VIRTUAL Falls 15% in 24 Hours, Testing $2.23 Key Support

01/14/2025 05:30

VIRTUAL price drops 43% in seven days, hitting oversold levels. Key support at $2.23 could lead to recovery or a further 48% decline.

VIRTUAL price is the top loser among major altcoins in the last 24 hours, falling 15% and extending its seven-day decline to 43%. This sharp drop has brought its market cap down to approximately $1.5 billion, as almost all big AI coins face strong corrections in the last week.

Key indicators like RSI and BBTrend highlight oversold conditions, signaling the potential for a recovery, though bearish momentum remains strong. With VIRTUAL hovering near critical support at $2.23, its next move could determine whether it rebounds or risks a further drop to $1.20, marking a potential 48% correction.

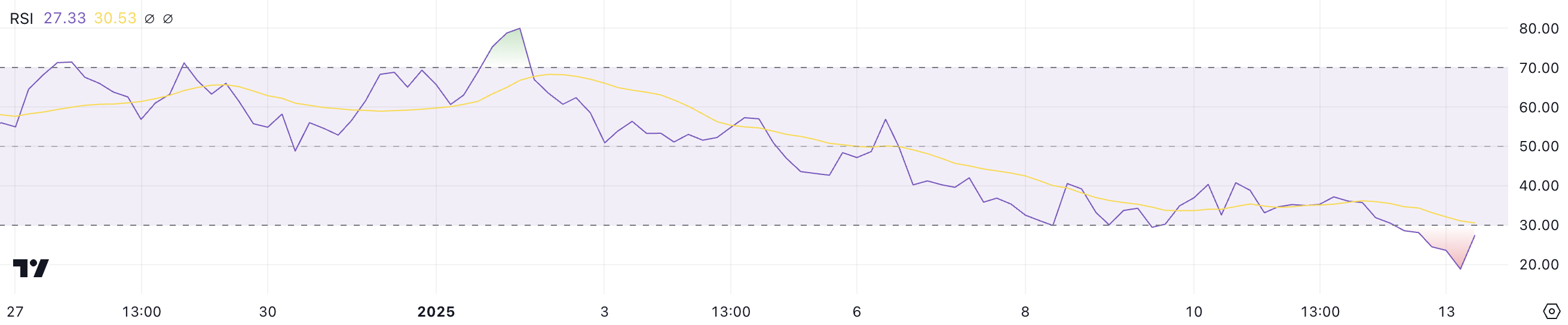

VIRTUAL RSI Hit Its Lowest Levels In 5 Months

VIRTUAL RSI is currently at 27.3, rebounding slightly after hitting a low of 18.7 a few hours ago. These levels mark the lowest RSI readings for VIRTUAL since August 2024, signaling significant oversold conditions. The RSI (Relative Strength Index) is a momentum oscillator that ranges from 0 to 100 and is commonly used to assess whether an asset is overbought or oversold.

Typically, an RSI below 30 indicates oversold conditions, suggesting the potential for a price rebound, while an RSI above 70 signals overbought conditions, hinting at a possible pullback.

With VIRTUAL’s RSI now at 27.3, it indicates that the asset remains in oversold territory. This could mean a short-term price recovery might be on the horizon, as oversold conditions often attract buyers looking for discounted entry points.

However, if bearish momentum persists, VIRTUAL price could remain under pressure, losing more spots among the biggest artificial intelligence coins.

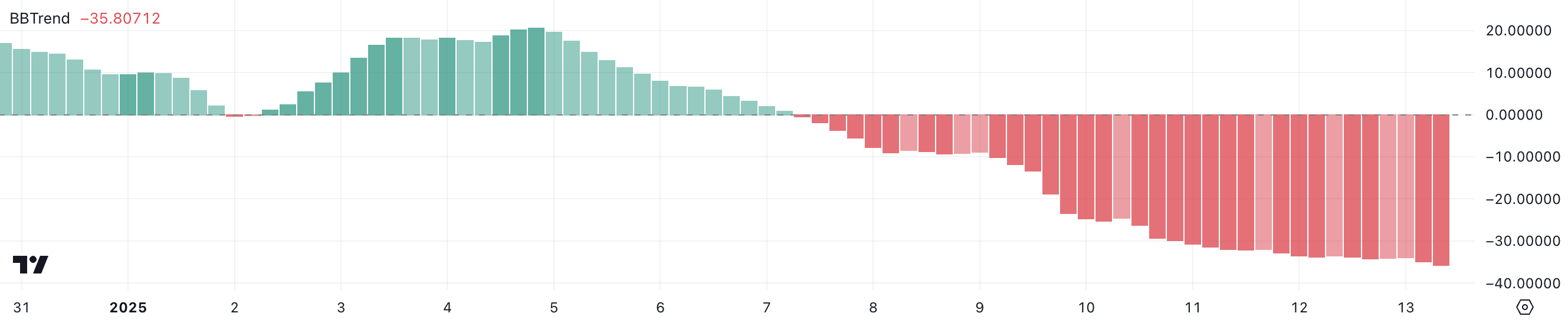

VIRTUAL BBTrend Is Breaking Negative Records

VIRTUAL’s BBTrend is currently at -35.8, marking its lowest level since August 8, 2024. This indicator has remained negative for six consecutive days, reflecting sustained bearish pressure. The BBTrend (Bollinger Band Trend) is a measure derived from Bollinger Bands, used to gauge market trends and momentum.

Positive values typically indicate bullish conditions with upward price momentum, while negative values suggest bearish conditions and downward pressure.

With VIRTUAL’s BBTrend at -35.8, the indicator signals a strong bearish trend and heightened selling pressure. Such low levels often indicate that the asset is deeply oversold, potentially setting the stage for a price stabilization or recovery if buying interest increases.

However, if the BBTrend remains negative and continues to decline, it could signal further downside for VIRTUAL, especially if broader market conditions remain unfavorable.

VIRTUAL Price Prediction: A Further 48% Decline?

VIRTUAL’s EMA lines recently formed a death cross, a bearish technical signal where the short-term moving average crosses below the long-term one.

This suggests increased downward momentum, with the VIRTUAL price now resting on a fundamental support level at $2.23. If this support fails, the price could plummet to $1.20, marking a potential 48% correction from current levels. This would cause the VIRTUAL market cap to lose its $1 billion market cap threshold, distancing the coin from other AI cryptos like RENDER and TAO.

On the other hand, if market sentiment around crypto AI agents improves and VIRTUAL price establishes an uptrend, the price could rebound and test the $2.81 resistance level.

Breaking through this resistance might allow VIRTUAL price to regain momentum and climb back toward $3.27, signaling a recovery from its recent bearish performance.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.