With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

JPMorgan predicts $15B in inflows for potential Solana and XRP ETFs, despite SEC rejections and regulatory hurdles.

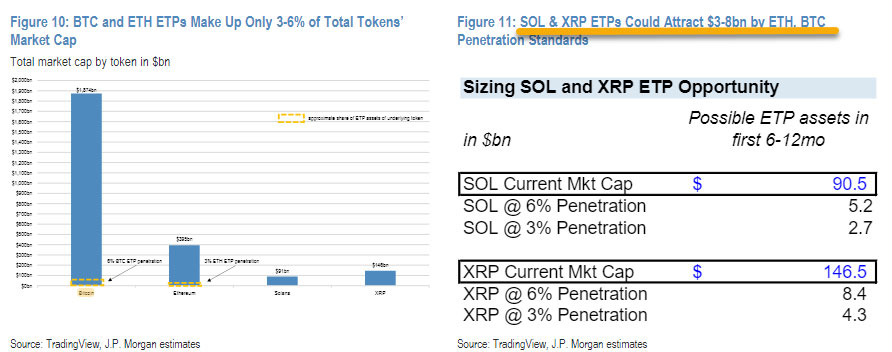

JPMorgan forecasts that exchange-traded products (ETPs) linked to XRP and Solana (SOL) may attract over $15 billion in net inflows. Observations of adoption patterns in Bitcoin BTC $96 142 24h volatility: 6.1% Market cap: $1.90 T Vol. 24h: $60.69 B and Ethereum ETH $3 187 24h volatility: 4.3% Market cap: $383.98 B Vol. 24h: $35.11 B ETPs support this projection, showcasing notable growth in asset accumulation.

Matthew Sigel, head of digital assets research at VanEck, highlighted that Bitcoin ETPs amassed $108 billion in assets within their first year, representing 6% of BTC’s $1.8 trillion market cap. Similarly, Ethereum ETPs achieved a 3% penetration rate, securing $12 billion in assets in six months. Based on similar growth metrics, XRP could gain $4 billion to $8 billion, while Solana might attract $3 billion to $6 billion.

Photo: Matthew Sigel

CoinShares reveals strong assets under management (AUM) for Solana and XRP ETPs. Solana-linked products currently manage $1.6 billion, and XRP-related ETPs handle $910 million. Notably, net inflows for 2024 show continued growth, with SOL and XRP ETPs receiving $438 million and $69 million, respectively.

Regulatory challenges continue to hinder progress despite promising market indicators. The US Securities and Exchange Commission (SEC) recently rejected proposals for exchange-traded funds (ETFs) tied to Solana. Ripple Labs remains embroiled in a legal dispute over whether XRP qualifies as a security.

Bloomberg analysts James Seyffart and Eric Balchunas suggested that ETFs linked to Litecoin LTC $99.14 24h volatility: 4.9% Market cap: $7.47 B Vol. 24h: $550.98 M and Hedera HBAR $0.28 24h volatility: 8.0% Market cap: $10.79 B Vol. 24h: $441.97 M are more likely to be approved.

Approval odds for XRP or Solana-based ETFs appear slim in the near term. However, analysts foresee potential regulatory shifts under a new administration. Seyffart and Balchunas speculated on the possibility of a more favorable approach toward ETF approvals under a Trump-led government.

Despite regulatory resistance, market sentiment has shown remarkable resilience. Solana’s price rose by 5.40% to $188 following JPMorgan’s forecast, accompanied by an over 150% spike in trading volume over 24 hours. Similarly, XRP XRP $2.56 24h volatility: 8.3% Market cap: $147.25 B Vol. 24h: $8.17 B climbed over 7% to $2.60, with trading volume increasing by 50% within the same period.

ETFs linked to Bitcoin and Ethereum have significantly influenced the market. BlackRock leads with $37.6 billion in Bitcoin ETF inflows and $3.6 billion in Ethereum ETF inflows. Historical trends highlight strong demand for regulated cryptocurrency products, with Bitcoin ETFs amassing $35.9 billion in cumulative inflows and Ethereum ETFs gathering $2.4 billion.

However, the journey hasn’t been without hiccups. On January 13, Bitcoin ETFs saw an outflow of $284.1 million, while Ethereum ETFs lost $39.4 million, marking three straight days of negative flows. These fluctuations underscore the market’s volatility and the delicate balance between optimism and caution.

Matthew Sigel described the potential XRP and SOL ETFs as “game changers” on social media, echoing growing sentiment about the transformative impact of such products. Although uncertainty looms over regulatory approvals, the broader vision of accessible and regulated crypto investments continues to drive market interest.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Bitcoin ETF News, Solana (SOL) News, Cryptocurrency News, News

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.