NewsBriefs - Standard Chartered tests Mag 7B index, replaces Tesla with Bitcoin for better returns and stability

03/25/2025 04:04

Standard Chartered developed a modified version of the 'Magnificent 7' tech index, named 'Mag 7B', by substituting Tesla with Bitcoin. The b...

Editor-curated news, summarized by AI

Standard Chartered tests Mag 7B index, replaces Tesla with Bitcoin for better returns and stability

Standard Chartered developed a modified version of the 'Magnificent 7' tech index, named 'Mag 7B', by substituting Tesla with Bitcoin. The bank's analysis revealed that Mag 7B outperformed the original Mag 7 index, demonstrating higher returns and lower volatility. This shift indicates Bitcoin's potential dual role as a tech stock and a hedge against traditional finance risks, suggesting increased institutional investment in Bitcoin could be advantageous.

Latest

-

Standard Chartered tests Mag 7B index, replaces Tesla with Bitcoin for better returns and stability

Standard Chartered developed a modified version of the 'Magnificent 7' tech index, named 'Mag 7B', by substituting Tesla with Bitcoin. The bank's analysis revealed that Mag 7B outperformed the original Mag 7 index, demonstrating higher returns and lower volatility. This shift indicates Bitcoin's potential dual role as a tech stock and a hedge against traditional finance risks, suggesting increased institutional investment in Bitcoin could be advantageous.

Expand

-

DWF Labs launches $250M liquid fund to boost growth in web3

DWF Labs is launching a $250 million Liquid Fund to accelerate the growth of mid and large-cap crypto projects. This initiative is part of DWF Labs' active investment strategy in the crypto industry, having recently committed $11 million to different blockchain projects, with upcoming investments totaling $35 million. The fund will support strategic venture capital and ecosystem enhancements in the crypto space, focusing on liquidity, DeFi activity, lending markets, public relations, and comprehensive go-to-market strategies, aimed at increasing real-world crypto adoption and industry innovation.

Expand

-

dYdX initiates first-ever DYDX Buyback Program

The dYdX community has launched its first-ever DYDX Buyback Program, allocating 25% of net protocol fees towards monthly buybacks of DYDX tokens from the open market to stake and enhance network security. This initiative is part of a broader strategy aimed at aligning tokenomics with the protocol's growth, ensuring long-term sustainability and strengthening the role of DYDX tokens within the ecosystem.

Expand

-

Fidelity introduces Ethereum-tracked 'OnChain' shares for Treasury money market fund

Fidelity Investments is launching 'OnChain,' an Ethereum-based blockchain share class for its Treasury money market fund. This new class will provide transparent and verifiable tracking of share transactions on the Ethereum blockchain, while maintaining traditional records for official ownership. The initiative reflects a growing trend of integrating blockchain technology into traditional financial instruments, with the market for tokenized US Treasury securities currently valued at about $4.77 billion.

Expand

-

Coinbase in advanced talks to buy Deribit

Coinbase is in advanced talks to acquire Deribit, a leading platform for trading Bitcoin and Ether options. The discussions have involved notifying regulators in Dubai, where Deribit holds a license. Bloomberg sources suggest no final agreement has been reached yet, although earlier reports valued Deribit between $4 billion and $5 billion.

Expand

-

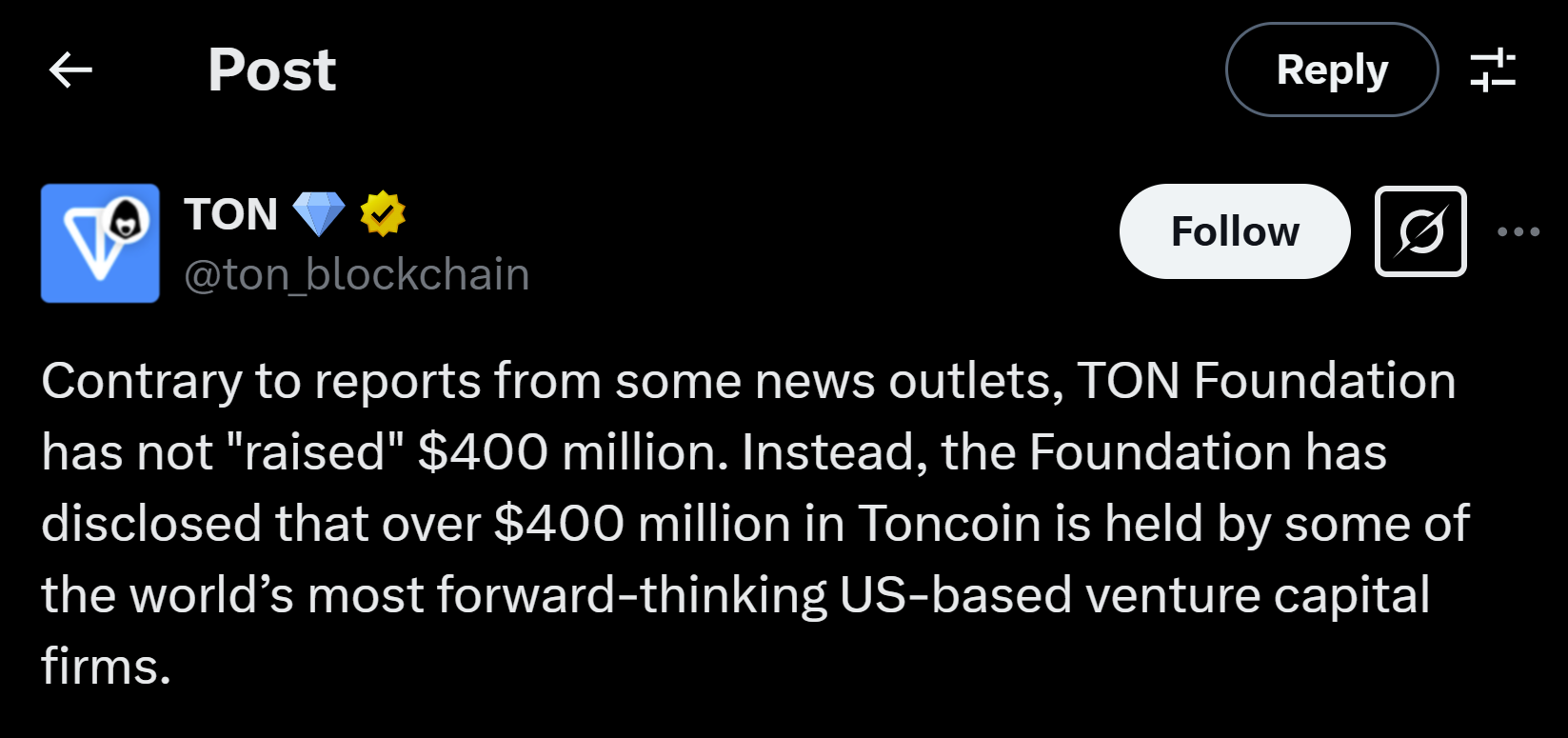

TON Foundation clarifies $400M in Toncoin held by top US VCs, not raised

TON Foundation has clarified that it has not raised $400 million. Instead, leading US venture capital firms including Sequoia Capital, Ribbit, Benchmark, and Kingsway have invested this amount in buying Toncoin. These firms are supporting the TON blockchain, which powers apps within the Telegram ecosystem, with over 40 million active users and 121 million Toncoin holders. The investment was made in Toncoin rather than traditional equity or cash.

Expand

-

MAIGA partners with io.net to supercharge AI-driven trading analysis

MAIGA has announced a partnership with io.net to utilize their IO Intelligence AI model, aiming to boost its AI-driven trading analysis. This collaboration will incorporate open-source AI models such as Deepseek R1 and Llama 3.3, offering MAIGA advanced tools for real-time market insights and predictive analytics, thereby enhancing decision-making and operational efficiency in token trading.

Expand

-

Eminem's ex-employee charged with leaking 25 tracks for $50,000 in Bitcoin

Joseph Strange, a former sound engineer for Eminem, was charged with copyright infringement and interstate transportation of stolen goods for illegally selling the rapper's unreleased tracks. Strange allegedly sold 25 songs, which Eminem wrote between 1999 and 2018, for about $50,000 in Bitcoin without consent from Eminem or Interscope Capital Labels Group. The US Attorney's Office for the Eastern District of Michigan stated the charges after authorities were alerted to the leaks by current employees. If convicted, Strange faces significant prison time and fines.

Expand

-

Eric Trump joins Metaplanet's Strategic Board of Advisors

Eric Trump has joined the Strategic Board of Advisors at Metaplanet to leverage his business expertise and passion for Bitcoin (BTC), aiding the company's growth as a leading Bitcoin treasury firm.

Expand

-

Senate to hold confirmation hearing for SEC Chair nominee Paul Atkins on March 27

The US Senate will conduct a confirmation hearing on March 27 for Paul Atkins, nominee for SEC Chair, known for his support of the crypto industry. Atkins, nominated by President Donald Trump, founded Patomak Global Partners and has ties with crypto exchanges and DeFi platforms. The hearing was delayed due to financial disclosure complications. Pending crypto-related decisions at the SEC, including reviews on spot crypto ETF proposals, could be influenced by Atkins' confirmation.

Expand

-

OCC ends reputation risk supervision after backlash from crypto industry

The Office of the Comptroller of the Currency (OCC) has ceased examining banks for reputation risk, a move influenced by criticism from the crypto industry. This change is part of broader efforts to improve transparency in the OCC's examination processes and ensure that banks can manage their own business decisions without undue influence from federal regulators. Additionally, the OCC has recently affirmed that crypto activities are permissible within the federal banking system, reversing previous restrictions. This comes amid legislative efforts to limit regulators' use of reputation risk in supervisory roles.

Expand

-

Canary Capital seeks SEC approval for first Pengu ETF

Canary Capital has filed with the US Securities and Exchange Commission for the first-ever Pengu ETF, marking an expansion in its crypto offerings. This ETF will focus on PENGU tokens and Pudgy Penguins NFTs, alongside other crypto assets like SOL and ETH. Canary is also pursuing altcoin ETFs for Sui, Hedera, and Litecoin. This comes as the SEC shows a more accommodating stance towards crypto ETFs, following previous approvals for Bitcoin and Ethereum spot ETFs.

Expand

-

TON Foundation secures over $400 million in Toncoin sales with major VC participation

The TON Foundation recently raised over $400 million through the sale of Toncoin, the native token of the TON blockchain, to top venture capital firms including Sequoia Capital, Ribbit, Benchmark, and Kingsway. These investments, fueled by the promising integration of TON blockchain within Telegram's messaging app ecosystem, aim to support the development of mini apps and leverage the mass distribution network of Telegram. Currently, the TON blockchain boasts 40 million active users and 121 million unique Toncoin holders.

Expand

-

Gotbit founder agrees to forfeit $23 million in plea deal for market manipulation

Gotbit founder Alex Andryunin will forfeit $22.9 million in stablecoins as part of a plea deal with the US Attorney for the District of Massachusetts, Leah B. Foley, over charges of wire fraud and crypto market manipulation. Andryunin pleaded guilty to charges including one count of conspiracy to commit wire fraud and market manipulation, and two additional counts of wire fraud. The deal includes a proposed sentence of up to 24 months with 36 months' supervised release, and bans Andryunin from any US crypto trading activities. His guilty plea cannot be withdrawn and sentencing conditions have yet to be determined.

Expand

-

Pakistan aims to legalize crypto to attract international investment

Pakistan is planning to establish a legal framework for cryptocurrency to attract international investment and enhance its digital-asset ecosystem. The Pakistan Crypto Council, led by Bilal bin Saqib, is working on clear regulatory guidelines. Crypto already enjoys popularity in Pakistan, which ranks ninth globally in adoption with an estimated 15-20 million users. The move aligns with broader regional trends and reflects international influences, including current US crypto strategies.

Expand