- AVAX surged 16%, leading top-10 ecosystems with rising DeFi TVL and renewed market momentum

- TVL rebound and bullish sentiment could drive AVAX toward $30, but key resistance remains ahead

Avalanche [AVAX] is back in motion, posting a sharp 16% gain over the past week to become the fastest-growing top-10 ecosystem this month.

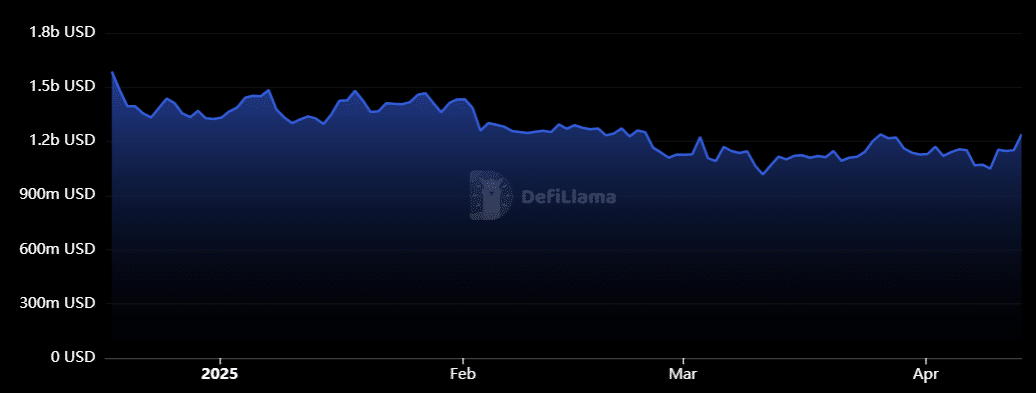

The move comes despite a continued slide in Total Value Locked (TVL), which has fallen from over $1.5 billion to around $1.1 billion since the start of 2025. Still, the latest price action suggests a shift in sentiment, with investors betting on a potential breakout.

TVL rebounds after three-month decline

Avalanche’s TVL showed a notable rebound in April, climbing back above $1.2 billion after a persistent downtrend since early January.

The chart reflects a clear dip from over $1.5 billion at the start of 2025 to sub-$1.1 billion by late March, mirroring broader risk-off sentiment in crypto markets.

However, the recent uptick suggests a shift in momentum — likely driven by rising AVAX prices, user incentives, and protocol reactivations.

While still below Q4 2024 levels, this bounce marks the first sign of sustained recovery and could signal a turning point.

AVAX eyes $30, but resistance looms

At press time, AVAX was trading around $20, recovering from March lows near $16.

Technically, the $30 level remains a key psychological and structural resistance – last tested in early February 2025 and again during multiple rejections in mid-2024.

The chart indicates that AVAX is breaking out of its short-term downtrend. However, for a decisive move toward the $30 mark, bulls must clear the resistance zone between $24 and $26.

If momentum holds and AVAX firmly reclaims the $26 level, a push toward $30 becomes achievable. That said, a period of short-term consolidation is likely before any potential breakout occurs.

Samyukhtha L KM is a journalist with a keen eye on the ever-changing digital asset landscape - and a soft spot for memecoins. With a Bachelors in Commerce and a Masters in Journalism and Mass Communication, she’s always curious about whether the next big thing in blockchain is hype or history in the making. When she’s not tracking the latest market moves, she’s reflecting on what blockchain adoption really means in a world still largely rooted in traditional finance.