BlackRock’s Bitcoin ETF Is Pulling Away From Rest of the Pack

02/17/2024 02:56

(Bloomberg) -- BlackRock Inc. is starting to dominate the nascent Bitcoin exchange-traded fund sector, with its iShares Bitcoin Trust (ticker IBIT) attracting more investor inflows this week than the rest of the other recent entrants combined.Most Read from BloombergAlexey Navalny, Jailed Activist Who Defied Putin, Dies at 47Bond Yields Climb as PPI Curbs Dovish Fed Wagers: Markets WrapHawaii Rightly Rejects Supreme Court’s Gun NonsenseApple Readies AI Tool to Rival Microsoft’s GitHub CopilotBid

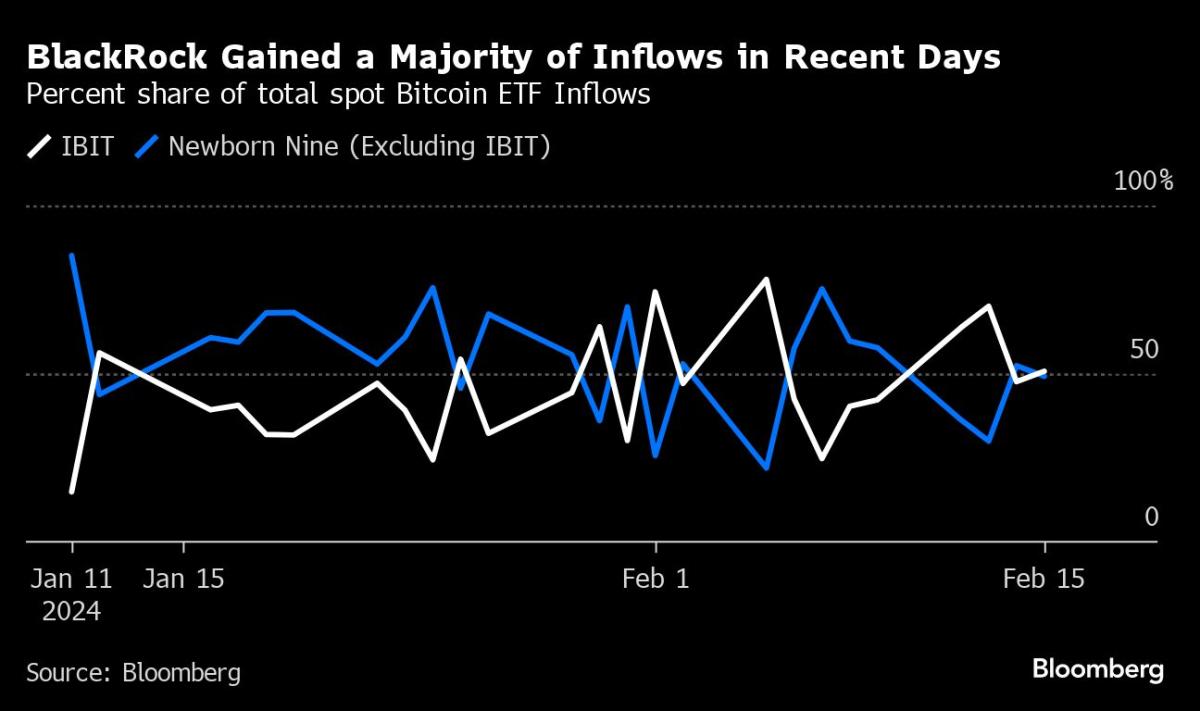

(Bloomberg) -- BlackRock Inc. is starting to dominate the nascent Bitcoin exchange-traded fund sector, with its iShares Bitcoin Trust (ticker IBIT) attracting more investor inflows this week than the rest of the other recent entrants combined.

Most Read from Bloomberg

Alexey Navalny, Jailed Activist Who Defied Putin, Dies at 47

Bond Yields Climb as PPI Curbs Dovish Fed Wagers: Markets Wrap

Biden Blames Putin for Navalny’s Death as Western Outrage Grows

Rising Bitcoin prices have attracted more investors to the much anticipated group of US spot Bitcoin ETFs — often referred to as the “Newborn Nine” — which were launched last month after the US Securities and Exchange Commission approved the new investment vehicle. Nearly $2.5 billion have flowed into the ETFs this week, with IBIT capturing about 58% of the week’s total, data compiled by Bloomberg show. On Monday, the fund saw the second highest single day of trading activity since it launched, with roughly $35 million shares changing hands.

Read more: How Spot Bitcoin ETFs Became Big Win for Wall Street: QuickTake

Early results had showed BlackRock and Fidelity Investments dominating the emergent sector, but the largest asset manager has since started to emerge as the market leader in recent days. Since launching on Jan. 11, the fund has gained over $5 billion in inflows, about $1.5 billion more than Fidelity’s offering.

A powerful distribution network and prominent brand identity have helped fuel the BlackRock fund flows, according to Todd Sohn, an ETF and technical strategist at Strategas Securities.

“It’s rare that a ‘new’ asset class comes into ETF form and so they want to be at the forefront of the movement, particularly as a leader in ETF solutions,” Sohn said. “I suspect this determination was only raised by the amount of competition out there.”

Most Read from Bloomberg Businessweek

How Paramount Became a Cautionary Tale of the Streaming Wars

‘Playing God’: This Labor Activist’s Relentless Emails Force Companies to Change

©2024 Bloomberg L.P.