Bitcoin Price Prediction: BTC Hits $43,000 Amid Tesla, El Salvador News; US Nonfarm Payrolls in the Spotlight

02/02/2024 13:49

Bitcoin price surges to $43,000 as Tesla mulls over Bitcoin sales, El Salvador remains steadfast on its crypto strategy, and US Nonfarm Payrolls

In the latest Bitcoin price prediction, BTC has surged to $43,000 amid speculation over Tesla’s potential sale of its remaining Bitcoin holdings after forgoing $500 million in unrealized profits. Meanwhile, the Salvadoran president reaffirms his steadfast Bitcoin adoption strategy, even as the country approaches its elections.

Additionally, a new report suggests that, against the backdrop of regulatory challenges, the cryptocurrency market continues to thrive in China. Amidst these unfolding narratives, the US Nonfarm Payrolls report looms large, poised to potentially influence investor sentiment and the subsequent price trajectory of Bitcoin.

Bitcoin Price Standstill; US Nonfarm Payrolls in the Spotlight;

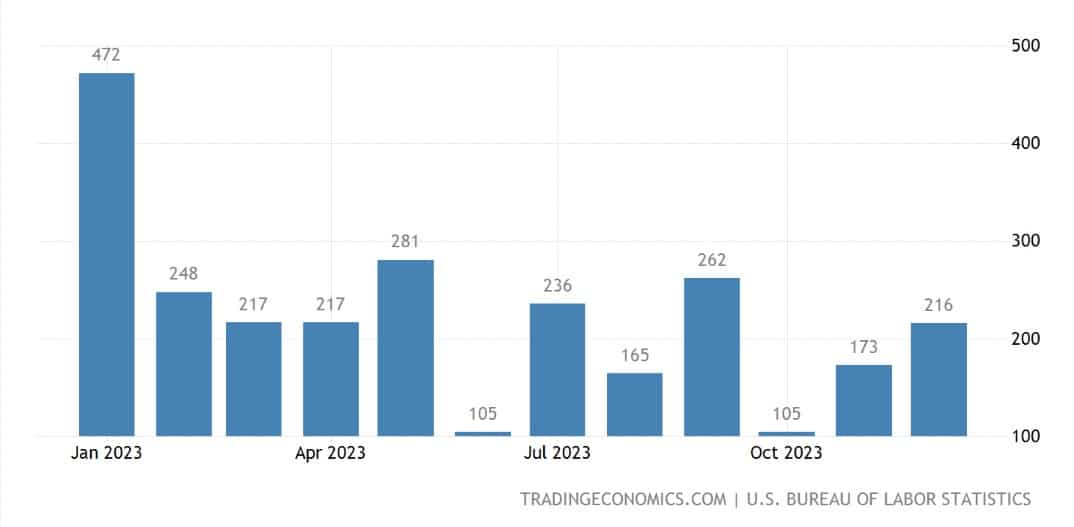

As Bitcoin navigates through market fluctuations, all eyes are on the upcoming US Nonfarm Payrolls (NFP) data, which could sway the cryptocurrency’s price. Analysts forecast the addition of 187K jobs, a dip from the previous 216K, while average hourly earnings are expected to grow by 0.3%, down from 0.4%.

The unemployment rate is projected to tick up slightly to 3.8% from 3.7%. These figures, alongside a slight downtick in consumer sentiment to 78.9, could signal economic headwinds, potentially affecting investor confidence and Bitcoin’s valuation in the short term.

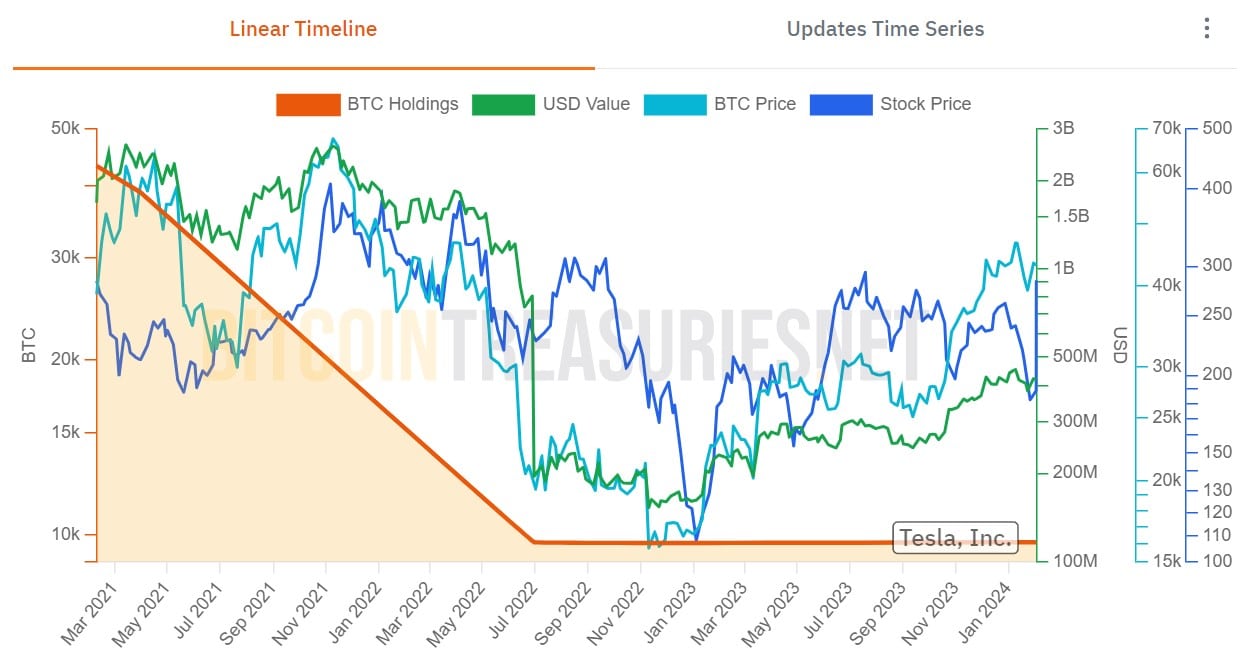

The electric vehicle giant, Tesla, initial $1.5 billion Bitcoin investment in February 2021, when Bitcoin hovered around $37,000, not only boosted the cryptocurrency’s value but also marked a significant corporate endorsement. However, Tesla’s decision to offload roughly 10% of its Bitcoin holdings in March 2021, at prices exceeding $60,000, seemed premature as Bitcoin’s price soared higher thereafter.

By June 2022, as Bitcoin’s value dipped below the $20,000 mark, Tesla further reduced its position, selling off a substantial portion of its holdings. Had Tesla maintained its original 43,200 Bitcoin cache, by early 2024, it would have amassed a value of nearly $2 billion.

Currently, with 9,720 Bitcoins left, Tesla’s stake is valued at approximately $400 million. The automotive titan’s next move in the cryptocurrency market is highly anticipated, as it has the potential to significantly influence Bitcoin’s valuation.

Whether Tesla will capitalize on the remaining Bitcoins or divest further could set a precedent, impacting investor sentiment and shaping Bitcoin’s financial narrative in the times ahead.

El Salvador’s Unshaken Bitcoin Resolve

El Salvador’s vice president, Félix Ulloa, expressed confidence that if President Nayib Bukele is reelected on February 4, El Salvador will continue to accept Bitcoin as legal tender. The International Monetary Fund recommended that El Salvador reevaluate its Bitcoin rules during loan discussions, but Ulloa declared that El Salvador had no plans to do so. Enthusiasm for Bitcoin adoption has increased with the recent U.S. approval of spot Bitcoin ETFs.

💥The $1 Million #Bitcoin Game Plan by @Excellion🚀

💥Salvadoran president @NayibBukele's #BTC strategy ‘unwavering’ amid elections🇸🇻

💥BTC price shows $60K ‘potential’ as MVRV metric copies Bitcoin bull cycles😎

Full Ep. #1538: https://t.co/3G6M1PzhK1 pic.twitter.com/6tnhHp8Djj

— Crypto News Alerts 🔥🎙 (@CryptoNewsYes) February 2, 2024

Ulloa stressed that plans pertaining to Bitcoin, such as the tax-free Bitcoin City and the provision of passports to investors who contribute $1 million in Bitcoin, would go on. El Salvador’s commitment to the national adoption of cryptocurrencies could be strengthened if its Bitcoin plan continues to be implemented, which would have a beneficial effect on BTC prices.

Cryptocurrency’s Resilience in China

Chinese cryptocurrency fans are more likely to make sizable investments in digital assets than their counterparts in Vietnam, South Korea, Taiwan, and Thailand, according to a Kyros Ventures analysis, despite official limitations.

Over 70% of respondents in the five nations, according to the report based on a poll of 5,268 participants, said that cryptocurrencies made up more than half of their asset portfolios. Remarkably, 33.3% of Chinese investors own a significant stake in stablecoins, placing them second only to Vietnam (58.6%). Despite official limitations, the bulk of Chinese investors continue to favor centralized cryptocurrency exchanges.

#Cryptocurrency thrives in China against odds, report says :

According to a #Kyros Ventures report, 33.3% of Chinese investors hold a large number of stablecoins, ranking them second only to Vietnam's 58.6%, indicating a higher level of risk appetite.#Bitcoin #BTC #Crypto pic.twitter.com/10DIr0HyjP

— TOBTC (@_TOBTC) February 1, 2024

As China mulls changing its anti-money laundering laws to allow cryptocurrency transactions, there have been notable advancements in Asia’s cryptocurrency regulatory environment. These patterns might encourage more people in the area to learn about and invest in cryptocurrencies like Bitcoin (BTC).