Ethereum Price Poised to Reclaim 15% Losses as Selling Pressure Eases

01/16/2025 02:00

Ethereum shows recovery potential as reduced profit-taking eases selling pressure. Flipping $3,327 support is key to a bullish rebound.

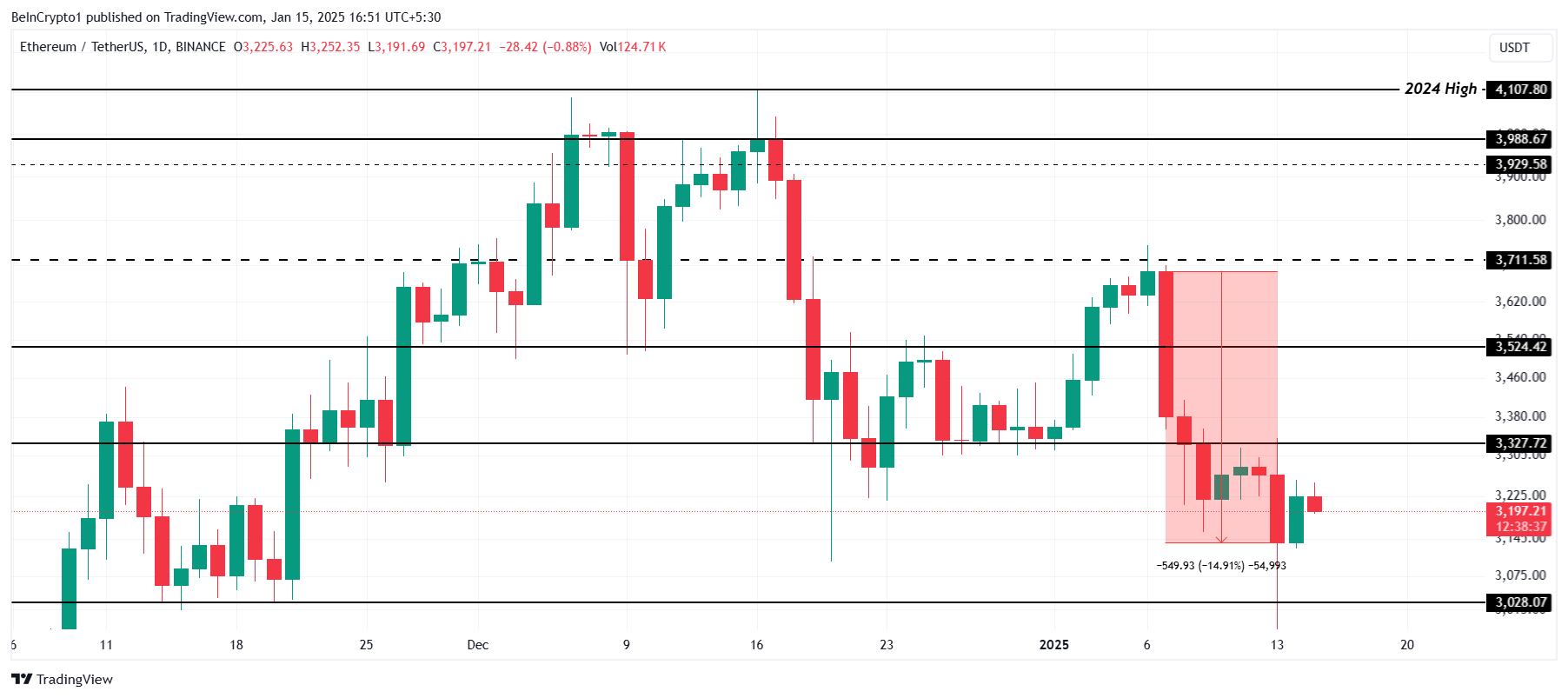

Ethereum (ETH) recently faced a correction that prevented it from breaching the $3,711 barrier, pulling the altcoin king below $3,200.

This 15% decline has triggered reduced activity among ETH investors, a positive sign that could support Ethereum’s recovery.

Ethereum Investors To Hold Back On Selling

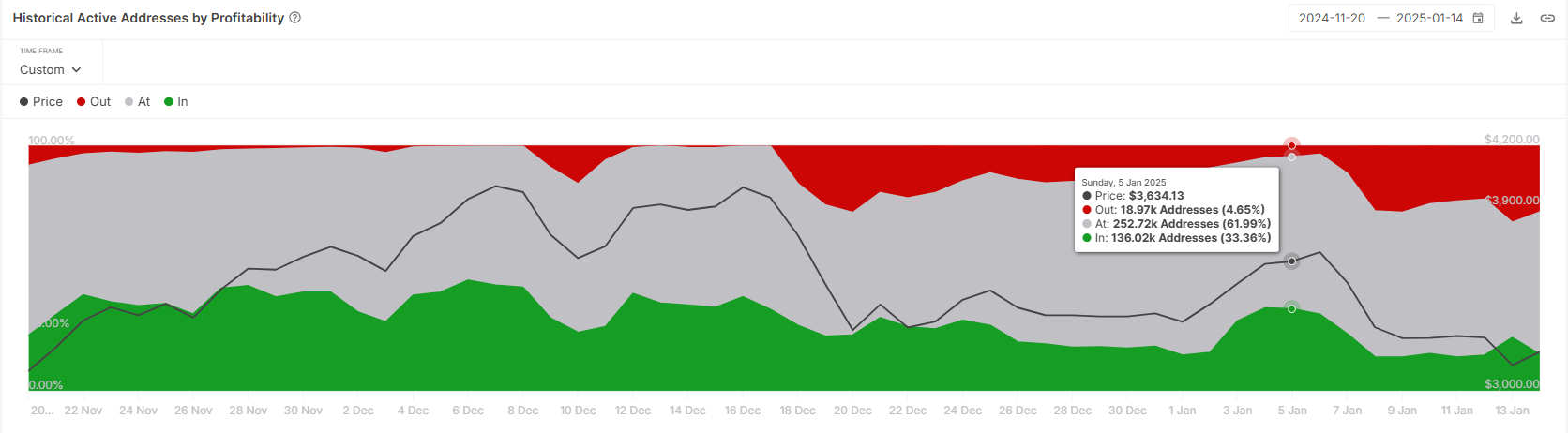

Observing Ethereum’s active addresses by profitability indicates that the concentration of investors in profit has dropped significantly, from 33% to 14%. This decrease is encouraging, as holders in profit are typically more prone to selling, which can pressure the price.

When the concentration of profitable investors falls below 25%, the impact of profit-booking on Ethereum’s price diminishes. This reduced selling tendency may provide the market with the stability needed to foster Ethereum’s price recovery in the near term.

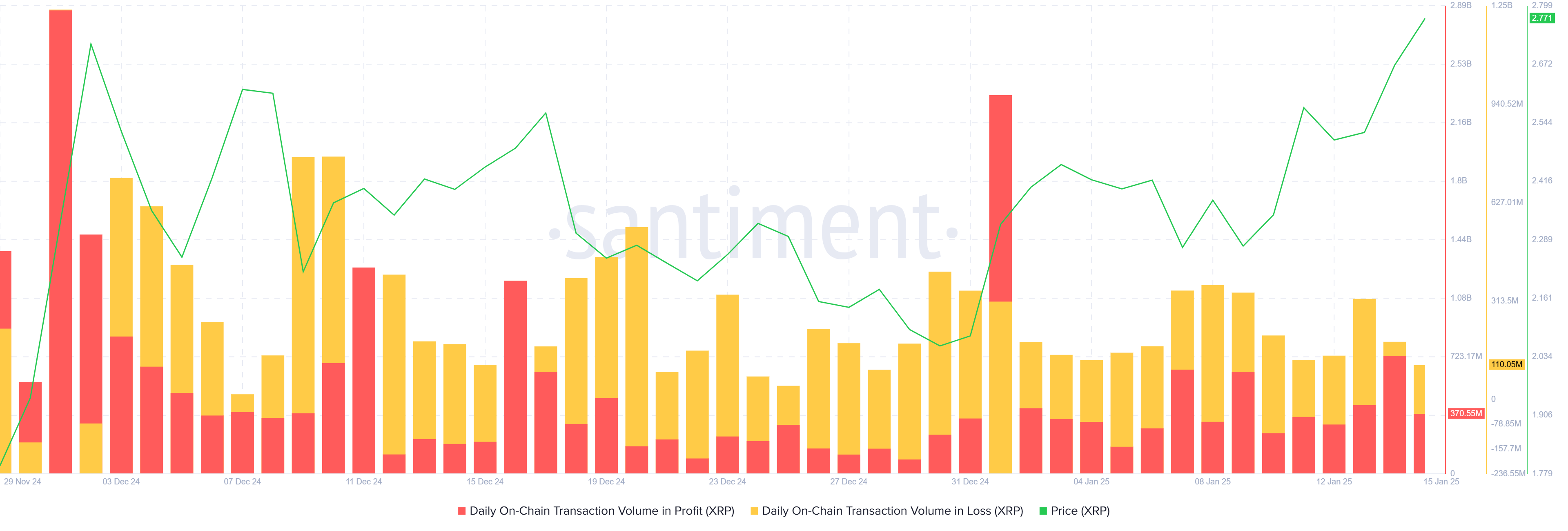

Ethereum’s transaction volume has been dominated by losses over the past month, with January 1 being an exception. The trend suggests that most investors have refrained from moving their ETH around, a signal that many may be opting for HODL during the decline.

The decline in selling activity highlights investor resilience, with fewer ETH tokens entering circulation. This pullback could further stabilize the market, providing Ethereum the support it needs to regain lost ground.

ETH Price Prediction: Finding a Breach

Ethereum’s price dropped by 15% over the last few days, bringing it to $3,197. To recover, ETH must first reclaim the $3,524 support level, which remains its primary target for a bullish rebound.

For this recovery to materialize, Ethereum will need to breach and flip $3,327 into support. Considering the positive cues from market sentiment and reduced selling pressure, ETH appears poised to continue its recovery journey.

However, if Ethereum fails to breach $3,327, it risks falling further to test the $3,028 support level. A drop below this level would invalidate the bullish outlook, extending the losses and raising caution among investors.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.