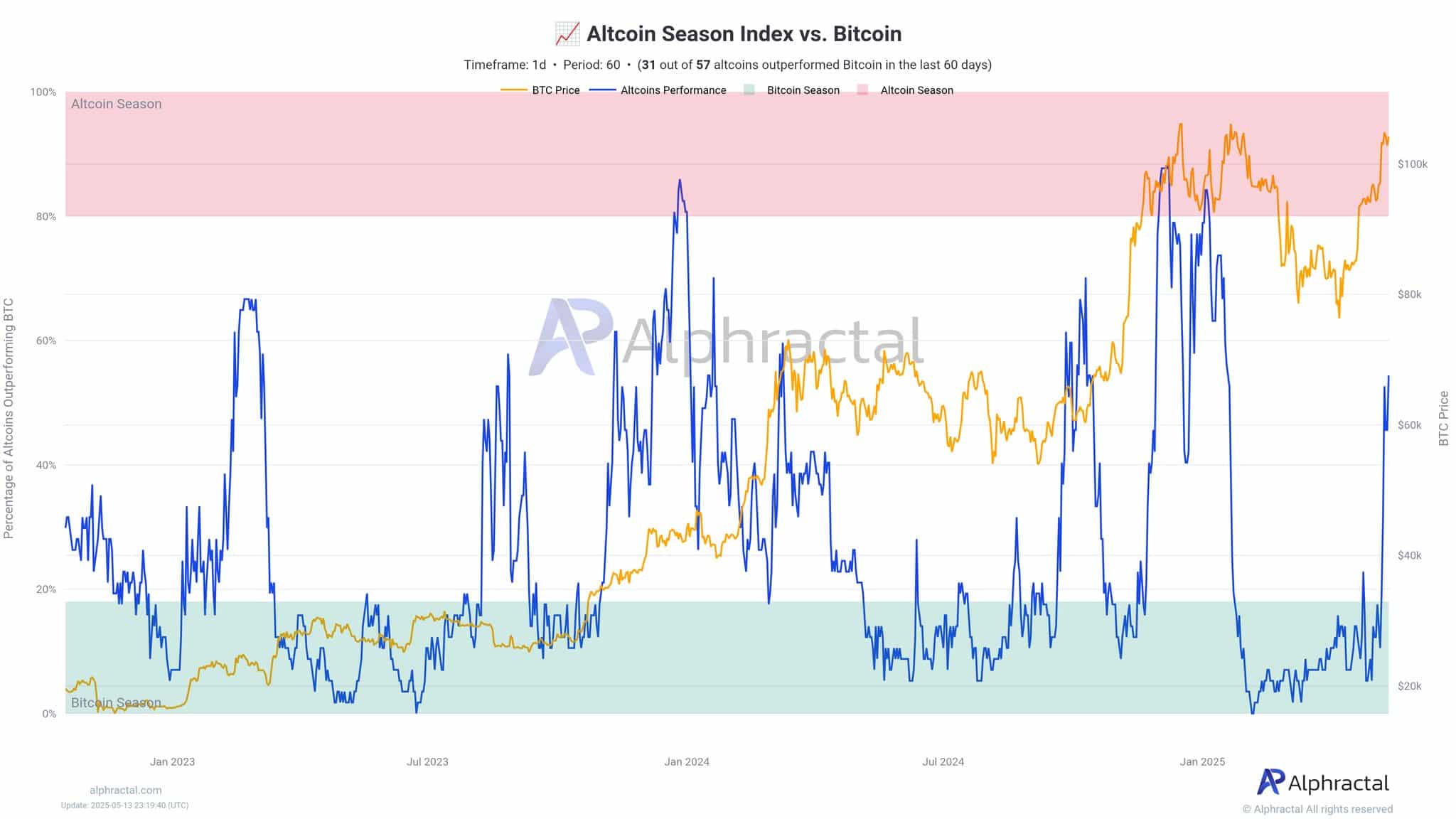

- Bitcoin dominance dips as altcoins outperform; signs suggest early stages of an altseason shift.

- Capital rotation into high-beta tokens like ETH, PEPE, and SUI signals rising risk appetite.

With Bitcoin’s [BTC] dominance chart flashing signs of exhaustion, the spotlight is shifting fast.

Analysts believe we’re on the cusp of a full-blown “altseason” – this is when investors move away from BTC and double down on emerging, high-velocity tokens.

As the market awakes with fresh momentum, the next wave of explosive altcoin gains may already be underway.

Signals flash as BTC dominance breaks lower

Bitcoin’s price has stalled near recent highs, while the percentage of outperforming alts is rising rapidly. Historically, such divergences precede explosive upside in the altcoin market.

“Bitcoin dominance just took a noticeable dip – from 65% down to 62% – while the altcoin market cap jumped $300 billion in a matter of weeks. That kind of shift doesn’t happen without reason.”

After a prolonged “bitcoin season” marked by dominance and capital concentration, traders are now rotating out of BTC in search of higher beta plays – potentially igniting the next wave of aggressive altcoin rallies.

Correction isn’t collapse!

Samyukhtha L KM is a journalist with a keen eye on the ever-changing digital asset landscape - and a soft spot for memecoins. With a Bachelors in Commerce and a Masters in Journalism and Mass Communication, she’s always curious about whether the next big thing in blockchain is hype or history in the making. When she’s not tracking the latest market moves, she’s reflecting on what blockchain adoption really means in a world still largely rooted in traditional finance.