Breaking: Bitcoin Bull Cathie Wood's Ark Invest Extends Coinbase And Robinhood Selling Spree

01/03/2024 17:21

Cathie Wood's Ark Invest continues to offload Coinbase (COIN) and Robinhood Markets (HOOD) shares as prices plunge despite Bitcoin recovery.

Bitcoin bull Cathie Wood’s asset management firm Ark Invest extends Coinbase (COIN) and Robinhood Markets (HOOD) selling spree as crypto shares take a hit despite a rally across the crypto market. Bitcoin surpassed $45.5K on Tuesday for the first time in last 2 years as investors consider a spot Bitcoin ETF approval by the US SEC.

Ark Invest Sells Coinbase and Robinhood Shares

On Jan 2, Cathie Wood’s Ark Invest sold a total of 3,360 Coinbase shares worth over $580K and 23,606 Robinhood shares worth nearly $300K, as per trades seen by CoinGape.

ARK Innovation ETF (ARKK) sold 2,944 Coinbase shares, ARK Next Generation Internet ETF (ARKW) offloaded 329 COIN shares, and ARK Fintech Innovation ETF (ARKF) sold 87 COIN stocks.

Ark Invest funds look to continue to offload COIN shares worth millions this month as part of its active fund management strategy, extending its selloff run of the last year.

Coinbase (COIN) price fell 9.80% on Tuesday, closing at $156.88. The price is moving up by 1.35% in the pre-market hours on Wednesday.

Recommended Articles

In addition, ARK Next Generation Internet ETF (ARKW) sold 23,606 Robinhood Markets (HOOD) shares. Ark Invest offloaded 121,100 HOOD shares last time on December 19 after HOOD shares closed 10.4% higher at $13.17.

HOOD price also closed 2.90% lower at $12.37 on Tuesday and appears to open further lower on Wednesday as it trades almost 1% lower in premarket hours today.

Also Read: Binance Announces New Solana (SOL), BNB, NFP, SEI & Other Crypto Margin Pairs

Ark Invest 21Shares Spot Bitcoin ETF Approval

Ark Invest sold 2.25 million Grayscale Bitcoin Trust (GBTC) shares worth $81 million last week. ARKW parked funds in ARK 21Shares Active Bitcoin Futures Strategy ETF (ARKA) and ProShares Bitcoin Strategy ETF (BITO) in preparation for its ARKB spot Bitcoin ETF approval.

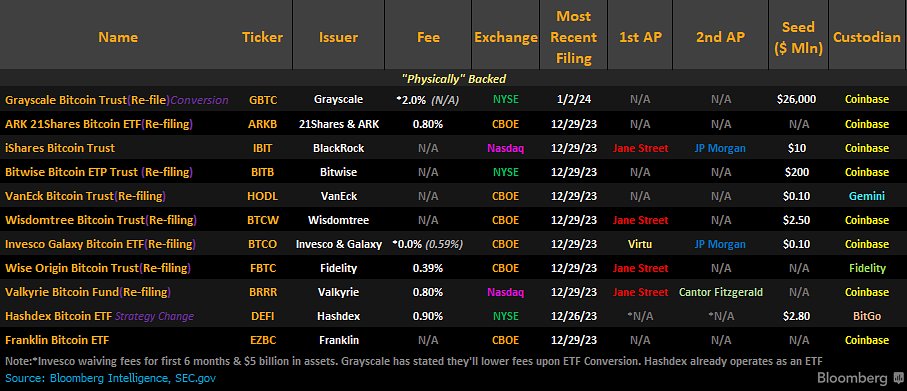

The spot Bitcoin ETF issuers expect to hear soon from the U.S. SEC on potential approval, with the approval window opening between Jan 5-10, 2024.

Notably, 11 issuers including Ark 21Shares have updated their spot Bitcoin ETF with APs, fees, and other changes and await the SEC’s decision.

Also Read: Crypto In Crosshairs As EU Regulators To Probe Banks-NBFIs Links

- Internet Computer Protocol Grabs Limelight With 222% ICP Price Rally

- SHIB Burn Rate Spikes 310%, Can It Spur Price Rally?

- Binance Announces New Solana (SOL), BNB, NFP, SEI & Other Crypto Margin Pairs

- MVRV Data Points Potential Bitcoin Price Targets of $52,000 and $70,000

- Crypto In Crosshairs As EU Regulators Deepens Probe On Banks-NBFIs Links

- Best Low-Cap Cryptocurrency Gems to Gain Massive ROI in 2024

- Top Altcoins To Buy January 2: SEI, LDO, ARB

- What’s Next For Bitcoin SV Price After 125% Weekly Surge?

- Ethereum Price At A Tipping Point, Can Surging Open Interest Fuel ETH Rally Past $3,000?

- Terra Classic Price Prediction As End-of-Correction Pattern Hints 34% Upsurge

Varinder has 10 years of experience in the Fintech sector, with over 5 years dedicated to blockchain, crypto, and Web3 developments. Being a technology enthusiast and analytical thinker, he has shared his knowledge of disruptive technologies in over 5000+ news, articles, and papers. With CoinGape Media, Varinder believes in the huge potential of these innovative future technologies. He is currently covering all the latest updates and developments in the crypto industry.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.