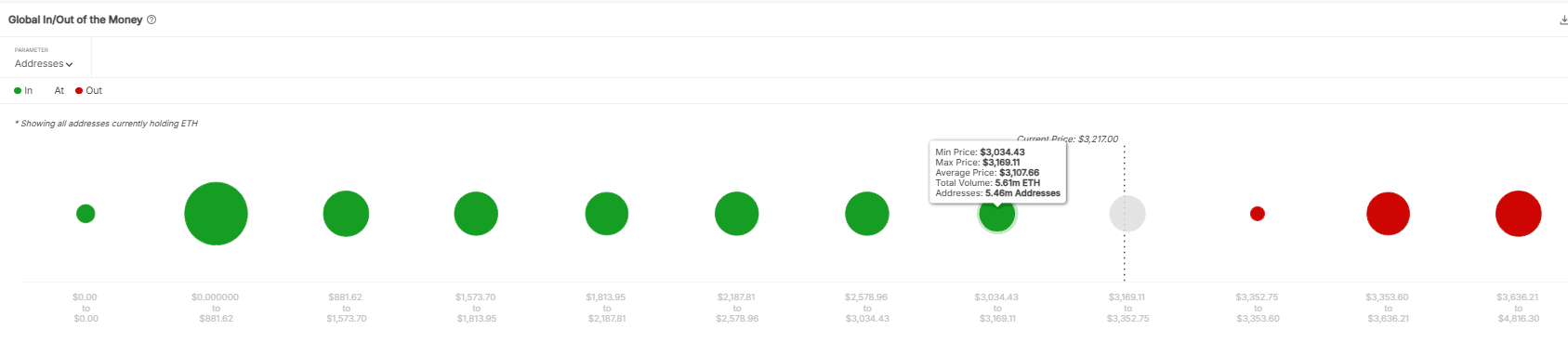

If capitulation continues, ETH could dip to $3,169. At this level, 5.46 million addresses, holding 5.61 million ETH, were bought at that price.

What these HODLers do next will be crucial to ETH’s next move. It’s a high-stakes gamble: HODL and wait for a market rebound, or cash out before another crash hits.

Will Ethereum whales take the risk?

The decision involves a blend of psychology and data. Statistically, ETH is still 33% above its post-election levels, a price point that has served as strong support in the past.

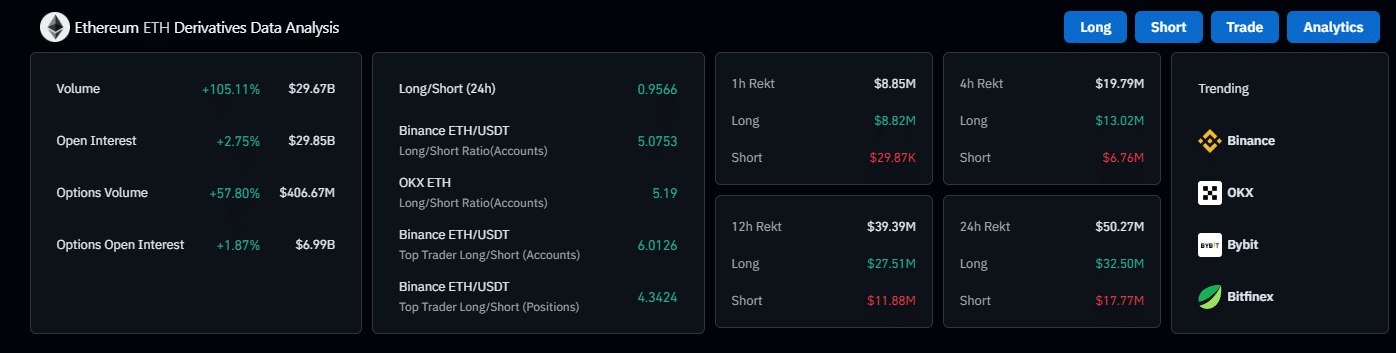

Additionally, futures markets are buzzing, with derivative volume soaring by 105% and Open Interest (OI) climbing by 2%.

But there’s more at play – investors are banking on a repeat of the Q4 cycle, hoping for another ‘Trump pump.’ No doubt, the psychological momentum is there, but will it be enough? According to AMBCrypto, a clear ‘Yes’ is still far off.

Read Ethereum’s [ETH] Price Prediction 2025–2026

Why the uncertainty? Major players are losing confidence, which could deplete the FOMO, fueling the current market optimism. Retail and institutional capital has yet to flow back in, and fear is high.

Unlike the last Trump rally, which sent Ethereum soaring to $4K, a similar reaction this time feels increasingly unlikely. Even with the Trump pump, it might not be enough to spark a strong recovery for Ethereum.

In short, caution is crucial right now. Ethereum’s recovery is tightly tied to the broader market rebound. The optimism surrounding the potential for a Trump pump is tempting, but it’s crucial not to get swept away by the “hype.”