NewsBriefs - Immutable partners with Japan's top mobile developer to launch TOKYO BEAST on Web3 platform

02/26/2025 10:00

Immutable, a leading Web3 gaming platform, has partnered with Japan's premier mobile gaming developer to launch TOKYO BEAST, an innovative b...

Editor-curated news, summarized by AI

Immutable partners with Japan's top mobile developer to launch TOKYO BEAST on Web3 platform

Immutable, a leading Web3 gaming platform, has partnered with Japan's premier mobile gaming developer to launch TOKYO BEAST, an innovative blockchain game featuring advanced mechanics and global tournaments. This partnership, marking Immutable's third with a unicorn developer, further solidifies its leadership in the Asian Web3 gaming market. TOKYO BEAST introduces a pooled NFT system and competitive features designed to attract both Web2 and Web3 players, aiming to set new standards in blockchain-based gaming.

Latest

-

Immutable partners with Japan's top mobile developer to launch TOKYO BEAST on Web3 platform

Immutable, a leading Web3 gaming platform, has partnered with Japan's premier mobile gaming developer to launch TOKYO BEAST, an innovative blockchain game featuring advanced mechanics and global tournaments. This partnership, marking Immutable's third with a unicorn developer, further solidifies its leadership in the Asian Web3 gaming market. TOKYO BEAST introduces a pooled NFT system and competitive features designed to attract both Web2 and Web3 players, aiming to set new standards in blockchain-based gaming.

Expand

-

Kaspersky reveals hundreds of fake GitHub projects spreading crypto malware

Hackers are creating numerous fake GitHub projects to disseminate malware that steals crypto and user credentials according to Kaspersky. The campaign, titled 'GitVenom,' features repositories filled with various malware types aimed at tricking users into downloading them. These projects look authentic and are often disguised as useful tools, but instead harbor info stealers and clipboard hijackers that compromise crypto transactions. The schemes have targeted users globally, with a notable focus on Russia, Brazil, and Turkey.

Expand

-

PayPal to enhance stablecoin PYUSD adoption, targeting global merchant transactions

PayPal Holdings Inc. plans to expand the use of its stablecoin, PYUSD, across its payment ecosystem, focusing on integrating it into products to serve its 20 million small-to-medium sized merchants. The initiative includes facilitating payment to vendors through an upcoming bill-pay product and enabling PYUSD payouts via Hyperwallet for global payments. The move aims to simplify cross-border transactions, reduce currency conversion friction, and enhance transaction speed, with key implementations set for completion by the end of 2025.

Expand

-

Hamster Kombat launches its own TON layer-2 network

Hamster Kombat, a popular Telegram crypto game, has launched its own layer-2 blockchain, the Hamster Network, on The Open Network (TON). This new network aims to provide a scalable, low-cost transaction platform specifically for games and apps. It features the TON Virtual Machine for seamless compatibility with existing TON dapps, includes a wallet, a bridge for token transfer, and a dedicated decentralized exchange. The Hamster Network, with its pilot game Hamster Boost, seeks to expand its user base by offering interactive gaming experiences.

Expand

-

Leveraged ETFs tied to Bitcoin stacker Strategy plunge nearly 50% in five days

Two leveraged exchange-traded funds (ETFs) linked to the bitcoin stockpiler Strategy, MSTX and MTSU, saw nearly a 50% drop in value within five days. This decline coincided with a significant drop in bitcoin price, which fell to below $87,000. The ETFs, which are designed to amplify returns by using derivatives and debt, experienced increased trading volumes and high risk, leading to steep losses. The equity market also faced challenges, influenced by upcoming tariffs announced by the US president, exacerbating the volatile trading environment.

Expand

-

Ethereum's Pectra upgrade debuts on Holesky testnet

The Pectra upgrade, significant for Ethereum, was launched on the Holesky testnet, marking a critical phase before its mainnet deployment. Although the upgrade initiated correctly, it faces finalization issues, with ongoing investigations by developers. The next planned testnet deployment is on Sepolia, contingent on resolving Holesky's problems. Pectra aims to enhance Ethereum's scalability, security, and usability with features like increased stake limits and enhanced rollup capabilities.

Expand

-

Metaplanet acquires $12.9 million worth of Bitcoin

Metaplanet Inc., listed on the Tokyo Stock Exchange, has expanded its Bitcoin holdings by purchasing an additional 135 coins. This acquisition increases its total holdings to 2,235 Bitcoin, as part of the company's Bitcoin Treasury Operations. The recent purchase involved an aggregated investment of 1.939 billion yen at an average price of 14,360,449 yen per token, with the goal of increasing shareholder value through enhanced BTC Yield, a performance metric showcasing growth in relation to fully diluted shares.

Expand

-

DOJ and OKX affiliate settle for over $500 million in unlicensed money transmitting case

The US Department of Justice (DOJ) has finalized a settlement with Aux Cayes FinTech Co. Ltd., an affiliate of crypto exchange OKX. Aux Cayes will pay more than $500 million, including $84 million in penalties and about $421 million in forfeited fees from US customers, for operating an unlicensed money transmitting business. Additionally, OKX has implemented measures to enhance compliance and plans to maintain these improvements.

Expand

-

DekaBank introduces crypto trading services for institutional clients

DekaBank is now providing crypto trading, custody, and management services exclusively for institutional clients, not for private customers. The bank has acquired a crypto custody license under the German Banking Act with approvals from the European Central Bank and the Federal Financial Supervisory Authority (Bafin). DekaBank aims to leverage its high security standards and well-established infrastructure to support institutional crypto activities, distinguishing itself from other competitors. It continues to assess approaches for private customer engagement in the crypto market.

Expand

-

USDC and EURC are the first legal stablecoins recognized under Dubai's crypto framework

The Dubai Financial Services Authority (DFSA) has approved Circle's stablecoins, USD Coin (USDC) and EURC, as the first recognized tokens under its crypto regime. This allows entities in the Dubai International Financial Centre (DIFC) to utilize these stablecoins in various digital asset applications such as payments and treasury management. This approval marks a significant step in regulatory clarity and progresses the crypto infrastructure in the United Arab Emirates (UAE), supported by recent legal frameworks and licensing systems for stablecoins.

Expand

-

Certora open-sources its Prover tool to enhance smart contract security

Certora has open-sourced the Certora Prover, a leading Formal Verification engine supporting Ethereum, Solana, and Stellar. This move aims to make high-level smart contract security accessible and integrated directly into the development process, promoting efficiency and inclusivity across the DeFi space. The tool, which has secured over $100 billion in total value locked and supports multiple major DeFi projects, now offers an open, community-driven model for securing smart contracts against potential exploits.

Expand

-

YZi Labs invests in crypto-AI startup Vana, Changpeng Zhao joins as advisor

YZi Labs (formerly Binance Labs) has invested an undisclosed amount in Vana, a crypto-AI startup focusing on data ownership, marking its first AI investment since rebranding. Binance co-founder Changpeng 'CZ' Zhao has also joined Vana as an advisor. The investment follows Vana's recent mainnet and token launch, planning to expand its DataDAO ecosystem and develop further AI integration.

Expand

-

PancakeSwap goes live on Monad testnet with ultra-low fees and enhanced features

PancakeSwap has launched on the Monad Testnet, introducing low trading fees, enhanced liquidity, and greater capital efficiency to the DeFi trading space. This test phase allows users to experience improved trading conditions with fees as low as 0.01%, but it involves using test tokens, meaning no real transactions, rewards, or burns will occur. The full capabilities of PancakeSwap on Monad, supporting both v2 and v3 liquidity options, aim to provide a scalable, fast, and cost-effective trading environment.

Expand

-

SEC concludes investigation into Robinhood's crypto operations without enforcement

The US Securities and Exchange Commission (SEC) has completed its investigation into Robinhood's cryptocurrency trading activities and decided not to take any enforcement action. This follows a Wells Notice issued in May 2024, suggesting potential enforcement, which has now been formally closed without further action. Despite differing views on the classification of digital assets under federal securities laws, Robinhood adjusted its offerings to align with SEC guidelines, significantly increasing its crypto trading volume and revenues in the fourth quarter of 2024.

Expand

-

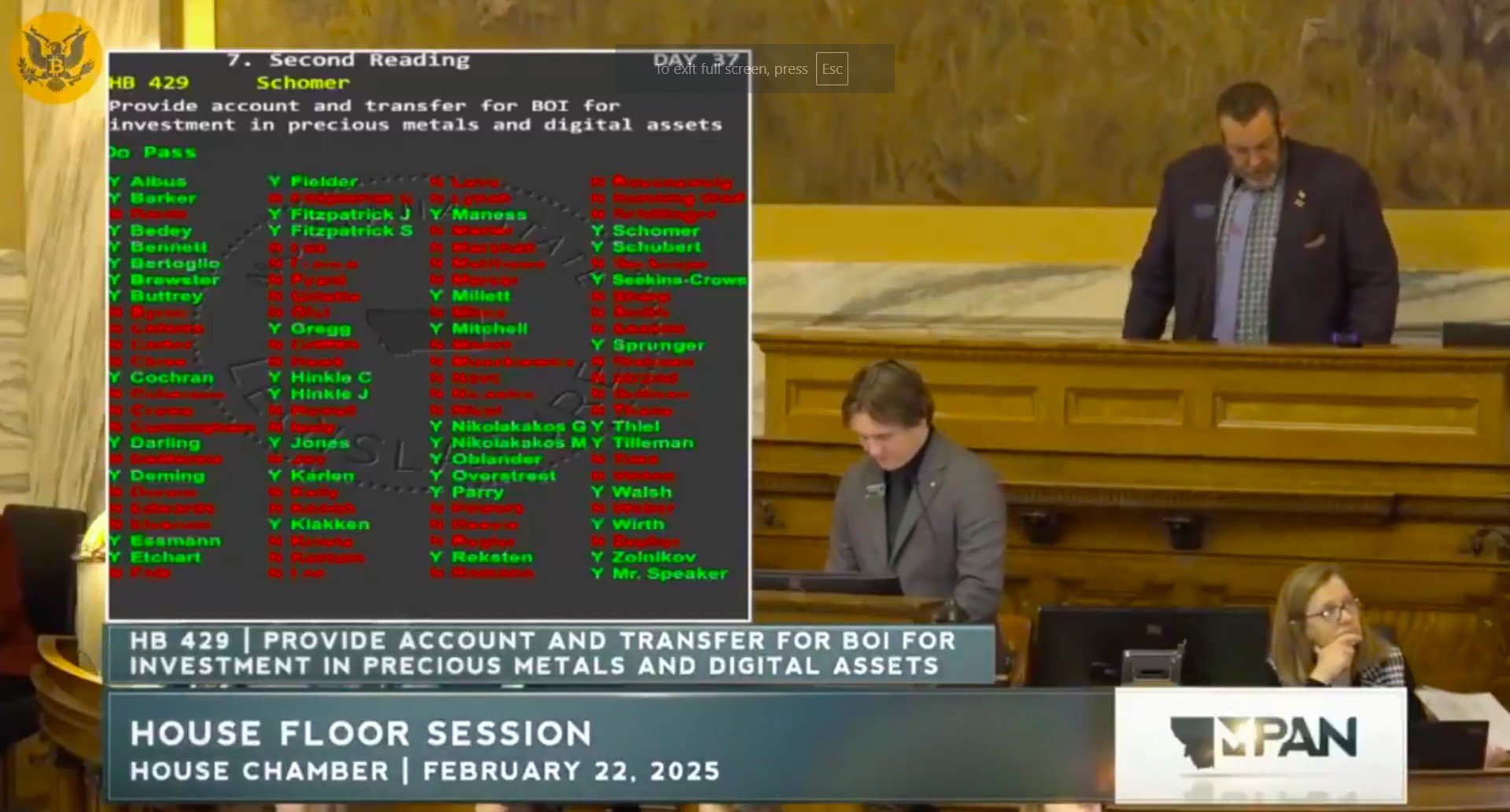

Montana’s Bitcoin reserve bill fails to pass second reading, effectively dead

The Montana House of Representatives failed to pass Bill 429, which aimed to designate Bitcoin as a state reserve asset, with a 41-59 vote. The bill intended to establish a special revenue account for investing in Bitcoin, precious metals, and stablecoins. Lawmakers expressed concerns over the risks associated with crypto investments and disagreed with granting the Montana Investment Council the authority to invest in crypto and NFTs. Despite some support, opposition, citing the speculative nature of the investment, prevailed.

Expand