Whales drive AAVE demand: Will it break $300 soon?

01/15/2025 14:00

AAVE is experiencing a demand resurgence after sliding lower last week, suggesting a high probability of a bullish recovery this week,

- AAVE whales have been accumulating in the last two weeks.

- A recap of spot and derivatives demand as the bears cool off.

Aave [AAVE] is off to an exciting week characterized by a resurgence of bullish demand. But even more interesting is that whales have been showing interest in AAVE, which could boost its potential recovery.

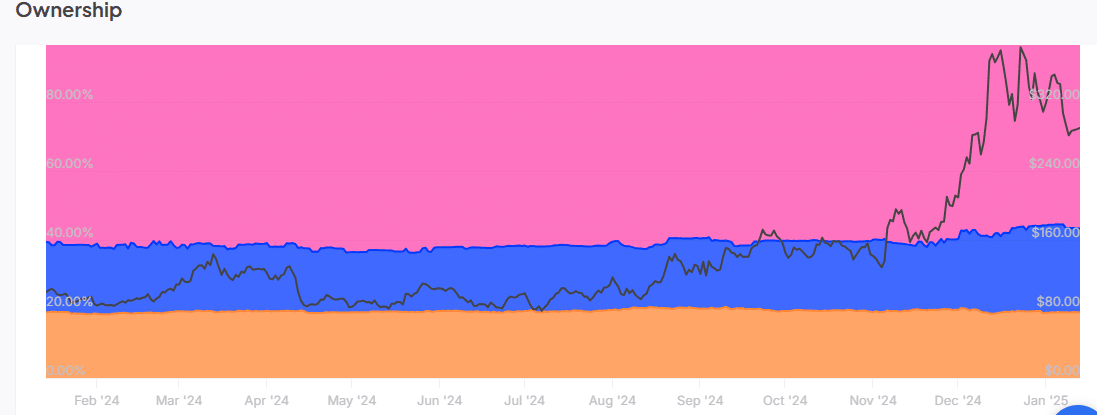

According to historical concentration data, whales have been accumulating the coin since the start of January.

Whales held 8.92 million AAVE tokens as of the 1st of January, which was equivalent to 55.75% of the total supply. That figure has since grown to 9.07 million tokens or 56.69% of the total supply.

Whales currently constitute the highest cohort of AAVE holders, thus having the biggest impact on price. This investor class has trimmed their balances from 4.05 million tokens to 3.88 million tokens during the same period.

Meanwhile, retail holders have also been buying the dip, increasing their balances from 3.03 million to 3.05 million AAVE.

Could whale demand support AAVE recovery?

Whale accumulation is a healthy sign for AAVE bulls. It suggests the price could potentially rally after its latest dip. AAVE bears seem to have run out of steam over the weekend, followed by a demand build-up.

AAVE sold for $290.75 after bouncing back by roughly 13% from its lowest price on the 13th of January. Its money flow indicator has been on an uptrend since the 8th of January, indicating that liquidity is flowing back into the token.

The weekend pivot and bullish momentum in the last two days could indicate that the coin is on the verge of more upside. However, sustained demand is necessary for this to happen.

The latest on-chain stats reveal robust interest after the latest wave of sell pressure bottomed out.

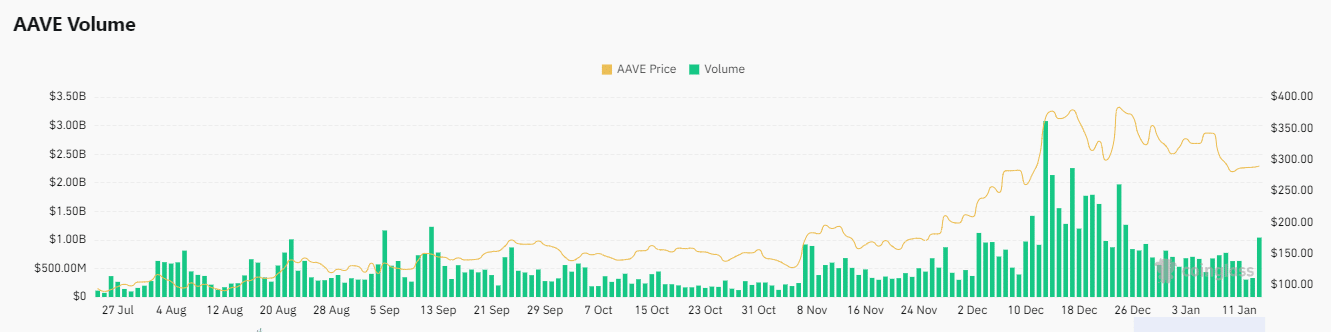

For example, AAVE derivatives volume peaked at $1.04 billion after a 61.05% uptick in the last 24 hours. This was the highest daily volume figure achieved so far this month.

The spike in volumes highlights the level of activity behind the token and its potential recovery. Open Interest peaked at $310.50 million after rallying by 6.95%.

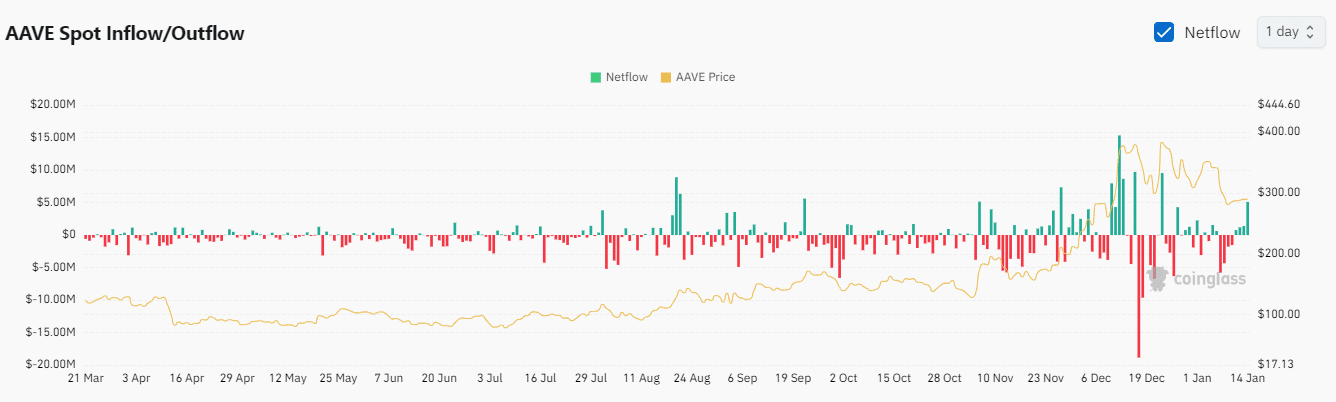

Demand also increased in the spot segment. As noted earlier, the MFI surged since the 7th of January, and spot demand shifted during the same timeline.

Spot outflows declined and turned positive on the 11th of January.

Read Aave’s [AAVE] Price Prediction 2025–2026

The coin’s Spot Inflows peaked at $5.09 million at the time of observation, the highest in the last two weeks.

This confirmed a demand resurgence for AAVE during this period. The real question is whether this demand can continue for more upside in the coming days.