NewsBriefs - Janover doubles SOL holdings to $21M, stock surges 1700%

04/15/2025 13:27

Janover has expanded its Solana (SOL) holdings to approximately $21 million, doubling its stack with an additional purchase of 80,567 SOL to...

Editor-curated news, summarized by AI

Janover doubles SOL holdings to $21M, stock surges 1700%

Janover has expanded its Solana (SOL) holdings to approximately $21 million, doubling its stack with an additional purchase of 80,567 SOL tokens worth around $10.5 million. This move aligns with the company’s new treasury strategy focused on SOL, following its acquisition by former Kraken executives Joseph Onorati and Parker White. Since embracing this crypto focused approach, Janover's share price has soared by over 1700%. The company continues its operations in commercial real estate while also planning to operate Solana validators.

Latest

-

AWS outage impacts major crypto exchanges and wallets including Binance and KuCoin

An Amazon Web Services outage in the Singapore region disrupted several major crypto platforms. Binance temporarily suspended withdrawals but resumed services shortly after. KuCoin and MEXC also experienced service interruptions, and crypto wallet Rabby faced similar issues. The AWS outage led to operational disruptions, including problems with asset transfers and order cancellations on MEXC, though their futures trading remained unaffected.

Expand

-

Janover doubles SOL holdings to $21M, stock surges 1700%

Janover has expanded its Solana (SOL) holdings to approximately $21 million, doubling its stack with an additional purchase of 80,567 SOL tokens worth around $10.5 million. This move aligns with the company’s new treasury strategy focused on SOL, following its acquisition by former Kraken executives Joseph Onorati and Parker White. Since embracing this crypto focused approach, Janover's share price has soared by over 1700%. The company continues its operations in commercial real estate while also planning to operate Solana validators.

Expand

-

Kraken expands US equities trading with plans for UK and European markets

Kraken has introduced US equities trading on its platforms through a partnership with Alpaca, offering over 11,000 stocks and ETFs commission-free. Initially available in select US states with plans for a national rollout, Kraken aims to provide a unified account for managing crypto, stocks, and ETFs. The expansion includes fractional investments and is part of Kraken's broader strategy to pave the way for asset tokenization and respond to growing demand for seamless, 24/7 trading across various asset classes.

Expand

-

NVIDIA launches first US-based AI supercomputer manufacturing sites

NVIDIA is establishing its first US-based facilities for manufacturing AI supercomputers, including production of the Blackwell chips in Arizona and supercomputers in Texas. The company is partnering with TSMC, Foxconn, and Wistron for production and with Amkor and SPIL for packaging and testing. This initiative, covering over a million square feet of manufacturing space, aims to ramp up mass production within 12-15 months and could generate half a trillion dollars of AI infrastructure in the US over the next four years.

Expand

-

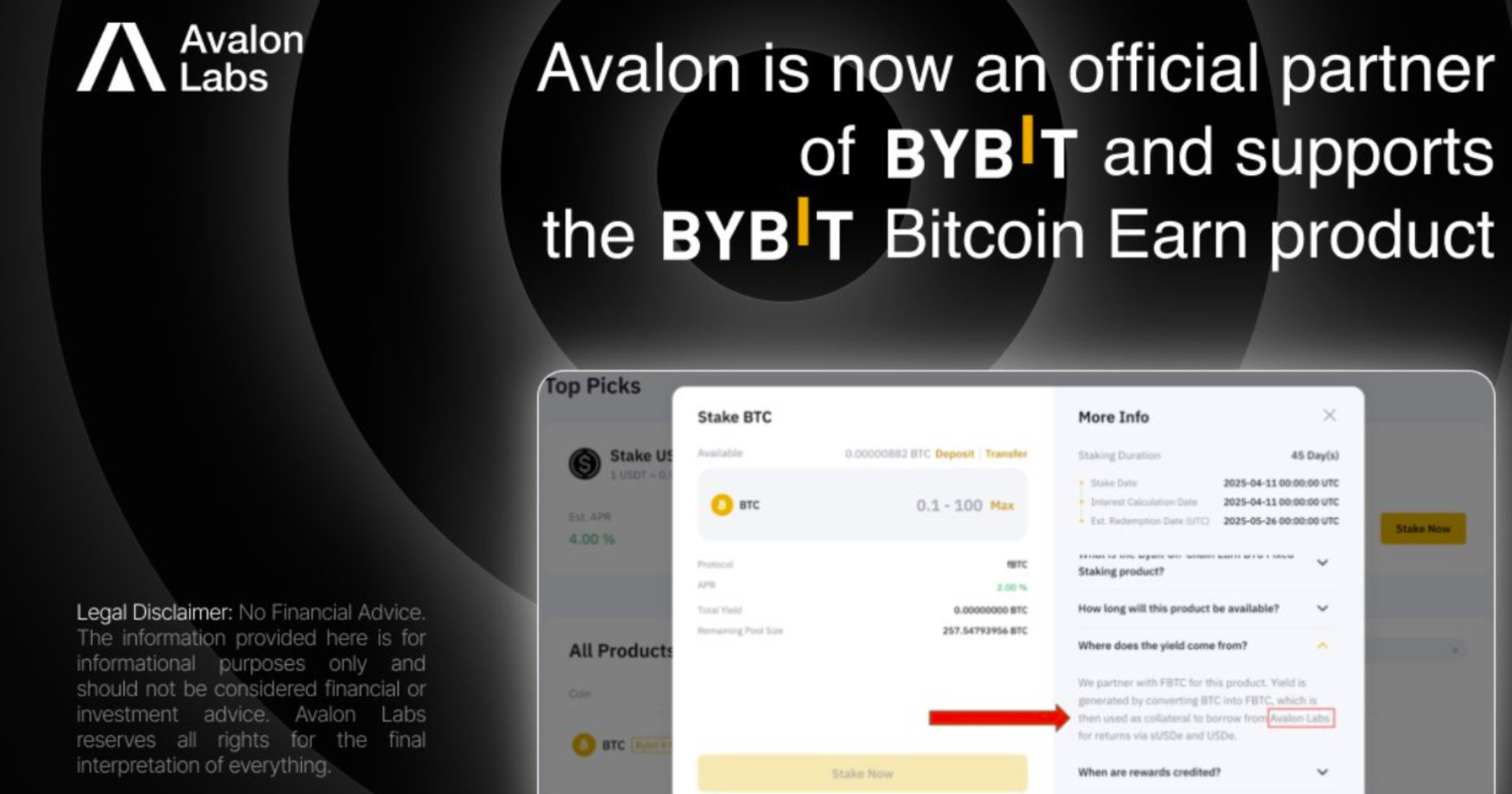

Bybit integrates Avalon to expand Bitcoin yield opportunities through CeDeFi bridge

Bybit has partnered with Avalon to incorporate a CeDeFi protocol into Bybit Earn, allowing users to generate yield on Bitcoin. Avalon utilizes a 1:1 Bitcoin-pegged token for fixed-rate borrowing, operational on the Mantle and Antalpha Prime platforms. The tokens are subsequently bridged onto Ethereum and other blockchains. This integration facilitates a bridge from CeFi to DeFi, leveraging assets in high-yield strategies managed by Ethena Labs' protocols.

Expand

-

JPMorgan expands blockchain payment services to include GBP

JPMorgan's blockchain division, Kinexys, has launched British pound-denominated blockchain deposit accounts in the UK, expanding its real-time settlement service to include the pound alongside existing euro and dollar functionalities. This enhancement facilitates 24/7 cross-border transactions and foreign exchange with more flexible FX settlement times. Kinexys has grown significantly since its inception, processing over $1.5 trillion in transactions, with corporate clients like LSEG's SwapAgent and commodities firm Trafigura among the initial users of the new GBP service.

Expand

-

Crypto funds see $795 million in outflows amid Trump tariff turmoil, reports CoinShares

Global crypto investment products saw net outflows of $795 million last week, driven by negative sentiment from tariff policies by President Trump, as reported by CoinShares. These outflows have cumulatively reached $7.2 billion since early February, nullifying most gains from the beginning of the year. Despite these challenges, a late-week surge in prices pushed the total crypto assets under management to $130 billion, an 8% increase. US investors led the outflows, particularly in bitcoin-focused and Ethereum-based products.

Expand

-

Mantra token price plunges 77% on Binance due to mass sell-off by key holders

The Mantra (OM) token listed on Binance experienced a sudden price drop of 77%. This significant decline was attributed to a selling spree by a manipulative group that held a large share of the tokens.

Expand

-

CryptoPunk seller pleads guilty to tax evasion on $13M in NFT profits

Waylon Wilcox of Dillsburg, Pennsylvania, has pleaded guilty to tax evasion charges for not reporting over $13 million earned from the sale of 97 CryptoPunk NFTs. The US Attorney's Office for the Middle District of Pennsylvania highlighted that Wilcox avoided nearly $3.3 million in taxes, marking a significant case in US law concerning NFT-related tax evasion. The IRS emphasizes the importance of reporting virtual currency transactions, with CryptoPunk sales now scrutinized in this light.

Expand

-

Lomond School in Scotland to accept Bitcoin payments and considers BTC reserve

Lomond School in Helensburgh, Scotland, will become the first UK school to accept Bitcoin as payment, addressing requests from local and international parents. The school plans to incorporate Bitcoin in phases and convert it to pound sterling to manage risks, ensuring compliance with UK financial regulations. Additionally, Lomond School may establish a Bitcoin asset reserve if the cryptocurrency gains wider acceptance in the UK and globally.

Expand

-

SEC crypto task force roundtable signals regulatory shift as Uyeda backs innovation-first approach

The US Securities and Exchange Commission (SEC), under Acting Chair Mark Uyeda, is exploring temporary regulatory measures to encourage blockchain innovation in the US. This approach marks a shift from the stricter oversight under former Chair Gary Gensler. The discussions occurred during a roundtable hosted by the SEC's crypto task force, which included major industry players like Uniswap Labs, FalconX, Coinbase, and representatives from traditional financial institutions. The SEC's evolving stance comes ahead of Paul Atkins taking over as Chair, indicating potential for a more crypto-friendly regulatory environment.

Expand

-

SEC allows McDonald's to dismiss Bitcoin treasury proposal by conservative shareholders

McDonald's chose not to discuss a proposal from the National Center for Public Policy, a conservative think tank and McDonald's shareholder, to buy Bitcoin after the US Securities and Exchange Commission supported the company's right to exclude the topic from its annual shareholder meeting. This decision reflects McDonald's lack of interest in altering its investment strategy to include Bitcoin despite the trend among some companies to add crypto to their balance sheets.

Expand

-

Bitcoin rises 4% as US inflation data bolsters market optimism

Recent US macroeconomic data revealing a decline in both the Producer Price Index (PPI) and Consumer Price Index (CPI) has spurred a 4% increase in Bitcoin prices to $82,500. Supplements from the Bureau of Labor Statistics indicated reductions in PPI by 0.4%, with core PPI dropping 0.1%, both lower than anticipated. This decrease in inflation rates has led to market optimism, promoting a broad recovery in crypto markets, with notable gains in major altcoins like Ether, Solana, and Cardano. Analysts, however, caution that cryptos' sensitiveness to geopolitical and economic headlines could affect this resurgence, as they keep an eye on US Treasury market conditions and ongoing US-China tariff tensions.

Expand

-

DOJ memo on crypto non-prosecution does not affect Do Kwon case, say US prosecutors

US prosecutors confirmed that the recent memo from Deputy Attorney General Todd Blanche, which advocates against prosecuting crypto firms under certain conditions, will not influence the charges against Terraform Labs founder Do Kwon. Despite the DOJ's broader move to refrain from crypto-related prosecutions, Kwon's charges remain unchanged and his trial is set to proceed, with the next pre-trial conference scheduled for June 12, 2025. Kwon faces various charges, including commodities fraud and money laundering, with a potential maximum sentence of up to 130 years if convicted.

Expand

-

SEC dismisses claims against Nova Labs related to Helium Network

The US Securities and Exchange Commission has dropped its claims against Nova Labs, stating that the firm's sale of hardware and distribution of tokens used for network growth does not constitute unregistered securities. This decision marks a significant development for the Helium community and the broader crypto industry, effectively clearing legal uncertainties for crypto projects involved in building real-world infrastructure through DePIN models.

Expand