NewsBriefs - Cboe to introduce new FTSE Bitcoin Index futures, expanding Bitcoin derivatives offerings

04/08/2025 15:00

Cboe plans to launch new FTSE Bitcoin Index futures on April 28, 2025, pending regulatory approval. These cash-settled futures, based on the...

Editor-curated news, summarized by AI

Cboe to introduce new FTSE Bitcoin Index futures, expanding Bitcoin derivatives offerings

Cboe plans to launch new FTSE Bitcoin Index futures on April 28, 2025, pending regulatory approval. These cash-settled futures, based on the FTSE Bitcoin Reduced Value Index, aim to complement existing bitcoin ETF index options and enhance Cboe's bitcoin product offerings. This expansion provides traders with more options for managing bitcoin exposure and implementing various trading strategies.

Latest

-

Cboe to introduce new FTSE Bitcoin Index futures, expanding Bitcoin derivatives offerings

Cboe plans to launch new FTSE Bitcoin Index futures on April 28, 2025, pending regulatory approval. These cash-settled futures, based on the FTSE Bitcoin Reduced Value Index, aim to complement existing bitcoin ETF index options and enhance Cboe's bitcoin product offerings. This expansion provides traders with more options for managing bitcoin exposure and implementing various trading strategies.

Expand

-

Galaxy Digital secures SEC approval to relocate to Delaware, eyes Nasdaq listing in May

Galaxy Digital has received approval from the US Securities and Exchange Commission for its registration statement related to the company's move from the Cayman Islands to Delaware. This relocation is part of its US expansion strategy, including a planned listing on Nasdaq next month. Galaxy is set to hold a shareholder meeting on May 9 to finalize its reorganization, with the Nasdaq listing anticipated shortly thereafter. The company is currently listed on the Toronto Stock Exchange and has also settled a significant legal matter with the New York Attorney General over its promotion of the Luna crypto.

Expand

-

BlackRock’s Fink sees 20% drop ahead but calls it a buying opportunity

BlackRock CEO Larry Fink stated that the market could face an additional 20% drop, interpreting current economic conditions as a long-term buying opportunity rather than a systematic risk. Highlighting inflation concerns and market sensitivity to US policy changes such as the recent tariffs introduced by President Trump, Fink expressed skepticism about the Federal Reserve reducing interest rates this year. Additionally, Fink pointed out the challenges facing the crypto market, notably Bitcoin, which has seen significant declines in value.

Expand

-

CoinShares reports $240M outflow in crypto ETPs amid US trade tariffs

Last week, cryptocurrency exchange-traded products (ETPs) experienced a significant outflow of $240 million, reversing previous gains, as reported by CoinShares. This shift in investor sentiment, largely driven by new US trade tariffs, influenced a total of $133 billion in holdings. Bitcoin ETPs particularly highlighted the trend with $207 million in outflows, marking a monthly net negative for the first time this year. Grayscale, leading the downturn, recorded the highest outflows at $1.4 billion YTD among all providers.

Expand

-

Tether ready to launch US-compliant stablecoin in response to potential US stablecoin legislation

Tether, a leading stablecoin issuer, is prepared to issue a US-compliant version of its USDT token should US stablecoin legislation pass. The company, which boasts over $140 billion in USDT in circulation, views this move as aligning with its strategy to strengthen the US dollar's influence globally, especially in emerging markets. Amid geopolitical shifts and the potential for dedollarization driven by other nations, Tether's commitment to the dollar underscores its dominance in the stablecoin market and its role in advancing dollar accessibility worldwide.

Expand

-

FTX disqualifies $2.5 billion in claims due to KYC noncompliance

FTX has disqualified nearly 400,000 claims, potentially canceling up to $2.5 billion due to customer failures in meeting a KYC verification deadline. A US bankruptcy court filing highlights the financial scope and volume of claims affected. This measure, reflecting on past lax due diligence, is a step in addressing one of crypto's biggest corporate collapses. Meanwhile, FTX is preparing to repay its primary creditors later in the month, having secured $11.4 billion for distribution.

Expand

-

Coinbase Derivatives to launch 24/7 Bitcoin and Ethereum futures for US traders on May 9

Coinbase Derivatives is set to launch 24/7 trading for Bitcoin and Ethereum futures in the US on May 9. This will offer American traders their first opportunity to engage in round-the-clock trading of regulated crypto futures. The futures contracts will be supported by institutional-grade infrastructure through Coinbase Financial Markets and Nodal Clear. Additionally, Coinbase is developing a perpetual-style futures product to align with global crypto derivatives markets while adhering to US regulatory standards.

Expand

-

Codex raises $15.8 million in seed round led by Dragonfly Capital for enterprise blockchain development

Codex, developing a blockchain for stablecoins tailored for enterprise applications, has secured $15.8 million in seed funding led by Dragonfly Capital. The round saw participation from Cumberland, Wintermute, and stablecoin pioneers Coinbase and Circle. The network, based on Ethereum Layer 2 technology from Optimism, aims to address mainstream adoption barriers like user experience friction, integration with existing systems, and regulatory compliance. Codex is enhancing its ecosystem to support transaction privacy, stable fees, and fiat conversion capabilities to meet business needs.

Expand

-

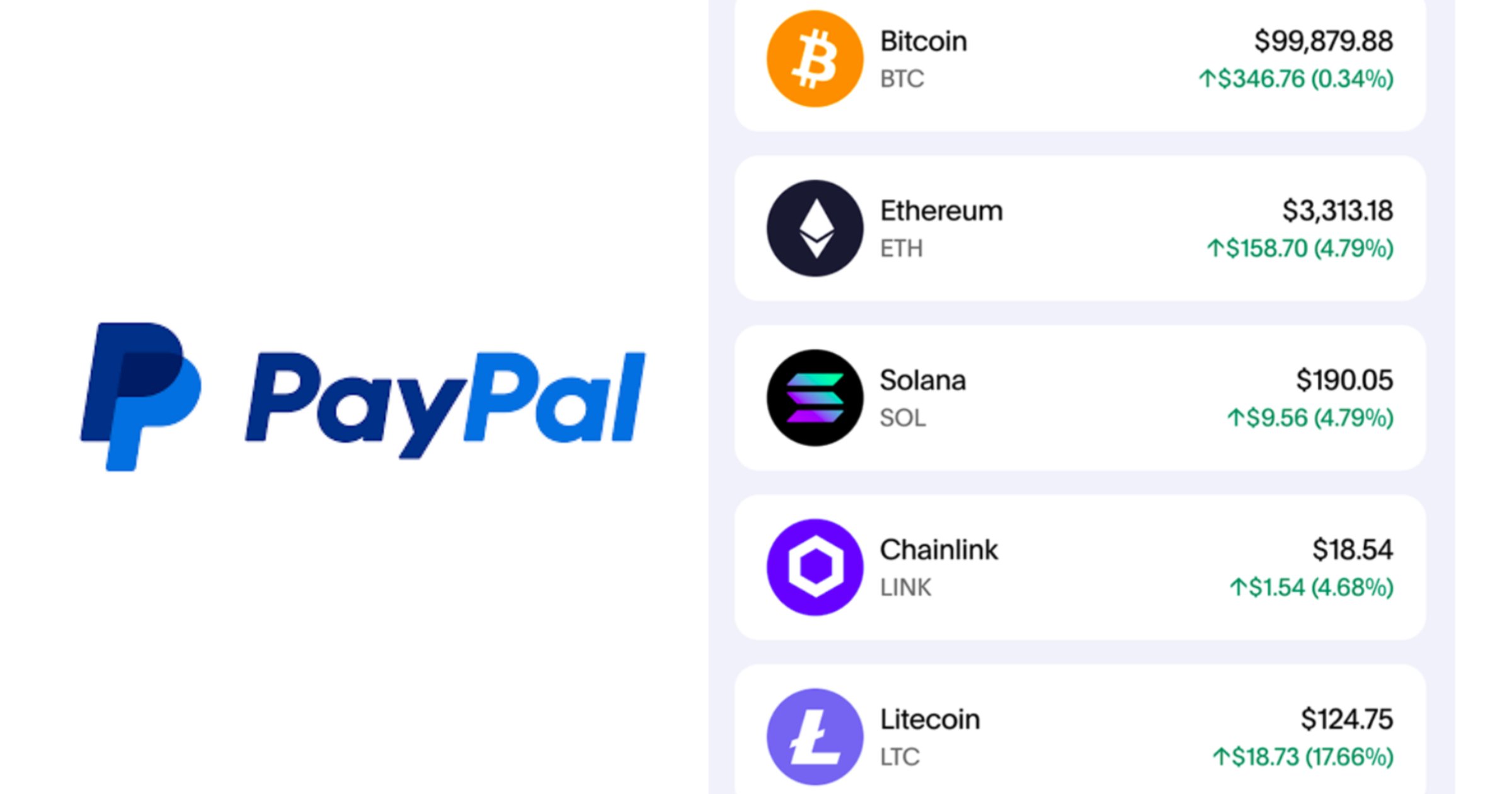

PayPal officially announces support for Chainlink, Solana

PayPal has expanded its crypto offerings to include Chainlink (LINK) and Solana (SOL), now allowing PayPal and Venmo users to buy, hold, sell, and transfer these tokens directly within their accounts. The addition serves PayPal's goal of increasing digital currency accessibility, reflecting its commitment to engaging more users in the crypto market. This move provides PayPal and Venmo users with more diverse options to engage with digital currencies in a trusted environment.

Expand

-

Bitget obtains El Salvador Digital Asset Service Provider (DASP) license

Bitget has acquired a Digital Asset Service Provider (DASP) license from El Salvador's National Commission of Digital Assets (CNAD) after previously obtaining a Bitcoin Services Provider (BSP) license in 2024. This advancement allows Bitget to offer a wide range of crypto services, including trading, staking, and investment solutions in El Salvador. The country's progressive regulatory framework favors the integration of Bitcoin and digital assets as part of its official financial system, making it a key destination for global crypto businesses.

Expand

-

House Financial Services Committee advances stablecoin regulation bill

The House Financial Services Committee has approved the Stablecoin Transparency and Accountability for a Better Ledger Economy Act, aiming to establish a regulatory framework for dollar-denominated stablecoins. The bill, supported by Committee Chair French Hill and Representative Bryan Steil, mandates one-to-one backing and stringent anti-money laundering measures. While the bill faces hurdles in alignment with Senate proposals and criticism over potential political influences, it represents a significant step toward formal stablecoin oversight in the US.

Expand

-

Franklin Templeton considers launching a crypto ETP in Europe after BlackRock jumps in

Franklin Templeton is exploring the possibility of launching a cryptocurrency exchange-traded product (ETP) in Europe, amid growing institutional interest in digital assets. This follows BlackRock's recent introduction of a bitcoin ETP in the region. Franklin Templeton, which manages a significant crypto ETF franchise in the US, is assessing the evolving regulatory landscape in Europe to inform its strategy. The company is committed to innovating across all asset classes, reflecting its ongoing engagement with the digital assets space.

Expand

-

SEC and Gemini seek 60-day stay to potentially resolve lawsuit

The US Securities and Exchange Commission and crypto exchange Gemini requested a 60-day stay from the District Court for the Southern District of New York to potentially resolve their legal dispute concerning Gemini Earn. The SEC had previously sued Gemini in January 2023, alleging that the platform offered and sold unregistered securities through its crypto lending program, which accumulated billions in crypto assets.

Expand

-

GameStop secures $1.5 billion through notes for Bitcoin investment

GameStop has raised $1.5 billion from a private offering of convertible notes, set to purchase bitcoin. This strategic move aligns with their plan to enhance their treasury assets through crypto, similar to previous tactics seen with Strategy in 2020. Despite the initial positive reaction in their stock value, skepticism among investors has risen regarding the effectiveness of this strategy. With substantial cash reserves and significant annual revenue, GameStop is positioned to considerably expand its bitcoin holdings.

Expand

-

Binance addresses sudden drop in ACT token and altcoins, adjusts leverage ratios

Binance issued a statement regarding a significant drop in the Act I: The AI Prophecy (ACT) token and other altcoins on its platform. The decline prompted liquidations among some futures traders and affected other tokens. Binance found that three VIP users heavily sold ACT tokens, affecting the market. Additionally, changes were made in leverage ratios for futures to manage risks and market stability. Meanwhile, Binance continues to investigate the declines and advises users on risk management.

Expand