Ethereum’s Price Stagnates Below $3,500, Though a Rebound Could Be Close

01/14/2025 23:00

Ethereum’s price remains below $3,500, but rising leverage ratios and low exchange reserves suggest a potential rebound soon.

Leading altcoin Ethereum (ETH) has traded below $3,500 for seven days, mirroring a broader bearish sentiment across the cryptocurrency market. Since it recorded an intraday high of $3,744 on January 6, the coin’s value has plummeted by 13%.

However, despite this price dip, key on-chain metrics suggest that Ethereum holders remain optimistic about the altcoin’s near-term prospects.

Ethereum Traders Remain Resilient

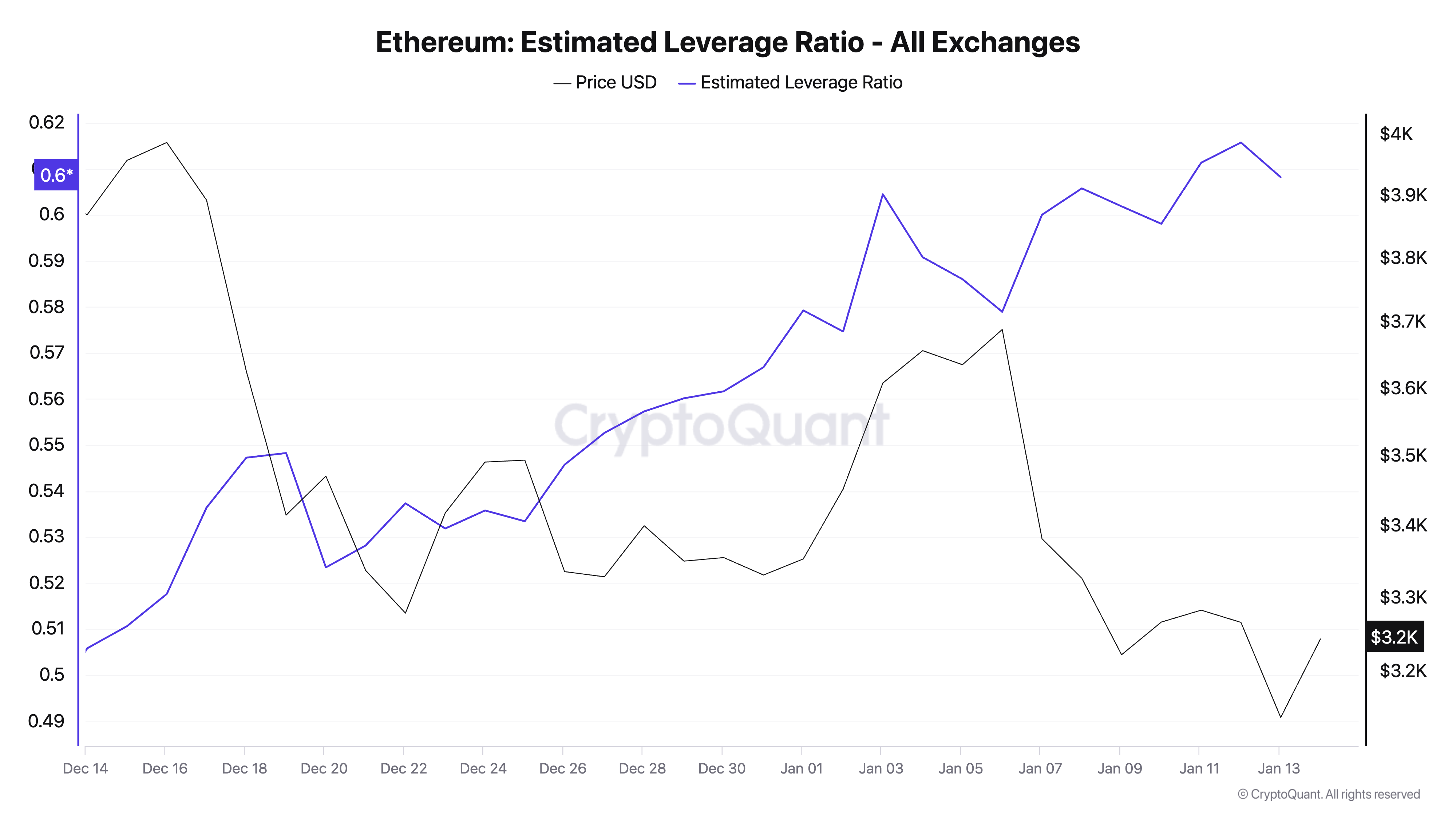

One such indicator is ETH’s rising estimated leverage ratio (ELR). Per CryptoQuant, this metric has maintained an upward trend despite ETH’s price decline in recent weeks. At 0.60 as of press time, ETH’s Estimated Leverage Ratio (ELR) has increased by 20% over the past month, despite a 15% drop in its price during the same period.

The ELR measures the average leverage traders use to execute trades on a cryptocurrency exchange. It is calculated by dividing the asset’s open interest by the exchange’s reserve for that currency.

ETH’s climbing ELR indicates an increased risk appetite among its traders. It suggests that the altcoin’s traders are increasingly willing to take on risk despite its current price weakness. A consistently high leverage ratio is a sign of strong conviction among traders that the price of ETH is poised for a rebound in spite of recent headwinds.

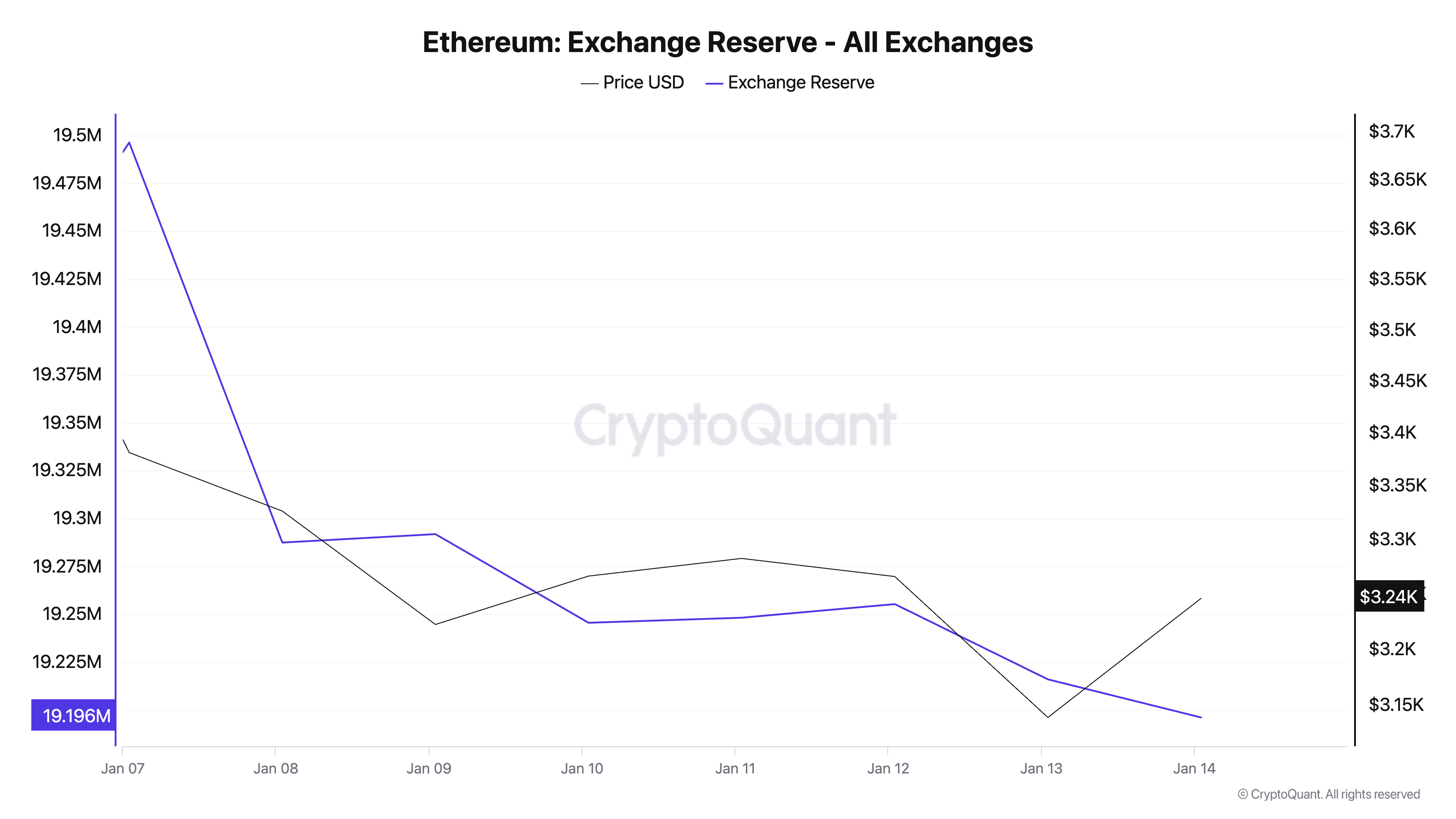

Furthermore, ETH’s exchange reserve has dropped to a two-month low of 19.19 million ETH, with the amount held in exchange wallets decreasing by 2% over the past week. This reduction suggests that market participants are lowering selling pressure and choosing to hold onto their ETH tokens.

As a result, it appears that ETH’s recent price decline is more influenced by the broader market’s bearish trends than by significant selloffs of ETH itself.

ETH Price Prediction: All Rests on the Broader Market

As of this writing, ETH trades at $3,226, just above the support level at $3,186. If broader market sentiment improves and ETH accumulation picks up, its price could rise toward $3,563.

However, if the market continues to experience a downturn, ETH may test the $3,186 support. If this level fails to hold, the coin’s value could drop to $2,945.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.