NewsBriefs - Su Zhu-backed OX.FUN denies insolvency amid allegations and asserts user fund safety

02/24/2025 13:00

OX.FUN, a crypto exchange, contended with allegations of insolvency and fund withdrawal issues. The exchange accused JefeDAO of manipulating...

Editor-curated news, summarized by AI

Su Zhu-backed OX.FUN denies insolvency amid allegations and asserts user fund safety

OX.FUN, a crypto exchange, contended with allegations of insolvency and fund withdrawal issues. The exchange accused JefeDAO of manipulating trades to tarnish its reputation and freezing $1 million USDC of JefeDAO's funds as a result. OX.FUN emphasizes user fund security and adherence to its service terms, despite social media claims of financial instability and urging user withdrawals.

Latest

-

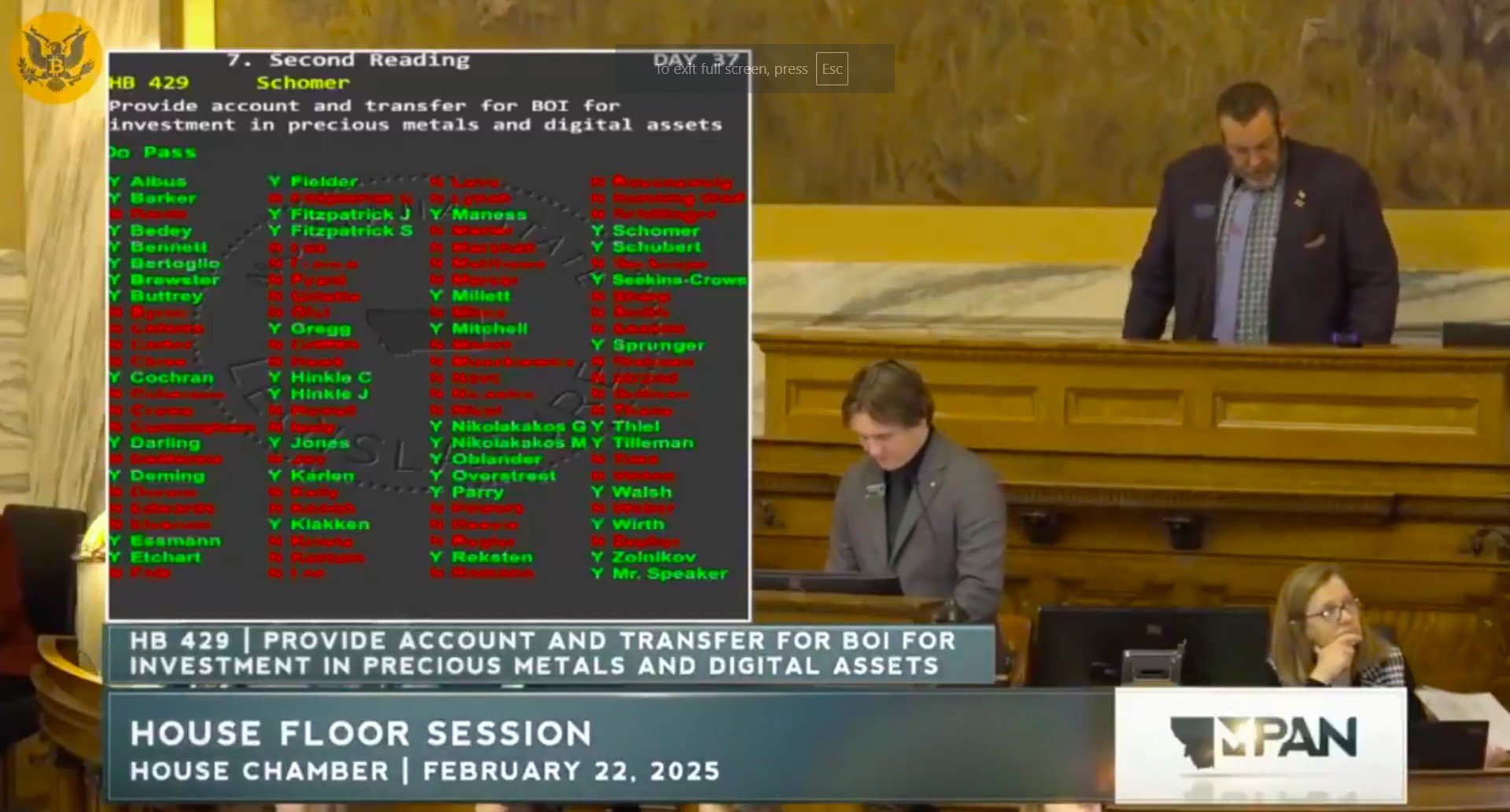

Montana’s Bitcoin reserve bill fails to pass second reading, effectively dead

The Montana House of Representatives failed to pass Bill 429, which aimed to designate Bitcoin as a state reserve asset, with a 41-59 vote. The bill intended to establish a special revenue account for investing in Bitcoin, precious metals, and stablecoins. Lawmakers expressed concerns over the risks associated with crypto investments and disagreed with granting the Montana Investment Council the authority to invest in crypto and NFTs. Despite some support, opposition, citing the speculative nature of the investment, prevailed.

Expand

-

Su Zhu-backed OX.FUN denies insolvency amid allegations and asserts user fund safety

OX.FUN, a crypto exchange, contended with allegations of insolvency and fund withdrawal issues. The exchange accused JefeDAO of manipulating trades to tarnish its reputation and freezing $1 million USDC of JefeDAO's funds as a result. OX.FUN emphasizes user fund security and adherence to its service terms, despite social media claims of financial instability and urging user withdrawals.

Expand

-

Bybit hack funds laundered through meme coins on PumpFun

Cryptocurrency detective ZachXBT uncovered that in the recent Bybit hack, stolen Ethereum was laundered through memecoins on the decentralized platform PumpFun. The thief notably launched a memecoin named QinShihuang, generating over $26 million in trading volume. The stolen funds traversed various blockchain networks, resulting in complex laundering paths using multiple wallets and currencies across platforms like Solana and Binance Smart Chain.

Expand

-

Bybit announces 10% recovery bounty for $1.4 billion crypto hack funds

Following the record-breaking $1.4 billion crypto exchange hack, Bybit has launched a recovery bounty program offering 10% of retrieved funds to contributors. Security firms and researchers are encouraged to assist in reclaiming assets stolen by the Lazarus Group, with potential rewards totaling up to $140 million, marking the largest bounty in crypto history. Bybit aims to enhance its security, liquidity, and community trust through this initiative.

Expand

-

Franklin Templeton launches Bitcoin and Ether index ETF EZPZ

Franklin Templeton has launched a new exchange-traded fund (ETF) called EZPZ, which holds Bitcoin and Ether based on the US CF Institutional Digital Asset Index. The ETF, which constitutes approximately 87% Bitcoin and 13% Ether, aims to expand by including more cryptocurrencies as they become eligible. This initiative provides US investors with direct exposure to these major cryptocurrencies without the need to purchase them individually.

Expand

-

AR.IO launches mainnet and token generation event, aiming to revolutionize permanent cloud storage

AR.IO, an Arweave-based network, launched its mainnet and token generation event, introducing a 'permanent cloud' storage model. The network offers immutable and provable data storage without recurring fees, positioning itself as a competitor to traditional cloud services like Google Cloud and Amazon Web Services. The ARIO token, with a total supply of 1 billion, will facilitate transactions and enable ownership of decentralized domains on the network.

Expand

-

KuCoin EU seeks MiCAR license in Austria for compliant crypto operations

KuCoin EU Exchange GmbH is applying for a MiCAR license in Austria, aiming to operate as a fully regulated crypto-asset service provider in the EEA. By securing this license, KuCoin EU plans to leverage KuCoin's technology, enhancing its offerings of secure and innovative crypto products and services across the 30 EEA member countries. The headquarters will be established in Vienna, identified as a strategic hub for its regulatory environment and talent pool. Both the CEO, Oliver Stauber, and COO, Christian Niedermueller, bring significant expertise to ensure compliance and operational success in the region.

Expand

-

Assetera launches tokenized US Treasury products in Europe with Ondo Finance

Assetera, an EU-regulated blockchain-based trading facility, has partnered with Ondo Finance to list institutional-grade tokenized US Treasuries. This collaboration makes it possible for European retail and institutional investors to access US government-backed securities via a compliant platform. The securities, supported natively on the Polygon network, facilitate atomic settlements, reducing counterparty risk and enabling efficient trade execution. Assetera's platform, integrating innovative trading tools and minute-by-minute pricing, aims to enhance liquidity and transparency in the digital assets market.

Expand

-

SEC drops appeal in legal battle over crypto broker-dealer rule

The Securities and Exchange Commission (SEC) has withdrawn its appeal against a Texas court decision that blocked a broker-dealer rule expansion, which would have required crypto liquidity providers and automated market makers with over $50 million in capital to register as dealers. This move, proposed under former SEC Chair Gary Gensler, would have subjected decentralized crypto protocols to stringent regulations, including Know Your Customer and Anti-Money Laundering rules, deemed unenforceable by crypto advocacy groups due to the decentralized nature of these protocols. The dismissal marks an end to the legal contention initiated by crypto entities in response to what they viewed as regulatory overreach.

Expand

-

ClustroAI raises $12M in Series A funding to expand decentralized edge AI technology

ClustroAI, an AI infrastructure startup backed by NVIDIA, closed a $12M Series A funding round led by Forum Ventures, raising the company's total funding to $15M. This round will finance the advancement of decentralized AI technologies, enabling enterprises to operate AI directly on local and edge devices, thus reducing cloud dependency and enhancing data privacy and cost efficiency. This investment also supports the scaling of ClustroAI's innovative edge AI solutions, which includes distributed AI compute architecture and improvements to AI operations and hardware compatibility.

Expand

-

Coinbase expands crypto derivatives with CFTC-regulated Solana and Hedera futures

Coinbase is advancing the maturation of the US crypto derivatives market, focusing on institutional and retail traders globally. It offers CFTC-regulated futures contracts for Solana and Hedera through Coinbase Derivatives, LLC, and is expanding futures trading access to institutions via Coinbase Financial Markets, Inc. Additionally, Coinbase International Exchange, LLC introduces EURC perpetual futures, enhancing crypto-native FX trading with leverage. These initiatives significantly contribute to the strategic exposure and risk management tools available in the crypto sector.

Expand

-

Strategy plans $2 billion convertible note offering for Bitcoin acquisitions

Strategy, formerly MicroStrategy, declared its intention to offer $2 billion in convertible senior notes at 0% interest to fund bitcoin purchases and other corporate needs. The notes, maturing in 2030, may convert into cash or stock options, also allowing for an additional $300 million purchase option for initial buyers. This announcement follows Strategy's profitability warning and acknowledgment of $1.79 billion in impairment losses from its bitcoin holdings in 2024.

Expand

-

Tether proposes to acquire 51% of Adecoagro to increase stake to majority

Tether Investments has proposed to acquire a 51% controlling stake in Adecoagro S.A., a South American sustainable production company. The offer of $12.41 per Common Share was made on February 14, 2025, aiming to increase Tether's stake from 19.4% to 51%. Adecoagro's Board is currently reviewing the proposal with assistance from legal and financial advisors to determine its suitability for shareholders.

Expand

-

HyperEVM goes live, enhancing Hyperliquid's financial system with programmability

HyperEVM is now live, marking a significant development for Hyperliquid by introducing full programmability with the initial release on its mainnet. Key features include the integration of HyperEVM blocks within L1, supporting secure transactions through HyperBFT consensus, enabling spot transfers between native and HyperEVM HYPE tokens, and deploying a canonical WHYPE system contract for DeFi applications. The launch is complemented by a mainnet-level bug bounty program and infrastructure enhancements like a dedicated JSON-RPC server. This upgrade aims to bolster Hyperliquid's onchain financial system without impacting the existing L1 user experience.

Expand

-

Meteora co-founder Ben Chow resigns amid Libra fallout

Ben Chow, co-founder of Meteora, has resigned following controversies related to the Libra memecoin, which experienced rapid valuation fluctuations. Chow's resignation comes despite assertions of non-involvement with insider activities related to Libra and other tokens. Meteora is now seeking new leadership as it navigates the aftermath of the scandal.

Expand