NewsBriefs - Hyperliquid upgrade introduces fully onchain voting for asset delisting

03/29/2025 00:47

Hyperliquid blockchain now supports fully onchain validator voting for asset delisting, utilizing a permissionless stake-based voting system...

Editor-curated news, summarized by AI

Hyperliquid upgrade introduces fully onchain voting for asset delisting

Hyperliquid blockchain now supports fully onchain validator voting for asset delisting, utilizing a permissionless stake-based voting system integrated into HyperCore. This system activates delisting automatically once a quorum is reached, eliminating the need for offchain coordination. An upcoming demonstration by Hyper Foundation validators will showcase the functionality by voting to delist MYRO perps.

Latest

-

Hyperliquid upgrade introduces fully onchain voting for asset delisting

Hyperliquid blockchain now supports fully onchain validator voting for asset delisting, utilizing a permissionless stake-based voting system integrated into HyperCore. This system activates delisting automatically once a quorum is reached, eliminating the need for offchain coordination. An upcoming demonstration by Hyper Foundation validators will showcase the functionality by voting to delist MYRO perps.

Expand

-

FDIC vows to collaborate with Trump's team to set clear crypto-related guidance for banks

The Federal Deposit Insurance Corporation (FDIC) released new guidance allowing FDIC-supervised institutions to engage in permissible crypto-related activities without prior approval. The guidance replaces FIL-16-2022, emphasizing that banks should manage the risks associated with these activities. FDIC Acting Chairman Travis Hill highlighted this as part of a broader initiative to revise approaches to crypto and blockchain activities, ensuring compliance with safety and soundness standards. The agency plans to collaborate with the President's Working Group on Digital Asset Markets to provide additional clarity on banks' engagement in specific crypto-related activities. The FDIC will also partner with other banking agencies to develop new guidance or regulations to replace existing interagency documents related to crypto assets.

Expand

-

Dominari Holdings invests $2 million in BlackRock’s Bitcoin ETF

Dominari Holdings has implemented a corporate Bitcoin treasury strategy by purchasing $2 million in BlackRock's iShares Bitcoin Trust ETF. Dominari, primarily engaged in wealth management, investment, and trading, plans to use its earnings and excess cash to continue expanding its investment in this and other crypto assets. This strategy coincides with their recent financial results indicating a projected annual revenue of $19 million for 2024.

Expand

-

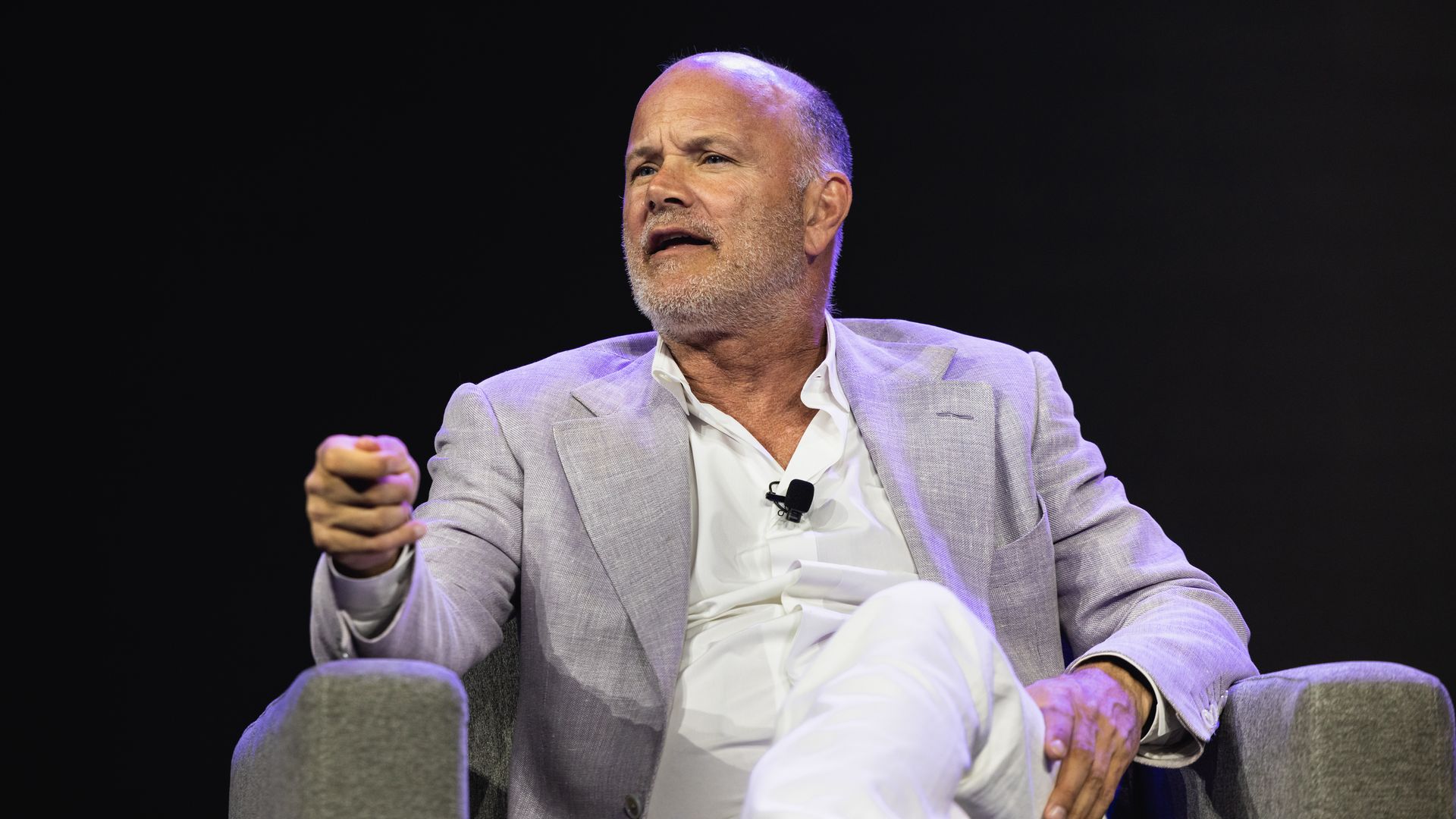

Galaxy Digital settles for $200 million with NY AG over LUNA promotion

Galaxy Digital has reached a $200 million settlement with the New York Attorney General's office for promoting LUNA without adequate disclosure of its financial interests. The settlement arises from allegations of Galaxy's misconduct in selling the once-prominent crypto token LUNA while publicly promoting it, significantly profiting from these activities without proper disclosure to investors. Galaxy neither admitted nor denied the allegations but agreed to a series of commitments to avoid future conflicts of interest.

Expand

-

SEC ends investigation into Crypto.com without filing charges

Crypto.com announced that the US Securities and Exchange Commission (SEC) has concluded its investigation into the company without pursuing any enforcement actions. This decision is part of a broader trend where the SEC has recently dropped multiple investigations and lawsuits against crypto firms such as Kraken, Coinbase, and Ripple. The SEC's shift in approach follows significant organizational changes and policy reversals since the onset of the Trump administration and the departure of former SEC Chair Gary Gensler.

Expand

-

SEC drops enforcement actions against Kraken, Consensys, and Cumberland

The US Securities and Exchange Commission has dismissed its civil enforcement actions against Kraken, Consensys, and Cumberland, citing a strategic reform in its regulatory approach rather than the merits of the cases. This move is part of the SEC's broader recalibration of its legal stance towards the crypto industry.

Expand

-

ICE collaborates with Circle to explore new crypto products based on USDC, USYC

Intercontinental Exchange and Circle have signed a memorandum of understanding to utilize Circle's stablecoin USDC and its tokenized money market offering, US Yield Coin (USYC), to innovate and develop new market solutions. This collaboration aims to integrate USDC into diverse use cases across ICE's derivative exchanges, clearinghouses, data services, and other markets, leveraging ICE's global network and Circle's technology to expand digital currency applications in capital markets.

Expand

-

Senate repeals controversial IRS crypto rule, President Trump expected to sign

The US Senate voted to repeal an IRS rule mandating decentralized finance industry participants to operate like traditional securities brokers, which required them to collect and report user trading data and issue tax forms. President Donald Trump is anticipated to approve this measure, overturning a rule that was introduced in the final days of the previous administration. The decision was supported by a bipartisan majority and reflected concerns over privacy and the excess regulatory burden on US innovation in the crypto sector.

Expand

-

GameStop plans $1.3 billion note offering to acquire Bitcoin as a treasury asset

GameStop announced a $1.3 billion private offering of convertible senior notes to fund its new Bitcoin acquisition plan, starting with these notes due in 2030 and targeting large institutional investors. This move aims to include Bitcoin as a treasury reserve asset, aligning with its updated investment policy announced along with its fourth-quarter earnings, where GameStop reported a net income of $131.3 million and $4.75 billion in cash. This initiative follows the closure of its NFT marketplace and reflects a significant pivot towards integrating Bitcoin into its treasury operations.

Expand

-

Fidelity plans to launch US dollar-pegged stablecoin

Fidelity Investments is preparing to launch a US dollar-pegged stablecoin and an Ethereum-based share class for its US dollar money market fund, expanding its offering in the crypto market. This move is part of a broader initiative under a crypto-friendly regulatory environment anticipated by the current US administration. Fidelity's stablecoin will be launched through Fidelity Digital Assets, while the Ethereum-based 'OnChain' share class aims to facilitate transaction tracking for the Fidelity Treasury Digital Fund. These developments reflect a growing trend of financial institutions embracing crypto services and products.

Expand

-

SEC concludes investigation into Immutable with no charges

The US Securities and Exchange Commission has ended its investigation into the Australian crypto firm Immutable, which had previously received a Wells notice over potential securities law violations. Immutable celebrated this decision as a victory for digital ownership in the gaming sector. This closure aligns with the SEC's recent trend of dropping cases against various crypto entities and pursuing clearer regulations under its new leadership post-Trump administration and Gary Gensler's tenure.

Expand

-

Cboe files 19b-4 for Fidelity Solana ETF, signaling mainstream push

Cboe has filed a 19b-4 form with the US Securities and Exchange Commission to list a Solana exchange-traded fund (ETF) proposed by Fidelity. Fidelity's Solana ETF, expected to track the spot price of SOL, aims to include the high-performance blockchain in regulated financial markets, expanding its crypto ETF range beyond Bitcoin and Ethereum. This move reflects a growing demand from investors for altcoin exposure and could significantly impact the mainstream financial integration of Solana.

Expand

-

GMX and MIM Spell targeted in $13 million crypto hack

On March 25th, GMX and MIM Spell, two key DeFi platforms, suffered a significant security breach resulting in the loss of approximately 3,260 ETH, valued around $13 million. The breach targeted their smart contracts, highlighting ongoing security concerns in the DeFi sector, especially for platforms with substantial TVL. GMX, a decentralized exchange, and MIM Spell, operated by Abracadabra, play major roles in trading and lending within the crypto ecosystem.

Expand

-

Kentucky governor Andy Beshear enacts Bitcoin Rights bill

Kentucky governor Andy Beshear signed the Bitcoin Rights bill into law, establishing legal protections for crypto users’ rights such as self-custody and operation of nodes without discrimination. The bill, HB701, introduced by Rep Adam Bowling, also safeguards crypto mining activities from local zoning changes and clarifies that crypto mining and staking are not considered securities. This comes as Bitcoin legislation progresses in another US state, where Oklahoma and Arizona are advancing their digital asset initiatives.

Expand

-

Dogecoin Foundation's corporate arm launches Official Dogecoin Reserve to enhance payment efficiency

House of Doge, the business arm of the Dogecoin Foundation, has launched the Official Dogecoin Reserve, buying 10 million Dogecoin to promote Dogecoin as a mainstream global payment option. This reserve aims to solve the transaction lag prevalent in digital currencies by enhancing payment efficiency at checkouts. The Reserve's initiation represents a significant development in making Dogecoin a reliable, scalable global currency for everyday transactions and merchant acceptance.

Expand